After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

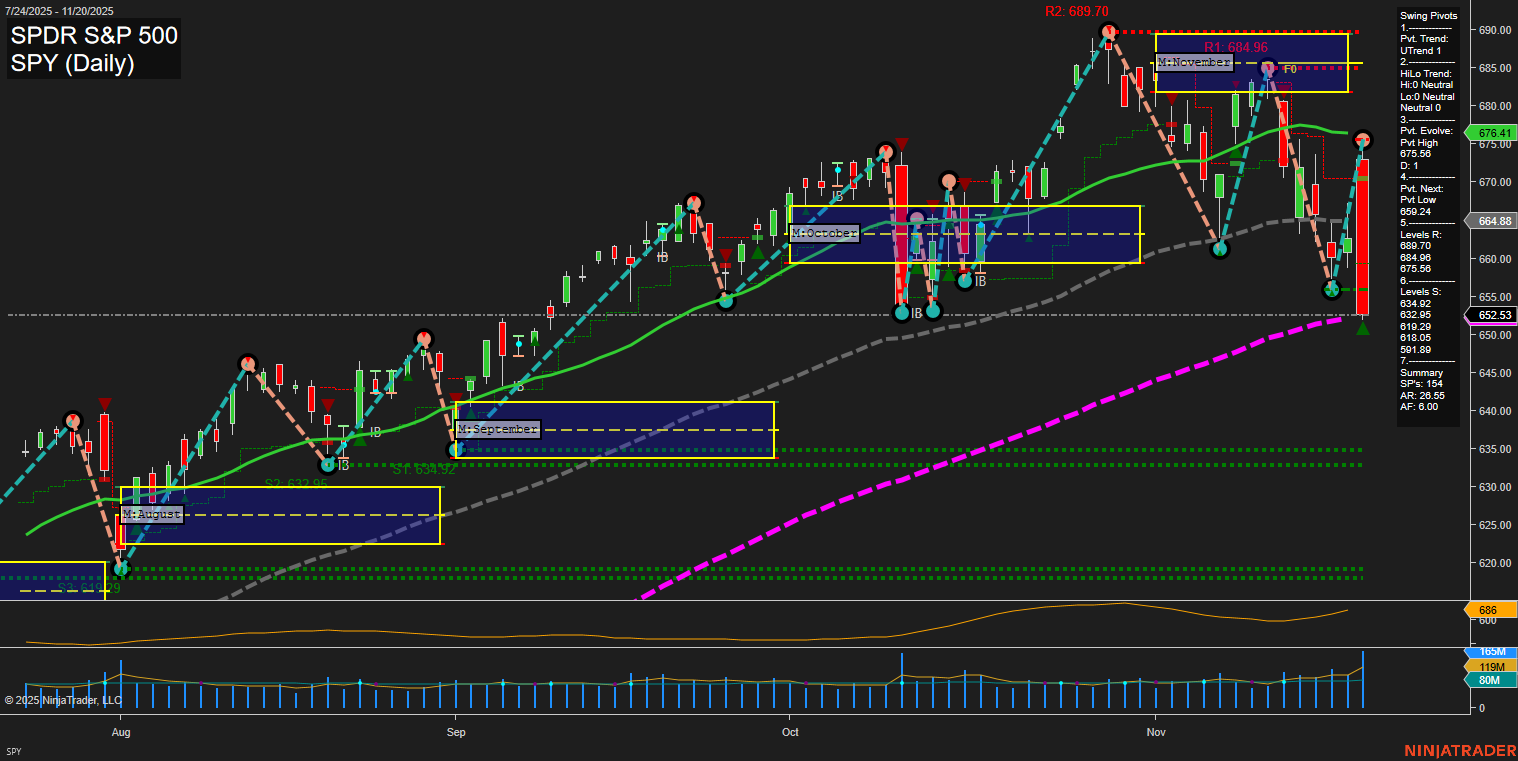

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Gold: Gold prices fluctuated around the $4,000 mark throughout the week, showing signs of waning momentum and choppy trading. Gold briefly rebounded from session lows despite a stronger dollar and is consolidating near key technical support levels.

- Crude Oil: Oil markets settled into defined trading ranges as both WTI and Brent failed to hold early rallies. The sector saw additional pressure from ongoing US-Russia geopolitics and fears that a possible peace deal may increase Russian oil exports.

- Indices: The S&P 500 experienced a turbulent week, dropping below its 50-day moving average and posting a 2% weekly loss. Heightened volatility, particularly in large-cap tech stocks, was driven by AI sector retracement and shifting risk sentiment.

- Tech Sector: Major technology stocks, especially AI leaders and the so-called “Mag 7,” faced renewed downside amid profit-taking and concerns about the durability of the AI rally. Nvidia shares slipped despite strong earnings, while Bitcoin’s sharp decline contributed to risk-off sentiment.

- Economic Data: October’s inflation and jobs reports were cancelled due to the US government shutdown. However, business activity rebounded in November, with rising consumer sentiment and a strong move higher in both the Dow and Nasdaq by midday Friday.

- Policy & Macro: Dovish remarks from Federal Reserve officials shifted market expectations toward a near-term rate cut. At the same time, debate continued regarding the accuracy and impact of delayed economic data, and the S&P 500’s role as a market benchmark was questioned in some quarters.

- Other Markets: Canadian equities steadily outperformed, buoyed by optimism about the USMCA trade deal’s impact next year. The retail sector posted mixed earnings results, while healthcare stocks showed relative strength over AI plays.

- Sentiment & Volatility: Pessimism among US consumers remains elevated amid persistent inflation, though volatility contributed to what some analysts view as a “healthy” market pullback. Uncertainty persists ahead of holiday shopping data and key Fed decisions.

News Conclusion

- Market volatility has intensified across equities, commodities, and crypto, with mixed performance seen across sectors and asset classes.

- Uncertainty around tech valuations, government data delays, and US monetary policy is driving cautious positioning and shorter-term trading approaches.

- Defensive and non-tech segments, such as healthcare and select international equities, showed greater resilience.

- Despite a week marked by sharp swings, US indices finished the day higher on Friday, buoyed by improved consumer sentiment and speculation over Fed policy shifts.

- Key support and resistance levels are critical for near-term trading, especially in gold and oil, while macroeconomic and holiday-related data releases remain in focus for upcoming sessions.

Market News Sentiment:

Market News Articles: 43

- Neutral: 46.51%

- Negative: 30.23%

- Positive: 23.26%

GLD,Gold Articles: 15

- Neutral: 53.33%

- Negative: 26.67%

- Positive: 20.00%

USO,Oil Articles: 7

- Negative: 57.14%

- Neutral: 28.57%

- Positive: 14.29%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: November 21, 2025 05:00

- GOOG 299.65 Bullish 3.33%

- IWM 235.60 Bullish 2.83%

- IJH 63.76 Bullish 2.41%

- AAPL 271.49 Bullish 1.97%

- AMZN 220.69 Bullish 1.63%

- SPY 659.03 Bullish 1.00%

- DIA 462.57 Bullish 0.98%

- META 594.25 Bullish 0.87%

- QQQ 590.07 Bullish 0.75%

- TLT 89.50 Bullish 0.30%

- GLD 374.27 Bearish -0.15%

- NVDA 178.88 Bearish -0.97%

- TSLA 391.09 Bearish -1.05%

- USO 69.30 Bearish -1.21%

- MSFT 472.12 Bearish -1.32%

- IBIT 47.97 Bearish -2.02%

Market State of Play: ETF Stocks (SPY, QQQ, IWM, IJH, DIA)

- SPY: 659.03 Bullish (+1.00%) — S&P 500 ETF showing continued strength, reflecting broad market optimism.

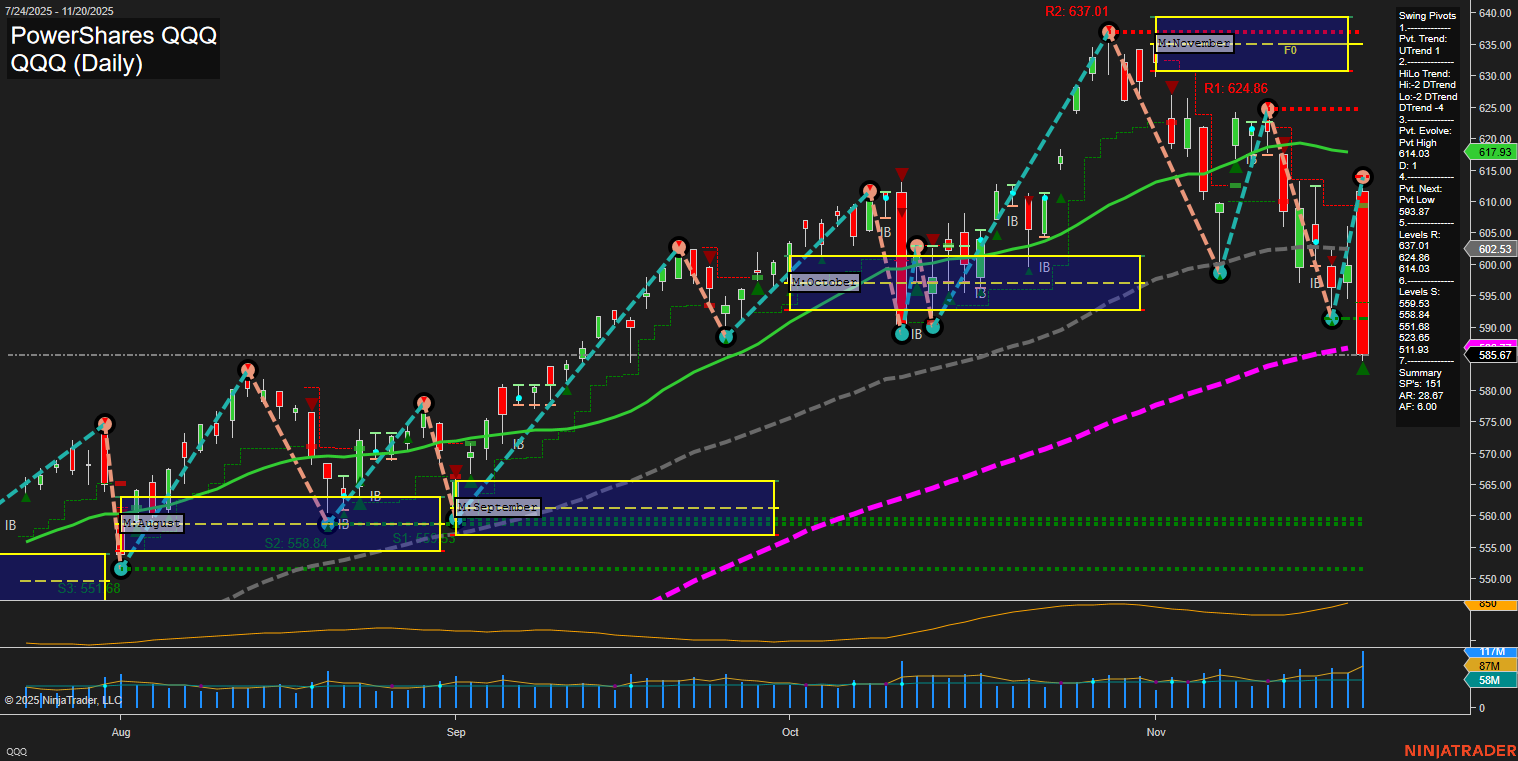

- QQQ: 590.07 Bullish (+0.75%) — Nasdaq-focused ETF in positive territory, though with moderate gains relative to other ETFs.

- IWM: 235.60 Bullish (+2.83%) — Small-cap ETF leading the pack with robust gains; risk appetite apparent.

- IJH: 63.76 Bullish (+2.41%) — Mid-cap stocks are rallying, showing sustained buying interest across different cap sizes.

- DIA: 462.57 Bullish (+0.98%) — Dow-tracking ETF in positive alignment with other indices.

Summary: All major US equity index ETFs are bullish, with small and mid-caps outperforming the broader market.

Mag 7 Stocks Snapshot

- AAPL: 271.49 Bullish (+1.97%) — Apple advancing robustly.

- GOOG: 299.65 Bullish (+3.33%) — Alphabet distinguished as the strongest performer among Mag 7.

- AMZN: 220.69 Bullish (+1.63%) — Steady gains for Amazon.

- META: 594.25 Bullish (+0.87%) — Meta Platforms posting modest gains.

- NVDA: 178.88 Bearish (-0.97%) — Nvidia under pressure despite market strength.

- TSLA: 391.09 Bearish (-1.05%) — Tesla trending lower.

- MSFT: 472.12 Bearish (-1.32%) — Microsoft facing meaningful losses in contrast to peers.

Summary: Mag 7 leadership is mixed: GOOG, AAPL, AMZN, and META solidly bullish; NVDA, TSLA, and MSFT are all in retreat, highlighting marked rotation within top-tech names.

Other Major ETFs

- TLT: 89.50 Bullish (+0.30%) — Slightly higher, suggesting mild buying interest in long-dated Treasuries.

- GLD: 374.27 Bearish (-0.15%) — Gold ETF marginally negative, possibly reflecting a move away from safe-havens.

- USO: 69.30 Bearish (-1.21%) — Oil ETF under selling pressure.

- IBIT: 47.97 Bearish (-2.02%) — Bitcoin ETF sharply lower, indicating risk-off moves in crypto instruments.

Summary: Non-equity ETFs are mixed: Treasuries modestly bid, with gold, oil, and Bitcoin-linked ETFs all registering losses.

Overall Market Summary

The session shows bullish momentum across major equity ETFs, led by small- and mid-cap outperformance. Within the Mag 7, internals are mixed as notable leaders (GOOG, AAPL) surge while key names (NVDA, TSLA, MSFT) lag. Outside of stocks, flows appear cautious: Treasuries edge up, while major alternative assets (gold, oil, crypto) trend lower, suggesting selective risk-taking and rotation.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts