After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

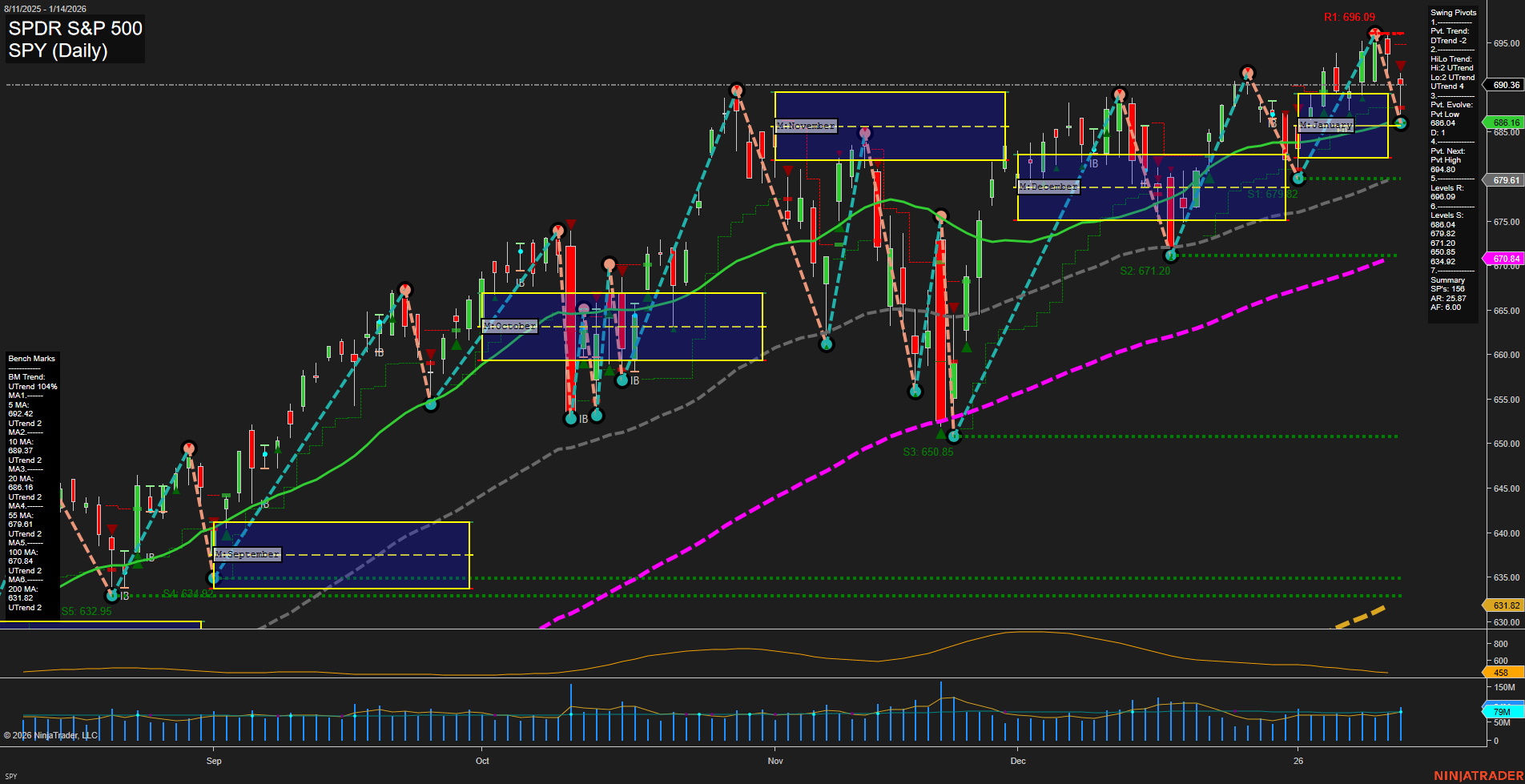

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Geopolitics & Oil: The US continues an aggressive posture in Venezuela, seizing a sixth oil tanker and benefiting from sharply higher prices for Venezuelan crude following recent political developments. Venezuela is proposing oil sector reforms to draw foreign investment. Meanwhile, oil prices pulled back as Iran tensions eased, and US crude markets saw heightened volatility.

- Equity Markets & Sentiment: US equities extended gains, driven by chip stocks’ rally after strong Taiwan Semi earnings and a bullish sentiment spike. Recent internal market indicators remain positive, though concerns are rising about a potential correction if the S&P 500 dips below critical levels. Major indices, including the S&P 500, edge closer to the 7,000 milestone, but volatility and valuation worries are mounting.

- Technology & Tariffs: New US tariffs on global semiconductor companies were announced, but a breakthrough US-Taiwan trade deal reduces tariffs to 15%, boosts US chip investment, and supports sector momentum. The launch of Anthropic’s new AI product pressured software stocks amid renewed debate on AI’s impact on traditional tech sectors.

- Commodities: Gold is holding near record levels with bullish price action, while crude oil faces volatile trading as market structure shifts. Precious metals remain in focus as investors seek relative value amid shifting macro factors.

- Macro & Policy: Inflation pressure is a major theme, with worries building from rising metals prices, geopolitical uncertainty, and potential threats to Fed independence. Portfolio managers and banks are mindful of the risks as inflation expectations become more uncertain for 2026. Equity market rotation is expected to continue, influenced by these macro trends.

- Financials: Bank stocks showed ongoing strength after a robust previous year, with large institutions like Morgan Stanley and Goldman outperforming. Dividend growth strategies are being re-evaluated due to sector shifts.

- Federal Reserve: Developments include a criminal probe into Fed Chair Powell, concern over the Fed’s independence, and consistent messaging from the Beige Book on consumer resilience despite ongoing economic headwinds.

News Conclusion

- Stock markets continue to push higher, led by semiconductors and strong earnings, amid optimism from positive sentiment surveys and a bullish outlook on US equities.

- Significant geopolitical events and active US policy interventions are reshaping global oil, commodity, and chip markets, with new trade dynamics emerging, especially between the US and Taiwan.

- Inflation concerns are resurfacing due to external market pressures and policy risks, prompting closer scrutiny of future price stability and central bank independence.

- While major indices approach historic levels, market participants face mixed signals: underlying momentum is robust, but risks of correction and sector rotation persist, leaving the forward path uncertain and volatile.

Market News Sentiment:

Market News Articles: 49

- Positive: 36.73%

- Neutral: 34.69%

- Negative: 28.57%

GLD,Gold Articles: 11

- Neutral: 63.64%

- Positive: 27.27%

- Negative: 9.09%

USO,Oil Articles: 20

- Negative: 55.00%

- Neutral: 25.00%

- Positive: 20.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: January 15, 2026 05:00

- NVDA 187.05 Bullish 2.13%

- IJH 70.24 Bullish 1.17%

- IWM 265.51 Bullish 0.88%

- META 620.80 Bullish 0.86%

- AMZN 238.18 Bullish 0.65%

- DIA 494.48 Bullish 0.59%

- QQQ 621.78 Bullish 0.36%

- SPY 692.24 Bullish 0.27%

- TLT 88.31 Bearish -0.02%

- TSLA 438.57 Bearish -0.14%

- MSFT 456.66 Bearish -0.59%

- GLD 423.33 Bearish -0.61%

- AAPL 258.21 Bearish -0.67%

- GOOG 333.16 Bearish -0.94%

- USO 71.13 Bearish -2.04%

- IBIT 54.00 Bearish -2.60%

Market Summary: ETF Stocks (SPY, QQQ, IWM, IJH, DIA)

- SPY: 692.24 (+0.27%) Bullish – The S&P 500 ETF is trading higher, showing broad-based strength.

- QQQ: 621.78 (+0.36%) Bullish – The Nasdaq-100 ETF is up, with positive momentum among large-cap tech stocks.

- IWM: 265.51 (+0.88%) Bullish – The Russell 2000 (small caps) outperforms, leading the ETF pack today.

- IJH: 70.24 (+1.17%) Bullish – Mid-caps are also notably strong, advancing over 1%.

- DIA: 494.48 (+0.59%) Bullish – The Dow ETF is posting solid gains, trailing slightly behind mid- and small-caps.

Summary: The major index ETFs are all in bullish territory, with small- and mid-caps leading gains, indicating strong risk sentiment across the market.

Market Summary: ‘Mag7’ Stocks (AAPL, MSFT, GOOG, AMZN, META, NVDA, TSLA)

- NVDA: 187.05 (+2.13%) Bullish – NVIDIA surges ahead, the session’s top performer among the group.

- META: 620.80 (+0.86%) Bullish – Meta Platforms advances on continued positive momentum.

- AMZN: 238.18 (+0.65%) Bullish – Amazon maintains an upward trajectory.

- TSLA: 438.57 (-0.14%) Bearish – Tesla pulls back, trading slightly lower.

- MSFT: 456.66 (-0.59%) Bearish – Microsoft shows weakness versus peers.

- AAPL: 258.21 (-0.67%) Bearish – Apple declines, lagging the group.

- GOOG: 333.16 (-0.94%) Bearish – Alphabet slips, underperforming other Mag7 names.

Summary: Mag7 performance is mixed: NVIDIA, Meta, and Amazon are firmly bullish, while Tesla, Microsoft, Apple, and Google see mild to moderate selling.

Market Summary: Other Notable ETFs (TLT, GLD, USO, IBIT)

- TLT: 88.31 (-0.02%) Bearish – Long-term Treasuries are flat to slightly lower.

- GLD: 423.33 (-0.61%) Bearish – Gold ETF retreats, indicating lower demand for safe-haven assets.

- USO: 71.13 (-2.04%) Bearish – Oil ETF drops sharply, showing weakness in crude prices.

- IBIT: 54.00 (-2.60%) Bearish – Bitcoin ETF leads declines, with a notable downturn.

Summary: Defensive and alternative asset ETFs are broadly bearish, with especially pronounced weakness in energy and digital asset segments.

State of Play Overview

- ETF Stocks: Broadly bullish, with particular strength in small- and mid-caps.

- Mag7 Stocks: Mixed, with clear strength in NVDA, META, and AMZN but others trailing or declining.

- Other ETFs: Mostly bearish, especially in energy (USO) and digital assets (IBIT), with defensive assets (TLT, GLD) also under mild pressure.

Note: For informational purposes only. No trading advice or recommendations provided.

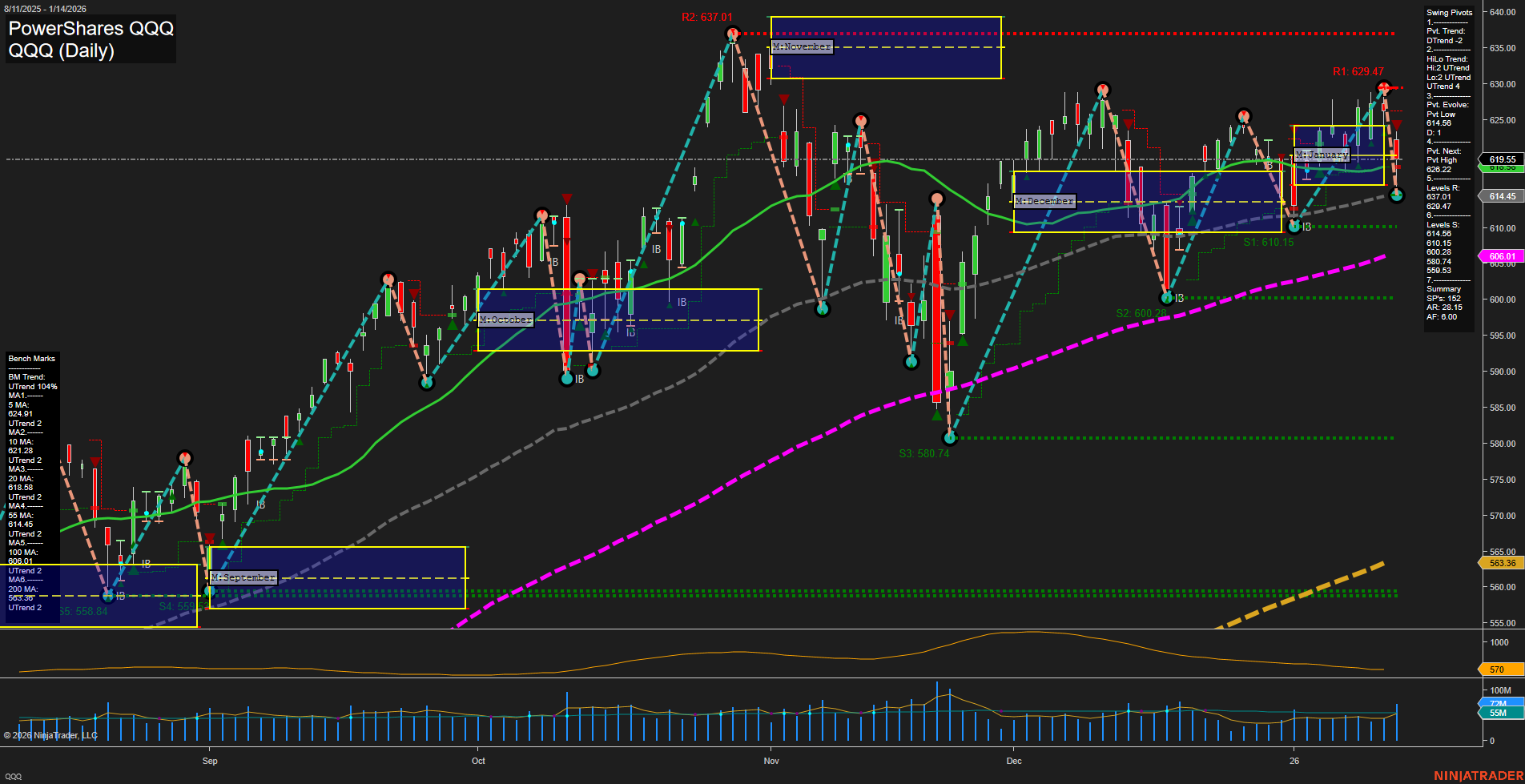

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts