After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

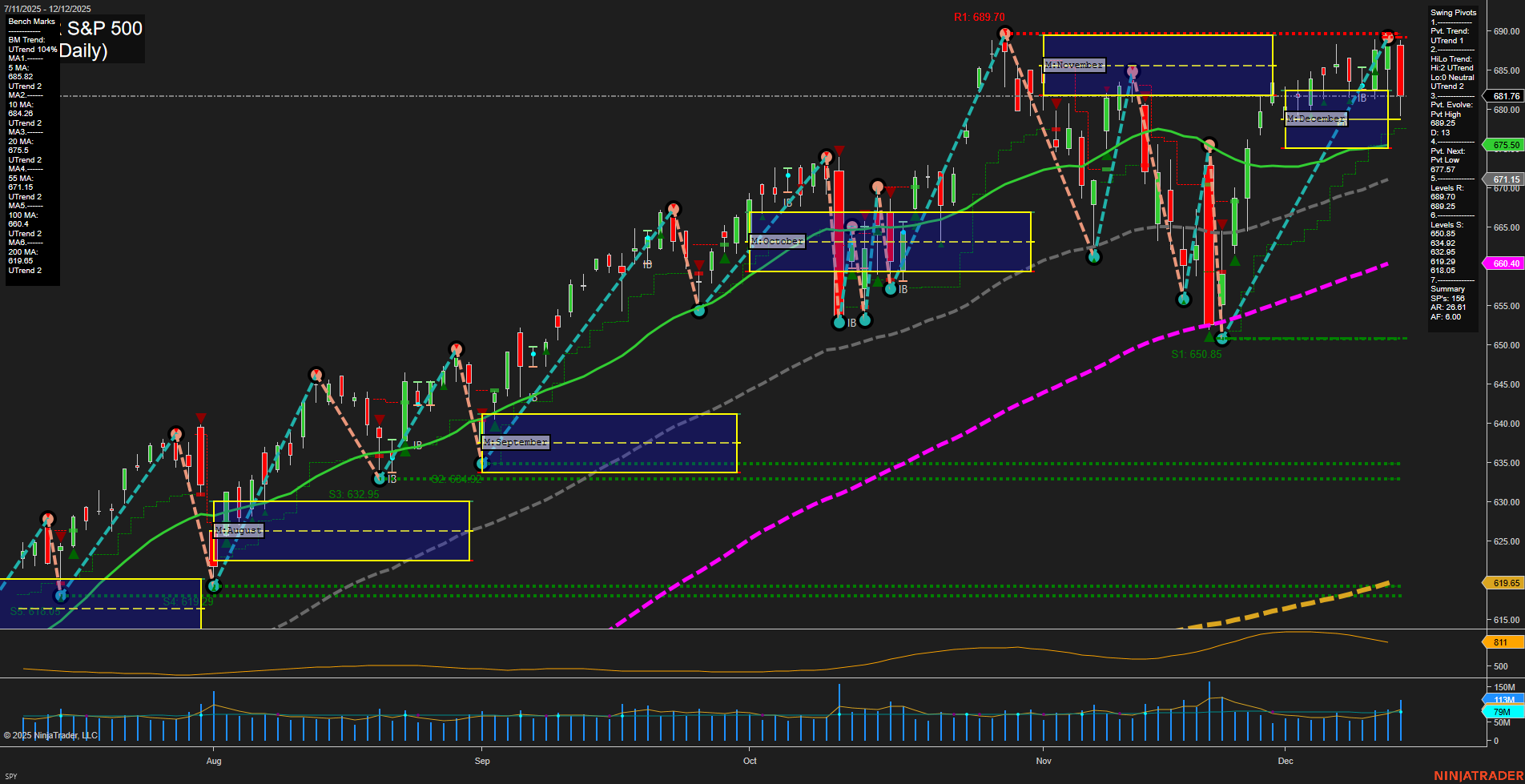

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Equities: The S&P 500 is seeing bullish forecasts, with some strategists calling for targets as high as 8,500 in 2026. Outlook remains split, with other industry experts warning of risks if economic conditions weaken. Small-cap stocks have drawn renewed attention on prospects of a mean reversion after years of lagging performance. AI-focused ETFs, especially those with heavy Nvidia exposure, have outperformed, though recent earnings disappointments in the sector have pressured indices like the NASDAQ.

- Commodities: Gold continues a record-breaking rally, closing in on all-time highs after a 60% surge in 2025, driven by central bank and retail investor demand and as a hedge against equity volatility and rate cuts. Gold ETFs are attracting renewed capital inflows. Silver and platinum also show strength, with platinum testing multi-year highs. Commodity stocks are noted to be outperforming. Oil remains under pressure from oversupply concerns, with WTI and Brent retreating to new lows. Natural gas follows similar bearish patterns.

- Interest Rates & Macro: The Federal Reserve has delivered another rate cut, though internal division is apparent, reflecting mixed signals in labor data—a rising JOLTS report contrasted with broader jobs market softness. The Fed acknowledges the labor market cooling, with unemployment drifting higher, though reassures against fears of a steep decline. Economic uncertainty is heightened by mixed jobs data and potential trouble in key corners of the financial markets. Outlook for 2026 remains debated among major firms—some anticipate opportunity, others caution about negative risk premiums and possible volatility if economic indicators worsen.

- Global Watch & ETFs: World indices tracked moderately, with focus on the US and commodity-linked ETFs—especially gold and AI sector funds—standing out for performance and investor interest.

News Conclusion

- Broadly, optimism toward US equities persists at the macro level, especially for large-cap and select sector plays like AI and commodities, but notable warnings are arising regarding potential market risks and negative risk premiums heading into 2026.

- Gold and related ETFs continue to outshine, propelled by safe-haven flows and central bank accumulation, while oil remains pressured as oversupply weighs on prices and sentiment.

- The fixed income and macroeconomic backdrop is more uncertain, with the Federal Reserve’s actions signaling both accommodation and division amid challenging labor market dynamics.

- The interplay between shifting interest rate policy, robust commodity demand, and sector rotation themes frames current and forward-looking market narratives for day traders and futures participants.

Market News Sentiment:

Market News Articles: 44

- Positive: 40.91%

- Neutral: 38.64%

- Negative: 20.45%

GLD,Gold Articles: 18

- Positive: 77.78%

- Neutral: 16.67%

- Negative: 5.56%

USO,Oil Articles: 7

- Negative: 57.14%

- Positive: 28.57%

- Neutral: 14.29%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 15, 2025 05:00

- TSLA 475.31 Bullish 3.56%

- NVDA 176.29 Bullish 0.73%

- META 647.51 Bullish 0.51%

- GLD 395.80 Bullish 0.09%

- TLT 87.40 Bullish 0.07%

- DIA 485.17 Bearish -0.05%

- SPY 680.73 Bearish -0.15%

- IJH 67.05 Bearish -0.18%

- GOOG 309.32 Bearish -0.39%

- QQQ 610.54 Bearish -0.50%

- IWM 251.93 Bearish -0.76%

- MSFT 474.82 Bearish -0.78%

- USO 67.89 Bearish -1.34%

- AAPL 274.11 Bearish -1.50%

- AMZN 222.54 Bearish -1.61%

- IBIT 48.66 Bearish -4.96%

Market Summary: ETFs, Mag7, and Key Assets (as of 12/15/2025 17:00)

ETF Stocks Overview

- SPY: 680.73 Bearish (-0.15%) – The S&P 500 ETF trades lower, reflecting broad market softness.

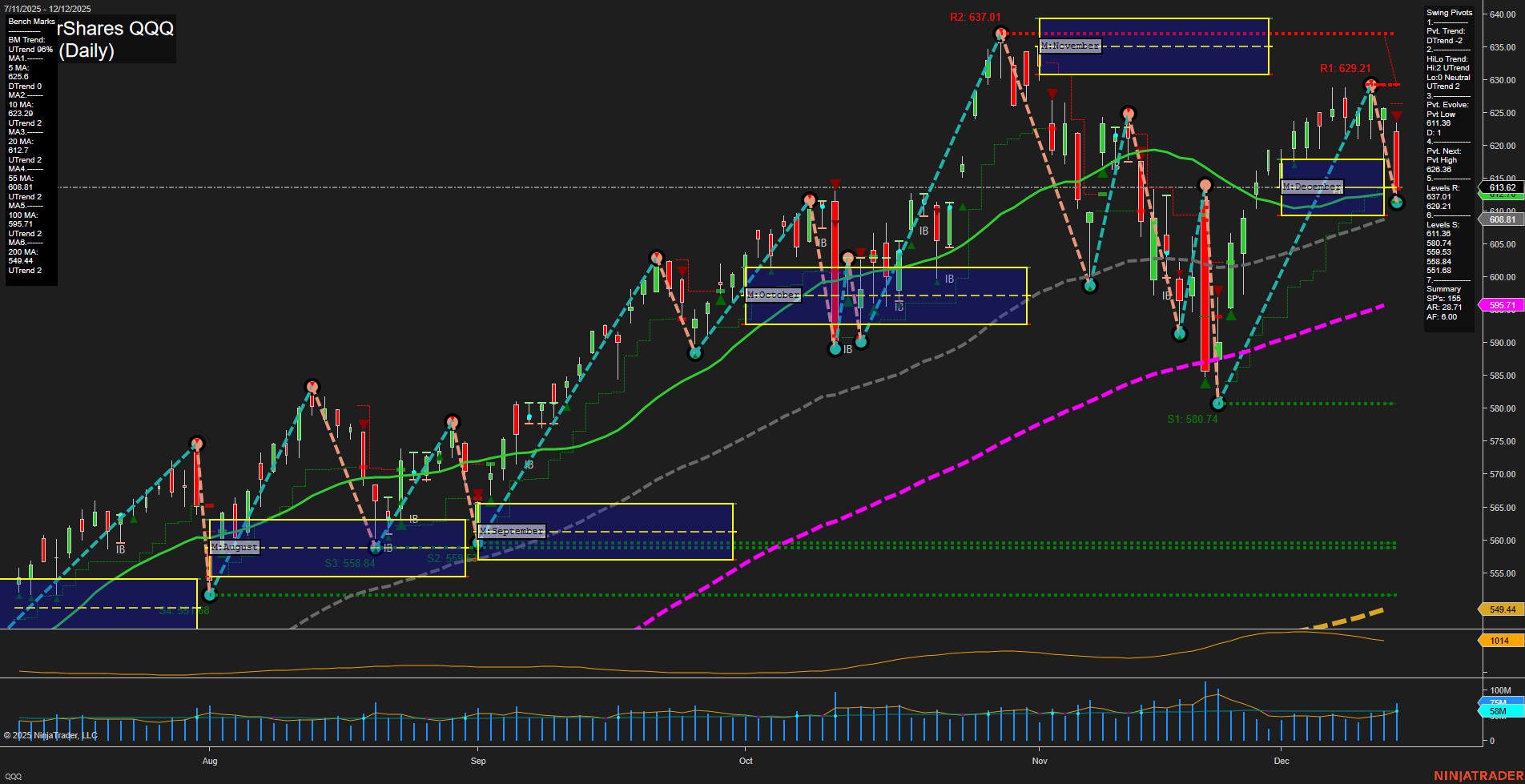

- QQQ: 610.54 Bearish (-0.50%) – Nasdaq-100 ETF under pressure, echoing tech sector lag.

- IWM: 251.93 Bearish (-0.76%) – Small caps ETF declines, suggesting risk-off appetite.

- IJH: 67.05 Bearish (-0.18%) – Mid-cap segment registers minor losses.

- DIA: 485.17 Bearish (-0.05%) – Dow Industrials ETF slightly lower, relatively resilient.

Interpretation: Major equity ETFs are predominantly under selling pressure, with breadth negative across large, mid, and small caps.

Magnificent 7 Stocks

- AAPL: 274.11 Bearish (-1.50%)

- MSFT: 474.82 Bearish (-0.78%)

- GOOG: 309.32 Bearish (-0.39%)

- AMZN: 222.54 Bearish (-1.61%)

- META: 647.51 Bullish (+0.51%)

- NVDA: 176.29 Bullish (+0.73%)

- TSLA: 475.31 Bullish (+3.56%)

Interpretation: The Mag7 show mixed performance. Strength in TSLA, NVDA, and META stands out, while AAPL, MSFT, GOOG, and AMZN face notable declines.

Other Notable ETFs

- GLD: 395.80 Bullish (+0.09%) – Gold ETF inches higher, indicating safe haven demand.

- TLT: 87.40 Bullish (+0.07%) – Long-term Treasuries see mild inflows.

- USO: 67.89 Bearish (-1.34%) – Oil ETF falls, energy sector underperforms.

- IBIT: 48.66 Bearish (-4.96%) – Bitcoin ETF experiences sharp pullback.

Interpretation: Defensive assets (gold, treasuries) are modestly firmer against declines in oil and crypto proxies.

Summary Table: Long/Short/Mixed Sentiment

| Theme | Bullish | Bearish |

|---|---|---|

| Major ETFs | SPY, QQQ, IWM, IJH, DIA | |

| Mag7 | TSLA, NVDA, META | AAPL, MSFT, GOOG, AMZN |

| Other ETFs | GLD, TLT | USO, IBIT |

Overall Market Tone: Equity ETFs and most Mag7 leaders are on the defensive. Select tech (TSLA, NVDA, META) and defensive ETFs offer relative strength, while energy and crypto exposure are notably weaker.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts