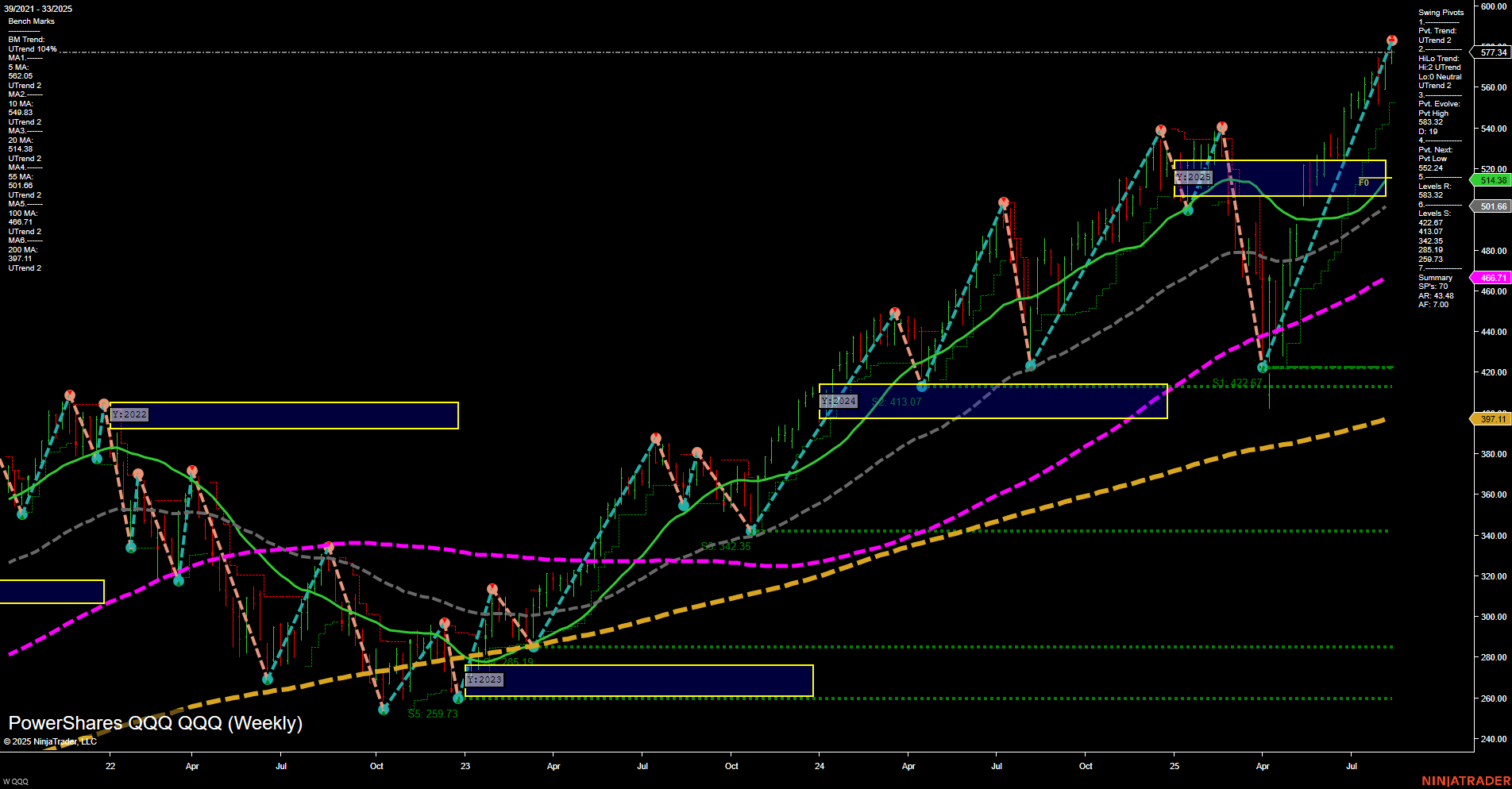

Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Wednesday 14:00 – FOMC Meeting Minutes (High Impact): Market participants will scrutinize the minutes for insight into the Federal Reserve’s policy outlook and timeline for rate adjustments. Any surprises regarding inflation outlook or rate hike/cut discussions may trigger sharp intraday moves across indices.

- Thursday 08:30 – Unemployment Claims (High Impact): A significant deviation from expectations could rapidly sway sentiment; higher claims may raise recession worries, while lower claims could reinforce tightening bias and put pressure on equities.

- Thursday 09:45 – Flash Manufacturing PMI (High Impact): A key gauge for economic activity. Strong data may boost confidence in the growth outlook, while weak numbers could weigh on risk assets.

- Thursday 09:45 – Flash Services PMI (High Impact): Drives immediate market reactions. Expansion surprises would buoy sentiment, while contraction could trigger selling, especially if coinciding with weaker manufacturing data.

- Friday 10:00 – Fed Chair Powell Speaks (High Impact): Powell’s Jackson Hole speech has historically been a catalyst for major market moves. Markets will look for clarity on future rate actions and the Fed’s view on the economic trajectory.

EcoNews Conclusion

- High-impact events clustered Wednesday–Friday, especially around the FOMC Minutes and Powell’s Jackson Hole appearance, are likely to drive elevated volatility in index futures.

- News events around the 10 AM time cycle often act as a catalyst for reversals or continuations.

For full details visit: Forex Factory EcoNews

Market News Summary

- S&P 500: The index achieved three new record highs within the week, rising 0.9%—marking four weekly gains out of the last five, and sitting nearly 10% higher year-to-date.

- Fed & Inflation: Despite an increase in producer prices, consumer inflation remains subdued, supporting expectations for potential Federal Reserve rate cuts as soon as September. U.S. equities set fresh highs on these easing policy outlooks.

- ETF Focus: Analysis highlights QQQ’s long-term outperformance and lower fees when compared to ARKK, with QQQ benefiting from recent market recovery trends.

- Oil Markets: The outcome of Trump-Putin discussions could alter Russian oil supply expectations, with crude futures poised for volatility as traders weigh potential supply risks versus technical price levels.

- Gold: Gold holds above $3,310 per ounce as traders await policy signals from Powell at Jackson Hole. Technical signals and a weakening dollar driven by tariffs are encouraging bullish sentiment, targeting higher ranges.

- Rates & Currencies: Rising rates and persistent inflation in Japan have accelerated the unwind of Yen carry trades, adding cross-market pressure amid ongoing speculation about Fed rate policy.

- Geopolitics: Defence and energy sectors may experience increased activity, as U.S. discussions with European leaders generate uncertainty regarding Ukraine and broader regional stability.

- Correction Risks: Despite record highs in major U.S. indices, some strategists warn of potential corrections ahead, citing stretched valuations.

- Technical Outlook: Recent conservative S&P 500 technical targets have been met, indicating markets have reached previously projected levels.

- Market Structure: Observations suggest equity prices are primarily determined by activity at the extreme margin of valuation distribution.

News Conclusion

- The S&P 500 remains strong year-to-date, supported by resilient earnings and easing policy expectations despite some inflationary pressures.

- Macro catalysts—including Federal Reserve communications, geopolitical developments, and commodity market shifts—are shaping market sentiment and volatility.

- Rotation among sectors, heightened ETF scrutiny, and technical milestones are prominent themes as markets digest recent gains and assess headline risks.

Market News Sentiment:

Market News Articles: 8

- Negative: 50.00%

- Positive: 25.00%

- Neutral: 25.00%

GLD,Gold Articles: 2

- Neutral: 50.00%

- Positive: 50.00%

USO,Oil Articles: 1

- Neutral: 100.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: August 17, 2025 06:15

- GOOG 204.91 Bullish 0.53%

- META 785.23 Bullish 0.40%

- DIA 449.53 Bullish 0.08%

- GLD 307.43 Bullish 0.06%

- AMZN 231.03 Bullish 0.02%

- SPY 643.44 Bearish -0.23%

- QQQ 577.34 Bearish -0.44%

- MSFT 520.17 Bearish -0.44%

- IWM 227.13 Bearish -0.49%

- AAPL 231.59 Bearish -0.51%

- IJH 63.53 Bearish -0.53%

- TLT 86.40 Bearish -0.71%

- NVDA 180.45 Bearish -0.86%

- IBIT 66.44 Bearish -0.88%

- USO 72.80 Bearish -1.27%

- TSLA 330.56 Bearish -1.50%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-08-17: 18:15 CT.

US Indices Futures

- ES Clear uptrend, YSFG/MSFG/WSFG all up, above NTZ/F0%, higher highs, recent high 6478.5, all MAs rising, strong support 5938.75, swing pivots confirm trend.

- NQ Strong bullish phase, YSFG/MSFG/WSFG all up, new high 23440.0, above NTZ/F0%, rising MAs, next support well below, swing pivots indicate higher highs/lows.

- YM Bullish across timeframes, YSFG/MSFG/WSFG up, above NTZ/F0%, current swing high 45084, resistance 46300, stable support below, all benchmarks rising, uptrend intact.

- EMD Short-term bullish above WSFG/MSFG NTZ, intermediate/long-term neutral to bearish, YSFG below NTZ, resistance 3258.6–3501.9, support 3109.0–2902.5, mixed MA trends, consolidation phase.

- RTY Bullish short-term, WSFG/MSFG up above NTZ/F0%, YSFG neutral, current swing high, resistance 2537.1/2431.7, support 2147.5–1725.3, short/intermediate MAs up, long-term MAs weak.

- FDAX YSFG/MSFG/WSFG all up above NTZ/F0%, swing high 24478–24509, strong uptrend, MAs all rising, support 23503 and below, momentum high, trend continuation phase.

Overall State

- Short-Term: Bullish

- Intermediate-Term: Bullish

- Long-Term: Bullish, except EMD and RTY (neutral/transition)

Conclusion

US indices futures present a strong HTF bullish structure, with ES, NQ, YM, RTY, and FDAX holding above key session fib grids (YSFG, MSFG, WSFG) and all major moving averages trending upward. Swing pivots support ongoing uptrends, with resistance levels being tested or surpassed while support remains below current prices, indicating trend continuation and breadth. EMD and RTY show neutral-to-bullish short/intermediate action, but EMD maintains a longer-term bearish tilt with yearly session structure still below NTZ. Overall, momentum remains strong, higher highs and lows persist, and technical confirmation across grids and pivots indicate ongoing structural strength in most US index futures. Potential short-term retracements may occur, but prevailing higher timeframe market structure is maintained by upward-trending benchmarks and HTF session grids.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts