After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

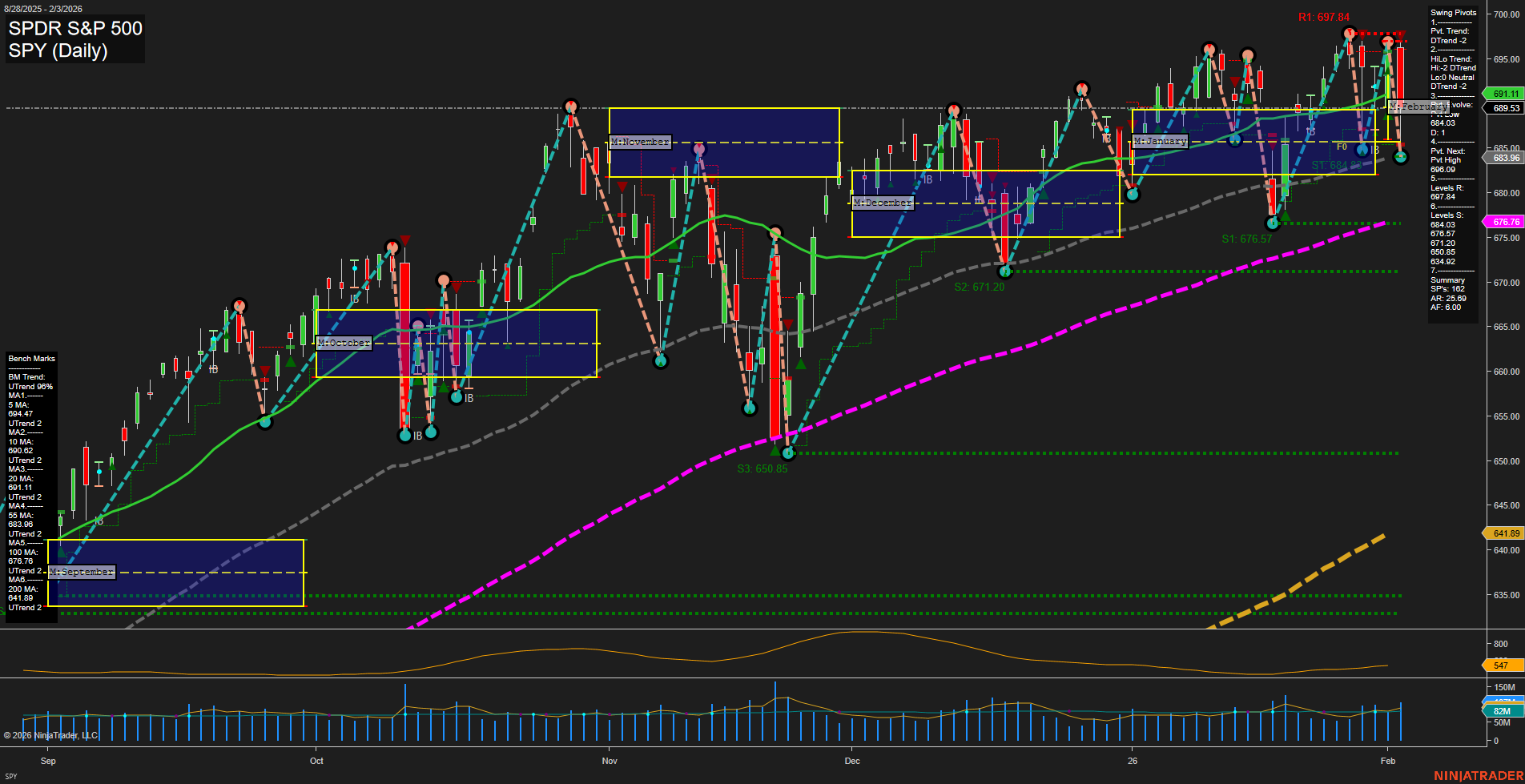

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Indices & Sectors: The Nasdaq 100 is facing pressure, with concerns of a technical breakdown as liquidity dries up and rotation out of tech intensifies. As tech stocks slump, investors are shifting into industrials and transportation, sectors that are now hitting new highs. The overall market is being weighed down by high valuations and similarities to 2022’s volatile conditions, prompting growing bearishness among options traders. European equities stand out with strong momentum, outperforming despite global volatility.

- ETFs & Leveraged Products: The ProShares UltraPro QQQ (TQQQ) remains in a holding pattern, with its leveraged structure vulnerable in choppy or sideways Nasdaq conditions. ETFs with significant Walmart exposure are finding some resilience amid market rotations.

- Commodities: Gold is struggling to hold key resistance levels and could enter consolidation or even slide further, despite sizable central bank purchases bolstering long-term demand signals. After a recent rally, metals like gold and silver have seen profit taking limit further upside. Oil prices have jumped sharply on reports that U.S.-Iran nuclear talks may collapse and escalating geopolitical tensions, while oil services and energy stocks are staging a historic comeback after years of underperformance.

- Economic Policy & Federal Reserve: Market participants continue monitoring major Fed developments: the capital buffers for large banks remain unchanged, with policy reviews ongoing; political developments and investigations are impacting Fed leadership nominations; and commentary about possible presidential intervention in Fed decisions is raising questions about central bank independence. The Fed has been actively buying short-duration Treasury bills, affecting liquidity and possibly influencing broader financial conditions.

- Macro Data & Outlook: Key U.S. data releases—including jobs and inflation reports—have been rescheduled due to budget delays, keeping market participants attuned to upcoming economic signals. Meanwhile, China’s continued record trade surpluses are reinforcing the Yuan and could lead to shifts in global currency and policy dynamics.

- IPO & M&A Activity: Renewed interest in IPOs and deal volume is being seen as a potential sign of returning confidence among private equity sponsors, pointing to broader market risk appetite in select segments.

News Conclusion

- The Nasdaq and U.S. tech stocks are experiencing heavy selling and sector rotation, with increased downside risk amid valuation concerns and bearish sentiment among derivatives traders. Defensive and value-oriented sectors such as industrials, transports, and energy are outperforming as investors rotate allocations.

- Gold and precious metals face headwinds from profit taking and technical resistance, despite fundamental tailwinds provided by central bank accumulation. Oil and oil services stocks are surging on geopolitical developments and shifting capital flows within the energy sector.

- Ongoing political and leadership issues at the Federal Reserve are contributing to market uncertainty regarding policy direction and central bank independence, with Treasury market activity and capital buffer decisions being closely followed.

- Macro data calendar disruptions and strong performance from major economies like China are shaping investor expectations as markets reassess risk and opportunity for positions going into the remainder of 2026.

Market News Sentiment:

Market News Articles: 47

- Negative: 40.43%

- Neutral: 38.30%

- Positive: 21.28%

GLD,Gold Articles: 16

- Neutral: 43.75%

- Positive: 37.50%

- Negative: 18.75%

USO,Oil Articles: 8

- Positive: 62.50%

- Neutral: 37.50%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 4, 2026 05:00

- AAPL 276.49 Bullish 2.60%

- IJH 69.90 Bullish 0.75%

- MSFT 414.19 Bullish 0.72%

- USO 77.88 Bullish 0.53%

- DIA 494.75 Bullish 0.50%

- GLD 453.97 Bearish -0.07%

- TLT 86.54 Bearish -0.25%

- SPY 686.19 Bearish -0.48%

- IWM 260.52 Bearish -0.86%

- QQQ 605.75 Bearish -1.75%

- GOOG 333.34 Bearish -2.16%

- AMZN 232.99 Bearish -2.36%

- META 668.99 Bearish -3.28%

- NVDA 174.19 Bearish -3.41%

- TSLA 406.01 Bearish -3.78%

- IBIT 41.57 Bearish -4.00%

ETF Market State: Long, Short, Mixed Overview

Today’s snapshot reveals a mixed environment across major equity and alternative asset ETFs.

While select ETFs remain in bullish territory, a significant portion, including major index and technology-linked ETFs, show notable bearish pressure.

Equity Index ETFs (SPY, QQQ, IWM, IJH, DIA)

- SPY: 686.19 (Bearish -0.48%)

Tracking the S&P 500, SPY slides amid risk-off sentiment. - QQQ: 605.75 (Bearish -1.75%)

Heavier pressure on tech-heavy QQQ marks significant underperformance. - IWM: 260.52 (Bearish -0.86%)

Small caps (Russell 2000) decline; risk appetite appears muted. - IJH: 69.90 (Bullish +0.75%)

Mid-caps provide a rare pocket of strength. - DIA: 494.75 (Bullish +0.50%)

Blue chips persist with moderate upside.

Mag7 & Large Cap Tech Stocks

- AAPL: 276.49 (Bullish +2.60%)

Apple stands out as a lone outperformer among large cap tech. - MSFT: 414.19 (Bullish +0.72%)

Microsoft maintains resilience with modest gains. - GOOG: 333.34 (Bearish -2.16%)

Alphabet experiences notable sell-off; underperformance among megacaps. - AMZN: 232.99 (Bearish -2.36%)

Amazon also participates in the downturn. - META: 668.99 (Bearish -3.28%)

Meta under pressure amid broad tech weakness. - NVDA: 174.19 (Bearish -3.41%)

Nvidia faces pronounced selling. - TSLA: 406.01 (Bearish -3.78%)

Tesla’s slide leads the Mag7 declines for the day.

Other Notables: Sector & Commodity ETFs

- USO: 77.88 (Bullish +0.53%)

Crude oil ETF shows continued bullish momentum, suggesting isolated strength in energy. - GLD: 453.97 (Bearish -0.07%)

Gold ETF barely tips negative, reflecting subdued haven demand. - TLT: 86.54 (Bearish -0.25%)

Long bonds remain under pressure, flagging investor caution on rates. - IBIT: 41.57 (Bearish -4.00%)

Digital asset/BTC-linked ETF suffers the sharpest daily loss, highlighting volatility.

Summary: State of Play

The current session is defined by mixed sector dynamics. Select mid- and large-cap segments (notably IJH, DIA, AAPL, MSFT, USO) stay positive, but broad indices, tech megacaps, and most alternative assets lean bearish or sharply negative.

Monitor for continued volatility and sector divergences.

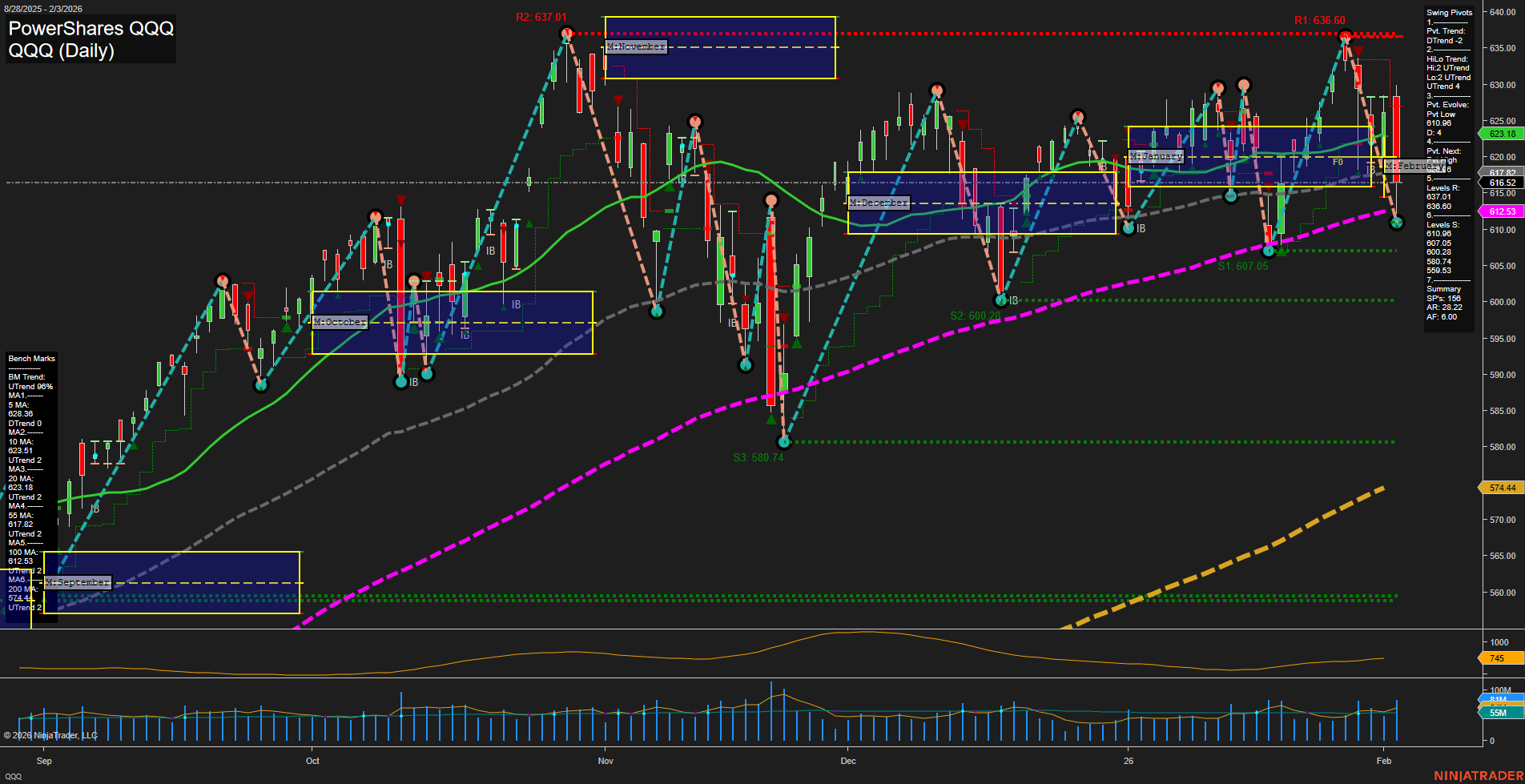

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts