After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

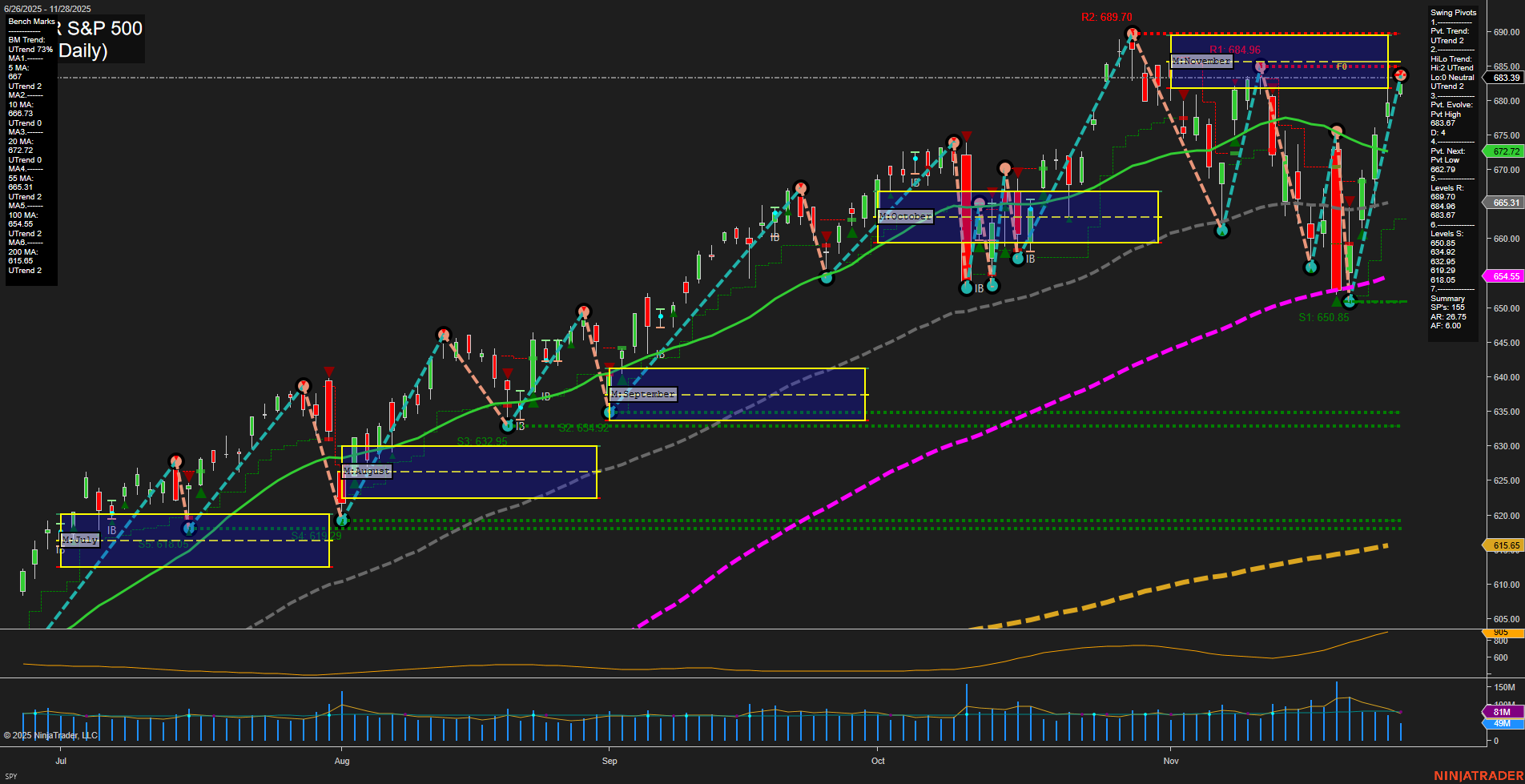

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Crypto Market Volatility: Bitcoin and Ethereum are expected to remain resilient amid heightened volatility, though altcoins may underperform following recent deleveraging events.

- S&P 500 Mixed Signals: Despite seven consecutive months of positive returns and a modest November gain, concerns grow over valuation bubbles driven by a handful of AI mega-cap stocks. Recent earnings from major tech names disappointed, fueling sharp corrections and increasing fears of market concentration.

- Year-End and 2026 Outlooks: Analysts see a favorable setup for stocks into 2026, with some projecting S&P 500 targets of 7,500–8,000 driven by AI growth and potential rate cuts. Discussions continue around overlooked AI stocks and continued opportunity amid high valuations.

- Retail and Institutional Sentiment: Retail investors have turned bearish on large-cap ETFs like SPY amid massive debt refinancing worries. Risk-off sentiment has taken hold, especially as the Dow Jones broke a multi-session winning streak.

- Macroeconomic Factors and the Fed: The US dollar saw a notable drop as market participants anticipate a December rate cut. News about the next Federal Reserve chair is fueling speculation, while rate hikes in Japan have pushed global yields higher and introduced fresh volatility.

- Sector Highlights: Oil gained ground following geopolitical tensions around key Russian export routes. High-yield dividend stocks and select ETFs continue to draw investor interest, while U.S. factory activity contracted at the fastest rate in four months, raising growth concerns.

- Market Dynamics: November saw sharp intramonth drawdowns but a swift recovery before month-end. Investors are rebalance-focused, with increased allocations to stocks and ETFs, especially in anticipation of a potential ‘Santa Claus rally’. However, international equities showed weakness and Bitcoin resumed selling into December.

- AI Focus and Deal Activity: Sector-specific dealmaking remains active, with new investments in software and infrastructure. While bubble talk surrounds mega-cap AI names, there is also attention on less prominent AI opportunities.

News Conclusion

- December opened with increased market caution amid bubble concerns in tech, an ongoing rotation toward high-quality and dividend stocks, and heightened volatility in crypto and global equities.

- Optimism persists for a year-end rally and positive 2026 outlooks, particularly for stocks and select ETFs supported by AI narratives and monetary policy expectations.

- Macroeconomic uncertainties—including upcoming Fed leadership changes, rate policy divergence, and weakening manufacturing data—are critical drivers of market sentiment and short-term risk.

Market News Sentiment:

Market News Articles: 56

- Neutral: 41.07%

- Positive: 35.71%

- Negative: 23.21%

GLD,Gold Articles: 11

- Positive: 63.64%

- Neutral: 27.27%

- Negative: 9.09%

USO,Oil Articles: 7

- Positive: 71.43%

- Neutral: 14.29%

- Negative: 14.29%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 1, 2025 05:00

- NVDA 179.92 Bullish 1.65%

- AAPL 283.10 Bullish 1.52%

- GLD 389.75 Bullish 0.48%

- AMZN 233.88 Bullish 0.28%

- TSLA 430.14 Bearish -0.01%

- USO 71.06 Bearish -0.01%

- QQQ 617.17 Bearish -0.34%

- SPY 680.27 Bearish -0.46%

- IJH 65.96 Bearish -0.57%

- DIA 473.32 Bearish -0.81%

- MSFT 486.74 Bearish -1.07%

- META 640.87 Bearish -1.09%

- IWM 245.62 Bearish -1.26%

- GOOG 315.12 Bearish -1.56%

- TLT 88.77 Bearish -1.60%

- IBIT 48.50 Bearish -5.92%

Market Summary: ETF Stocks, Mag7, and Key ETFs Snapshot (12/01/2025 17:00:00)

ETF Stocks Overview

- SPY (S&P 500 ETF): 680.27 Bearish (-0.46%)

- QQQ (Nasdaq 100 ETF): 617.17 Bearish (-0.34%)

- IWM (Russell 2000 ETF): 245.62 Bearish (-1.26%)

- IJH (S&P Midcap 400 ETF): 65.96 Bearish (-0.57%)

- DIA (Dow Jones ETF): 473.32 Bearish (-0.81%)

Current State: Broad-based ETFs are under pressure with negative performances across large-cap (SPY, DIA), tech-heavy (QQQ), small-cap (IWM), and mid-cap (IJH) exposures. This points to wide market weakness as of the snapshot.

Mag7 Stocks Highlights

- NVDA: 179.92 Bullish (+1.65%)

- AAPL: 283.10 Bullish (+1.52%)

- AMZN: 233.88 Bullish (+0.28%)

- TSLA: 430.14 Bearish (-0.01%)

- MSFT: 486.74 Bearish (-1.07%)

- META: 640.87 Bearish (-1.09%)

- GOOG: 315.12 Bearish (-1.56%)

Current State: The Mag7 group reflects a mixed session. Notably, NVDA and AAPL are displaying significant relative strength, whereas MSFT, META, and GOOG are showing notable declines. AMZN trades modestly higher, while TSLA is marginally lower.

Other Key ETFs

- GLD (Gold ETF): 389.75 Bullish (+0.48%)

- USO (Oil ETF): 71.06 Bearish (-0.01%)

- TLT (20+ Yr Treasury ETF): 88.77 Bearish (-1.60%)

- IBIT (Bitcoin ETF): 48.50 Bearish (-5.92%)

Current State: GLD shows resilience to the downside pressure, indicating a potential bid for safety. TLT trades sharply lower, suggesting weakness in long-term US Treasuries. USO is fractionally down. IBIT has a substantial negative move, reflecting heightened volatility in Bitcoin-related assets.

Overall Snapshot

- Bullish Standouts: NVDA, AAPL, GLD, AMZN

- Mixed/Rangebound: TSLA, USO

- Bearish Momentum: Broad ETFs (SPY, QQQ, IWM, IJH, DIA), Tech leaders (MSFT, META, GOOG), TLT, IBIT

At this juncture, equities are mostly trending lower across major indices and several large tech names, with selective outperformance in stocks such as NVDA and AAPL and relative strength in gold. Fixed income and Bitcoin-sector ETFs are seeing pronounced downside.

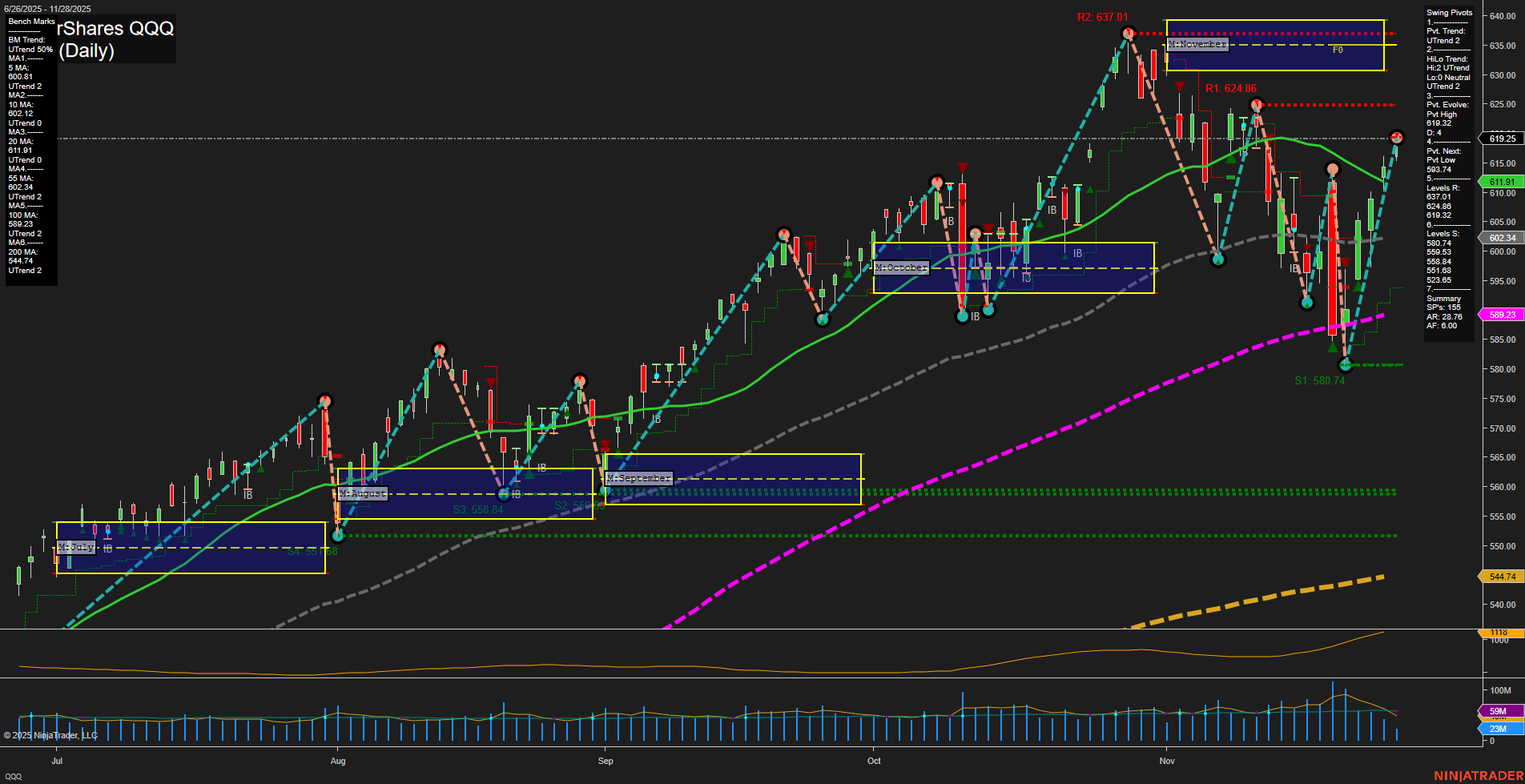

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts