Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

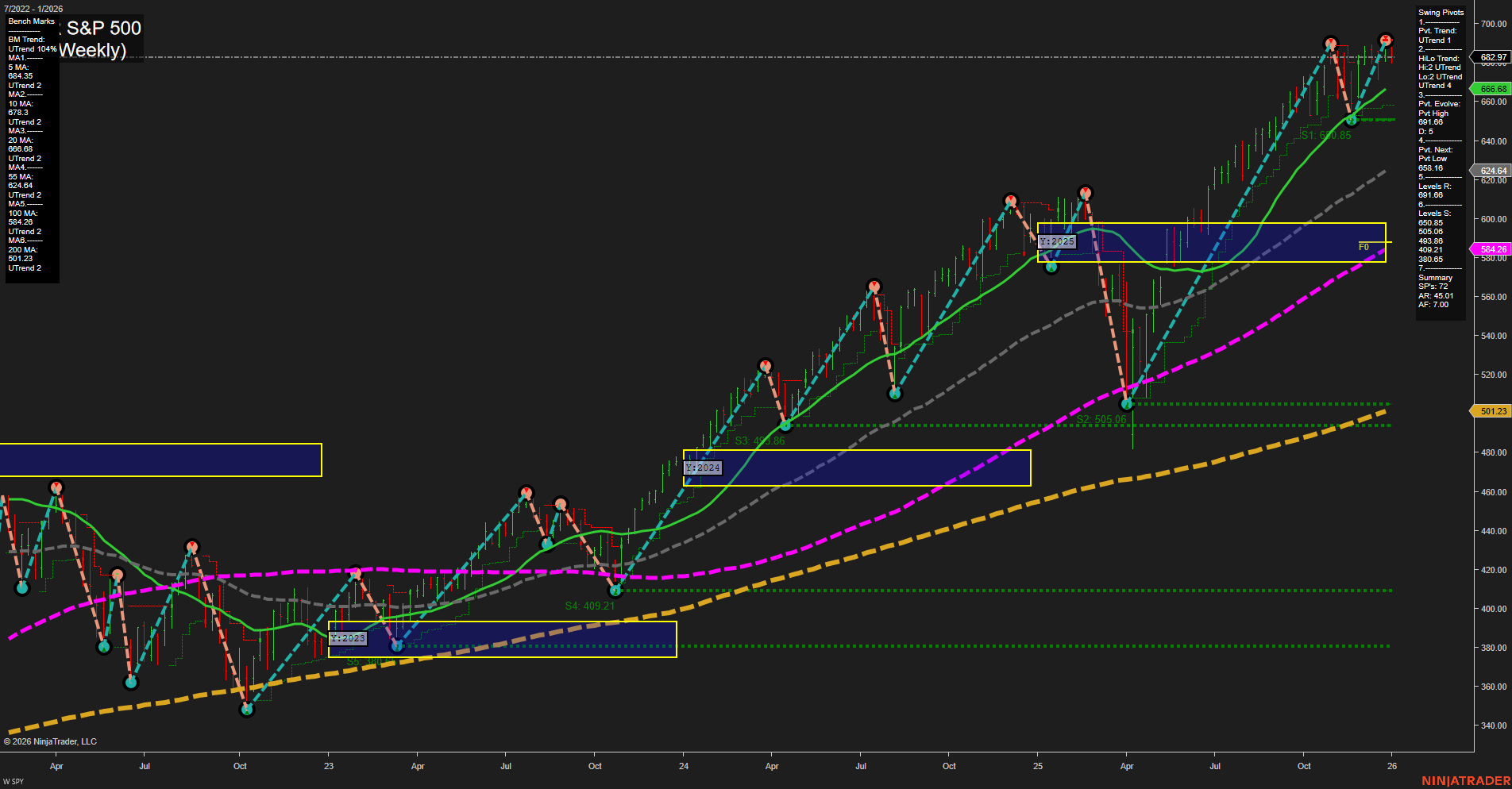

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Monday 10:00 – ISM Manufacturing PMI (High Impact): Key gauge for US manufacturing activity. Higher-than-expected readings can signal economic expansion, often boosting equity index futures; misses tend to trigger risk-off sentiment.

- Wednesday 08:15 – ADP Non-Farm Employment Change (High Impact): Early insight into labor market health ahead of NFP. Surprises can shift futures direction pre-market.

- Wednesday 10:00 – ISM Services PMI (High Impact): The dominant US economic sector; strong data supports bullish momentum, while misses can cause sharp pullbacks.

- Wednesday 10:00 – JOLTS Job Openings (High Impact): Labor demand signal; deviations from forecasts can accelerate existing market trends, particularly around employment and growth outlooks.

- Thursday 08:30 – Unemployment Claims (High Impact): Weekly gauge of labor market resilience. Unexpected spikes or drops can lead to swift index futures reactions.

- Friday 08:30 – Average Hourly Earnings, Non-Farm Employment Change, Unemployment Rate (High Impact): Core monthly jobs report cards. Surprises on jobs or wage inflation can produce sharp volatility and set the tone for the day’s trend.

- Friday 10:00 – Prelim UoM Consumer Sentiment, Inflation Expectations (High Impact): Consumer mood and inflation outlooks; outsized moves here can prolong or reverse moves set by the jobs data earlier in the session.

EcoNews Conclusion

- This week’s calendar is front- and back-loaded with multiple high-impact US data events centered on manufacturing, services, and especially labor market reports (Wednesday and Friday), supporting the potential for sharp intra-day momentum shifts and elevated volume during and after these releases.

- News events around the 10 AM time cycle often act as catalysts for reversals or continuations; Wednesday and Friday both present notable 10:00 releases closely following market opens.

- Expect market participants to closely monitor Friday’s NFP and wage data for indications on Fed policy trajectory and inflation risk, which may drive significant market re-pricing.

- Momentum and volume may slow ahead of Friday’s NFP as traders position defensively for headline risk.

For full details visit: Forex Factory EcoNews

Market News Summary

- S&P 500: Despite ending 2025 with a four-day losing streak, the S&P 500 posted a robust 16.4% annual gain, with technical momentum confirmed by its 50-day moving average staying above the 200-day since July.

- Passive Income Strategies: Retirement-focused income portfolios that leverage volatility and strategic allocation may offer major stress reduction for retirees, with new frameworks suggested to enhance income stability.

- IPO Pipeline: The 2026 IPO market is expected to be dominated by major tech names such as OpenAI, SpaceX, and Anthropic, shifting investor attention and increasing competition for capital among smaller companies.

- Venezuela Crisis: Uncertainty surrounds market impact after the U.S. removed Venezuela’s president. Oil price volatility remains contained given ample global supply, with any potential spikes expected to be temporary. Futures markets are expected to react to this geopolitical development.

- Oil Markets: Oil prices declined roughly 18% in 2025. The current outlook shows little justification for a significant rebound in 2026, despite potential short-term premiums due to geopolitical tension.

- Gold: Gold maintained its uptrend during recent volatility, with key support levels in focus as the Venezuelan situation develops.

- Buffer ETFs: Research notes that despite similar returns to balanced funds, elevated fees may undermine the cost-effectiveness of buffer ETFs as a protection tool.

- Economic Data: The upcoming December U.S. jobs report is seen as pivotal for Treasury yields, with stronger employment potentially pushing 10-year rates higher. The stock market is coming off a mediocre start to 2026 and is closely watching this data release.

- Nasdaq-100: The index’s long-term outperformance remains notable, benefiting from a heavy concentration in leading technology and innovative companies.

- Sector Developments: Key sectors that saw significant advancement in 2025 included nuclear, space, quantum, crypto, drones, and health care—boosted by executive initiatives and deregulation.

- Venezuela’s Oil Future: Analysts suggest Venezuela’s oil industry could require an orderly political transition and substantial investment for any significant revival following recent U.S. actions.

News Conclusion

- The S&P 500 demonstrated resilience in 2025, posting strong gains and maintaining positive technical signals despite late-year volatility tied to global events.

- Major tech IPOs are set to shape capital flows and market narratives in 2026, while notable sector advances from regulatory changes remain in focus.

- Geopolitical developments, particularly the U.S. intervention in Venezuela, are resulting in market attention to oil, gold, and futures movement; however, ample supply is seen as a factor limiting oil price spikes for now.

- Economic data releases, specifically employment figures, are anticipated to be key near-term drivers for interest rates and index futures direction.

- Debate continues over the value proposition of buffer ETFs, as fee structures are weighed against modest additional returns and protection levels.

- Attention remains on sectoral momentum and long-term index outperformance, especially within technology-heavy benchmarks.

Market News Sentiment:

Market News Articles: 9

- Positive: 55.56%

- Neutral: 44.44%

GLD,Gold Articles: 2

- Positive: 50.00%

- Negative: 50.00%

USO,Oil Articles: 5

- Neutral: 60.00%

- Negative: 20.00%

- Positive: 20.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: January 4, 2026 06:15

- IBIT 50.94 Bullish 2.60%

- IJH 66.91 Bullish 1.38%

- NVDA 188.85 Bullish 1.26%

- IWM 248.78 Bullish 1.06%

- DIA 483.63 Bullish 0.64%

- GLD 398.28 Bullish 0.50%

- GOOG 315.32 Bullish 0.48%

- SPY 683.17 Bullish 0.18%

- TLT 87.03 Bearish -0.15%

- QQQ 613.12 Bearish -0.19%

- USO 68.96 Bearish -0.29%

- AAPL 271.01 Bearish -0.31%

- META 650.41 Bearish -1.47%

- AMZN 226.50 Bearish -1.87%

- MSFT 472.94 Bearish -2.21%

- TSLA 438.07 Bearish -2.59%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2026-01-04: 18:15 CT.

US Indices Futures

- ES Bearish WSFG/MSFG trends, below key NTZ/F0%, swing structure down, resistance 7013.50, support 6448.87, long-term MAs up, corrective phase within intact long-term uptrend.

- NQ Bearish across WSFG/MSFG/YSFG, below NTZs, swing pivot high 26655.50, support 24131.00, short/intermediate MAs down, long-term trend neutral/under test, corrective within larger uptrend.

- YM Consolidating, WSFG down, MSFG up, swing uptrend, resistance 49048, support 45688, short-term MAs down, long-term MAs up, mixed signals, bullish intermediate structure.

- EMD WSFG neutral/down, MSFG up, YSFG neutral/down, swing pivots up, resistance 3549.3/3343.1, support 3230.7, long-term MAs in uptrends, choppy consolidation, constructive intermediate term.

- RTY Mixed WSFG, MSFG/YSFG up, swing uptrend, resistance 2591.8, support 2411.7, volatility high, digesting gains, bullish intermediate/long-term outlook, short-term neutral at resistance.

- FDAX Strong bullish all timeframes, above all Fib grid NTZs, new swing high at 25061, support 24341, all MAs up, robust trend continuation, higher highs/lows, strong technical structure.

Overall State

- Short-Term: Bearish to Neutral

- Intermediate-Term: Bullish to Neutral

- Long-Term: Bullish (ES/RTY/FDAX), Neutral (NQ/YM/EMD), Bearish (ES Daily/RTY Daily/YM Daily)

Conclusion

US indices futures present a corrective/consolidative stance on higher timeframes, with most instruments showing short-term bearish or neutral signals due to price residing below key WSFG and NTZ/F0% levels. Intermediate trends display bullish tendencies in YM, EMD, RTY, and FDAX as indicated by upward MSFGs and supportive swing pivots, while NQ and ES continue short/intermediate corrective phases. Long-term structures remain bullish for ES, RTY, and FDAX based on YSFG and rising long-term MAs, while NQ, YM, and EMD are more neutral, reflecting tests of key support. Major indices are responding to prior strong rallies with rotation, choppy momentum, and volatility, as resistance and support levels defined by swing pivots and Fib grids are tested. FDAX leads in trend alignment, while other indices consolidate within long-term uptrends or neutral structures.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

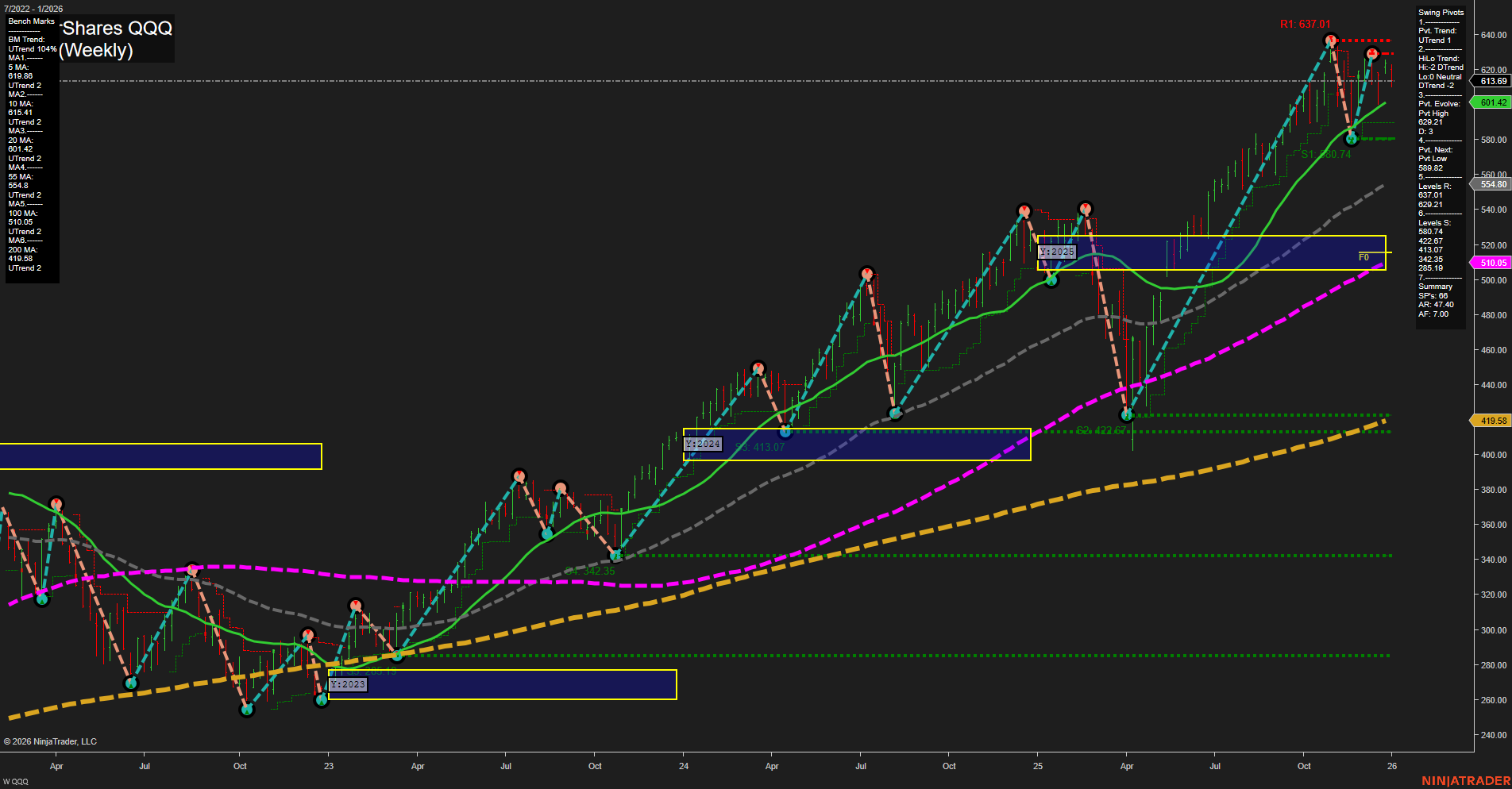

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts