Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

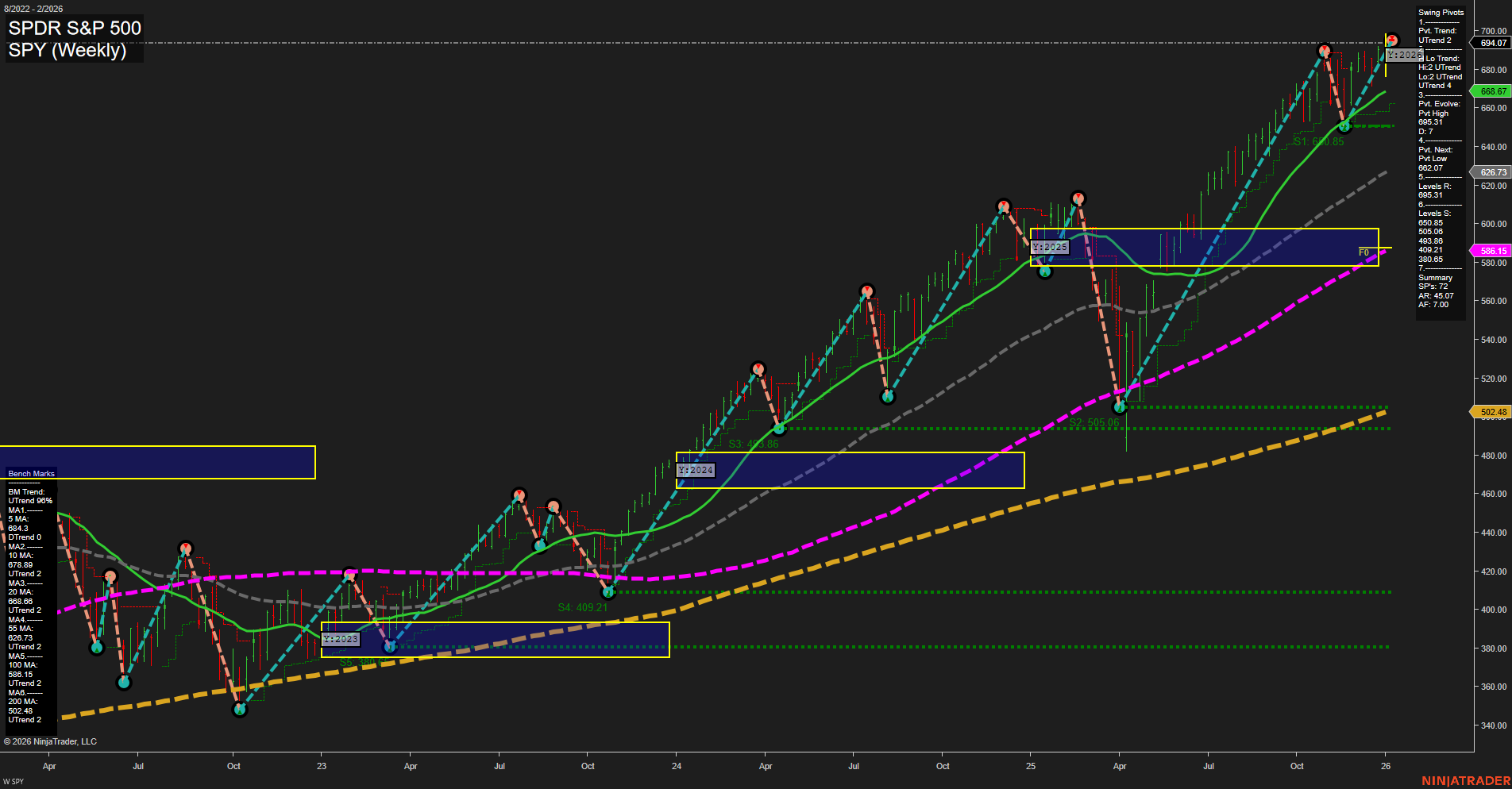

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

- 2026-01-19 Birthday of Martin Luther King, Jr

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- GS Release: 2026-01-15 T:BMO

- MS Release: 2026-01-15 T:BMO

- BAC Release: 2026-01-14 T:BMO

- C Release: 2026-01-14 T:BMO

- WFC Release: 2026-01-14 T:BMO

- JPM Release: 2026-01-13 T:BMO

Earnings Summary and Market Conclusion (as of Jan 12, 2026):

Looking ahead, major U.S. bank earnings will drive market sentiment, with JPMorgan (JPM) kicking off the financial sector’s Q4 reporting on January 13, followed by Bank of America (BAC), Citigroup (C), and Wells Fargo (WFC) on January 14, and Goldman Sachs (GS) and Morgan Stanley (MS) on January 15, all reporting before the market open. These back-to-back results from heavyweight financials can set the tone for S&P 500 and Dow Jones index futures, especially given their influence on risk appetite and credit outlooks at the start of the year. Historically, indices experience tight ranges and thinner volumes in the days leading up to clustered bank earnings, as traders await clarity on loan growth, margins, and forward guidance. This effect is magnified with broader market attention also fixed on the upcoming results from NVDA, MAG7, and AI-related technology stocks, further dampening momentum across the indices. Increased volatility and volume can be expected as results hit, with sector rotation and index rebalancing often following these earnings releases. In the interim, traders should expect cautious index futures behavior and potential choppiness as the market digests preliminary guidance and awaits the high-impact news flow.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Tuesday 08:30 – USD CPI m/m, Core CPI m/m, CPI y/y (High): Key inflation readings in focus. Surprises to the upside can spark rate hike speculation and prompt sharp, broad index futures volatility, especially NASDAQ and S&P. Lower-than-expected numbers could trigger rallies on anticipated policy loosening. All eyes on headline and core figures for inflation trend confirmation.

- Wednesday 08:30 – USD PPI m/m, Core PPI m/m, Core Retail Sales m/m, Retail Sales m/m (High): Producer inflation and spending data at the open are positioned to drive morning volatility. Higher PPI/retail results bolster the case for persistent inflation, potentially dampening index sentiment. Weakness in both may point to cooling demand and economic strength—helpful for dovish Fed bets. Heavy clustering of major data in one time block increases risk of outsized market swings.

- Thursday 08:30 – USD Unemployment Claims (High): A closely watched gauge of labor market conditions, likely to prompt directional index moves if data sharply diverges from expectations. Unexpectedly low claims signal jobs resilience, supporting rates-higher-for-longer pricing; high claims can increase recession fears and fuel downside risk.

- Wednesday 10:30 – USD Crude Oil Inventories (Low): Energy related, but only material for equity indices if a sharp supply/demand imbalance impacts oil prices, stoking inflation or geopolitical anxieties.

EcoNews Conclusion

- Multiple high-impact inflation and consumer reports will dominate index futures price action in the early sessions Tuesday and Wednesday, with CPI and PPI as key macro catalysts.

- Expect market momentum and volume to cluster around major data releases, particularly at 08:30 ET both days.

- News events around the 10 AM time cycle often act as a catalyst for reversals or continuations.

- Oil inventory swings could influence indices only if accompanied by major price spikes, given inflation concerns.

For full details visit: Forex Factory EcoNews

Market News Summary

- Indices & Earnings: S&P 500 futures fell following a positive Friday close as focus shifts to bank earnings, with JPMorgan and major financials kicking off Q4 reports. Analyst expectations are high, with notable EPS and revenue growth projected for JPMorgan and Citigroup.

- Macro Data: December’s Consumer Price Index (CPI) and labor figures are in focus. CPI is forecast to rise 0.3% month-on-month for both headline and core readings, influencing interest rate bets. However, economists warn data may be affected by missing components from the government shutdown.

- Geopolitics & Commodities: Oil prices climbed amid escalating unrest in Iran and ongoing Middle East supply risk, with continued discussions on Venezuelan oil exports to Asia. However, crude futures showed mixed movement as oversupply concerns counter balance supply risks. Gold advanced on safe-haven demand, driven by geopolitical tensions involving Iran and Venezuela, and anticipation of key inflation data.

- Central Bank Developments: Federal Reserve Chair Jerome Powell faces an unprecedented criminal probe and grand jury subpoenas tied to testimony about the Fed’s building renovation, intensifying uncertainty about Fed leadership and policy direction. Market participants are watching for Trump’s announcement of the next Fed Chair, due by month’s end.

- Currency Markets: Asian currencies were mixed. Diminished expectations for imminent Fed rate cuts pressured some regional currencies after U.S. employment data.

- Sector & Economic Trends: Consumer sentiment exceeded forecasts but remains below prior-year levels. Retail spending accelerated in December, according to retail monitors, while supply chain layoffs increased with persistent tariff-driven cost pressures.

- Outlook: Analysts remain optimistic on 2026 earnings growth, with S&P 500 performance driven by tech leaders. Expectations for higher volatility ahead are noted, particularly due to headline risk and central bank uncertainty.

News Conclusion

- Markets are contending with a complex backdrop of positive earnings expectations, cautious macro data interpretation, and heightened volatility from unforeseen legal and political developments at the Federal Reserve.

- Commodities trade remains driven by geopolitical uncertainties, with surges in oil and gold prices tempered by fundamental supply dynamics.

- Economic sentiment is improving, but inflation and policy risks present potential hurdles for sustained upside in risk assets.

Market News Sentiment:

Market News Articles: 22

- Negative: 40.91%

- Neutral: 31.82%

- Positive: 27.27%

Sentiment Summary:

Out of 22 market news articles analyzed, 40.91% carried a negative tone, 31.82% were neutral, and 27.27% were positive.

Conclusion:

The current news flow is predominantly negative, with negative coverage outweighing both neutral and positive sentiment among the reported articles.

GLD,Gold Articles: 4

- Positive: 75.00%

- Neutral: 25.00%

Sentiment Summary: The majority of recent market news articles regarding GLD and gold carry a positive sentiment, with 75% of the coverage being positive and 25% neutral.

This reflects predominantly favorable market news sentiment for GLD and gold at this time.

USO,Oil Articles: 9

- Positive: 44.44%

- Neutral: 33.33%

- Negative: 22.22%

Sentiment Summary: Out of 9 recent articles on USO and oil, 44.44% reflect a positive sentiment, 33.33% are neutral, and 22.22% are negative.

This indicates that recent market news sentiment regarding USO and oil is generally more positive, with a notable proportion of articles maintaining a neutral tone.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: January 12, 2026 07:16

- TSLA 445.01 Bullish 2.11%

- META 653.06 Bullish 1.08%

- QQQ 626.65 Bullish 1.00%

- GOOG 329.14 Bullish 0.96%

- IJH 69.11 Bullish 0.88%

- IWM 260.23 Bullish 0.76%

- GLD 414.47 Bullish 0.72%

- TLT 87.93 Bullish 0.66%

- SPY 694.07 Bullish 0.66%

- DIA 495.02 Bullish 0.51%

- AMZN 247.38 Bullish 0.44%

- USO 70.78 Bullish 0.34%

- MSFT 479.28 Bullish 0.24%

- AAPL 259.37 Bullish 0.13%

- NVDA 184.86 Bearish -0.10%

- IBIT 51.16 Bearish -0.70%

Market Summary: ETF Stocks & Major Tech (as of 01/12/2026)

ETF Stocks: SPY, QQQ, IWM, IJH, DIA

- SPY: $694.07 (Bullish, +0.66%)

S&P 500 tracker continued upward momentum, reflecting broad market strength. - QQQ: $626.65 (Bullish, +1.00%)

Nasdaq-100 leading performance, boosted by strong tech sector gains. - IWM: $260.23 (Bullish, +0.76%)

Russell 2000 also in positive territory, signaling risk appetite in small-caps. - IJH: $69.11 (Bullish, +0.88%)

Mid-cap equities advancing alongside large- and small-cap peers. - DIA: $495.02 (Bullish, +0.51%)

Dow Jones ETF posts moderate gains, lagging relative to QQQ/SPY.

Magnificent 7 (AAPL, MSFT, GOOG, AMZN, META, NVDA, TSLA)

- TSLA: $445.01 (Bullish, +2.11%)

Tesla outpaces peers, leading today’s tech rally. - META: $653.06 (Bullish, +1.08%)

Meta maintains leadership with further solid gains. - GOOG: $329.14 (Bullish, +0.96%)

Alphabet shows strong positive sentiment. - AMZN: $247.38 (Bullish, +0.44%)

Amazon keeps positive momentum, though gains are moderate. - MSFT: $479.28 (Bullish, +0.24%)

Microsoft trends modestly higher in step with peers. - AAPL: $259.37 (Bullish, +0.13%)

Apple also registers slight gains. - NVDA: $184.86 (Bearish, -0.10%)

Nvidia shows minor weakness, diverging from the overall sector trend.

Other ETFs: TLT, GLD, USO, IBIT

- TLT: $87.93 (Bullish, +0.66%)

Long-dated Treasuries up, indicating some interest in duration or defensive positioning. - GLD: $414.47 (Bullish, +0.72%)

Gold ETF steady and rising, possibly on ongoing inflation or risk themes. - USO: $70.78 (Bullish, +0.34%)

Oil ETF advances, though at a slower pace. - IBIT: $51.16 (Bearish, -0.70%)

Bitcoin ETF slips, underperforming traditional and alternative assets today.

State of Play: Long/Short/Mixed Overview

- Long (Bullish): Most major equities, ETF indices, and commodity proxies show upward momentum. This encompasses the main indices (SPY, QQQ, DIA, IWM, IJH), most Mag7 tech names (TSLA, META, GOOG, MSFT, AAPL, AMZN), and alternative/commodity ETFs (TLT, GLD, USO).

- Short (Bearish): Select weakness observed in NVDA and IBIT, reflecting mixed sentiment in the most speculative/volatile names.

- Mixed: General backdrop is positive, with just isolated downside in a few names.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2026-01-12: 07:17 CT.

US Indices Futures

- ES Consolidation near highs, YSFG/MSFG bullish, WSFG neutral/down, support at 6468.73, resistance 7017.00, swing pivots up, MA benchmarks up, range-bound at resistance.

- NQ Near highs, MSFG up, YSFG/WSFG neutral to down, support 23464.58, resistance 26655.50, swing and HiLo pivots mixed, MA benchmarks up, consolidating with volatility near resistance.

- YM Strong uptrend, YSFG/MSFG bullish, WSFG down/neutral, support below 49000, resistance 49876, swing pivots up, MA benchmarks rising, holding above monthly/yearly grids with consolidation.

- EMD Uptrend, YSFG/MSFG bullish, WSFG down/neutral, above key SFG levels, swing pivots up, resistance 3549.3, support 3207.7, MA benchmarks up, elevated volatility, in retracement or continuation phase.

- RTY New swing highs, MSFG/YSFG bullish, WSFG down, support 2300.0, resistance 2624.9, swing pivots upward, MA benchmarks up, consolidation possible post-rally.

- FDAX Robust uptrend, price above all SFG/NTZ levels, YSFG/MSFG/WSFG bullish, uptrend pivots, resistance above 25524, support 24220, MA benchmarks all up, strong rally phase.

Overall State

- Short-Term: Neutral

- Intermediate-Term: Bullish

- Long-Term: Bullish

Conclusion

HTF structures across US indices futures indicate continued consolidation near or at recent highs, following strong intermediate and long-term uptrends as identified by MSFG and YSFG grids. WSFG levels show more neutral or mild downtrends, reflecting ongoing short-term pullbacks or consolidation phases seen especially in ES, NQ, YM, EMD, and RTY. Momentum continues to be confirmed by major benchmarks and moving averages trending upwards on higher timeframes. Resistance levels are clustered near all-time or swing highs, while support layers are well-established below, suggesting a range-bound environment in the short term. Recent swing pivots reflect prevailing uptrends, but mixed WSFG signals reflect choppiness and potential for intra-week retracement. FDAX continues as a leading instrument with strongly aligned HTF uptrends, often preceding or confirming US index futures moves. Directional bias remains bullish for intermediate and long-term horizons, with overall technical structure supporting ongoing trend continuation scenarios unless key support levels are breached.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts