Market Roundup – NYSE After Market Close Bullish as of November 26, 2025 05:00 ct

After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

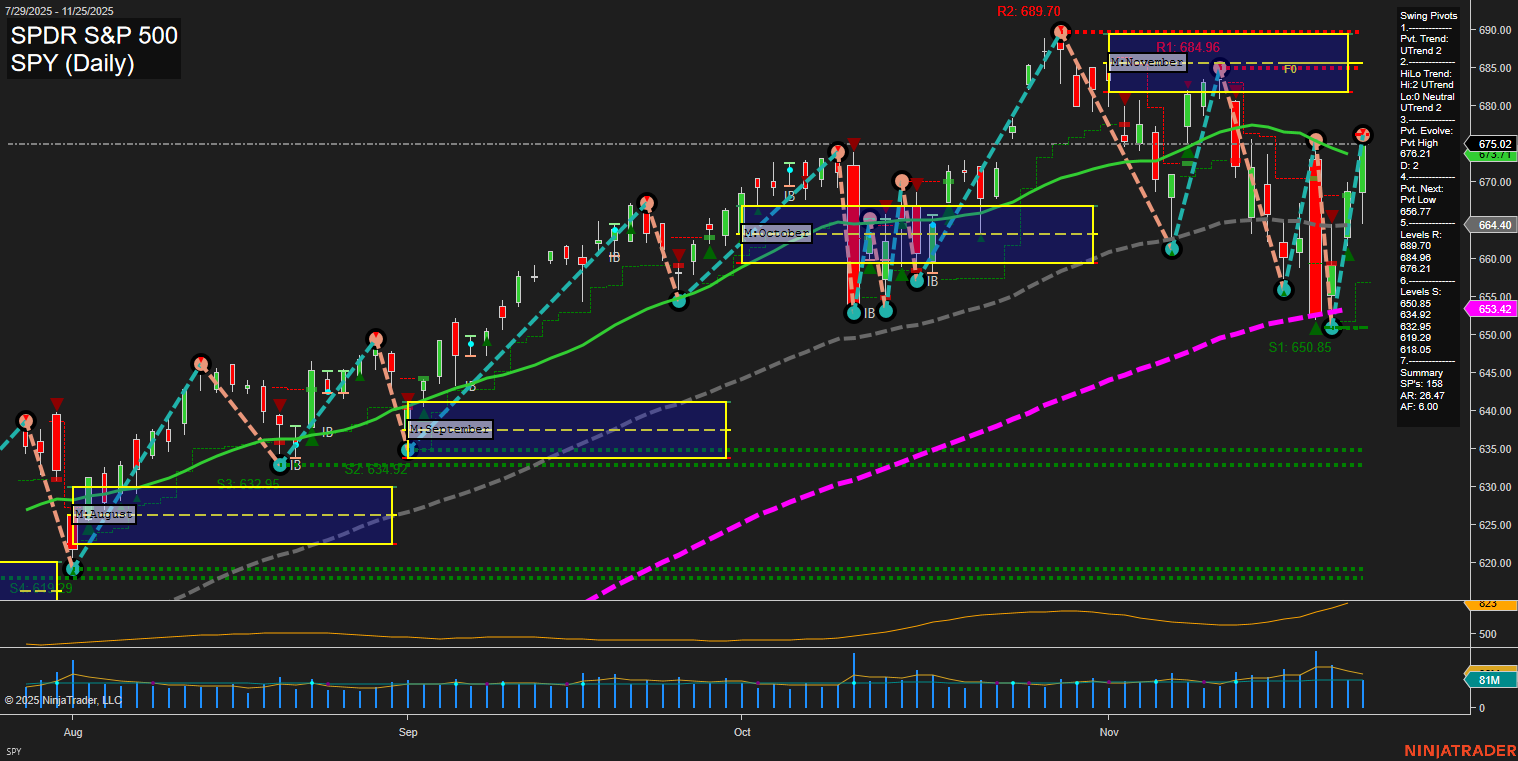

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- U.S. crude oil inventories rose due to higher net imports, and crude stocks climbed by 2.8 million barrels—above analyst expectations. Oil prices stabilized as the market analyzed the EIA report and watched for potential impacts from diplomatic efforts in the Russia-Ukraine conflict.

- Precious metals remained in focus: Gold ETFs saw strong demand as the dollar weakened and gold prices tested new highs; silver also rallied sharply. Forecasts suggest that gold could surpass $4,900 per ounce in 2026 if diversification drives investor flows. However, technical resistance remains near current gold levels, with trendlines capping further upside short term.

- Equity markets staged a robust advance, with the Dow rising over 300 points and the S&P 500 and Nasdaq closing higher for a fourth consecutive session. Tech and AI-linked stocks—including Dell and Robinhood—supported index gains as the probability of Federal Reserve rate cuts climbed to 85% in rate futures.

- Major brokerages provided bullish long-term outlooks for U.S. equities, with projections that the S&P 500 could reach or exceed 8,000 by end-2026. AI adoption and anticipated monetary easing are noted as key drivers. Meanwhile, discussions highlighted a potential pause ahead in the S&P 500’s longer-term uptrend and emphasized opportunities in small caps as investors chase top-line growth.

- Mixed signals from the Federal Reserve and ambiguous rate-cut timing led to an uptick in hedging activity in rate derivatives. The latest Beige Book flagged softening consumer and business sentiment, with signs of slowing demand and increasing price sensitivity, especially among lower- and middle-income groups. Black Friday sales face challenges from tariff-driven price increases, undermining typical holiday discounts.

- Market participants debated year-end positioning, the prospects for a Santa Claus rally, and strategies such as covered call ETFs, citing mild VIX readings and valuation pressures. Consumer confidence appears to be rebounding, supporting select festive stocks, yet caution is warranted following November’s market volatility.

- Analysts also highlighted potential for significant fiscal stimulus in 2026 and discussed international investment opportunities as 2025 winds down.

News Conclusion

- Stocks advanced for a fourth session, erasing last week’s declines, with the momentum fueled by expectations for December rate cuts and optimism toward AI-driven growth. Technology and small-cap stocks led gains, while discussions centered on sustained market strength heading into year-end and into 2026.

- Gold and other precious metals maintained upward momentum, supported by a weaker dollar and strong safe-haven demand, though price resistance remains a technical factor to watch. Forecasts for gold remain bullish longer term, conditional on continued investor interest in diversification strategies.

- Despite upbeat market performance, caution persists amid signs of slowing consumer spending and wider economic uncertainty, as reflected in the Fed’s latest Beige Book and ongoing debate about the breadth and durability of the market rally.

- Oil stabilized after inventory data and remains sensitive to geopolitical developments and ongoing OPEC+ discussions. Economic data and Fed policy expectations are set to remain key catalysts for short-term futures trading.

- The market backdrop is characterized by optimism around monetary easing and AI, countered by periodic concerns over valuations, policy uncertainty, and consumer sentiment.

Market News Sentiment:

Market News Articles: 44

- Positive: 47.73%

- Neutral: 36.36%

- Negative: 15.91%

GLD,Gold Articles: 13

- Positive: 46.15%

- Neutral: 38.46%

- Negative: 15.38%

USO,Oil Articles: 7

- Neutral: 42.86%

- Positive: 28.57%

- Negative: 28.57%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: November 26, 2025 05:00

- IBIT 51.03 Bullish 2.97%

- MSFT 485.50 Bullish 1.78%

- TSLA 426.58 Bullish 1.71%

- NVDA 180.26 Bullish 1.37%

- USO 70.04 Bullish 1.14%

- IWM 247.30 Bullish 0.89%

- QQQ 614.27 Bullish 0.88%

- GLD 383.12 Bullish 0.80%

- SPY 679.68 Bullish 0.69%

- DIA 474.35 Bullish 0.67%

- IJH 65.99 Bullish 0.59%

- TLT 90.64 Bullish 0.44%

- AAPL 277.55 Bullish 0.21%

- AMZN 229.16 Bearish -0.22%

- META 633.61 Bearish -0.41%

- GOOG 320.28 Bearish -1.04%

Market Summary: ETF Stocks, MegaCap Tech (Mag7), and Key Sector ETFs (as of 11/26/2025)

ETF Stocks Overview

- SPY 679.68 (+0.69%) — The S&P 500 ETF holds a bullish tone, suggesting a positive day across large-cap equities.

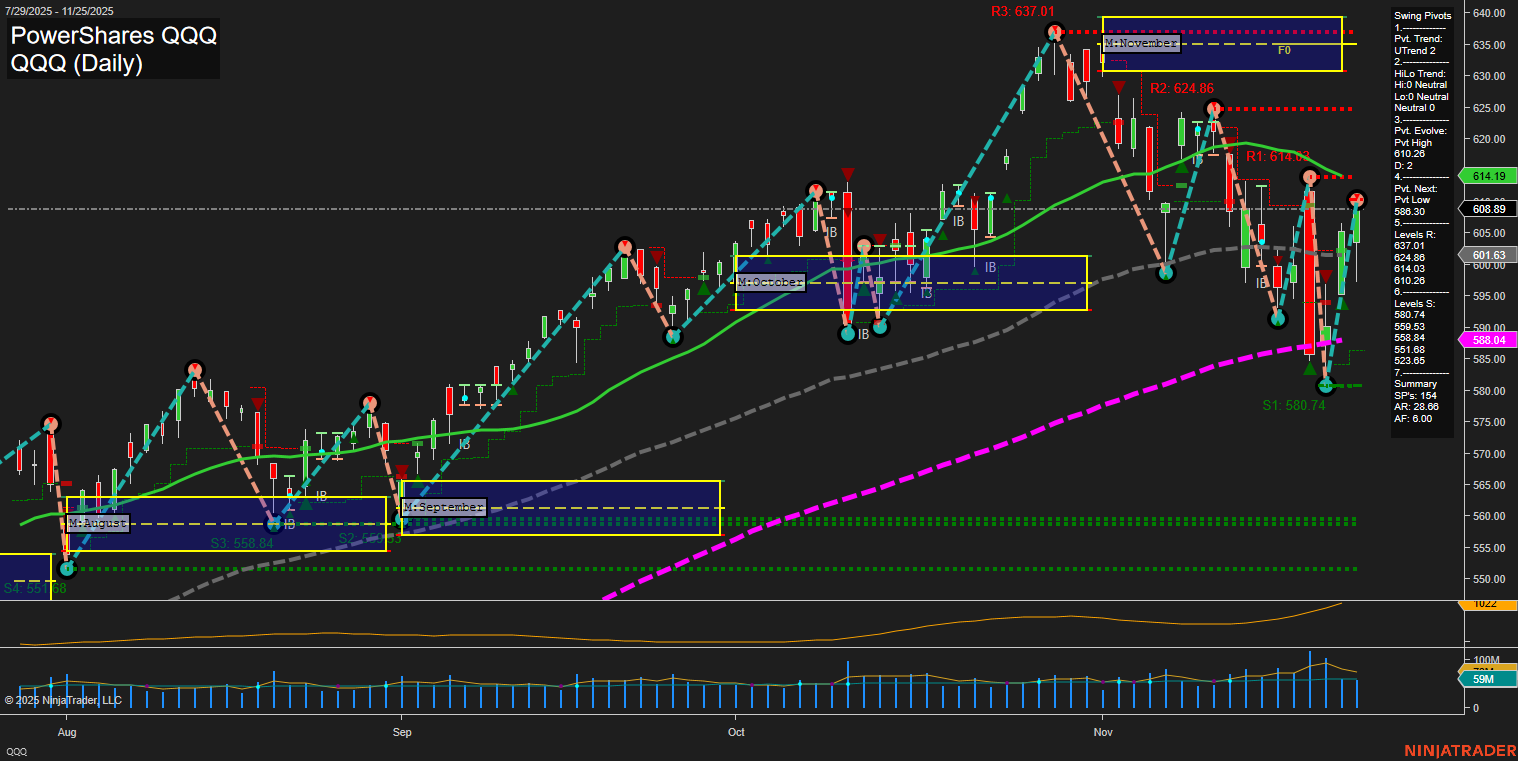

- QQQ 614.27 (+0.88%) — The Nasdaq 100 ETF shows leadership among major benchmarks, reflecting tech sector strength.

- IWM 247.30 (+0.89%) — The Russell 2000 ETF is also bullish, indicating broad participation including small caps.

- IJH 65.99 (+0.59%) — Midcaps are advancing, extending the positive market momentum.

- DIA 474.35 (+0.67%) — Dow Jones ETF signals blue-chip participation in the rally.

Mag7 Stocks Summary

- MSFT 485.50 (+1.78%) — Microsoft leads mega-cap gains, showing strong buying interest.

- TSLA 426.58 (+1.71%) — Tesla also ranks highly among gainers.

- NVDA 180.26 (+1.37%) — NVIDIA supports tech’s leadership.

- AAPL 277.55 (+0.21%) — Apple posts modest gains, contributing positively.

- AMZN 229.16 (-0.22%) — Amazon slips, offering a notable divergence from the group.

- META 633.61 (-0.41%) — Meta is also in the red, underperforming versus other megacaps.

- GOOG 320.28 (-1.04%) — Google is weakest in the group for the session.

Key Thematic & Sector ETFs

- IBIT 51.03 (+2.97%) — The spot bitcoin ETF outpaces all other tickers, highlighting strong momentum in digital assets.

- USO 70.04 (+1.14%) — The oil ETF posts solid gains, signaling strength in energy markets.

- GLD 383.12 (+0.80%) — The gold ETF advances, showing demand for precious metals.

- TLT 90.64 (+0.44%) — The long U.S. Treasury ETF is positive, suggesting stabilization in bond prices.

State of Play: Market Sentiment Snapshot

- Long/Bullish: Broad-based strength in major ETFs (SPY, QQQ, IWM, IJH, DIA), most Mag7 tech names (MSFT, TSLA, NVDA, AAPL), digital assets (IBIT), energy (USO), gold (GLD), and bonds (TLT).

- Short/Bearish: Select mega-cap tech (AMZN, META, GOOG) lag the broader uptrend with modest to moderate declines, underlining a mixed dynamic within big tech leadership.

- Mixed: Sector and thematic ETFs post varied strength; the overall tone is risk-on with some isolated underperformance in parts of the mega-cap tech space.

For informational purposes only. No trading advice or recommendations.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts