Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

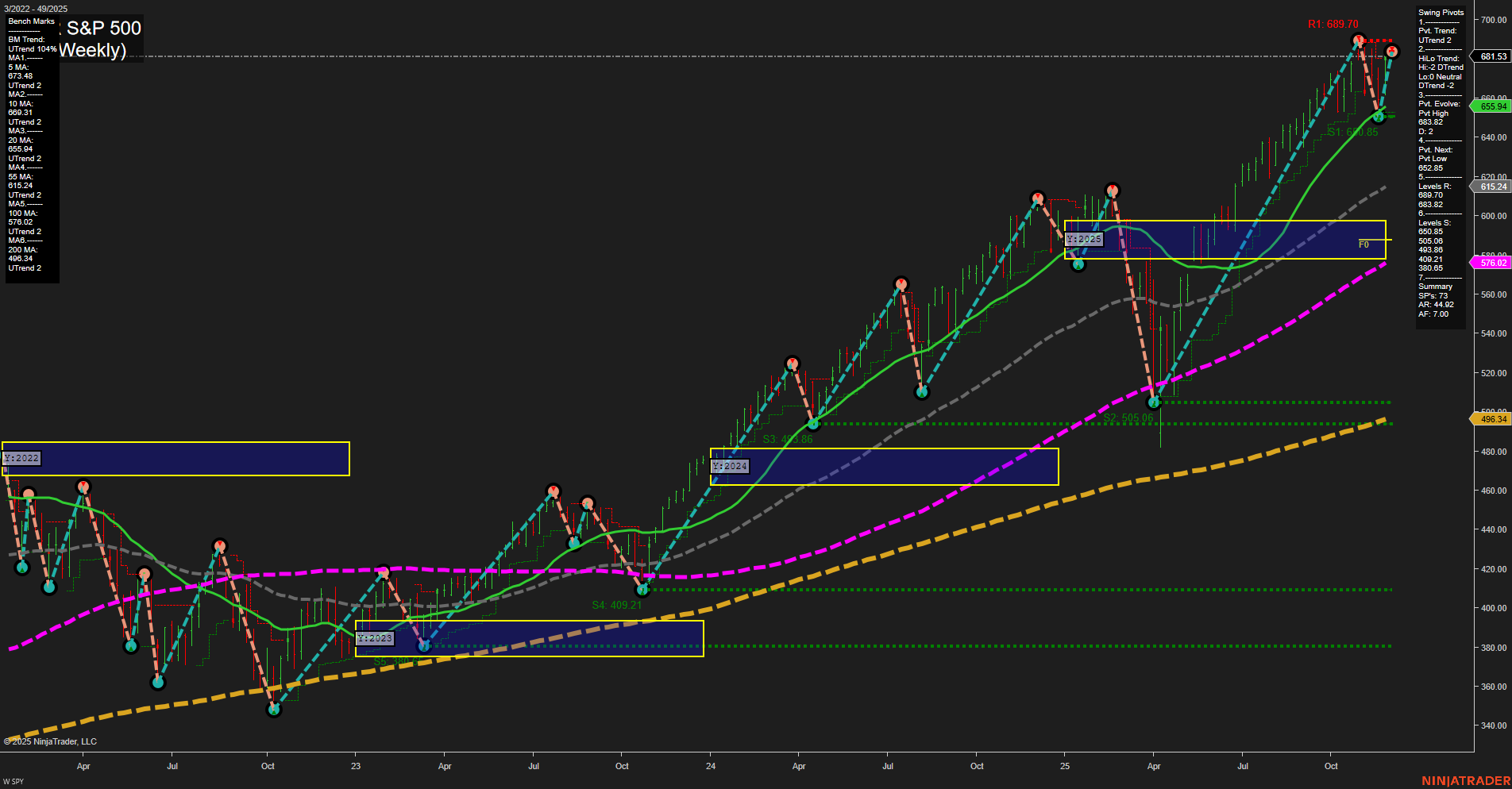

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

No monitored EcoNews market events.

For full details visit: Forex Factory EcoNews

Market News Summary

- Crude Oil: Oil prices are experiencing high volatility. Crude is trading within a tight, falling channel, encountering resistance at the 20-day moving average, and testing support near $57.21–$57.77. Forecasts point toward lower oil and gas prices through 2026, with Brent crude projected to drop to $55 per barrel and retail gas to $3 per gallon. Additional downward pressure comes from OPEC+ increasing supply despite weak prices, and geopolitical tensions such as the Russia-Ukraine situation, though occasional risk premiums are re-entering the market.

- Equities & Indices: Major US indices remain at or near all-time highs, with the NASDAQ posting over 20% annual gains despite recent pullbacks. The broader market recovered on strong tech and crypto performance, notably after positive earnings from CrowdStrike, Marvell Technology, and MongoDB, pushing futures higher into the next session. European equities are set for a positive open, following global momentum.

- Sentiment: Despite index gains, the CNN Money ‘Fear & Greed’ index is firmly in the “Extreme Fear” zone. Investors display skittish behavior, with some warnings from Bitcoin’s sharp correction signaling possible overextension in AI and tech names.

- Gold & Silver: Precious metals are staging a rebound, with gold and silver buoyed by weak manufacturing data, technical support, and rate-cut expectations. Gold hovers above key support as Fed cut odds rise to 87–89%. Silver continues a strong rally, hitting historic highs on supply deficits and robust demand from industrial users.

- Sector Rotation & Outlook: As capital begins shifting, energy is considered at a sentiment bottom while mega-cap tech’s dominance raises concerns for next year. Optimism persists for “diamonds in the rough” among S&P 500 laggards.

- Regulatory & Macro Developments: The SEC is preparing significant regulatory changes focused on digitization and settlement efficiency. The Trump administration is reportedly advancing new fuel economy standards, and central bank leadership remains in focus.

- Other: Swiss inflation prints flat in November. Warnings surface about the prospects of a “lost decade” in stocks, especially impacting retirement strategies.

News Conclusion

- Market volatility remains pronounced across major asset classes, especially in energy and tech stocks. Oil markets are pressured by both increased supply and flagging demand, though geopolitical risk adds complexity.

- Equity indices are supported by tech earnings and crypto rebounds, yet sentiment is fragile with risk signals from broader market indicators and cryptocurrency volatility.

- Precious metals are benefiting from macroeconomic uncertainty, supportive technicals, and expectations of central bank easing.

- Sector reallocations and regulatory shifts are notable market themes, as investors weigh the sustainability of tech outperformance and look toward possible energy sector recovery and market structure reforms.

- Lingering macroeconomic uncertainties and earnings volatility continue to shape near-term trading setups into 2026.

Market News Sentiment:

Market News Articles: 38

- Positive: 47.37%

- Neutral: 36.84%

- Negative: 15.79%

Sentiment Summary: Out of 38 market news articles, 47.37% convey a positive outlook, 36.84% are neutral, and 15.79% express negative sentiments.

Conclusion: The majority of recent market news articles reflect a generally positive sentiment, with a significant proportion maintaining a neutral tone and a smaller segment highlighting negative perspectives.

GLD,Gold Articles: 14

- Neutral: 35.71%

- Positive: 35.71%

- Negative: 28.57%

Sentiment Summary:

Among 14 recent articles on GLD and gold, 35.71% reflect a neutral sentiment, 35.71% convey a positive outlook, and 28.57% indicate negative sentiment.

This distribution shows that coverage is relatively balanced between neutral and positive views, with a smaller but notable share of negative sentiment present in market commentary.

USO,Oil Articles: 7

- Negative: 57.14%

- Positive: 28.57%

- Neutral: 14.29%

Sentiment Summary: The majority of recent market news coverage for US Oil (USO) is negative, accounting for 57.14% of articles. Positive sentiment is present in 28.57% of articles, while 14.29% of coverage is neutral.

This indicates that recent news flow around USO and oil is predominantly negative, with limited positive and neutral perspectives.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 3, 2025 07:16

- IBIT 51.67 Bullish 6.54%

- AAPL 286.19 Bullish 1.09%

- META 647.10 Bullish 0.97%

- NVDA 181.46 Bullish 0.86%

- QQQ 622.00 Bullish 0.78%

- MSFT 490.00 Bullish 0.67%

- DIA 475.26 Bullish 0.41%

- GOOG 316.02 Bullish 0.29%

- AMZN 234.42 Bullish 0.23%

- SPY 681.53 Bullish 0.19%

- TLT 88.81 Bullish 0.05%

- IWM 245.17 Bearish -0.18%

- TSLA 429.24 Bearish -0.21%

- IJH 65.73 Bearish -0.35%

- GLD 387.24 Bearish -0.64%

- USO 70.20 Bearish -1.21%

Market Summary: ETF Stocks

- SPY: 681.53 (Bullish +0.19%) – S&P 500 ETF continues in an uptrend, posting modest gains.

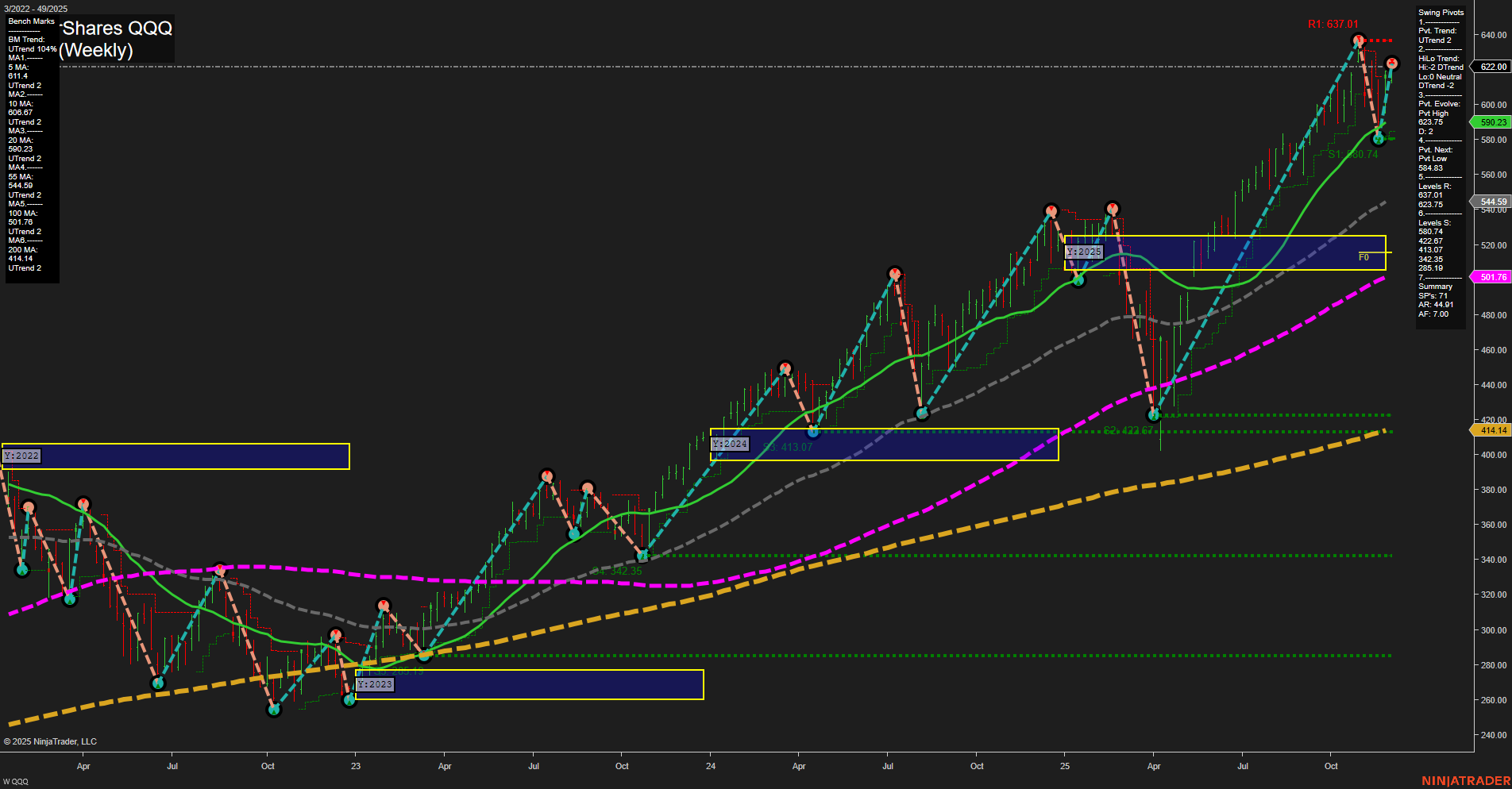

- QQQ: 622.00 (Bullish +0.78%) – Nasdaq 100 ETF outperforms, supported by tech sector strength.

- DIA: 475.26 (Bullish +0.41%) – Dow Industrials ETF edges higher but lags NASDAQ counterparts.

- IWM: 245.17 (Bearish -0.18%) – Small Caps ETF shows mild weakness, diverging from large caps.

- IJH: 65.73 (Bearish -0.35%) – Mid Caps ETF also declines, reflecting broader market rotation.

Mag7 Stocks – State of Play

- AAPL: 286.19 (Bullish +1.09%) – Apple leads, with strong positive momentum.

- MSFT: 490.00 (Bullish +0.67%) – Microsoft sustains its long trend, contributing to market optimism.

- GOOG: 316.02 (Bullish +0.29%) – Alphabet advances, but with moderate gains.

- AMZN: 234.42 (Bullish +0.23%) – Amazon stays positive, echoing broader tech gains.

- META: 647.10 (Bullish +0.97%) – Meta shows strong performance within big tech.

- NVDA: 181.46 (Bullish +0.86%) – Nvidia continues to benefit from AI and semiconductor momentum.

- TSLA: 429.24 (Bearish -0.21%) – Tesla underperforms, standing out as a notable laggard among Mag7.

Sector & Other Noteworthy ETFs

- IBIT: 51.67 (Bullish +6.54%) – Spot Bitcoin ETF surges, reflecting high speculative interest.

- TLT: 88.81 (Bullish +0.05%) – Long-term Treasury ETF shows minimal change, indicating bond market stability.

- GLD: 387.24 (Bearish -0.64%) – Gold ETF comes under pressure, signaling potential risk-off rotation.

- USO: 70.20 (Bearish -1.21%) – Oil ETF pulls back, with energy sector weakness.

Overall Market Sentiment

The snapshot reveals a bullish tilt among large-cap and tech-focused ETFs, led by strong performance in the Mag7 (notably Apple, Meta, and Nvidia). Small-cap stocks (IWM, IJH) and select sectors (GLD, USO) are underperforming. The standout move is the sharp rally in IBIT, reflecting heightened activity in digital asset markets. This divergence across asset classes and capitalizations shows a mixed but tech-heavy bias at this time.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-12-03: 07:16 CT.

US Indices Futures

- ES Bullish YSFG/MSFG/WSFG, new swing highs, strong bullish MA alignment, bench above YSFG, support at 6525, resistance recent swing high, volatility elevated, trend continuation environment.

- NQ Bullish YSFG/MSFG/WSFG, large bars/fast momentum, high at 26399, support 25072, all MAs up, above NTZ/F0%, consecutive long signals, no major reversal signs.

- YM Bullish YSFG/MSFG, WSFG short-term neutral, above major MAs, recent swing high at 48528, support 45770, short-term chop, MAs supportive, higher timeframe trend intact.

- EMD YSFG/MSFG bullish, WSFG short-term neutral/weak, price below NTZ, swing high 3293, resistance 3347-3352, support 3202-3240, MAs up, consolidation after rally.

- RTY Monthly/Yearly SFG up, WSFG down, short-term swings neutral, pivot high 2484, support 2397-2431, resistance 2484/2506/2566, MAs bullish, volatility moderate, consolidating pullback.

- FDAX Weekly uptrend, WSFG short-term down, MSFG bullish, daily rebound above MSFG, resistance 23932-24891, support 22963-23386, all key MAs bullish long-term, transition/consolidation phase.

Overall State

- Short-Term: Mixed (ES, NQ, YM bullish; EMD, RTY, FDAX neutral/bearish)

- Intermediate-Term: Bullish all indices except FDAX neutral

- Long-Term: Bullish all indices

Conclusion

US Indices Futures HTF technicals reflect a dominant long-term bullish structure across ES, NQ, YM, EMD, RTY, and FDAX, supported by persistent YSFG and MSFG uptrends, and benchmark moving averages aligned upward. Short-term trends are mixed: ES and NQ lead with persistent momentum and new highs above major pivot and session grid levels, while YM, EMD, RTY, and FDAX display short-term corrective phases or consolidation below resistance. Key swing pivot and S/R levels are well-defined, with significant buffers above major supports. Volatility remains moderate to elevated, and trend continuation signals are present on leading instruments. While short-term retracements and range conditions are active in certain contracts, the HTF context is characterized by upward intermediate and long-term directional correlation, with benchmarks holding above critical session fib grid centers. Intra-day reversals may develop, but no major reversal signals are present in the higher timeframes as of this analysis.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts