Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

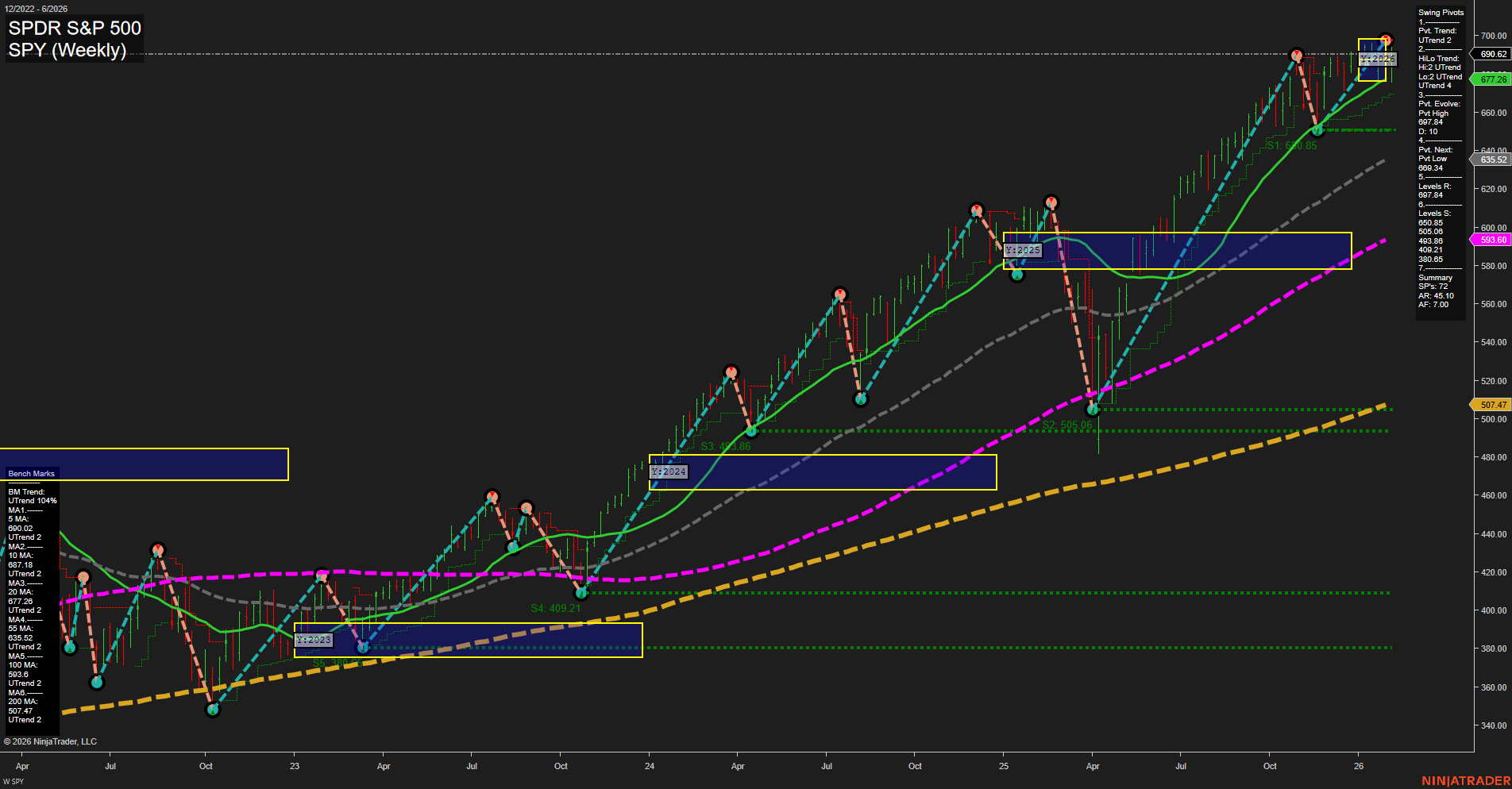

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

- 2026-02-16 Washington’s Birthday

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary: High Impact Market-Moving Events

Tuesday

- 08:30 – USD Core Retail Sales m/m & Retail Sales m/m:

Both core and headline retail sales reports are key gauges of consumer spending strength. Above-expectation readings typically spark equity index rallies, while disappointing numbers can cause downside volatility, reflecting concerns over economic momentum.

Wednesday

- 08:30 – USD Average Hourly Earnings m/m, Non-Farm Employment Change, Unemployment Rate:

This trio of labor market data releases—often called “NFP day”—has potential for large, sharp moves in index futures. Strong jobs and wage gains are interpreted hawkishly for policy and may pressure markets, while weaker data tends to drive relief rallies. Volume and volatility are usually elevated around these releases.

Thursday

- 08:30 – USD Unemployment Claims:

Weekly unemployment claims can affect short-term sentiment, especially if results surprise significantly relative to consensus.

Friday

- 08:30 – USD Core CPI m/m, CPI m/m, CPI y/y:

CPI inflation data is a top-tier catalyst for index futures. Higher-than-expected prints tend to trigger knee-jerk selling due to rate hike fears, while cooler inflation can spark relief rallies. The impact often extends well into Friday’s session.

EcoNews Conclusion

- Index futures traders should anticipate heightened volatility and sharp directional moves around Tuesday’s retail sales, Wednesday’s major labor market reports, and Friday’s CPI inflation data.

- Market momentum and volume may slow in the days leading up to Friday’s CPI, as traders position ahead of this key inflation report.

For full details visit: Forex Factory EcoNews

Market News Summary

- ETF Sector Rotation: QQQ continues to outperform SPY and VOO over 1- and 5-year periods, boosted by strong tech exposure, but it carries higher volatility, greater drawdowns, and offers lower dividend yields with higher fees compared to its S&P 500-focused peers.

- Rate Cut Hopes Fuel Value Rotation: Softer employment and labor figures have revived expectations for Fed rate cuts, prompting a rotation from growth stocks to value plays as investors reassess risk appetite, especially while awaiting delayed macro data and major corporate earnings.

- Dow Jones Record Run: The Dow surged above the 50,000 level, underpinned by broad sector rotation, ongoing AI investment, lower rate expectations, and increased equity inflows as investors shift from fixed-rate products.

- Gold Rally Tests Key Technical Level: Gold surged past $4,900, buoyed by speculative inflows after a margin hike. The price direction hinges on action near its 50-day moving average.

- Bond ETF Focus: SPLB and TLT both offer strong dividend yields. SPLB’s trailing returns exceed TLT’s, but TLT provides lower risk as it consists of U.S. government bonds.

- Liquidity Drain and Potential for Volatility: Treasury settlements are expected to pull $62 billion from the financial system this week. Recent settlement days have coincided with S&P 500 declines, historically averaging -0.43%.

- Labor Market Uncertainty: Market participants are closely watching the January jobs report, delayed along with CPI data. Last year’s weak labor conditions continue to cast a shadow, leaving investors sensitive to signs of economic fragility.

- Equity Indices Technicals: Despite a bearish break, the S&P 500’s technical signals provide no clear directional bias at present.

- Dividend and High Income Strategies: Dividend-focused investment strategies remain in the spotlight, with some advocates suggesting alternative approaches could offer superior returns and market-beating income.

- Retirement Income Solutions: Focus surfaces on investment pairings capable of delivering 8%+ dividends for retirement portfolios.

- Company-Specific Outlook: Coca-Cola is projected to provide steady growth and resilient margins amid continued macro headwinds.

News Conclusion

- Market sentiment is mixed with the Dow at record highs and persistent value rotation, but headline risks remain from looming data releases and systemic liquidity drains.

- Sector differentiation between technology, value, and high-dividend strategies remains a central market theme, with investors reacting to macroeconomic volatility and shifting expectations for interest rates.

- Technical uncertainty persists across major indices, and elevated volatility is possible in the week ahead due to macroeconomic report delays and significant Treasury settlements.

- Income-oriented products—including select bond ETFs and high-dividend equities—are attracting renewed focus amid the current rotation and evolving risk landscape.

Market News Sentiment:

Market News Articles: 7

- Neutral: 42.86%

- Negative: 28.57%

- Positive: 28.57%

GLD,Gold Articles: 3

- Positive: 100.00%

No stock-related news items found.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 8, 2026 06:15

- IBIT 39.68 Bullish 9.92%

- NVDA 185.41 Bullish 7.87%

- IWM 265.02 Bullish 3.59%

- TSLA 411.11 Bullish 3.50%

- IJH 71.73 Bullish 3.16%

- GLD 455.46 Bullish 3.07%

- DIA 501.03 Bullish 2.48%

- QQQ 609.65 Bullish 2.11%

- SPY 690.62 Bullish 1.92%

- MSFT 401.14 Bullish 1.90%

- AAPL 278.12 Bullish 0.80%

- USO 76.99 Bullish 0.39%

- TLT 87.54 Bullish 0.07%

- META 661.46 Bearish -1.31%

- GOOG 323.10 Bearish -2.48%

- AMZN 210.32 Bearish -5.55%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2026-02-08: 18:15 CT.

US Indices Futures

- ES Uptrend on WSFG and MSFG, above NTZ weekly/monthly, swing pivots and MAs bullish, resistance near 7043, YSFG slightly negative, support at 6785, mixed short/long signals, long-term neutral.

- NQ WSFG trend up, above weekly NTZ short-term, MSFG & YSFG down, below NTZ, swing pivots/downtrends, S/R at 24,249.75, all short/intermediate MAs down, long-term MAs up, mixed signals.

- YM Data unavailable for current session.

- EMD Strong uptrend on YSFG/MSFG/WSFG, price well above NTZ, bullish swing pivots, all MAs trending upward, resistance at 3607.6, support at 3414.8, sustained higher highs, consistent long signals.

- RTY Data unavailable for current session.

- FDAX Intermediate and long-term bullish on MSFG/YSFG, above key fib grid levels, short-term neutral/down on pivots/MA, resistance at 25,641, support at 23,133, long signals align with bullish structure.

Overall State

- Short-Term: Neutral to Bullish (strength in ES/EMD, neutral NQ/FDAX)

- Intermediate-Term: Bullish with isolated neutral/bearish signals (ES/EMD/FDAX strong, NQ weaker)

- Long-Term: Mixed (EMD/FDAX bullish, ES neutral, NQ bearish)

Conclusion

US Indices Futures present a technically mixed environment. EMD leads with robust uptrends across all HTF grids and benchmarks, posting higher highs with confirmed momentum. ES displays persistent short/intermediate-term uptrends above key WSFG/MSFG levels and upward MAs, but faces long-term consolidation as reflected in the slightly negative YSFG and neutral long-term structure. NQ signals ongoing volatility with short-term support on the weekly grid, but maintains a broader corrective stance as intermediate/long-term fib grids remain bearish and moving averages diverge. FDAX continues its intermediate/long-term uptrend, digesting recent gains after a short-term retracement, with bullish structure reinforced above major grid benchmarks and long-term MA strength. YM and RTY data are unavailable. Any intra-day reversals should be viewed within the prevailing HTF structural context, as leading contracts (EMD/FDAX) reflect sustained momentum while ES and NQ approach key S/R pivots and consolidation zones. Directional correlations favor ongoing trend structure in leaders, while laggards exhibit mixed or consolidation signals.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

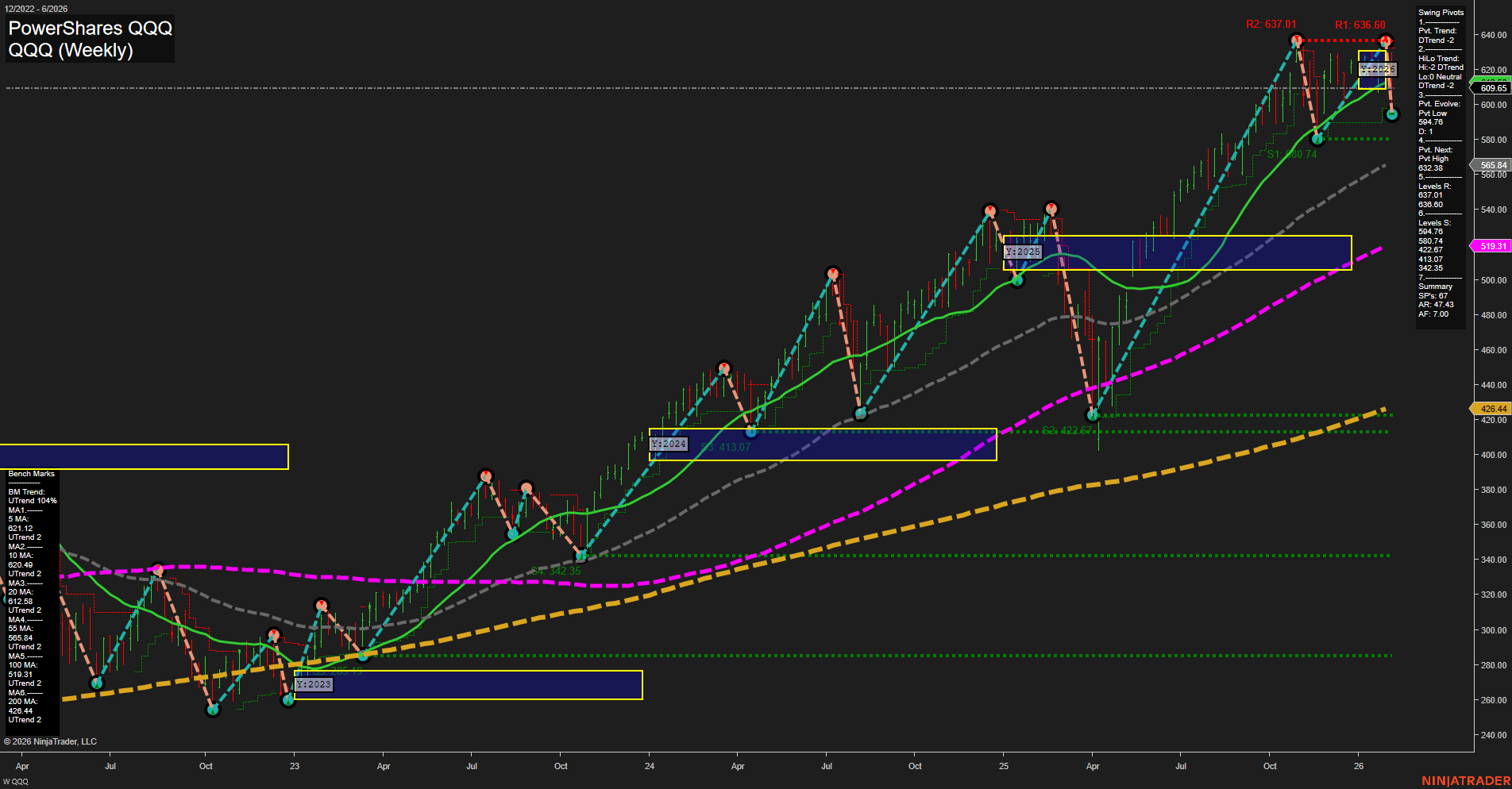

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts