Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

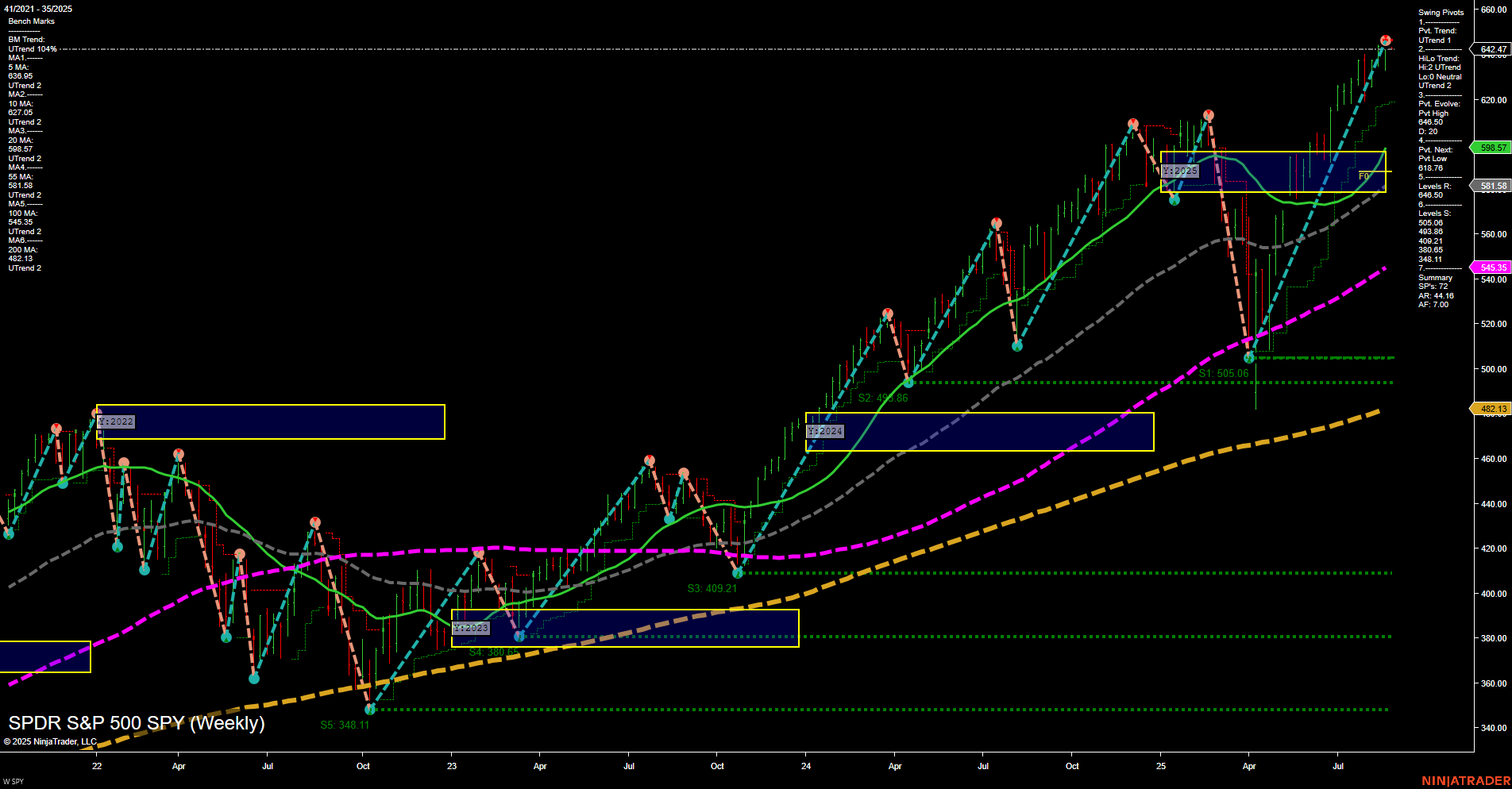

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

- 2025-09-01 Labor Day

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

Thursday 08:30 – USD Prelim GDP q/q (High Impact): The advanced reading on GDP is likely to set the tone for the U.S. economic growth outlook. Stronger GDP could fuel bullish sentiment on equity indices, while a below-forecast print may weigh on market confidence.

Thursday 08:30 – USD Unemployment Claims (High Impact): Weekly claims will shape market expectations of labor market resilience. A surprise increase could stoke recession concerns and increase market volatility. Conversely, lower claims support risk-on moves.

Friday 08:30 – USD Core PCE Price Index m/m (High Impact): As the Fed’s preferred inflation measure, the Core PCE will be closely watched for clues on monetary policy. Any upside surprise may trigger fears of prolonged rate hikes, pressuring indices, while a softer reading could lift sentiment.

Wednesday 10:30 – USD Crude Oil Inventories (Medium Impact): Oil inventory levels remain relevant. A sharp drawdown can signal tightening supply and keep inflation concerns elevated, potentially dampening equity index performance if oil prices rise further.

EcoNews Conclusion

- Major market-moving indicators cluster on Thursday and Friday, heightening breakout risk during those sessions.

- Market momentum and volume may slow in the days leading up to Prelim GDP and Core PCE, with sharp moves likely following their release.

- High oil prices, combined with any inventory surprises, can have a direct impact on inflation expectations and thus influence indices.

For full details visit: Forex Factory EcoNews

Market News Summary

- Fed Independence Shock: Market sentiment turned risk-off after President Trump announced the firing of Federal Reserve Governor Lisa Cook, citing alleged impropriety related to mortgage documents. Cook contested the dismissal, arguing presidential overreach, intensifying concerns over central bank independence.

- Market Reaction: US stock futures dipped, with the Dow trading in the red ahead of the open. Gold and bond yields surged as investors sought safe havens amid volatility. The US dollar softened slightly on the heightened uncertainty surrounding Fed policy control.

- International & Policy Impact: European markets priced in a weaker open, with global investors weighing political interference at the Fed and additional budget disputes. Meanwhile, Trump threatened fresh tariffs and export restrictions targeting nations with digital taxes, putting technology, semiconductor, and export-oriented sectors in focus.

- Commodities and Earnings: Crude oil prices rebounded on geopolitical risks but face mixed forecasts from IEA, EIA, and OPEC. Natural gas held support levels. Gold saw increased interest, partly attributed to movements at the central bank. S&P 500 earnings reports highlighted a 10% year-over-year rise, supporting a positive undertone for broader US equities despite political drama.

- IPO and Small Cap Activity: The IPO market outlook remained robust, with expectations for record activity through 2025 and increased preparation for future listings. Small-cap stocks continued to rally, outpacing broader indices and emerging as potential market leaders.

- Macro Risks: The US national debt trajectory worsened, with projections of total debt reaching 120% of GDP in the next decade, raising concerns over long-term fiscal health.

News Conclusion

- The forced departure attempt of Fed Governor Lisa Cook heightened anxieties about central bank independence, sparking immediate volatility across equities, bonds, currencies, and commodities.

- Uncertainty regarding Fed leadership and policy autonomy is a core theme, with global and US markets responding to the potential for greater political intervention in monetary policy.

- Broader geopolitical and trade tensions remain in focus, particularly threats of new tariffs and restrictions, impacting sectors exposed to global supply chains and technology.

- Resilient corporate earnings, ongoing strength in the IPO pipeline, and leadership among small-caps and energy sectors provided counterbalance to the prevailing risk climate.

- Long-term debt and fiscal concerns persist, adding a layer of caution to market outlooks despite short-term trading opportunities driven by news flow.

Market News Sentiment:

Market News Articles: 52

- Negative: 48.08%

- Positive: 26.92%

- Neutral: 25.00%

Sentiment Summary:

Out of 52 market news articles, 48.08% conveyed negative sentiment, 26.92% were positive, and 25.00% were neutral.

This distribution indicates that recent market news coverage has been weighted more toward negative sentiment, with positive and neutral articles making up less than half of the total.

GLD,Gold Articles: 10

- Neutral: 60.00%

- Positive: 30.00%

- Negative: 10.00%

Sentiment Summary: The majority of recent news articles on GLD and gold are neutral (60%), with a notable portion showing positive sentiment (30%) and a smaller segment reflecting negative sentiment (10%).

This indicates a generally balanced news environment around gold, with limited negative coverage and some signs of positive tone in recent reporting.

USO,Oil Articles: 6

- Neutral: 83.33%

- Positive: 16.67%

Sentiment Summary: The majority of recent news articles related to USO and oil display a neutral sentiment (83.33%), with a smaller proportion reflecting a positive outlook (16.67%).

This indicates that current market commentary is largely measured, with limited positive sentiment present in recent coverage.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: August 26, 2025 07:16

- TSLA 346.60 Bullish 1.94%

- USO 75.75 Bullish 1.49%

- GOOG 209.16 Bullish 1.18%

- NVDA 179.81 Bullish 1.02%

- META 753.30 Bearish -0.20%

- GLD 309.83 Bearish -0.24%

- AAPL 227.16 Bearish -0.26%

- TLT 86.80 Bearish -0.29%

- QQQ 570.32 Bearish -0.29%

- AMZN 227.94 Bearish -0.39%

- SPY 642.47 Bearish -0.44%

- MSFT 504.26 Bearish -0.59%

- IJH 64.71 Bearish -0.77%

- DIA 453.07 Bearish -0.78%

- IWM 232.36 Bearish -1.05%

- IBIT 62.88 Bearish -5.09%

Market ETF & Stock Summary – Trader Snapshot (as of 08/26/2025, 07:16)

ETF Stocks Overview

- SPY (S&P 500): $642.47 – Bearish (-0.44%)

- QQQ (NASDAQ 100): $570.32 – Bearish (-0.29%)

- IWM (Russell 2000): $232.36 – Bearish (-1.05%)

- IJH (Mid-Cap): $64.71 – Bearish (-0.77%)

- DIA (Dow 30): $453.07 – Bearish (-0.78%)

Summary: Major US equity index ETFs remain under pressure, with all reporting negative performance, led by small-cap weakness. The prevailing sentiment is mixed-to-bearish across the board for large, mid, and small caps.

Mag7 Stock Snapshot

- AAPL (Apple): $227.16 – Bearish (-0.26%)

- MSFT (Microsoft): $504.26 – Bearish (-0.59%)

- GOOG (Alphabet): $209.16 – Bullish (+1.18%)

- AMZN (Amazon): $227.94 – Bearish (-0.39%)

- META (Meta): $753.30 – Bearish (-0.20%)

- NVDA (Nvidia): $179.81 – Bullish (+1.02%)

- TSLA (Tesla): $346.60 – Bullish (+1.94%)

Summary: The Mag7 group shows mixed action. Tesla leads with strong bullish momentum, alongside Nvidia and Alphabet, while Apple, Microsoft, Amazon, and Meta display minor bearish trends.

Key Sector & Thematic ETFs

- TLT (20+ Yr Treasuries): $86.80 – Bearish (-0.29%)

- GLD (Gold): $309.83 – Bearish (-0.24%)

- USO (Oil Fund): $75.75 – Bullish (+1.49%)

- IBIT (Bitcoin ETF): $62.88 – Bearish (-5.09%)

Summary: Commodity and alternative asset ETFs diverge in trajectory: USO remains bullish with a notable upward move, while gold and treasuries are slightly negative. Crypto exposure (IBIT) faces larger downside volatility.

State of Play

- Long: TSLA, USO, GOOG, NVDA

- Short: META, GLD, AAPL, TLT, QQQ, AMZN, SPY, MSFT, IJH, DIA, IWM, IBIT

- Mixed: Mag7 overall (split), sector ETFs show divergence

Summary: Current market dynamics reveal selective pockets of strength (notably in Tesla, energy, and certain tech leaders), while broader indices and alternative assets tilt toward downside or consolidation. Market breadth is narrow, with risk-off evident in small- and mid-cap benchmarks and cryptocurrencies.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-08-26: 07:16 CT.

US Indices Futures

- ES Long-term and intermediate-term bullish, price above YSFG/MSFG NTZs, short-term WSFG trend down, below NTZ center, recent swing pivots show short-term downtrend, resistance near highs, key support 6194.25.

- NQ Long/intermediate-term bullish, above YSFG/MSFG NTZs, short-term WSFG trend down, consolidation below NTZ, swing pivots and benchmarks rising, support 22,775, resistance 24,068.50, moderate volatility, choppy short-term action.

- YM Long/intermediate-term bullish, above YSFG/MSFG NTZs, short-term WSFG trend down, below NTZ, swing high resistance 45,878, key support 43,496, broad uptrend with current consolidation, recent short-term signals bearish.

- EMD Long/intermediate-term bullish, price above YSFG/MSFG NTZs, short-term WSFG trend down, below NTZ, swing pivots up, resistance 3293.4, support 3137.2, moderate volatility, consolidating recent gains, short-term signals mixed.

- RTY Long-term bullish, intermediate-term neutral, above YSFG/MSFG NTZs, short-term WSFG trend down, below NTZ, swing pivots indicate pullback phase, resistance 2374.9, support 2181.5, volatility moderate, corrective short-term action.

- FDAX Long-term bullish, intermediate-term bullish, short/intermediate-term bearish, below WSFG NTZ, resistance 24,478, support 22,112, benchmarks rising long-term, support under pressure, moderate volatility, consolidative phase.

Overall State

- Short-Term: Neutral to Bearish

- Intermediate-Term: Bullish

- Long-Term: Bullish

Conclusion

US Indices Futures are in broad intermediate and long-term uptrends, confirmed by price above YSFG and MSFG NTZs and all major moving averages trending higher. Short-term (WSFG) context shows recent trend shifts lower, with prices below weekly NTZs, swing pivots signaling consolidation or retracement phases, and overhead resistance tested near recent highs. Most markets are experiencing corrective or range-bound short-term movement within larger bullish structures. Support levels from prior swing pivots and fib grids are actively in focus. Directional correlations reveal similar short-term pressure across all indices, with FDAX showing the greatest intermediate-term weakness. Overall structure remains bullish for higher timeframes, despite short-term consolidation, volatility, and active resistance-testing across most US Index Futures.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

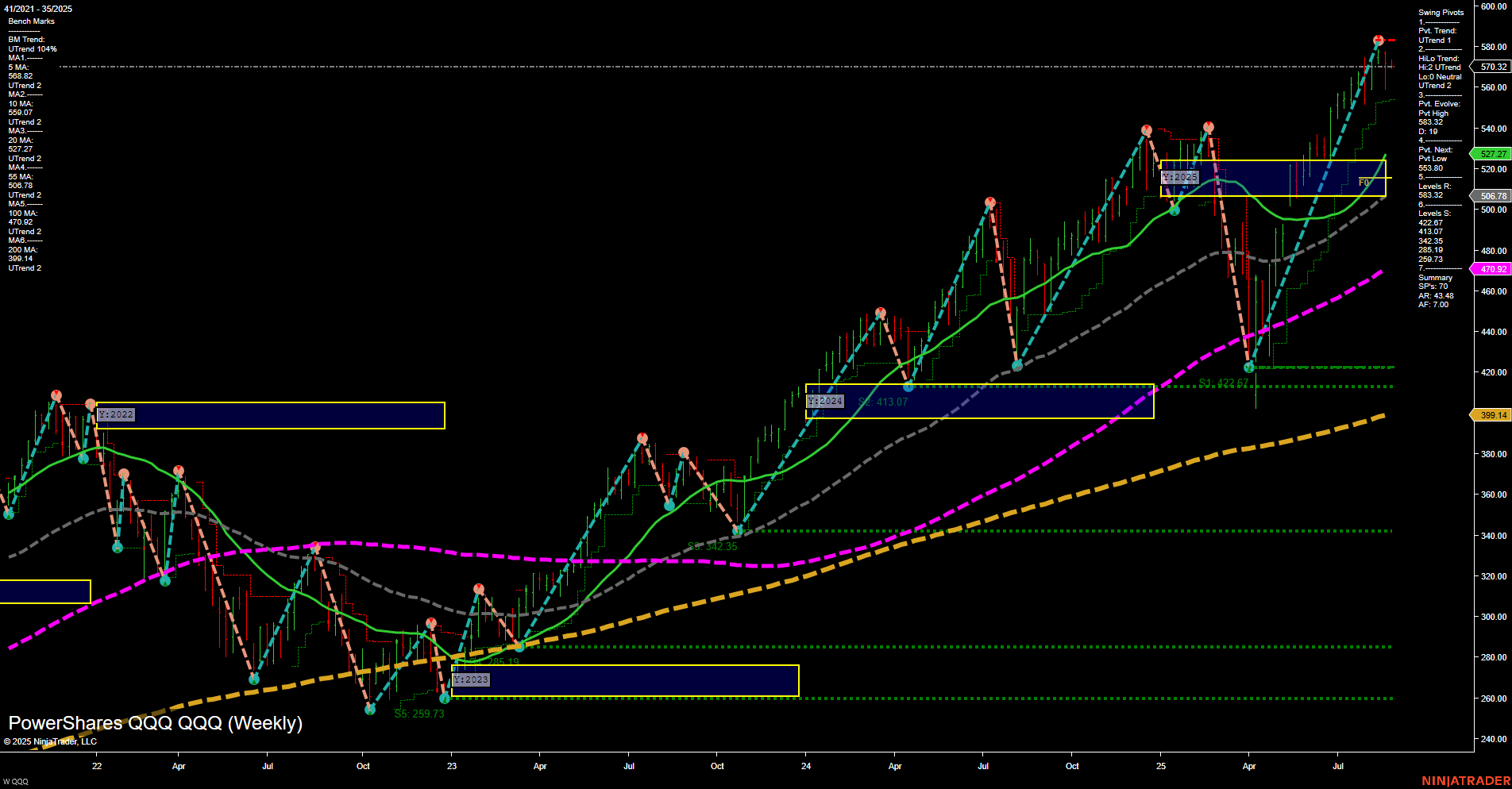

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts