After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

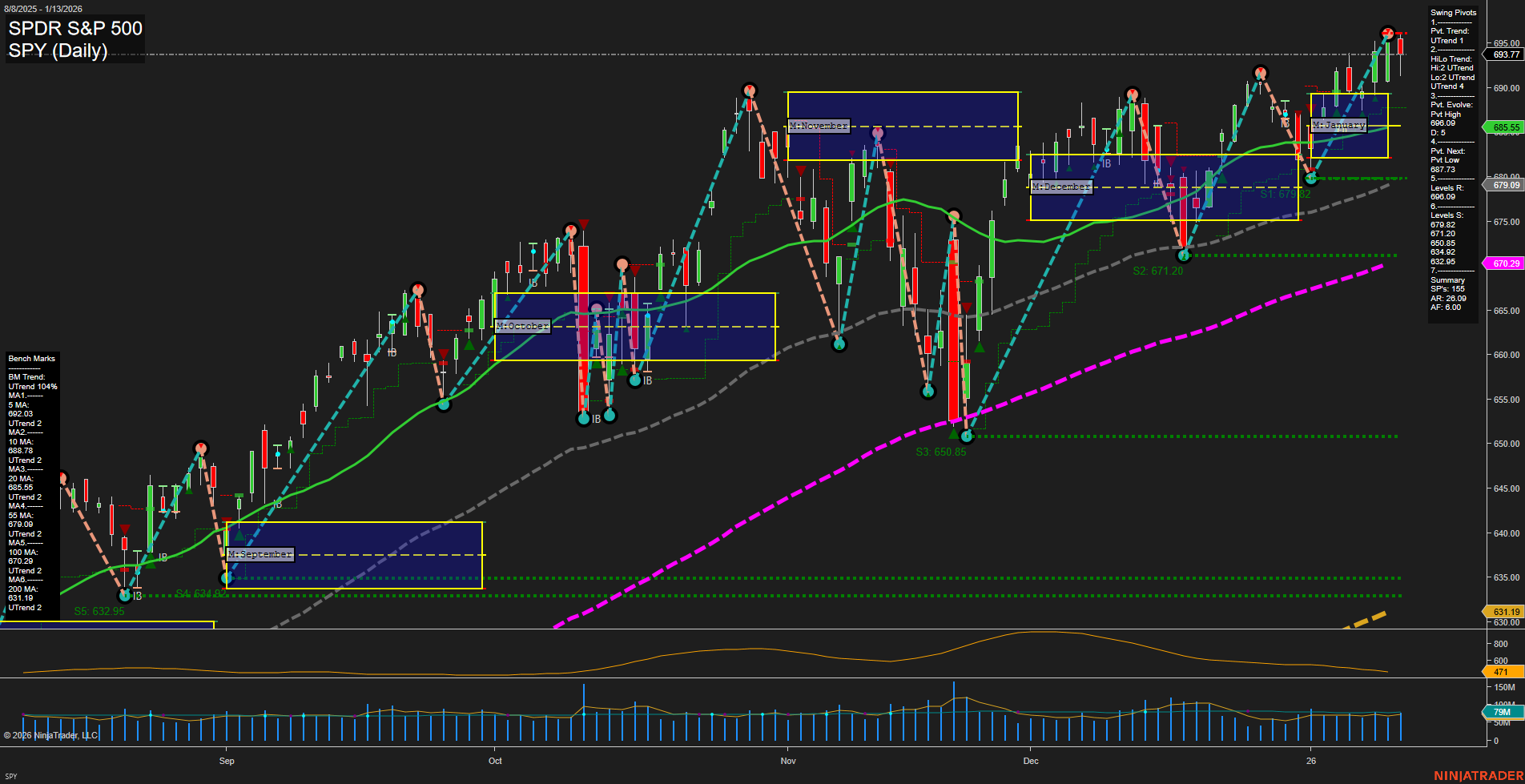

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Tech & Mega Caps: The largest tech stocks (“Mag 7”) underperformed, driven by recent economic data and continued scrutiny over growth, labor, and inflation signals. The Nasdaq saw sharp declines, posting its worst daily loss in a month due to tech weakness and investor rotation into other sectors.

- Banking Sector: Major banks including Wells Fargo, Citigroup, Bank of America, and JPMorgan faced notable stock declines after reporting Q4 earnings. Despite strong numbers, high expectations fueled disappointment and sell-offs.

- Federal Reserve: Fed Chair Jerome Powell remains under DOJ investigation, prompting political calls for his departure and leading Powell to skip congressional testimony. Market uncertainty surrounds leadership and Fed independence amid political pressure.

- Oil Markets: Oil prices experienced significant swings, initially rallying on Iran and Venezuela tensions, then dropping nearly 2% after eased geopolitical threats. Despite volatility, some market participants see a basis for further gains.

- Gold & Precious Metals: Gold posted fresh all-time highs as investors flocked to safe-haven assets. Gold and silver remain supported, but platinum group metals (PGMs) are highlighted for their upside potential in this environment.

- US-Venezuelan Oil Trade: The US finalized a $500 million Venezuelan oil purchase under a new deal, with Venezuelan crude commanding a premium over Canadian grades for Gulf Coast refiners.

- Indices & Broader Markets: Major US indices (Dow, S&P 500, Nasdaq) all ended lower, weighed down by tech and bank stocks. Q4 earnings are in focus as markets gauge whether S&P 500’s record highs can be justified.

- Other Themes: Equities are showing resilience in the face of macro risks and global volatility. Tariff debates, trade data, and market rotations continue to shape sentiment, with the Supreme Court slow to rule on tariff legality and China hitting a record trade surplus.

News Conclusion

- Wednesday’s session saw broad declines across major US indices, primarily driven by renewed tech and financial sector weakness and mixed earnings reactions.

- Political developments surrounding the Federal Reserve have added an element of uncertainty to rate and policy expectations.

- Commodities were volatile, with oil prices whipsawing on shifting geopolitical risks and gold extending its bull trend on safe-haven demand.

- Investors are focused on upcoming corporate earnings to determine if market valuations remain sustainable after a period of record highs.

- Global trade and regulatory disputes remain relevant, influencing pricing dynamics in critical sectors such as energy and manufacturing.

Market News Sentiment:

Market News Articles: 49

- Negative: 44.90%

- Neutral: 38.78%

- Positive: 16.33%

GLD,Gold Articles: 15

- Positive: 73.33%

- Neutral: 20.00%

- Negative: 6.67%

USO,Oil Articles: 21

- Positive: 42.86%

- Negative: 28.57%

- Neutral: 28.57%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: January 14, 2026 05:00

- IBIT 55.44 Bullish 3.49%

- GLD 425.94 Bullish 1.02%

- IWM 263.19 Bullish 0.70%

- TLT 88.33 Bullish 0.58%

- IJH 69.43 Bullish 0.10%

- GOOG 336.31 Bearish -0.04%

- DIA 491.58 Bearish -0.07%

- AAPL 259.96 Bearish -0.42%

- SPY 690.36 Bearish -0.49%

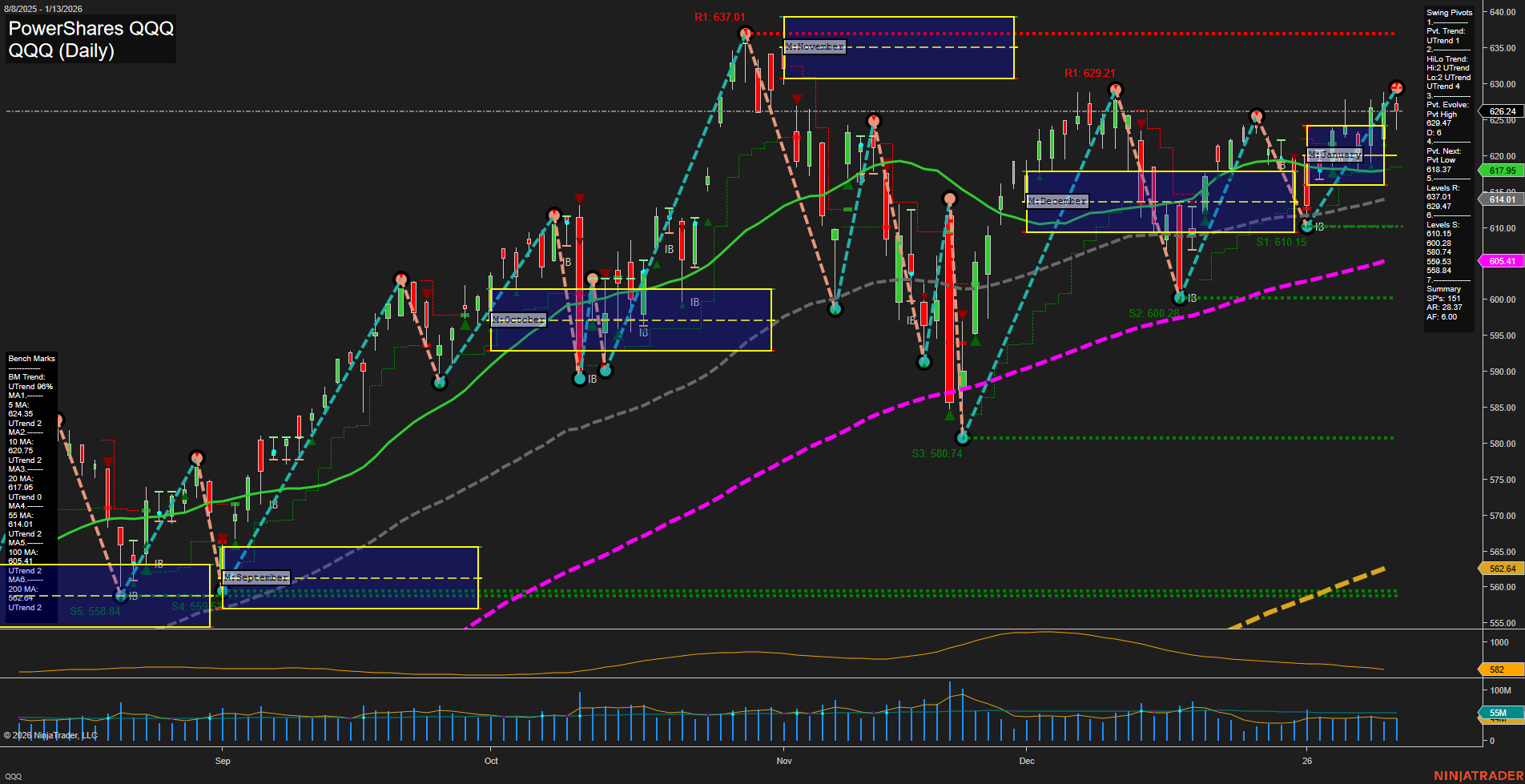

- QQQ 619.55 Bearish -1.07%

- USO 72.61 Bearish -1.18%

- NVDA 183.14 Bearish -1.44%

- TSLA 439.20 Bearish -1.79%

- MSFT 459.38 Bearish -2.40%

- AMZN 236.65 Bearish -2.45%

- META 615.52 Bearish -2.47%

Market State of Play: Summary for Traders

ETF Stocks Overview

- SPY: 690.36 Bearish (-0.49%) – S&P 500 tracker under pressure with a notable selloff.

- QQQ: 619.55 Bearish (-1.07%) – Nasdaq-100 ETF experiencing sharper declines compared to large-caps.

- IWM: 263.19 Bullish (+0.70%) – Russell 2000 ETF holds positive, diverging from broader indices.

- IJH: 69.43 Bullish (+0.10%) – US midcap ETF remains slightly positive.

- DIA: 491.58 Bearish (-0.07%) – Dow Jones Industrial Average almost flat but leaning downward.

Summary: Major indices are skewed bearish, but small- and mid-cap ETFs show resilience and some bullish momentum as of this snapshot.

MAG7 Key Stocks Snapshot

- AAPL: 259.96 Bearish (-0.42%)

- MSFT: 459.38 Bearish (-2.40%)

- GOOG: 336.31 Bearish (-0.04%)

- AMZN: 236.65 Bearish (-2.45%)

- META: 615.52 Bearish (-2.47%)

- NVDA: 183.14 Bearish (-1.44%)

- TSLA: 439.20 Bearish (-1.79%)

Summary: Across the MAG7, sentiment is uniformly bearish with the sharpest drawdowns in AMZN, META, and MSFT. No positive outliers among the large tech leaders.

Other Key ETFs

- IBIT (Bitcoin ETF): 55.44 Bullish (+3.49%) – Strong positive move, leading gains in this snapshot.

- GLD (Gold ETF): 425.94 Bullish (+1.02%) – Gold tracking ETF shows steady risk-off demand.

- TLT (Long-Term Treasuries): 88.33 Bullish (+0.58%) – Signs of buying in long duration bonds.

- USO (Oil Fund): 72.61 Bearish (-1.18%) – Oil tracking ETF under pressure alongside broader equity weakness.

Summary: Flows to alternative assets (Bitcoin, Gold, Treasuries) suggest a risk-off posture despite isolated equity sector resilience.

Market Profile at a Glance

- Large-cap and tech stocks: Bearish bias, MAG7 fully red.

- Small- and mid-cap equities: Mixed to bullish.

- Safe haven assets (IBIT, GLD, TLT): Clear upside momentum.

- Commodities (USO): Underperforming in this session.

Note: This snapshot reflects short-term sentiment and does not constitute advice. Price movements can shift rapidly in response to evolving market dynamics.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts