After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

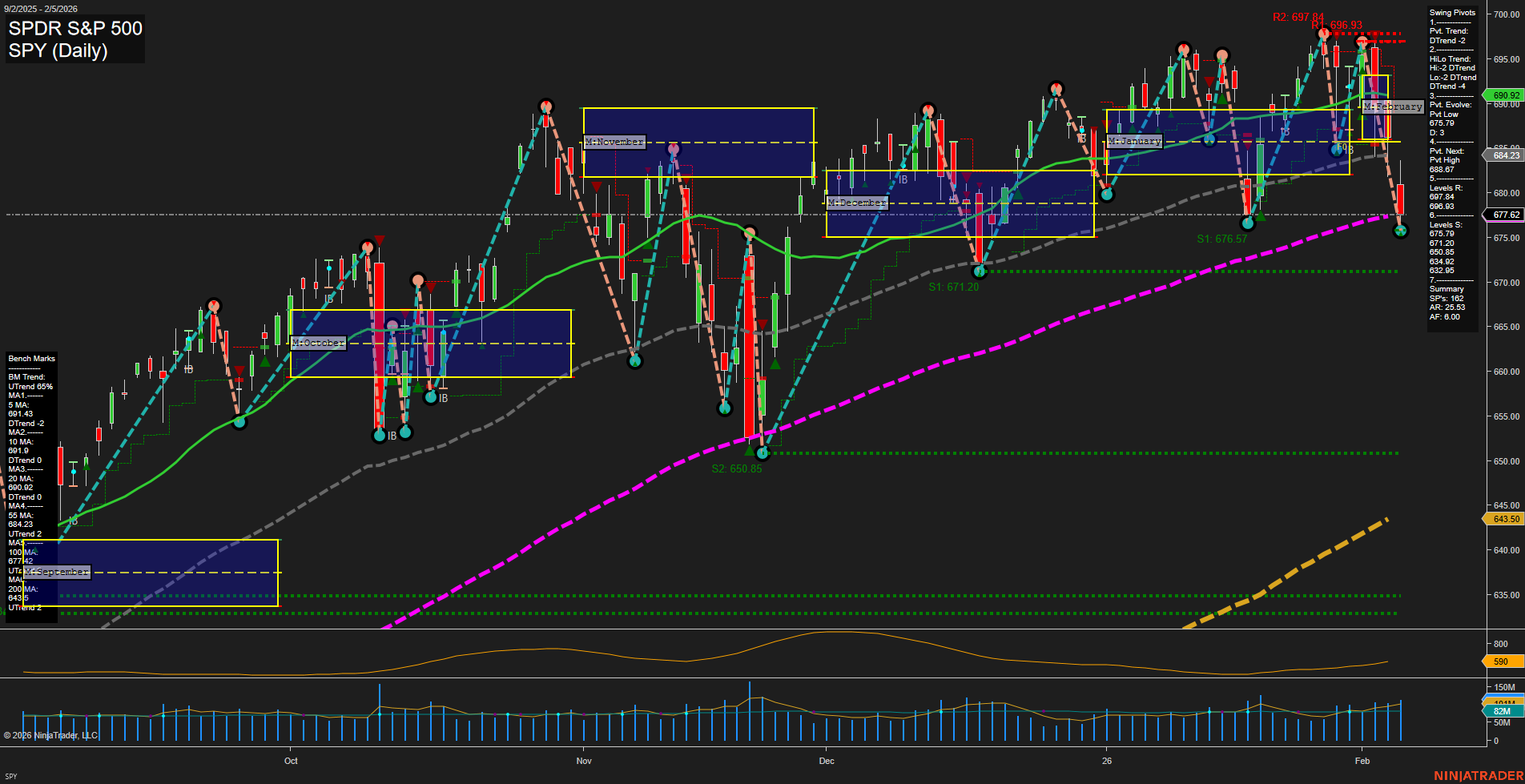

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Gold and Metals: Gold prices remain volatile, experiencing wild weekly swings between $4,400 and $5,000. Despite heavy drawdowns in gold and silver, ETF investors showed resilience and analysts maintain a bullish long-term case. Gold stocks are rebounding after a late January rout, and recent price action suggests a possible bullish reversal for gold. Silver gained 9% amid intense dip buying.

- Equity Markets: The S&P 500 and value-oriented funds (like XLP) are seeing capital rotation from growth stocks, as growth sectors—particularly technology—face continued selling. The Dow Jones Industrial Average hit a record high above 50,000, driven partly by strength in transportation stocks, while a broadening market is viewed as a healthy sign for equities. Tech stocks, especially those focused on chips, endured pronounced sell-offs, although there was a Friday rebound. QQQ shows signs of an undervalued setup poised for breakout, while MGK and SPY offer contrasting risk/reward profiles with concentration in growth vs. broader diversification.

- Commodities & Energy: Oil prices rebounded amid heightened U.S.-Iran tensions, with traders betting on no imminent deal. Geopolitical risk keeps oil markets on edge into the weekend. U.S. Energy Secretary stated that low oil prices give the U.S. greater leverage with Iran.

- Macro & Policy: Tariff uncertainty and debates about their benefits continue, while news around Federal Reserve appointments stirs market speculation. Higher bond yields contributed to intraday equity volatility. President Trump’s comments regarding the Fed chair nominee brought brief attention but were downplayed by Treasury leadership.

- AI & Sector Flows: The technology sector is the year’s worst S&P performer so far, but AI-related capital expenditures are surging and generating opportunities throughout the AI infrastructure chain. This has resulted in apparent mispricing within tech stocks, despite broader growth to value rotation.

- IPO Activity & Stock Highlights: Clear Street’s billion-dollar IPO signals heightened confidence in upcoming public offerings. GE Vernova stands out for its relative strength despite overall market choppiness, supported by strategies focused on finding market leaders.

- Labor & Industry: BP faces labor pressures from the largest refinery workforce in the Midwest, as the company reportedly does not plan to honor the national oil bargaining agreement.

News Conclusion

- Market volatility remains pronounced across all major asset classes, especially in metals, technology, and energy. Despite recent drawdowns, sentiment is turning positive in several key areas. Record marks in the Dow, successful IPOs, and capital rotation into value stocks suggest optimism beneath the surface turbulence.

- Ongoing geopolitical tensions and shifting sector leadership continue to shape short-term trading dynamics. A broadening of market participation and renewed investor interest in select sectors creates pockets of strength even as headline risks persist.

- Key themes include strong activity in gold and silver, dynamic swings in oil, significant fund flows between growth and value, and a rapidly changing tech landscape driven by AI developments and rotation pressures.

Market News Sentiment:

Market News Articles: 41

- Positive: 36.59%

- Neutral: 36.59%

- Negative: 26.83%

GLD,Gold Articles: 16

- Neutral: 56.25%

- Negative: 25.00%

- Positive: 18.75%

USO,Oil Articles: 11

- Negative: 54.55%

- Positive: 27.27%

- Neutral: 18.18%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 6, 2026 05:00

- IBIT 39.68 Bullish 9.92%

- NVDA 185.41 Bullish 7.87%

- IWM 265.02 Bullish 3.59%

- TSLA 411.11 Bullish 3.50%

- IJH 71.73 Bullish 3.16%

- GLD 455.46 Bullish 3.07%

- DIA 501.03 Bullish 2.48%

- QQQ 609.65 Bullish 2.11%

- SPY 690.62 Bullish 1.92%

- MSFT 401.14 Bullish 1.90%

- AAPL 278.12 Bullish 0.80%

- USO 76.99 Bullish 0.39%

- TLT 87.54 Bullish 0.07%

- META 661.46 Bearish -1.31%

- GOOG 323.10 Bearish -2.48%

- AMZN 210.32 Bearish -5.55%

Market State Overview — Snapshot for Traders (as of 02/06/2026)

ETF Stocks: Broad Market Indexes

- SPY: 690.62 Bullish (+1.92%) — The S&P 500 ETF remains upward, with steady gains underscoring broad market optimism.

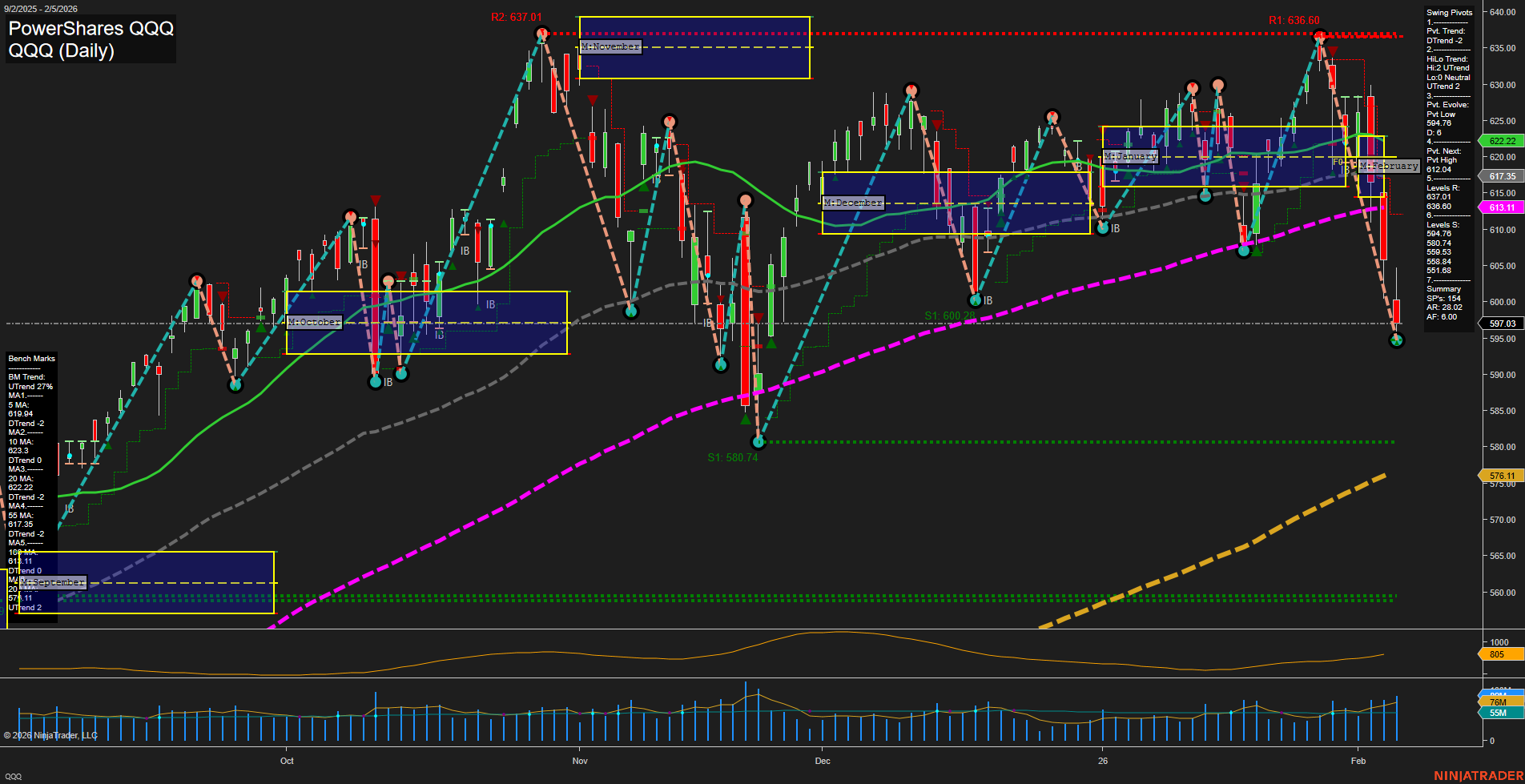

- QQQ: 609.65 Bullish (+2.11%) — The Nasdaq-100 ETF follows tech sector strength, continuing in positive territory.

- IWM: 265.02 Bullish (+3.59%) — Russell 2000 ETF leads small-cap momentum.

- IJH: 71.73 Bullish (+3.16%) — Mid-cap ETF sustains its bullish advance.

- DIA: 501.03 Bullish (+2.48%) — Dow Jones ETF maintains a positive trend.

Magnificent 7

- NVDA: 185.41 Bullish (+7.87%) — Nvidia dominates with outsized gains, reflecting semiconductor strength.

- TSLA: 411.11 Bullish (+3.50%) — Tesla bounces with renewed bullish sentiment.

- MSFT: 401.14 Bullish (+1.90%) — Microsoft continues to edge higher, consistent with overall market tone.

- AAPL: 278.12 Bullish (+0.80%) — Apple advances modestly.

- META: 661.46 Bearish (-1.31%) — Meta enters negative territory, indicating some sector divergence.

- GOOG: 323.10 Bearish (-2.48%) — Alphabet drops back, contrasting with tech peers.

- AMZN: 210.32 Bearish (-5.55%) — Amazon’s pullback is significant among the Mag7 names.

Other Notable ETFs

- IBIT: 39.68 Bullish (+9.92%) — Largest gain in this snapshot; crypto-related ETF leads risk-on assets.

- GLD: 455.46 Bullish (+3.07%) — Gold ETF shows strong risk-hedge behavior.

- USO: 76.99 Bullish (+0.39%) — Oil ETF trends higher, but with limited momentum.

- TLT: 87.54 Bullish (+0.07%) — Treasury ETF posts slight gain, indicating steadiness in bond markets.

Summary

The current snapshot reflects substantial bullishness across core equity ETFs and many Mag7 components, with standouts in NVDA and IBIT. However, notable divergences exist, as Amazon, Google, and Meta are in a bearish phase, signaling sector rotation or stock-specific factors. Precious metals and treasuries are modestly positive, while energy lags in relative terms.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts