Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

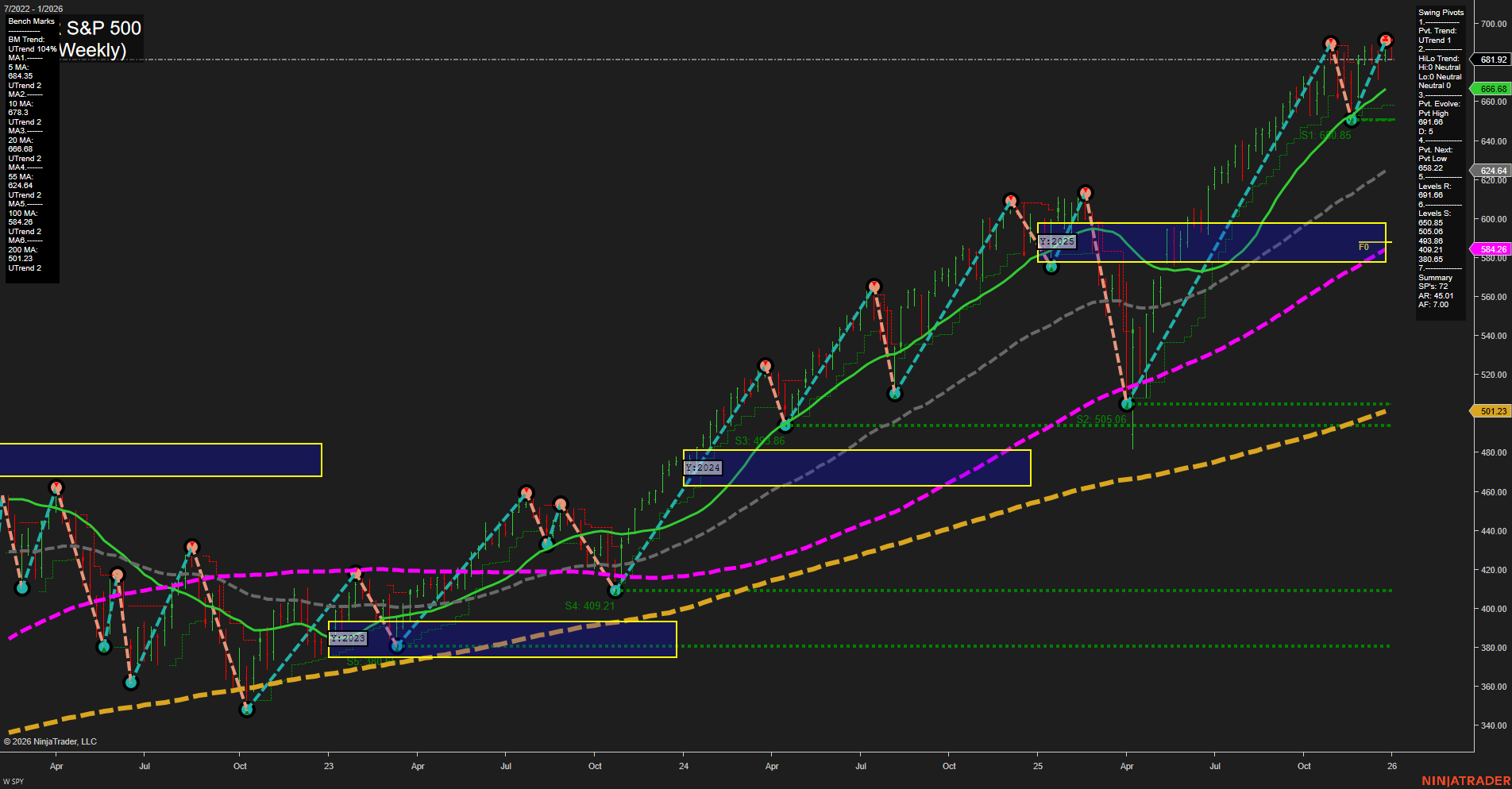

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

No monitored EcoNews market events.

For full details visit: Forex Factory EcoNews

Market News Summary

- The US dollar posted its worst performance since 2017, pressured by Federal Reserve instability, tariff disputes, and a slowing economy.

- Warren Buffett stepped down as CEO of Berkshire Hathaway, highlighting a shift in his investing philosophy rooted in early influences.

- Late 2025 pricing in US Treasuries and Fed funds futures indicates growing expectations for more accommodative monetary policy in early 2026, with longer-dated yields easing as financial conditions appear set to loosen.

- Sector rotation that began in late 2025 is likely to continue into 2026, with particular scrutiny on overvalued AI stocks and potential bargains in sectors trading below fair value.

- Gold climbed amid ongoing geopolitical risks, especially in the Middle East, while gold and silver consolidation is being interpreted by some as a setup for further upside after strong 2025 gains.

- VOO and SPY, both S&P 500-tracking ETFs, continue to offer similar risk and return profiles, with VOO’s lower expense ratio drawing attention.

- US reduced proposed tariffs on Italian pasta, easing trade tensions in that area.

- Oil prices edged higher after a significant annual loss in 2025, affected by Ukrainian drone strikes on Russian facilities and US restrictions on Venezuelan exports. Nevertheless, inventory oversupply and OPEC+ deliberations contribute to a mixed outlook for energy markets.

- Asian currencies traded mixed against the dollar, as market participants weighed expectations of US rate cuts in 2026.

- US Treasury yields saw modest gains as trading started in Europe, but overall Treasurys remained little changed with a near-term rate cut seen as unlikely.

- The S&P 500 finished 2025 with a 16% gain but began the new year on a losing streak, with signs of declining investor sentiment as tracked by the Fear & Greed Index.

- Analysts at RBC Capital Markets project gold could reach over $5,100 per ounce in 2026, citing its role as a hedge and ongoing strategic flows.

- Goldman suggests the US economy may outperform expectations in 2026, while prior year weakness may linger.

- Tech stocks are forecast to gain 20-25% in 2026, particularly as artificial intelligence sectors face a “prove it” year.

- Income-focused investors continue to look towards dividend stocks and energy pipelines for opportunities in 2026.

- There are warnings of cracks in the stock market beneath strong performance by Big Tech, with challenges expected to become more pronounced in the coming year, especially as tariffs could weigh on economic growth.

- Fed Chair Powell’s future beyond his current term remains uncertain, adding an element of unpredictability to Fed leadership.

- Gold slipped below $4,500 after a strong rally, even as concerns about US debt underpin continued interest in precious metals.

- Asian gold markets rebounded this week, led by retail demand in India and China after a pullback from all-time price highs.

- Broad market themes for 2026 include artificial intelligence, interest rates, and ongoing economic pressures as outlined by several prominent Wall Street investors.

News Conclusion

- Markets are starting 2026 with mixed signals: strong prior-year performance for both equities and gold, but emerging headwinds from currency weakness, lingering tariff disputes, and questions around US economic and monetary policy direction.

- Investor sentiment appears cautious amid recent losing streaks and a neutral Fear & Greed Index reading, while rotation among market sectors and persistent geopolitical and macroeconomic risks are shaping both risk appetite and asset allocation.

- Precious metals remain in focus due to inflation hedging and geopolitical concerns, with analysts expressing further upside potential for gold and silver prices.

- Tech and AI sectors face valuation concerns but are still anticipated by some analysts to deliver robust gains if fundamental performance materializes.

- Uncertainty over future Fed leadership and rate policy adds to overall market ambiguity as 2026 gets underway.

Market News Sentiment:

Market News Articles: 16

- Neutral: 56.25%

- Positive: 25.00%

- Negative: 18.75%

Sentiment Summary:

Out of 16 market news articles, 56.25% were neutral, 25.00% positive, and 18.75% negative.

Conclusion:

The overall market news sentiment is largely neutral, with a higher proportion of neutral articles compared to positive and negative ones. Positive sentiment is present but is outweighed by neutral coverage, while negative sentiment represents a smaller share of the recent news.

GLD,Gold Articles: 6

- Positive: 83.33%

- Neutral: 16.67%

Sentiment Summary: The majority of recent articles on GLD and gold are positive (83.33%), with a small portion being neutral (16.67%).

This indicates that recent news coverage predominantly features favorable sentiment towards GLD and gold.

USO,Oil Articles: 3

- Neutral: 33.33%

- Positive: 33.33%

- Negative: 33.33%

Sentiment Summary: Recent articles on USO and oil exhibit a balanced sentiment, with coverage evenly split among neutral, positive, and negative perspectives.

The market narrative for USO and oil is currently mixed, with no clear directional bias dominating recent news.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: January 2, 2026 07:16

- GOOG 313.80 Bearish -0.24%

- IBIT 49.65 Bearish -0.36%

- AAPL 271.86 Bearish -0.45%

- NVDA 186.50 Bearish -0.55%

- DIA 480.57 Bearish -0.62%

- GLD 396.31 Bearish -0.65%

- AMZN 230.82 Bearish -0.74%

- SPY 681.92 Bearish -0.74%

- IWM 246.16 Bearish -0.75%

- MSFT 483.62 Bearish -0.79%

- TLT 87.16 Bearish -0.80%

- QQQ 614.31 Bearish -0.83%

- USO 69.16 Bearish -0.83%

- META 660.09 Bearish -0.88%

- TSLA 449.72 Bearish -1.04%

- IJH 66.00 Bearish -1.05%

Market Snapshot: ETF Stocks, Mag7 & Key ETFs — 01/02/2026

ETF Stocks Overview

- SPY 681.92 Bearish (-0.74%)

The S&P 500 ETF signals a broad-based slide, mirroring overall market risk-off sentiment. - QQQ 614.31 Bearish (-0.83%)

Nasdaq-100 ETF under pressure, reflecting tech sector weakness. - DIA 480.57 Bearish (-0.62%)

Dow ETF also trending down, with blue chips facing selling momentum. - IWM 246.16 Bearish (-0.75%)

Russell 2000 ETF showing small-cap softness, tracking broader risk aversion. - IJH 66.00 Bearish (-1.05%)

S&P MidCap 400 ETF underperforms, demonstrating deepening declines within mid-caps.

Mag7 Tech Leaders

- AAPL 271.86 Bearish (-0.45%)

- MSFT 483.62 Bearish (-0.79%)

- GOOG 313.80 Bearish (-0.24%)

- AMZN 230.82 Bearish (-0.74%)

- META 660.09 Bearish (-0.88%)

- NVDA 186.50 Bearish (-0.55%)

- TSLA 449.72 Bearish (-1.04%)

All mega-cap tech names, the so-called “Magnificent 7,” are trading lower in this session, experiencing losses ranging from moderate to notable, with TSLA and META seeing more pronounced downturns.

Other Key ETFs

- TLT 87.16 Bearish (-0.80%)

The long Treasury ETF indicates continued pressure in bonds. - GLD 396.31 Bearish (-0.65%)

Gold ETF also slipping, showing a lack of traditional safe-haven response today. - USO 69.16 Bearish (-0.83%)

Crude oil exposure down, with USO reflecting global growth or supply-demand concerns. - IBIT 49.65 Bearish (-0.36%)

Bitcoin ETF softer amid generalized risk-off tone.

Summary of State of Play

Across major equity ETFs, large-cap and mid-cap sectors, “Magnificent 7” tech leaders, and alternative assets, the tone is broadly bearish. Negative momentum is apparent, with all listed instruments trading lower in this snapshot. The red day is evident across risk assets and alternate vehicles, with no notable pockets of relative strength.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2026-01-02: 07:16 CT.

US Indices Futures

- ES: YSFG/MSFG bullish, WSFG/pivot short-term bearish, below WSFG NTZ, resistance 7013.50, support 6780.54/6771.25, long-term MAs trending up, mixed recent signals, consolidation after highs.

- NQ: YSFG/MSFG up, WSFG short-term weak, below WSFG NTZ, pivot uptrend, resistance near 25700+, support 24887.75, all MAs up, recent choppy signals, higher timeframe structure bullish.

- YM: YSFG/MSFG bullish, WSFG short-term consolidation/pullback, below WSFG NTZ, resistance at recent highs, support 47253/46706, uptrend in benchmarks, minor retracement within bull context.

- EMD: YSFG/MSFG up, WSFG/pivot short-term down, below WSFG NTZ, resistance 3434.7, support 3133.2, higher timeframe MAs up, short signal, corrective phase after rally.

- RTY: YSFG/MSFG bullish, WSFG/pivots short-term bearish, below WSFG NTZ, resistance 2511.5, support 2355.9/2321.0, long-term structure intact, corrective pullback ongoing.

- FDAX: YSFG/MSFG/WSFG strong uptrend, all MAs rising, above all NTZ/F0%, resistance 25061, support 24341, higher highs/lows, uptrend continuation phase, bullish structure dominating all timeframes.

Overall State

- Short-Term: Neutral to Bearish (pullbacks/corrective phases in ES, YM, EMD, RTY; FDAX bullish)

- Intermediate-Term: Bullish (all indices in MSFG uptrends, above monthly NTZ, consolidation or minor retracement)

- Long-Term: Bullish (all indices above yearly NTZ, all long-term moving averages up)

Conclusion

US Indices Futures show corrective or consolidative short-term structure, with current price below or testing WSFG neutral zones across ES, NQ, YM, EMD, and RTY, and short-term bearish signals or pivots evident. Intermediate and long-term MSFG/YSFG trends remain up, with benchmark moving averages trending higher and all indices trading above their long-term neutral zones. Key resistance levels have capped recent highs, while layered support levels remain defined below. FDAX presents persistent strength across all periods, leading global bullish structure. The overall HTF context reflects a market digesting recent gains within established uptrends, with current action driven by rotational signals, short-term choppiness, and pivotal reactions to support and resistance, especially as short-term corrections align with sustained broader strength.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts