After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

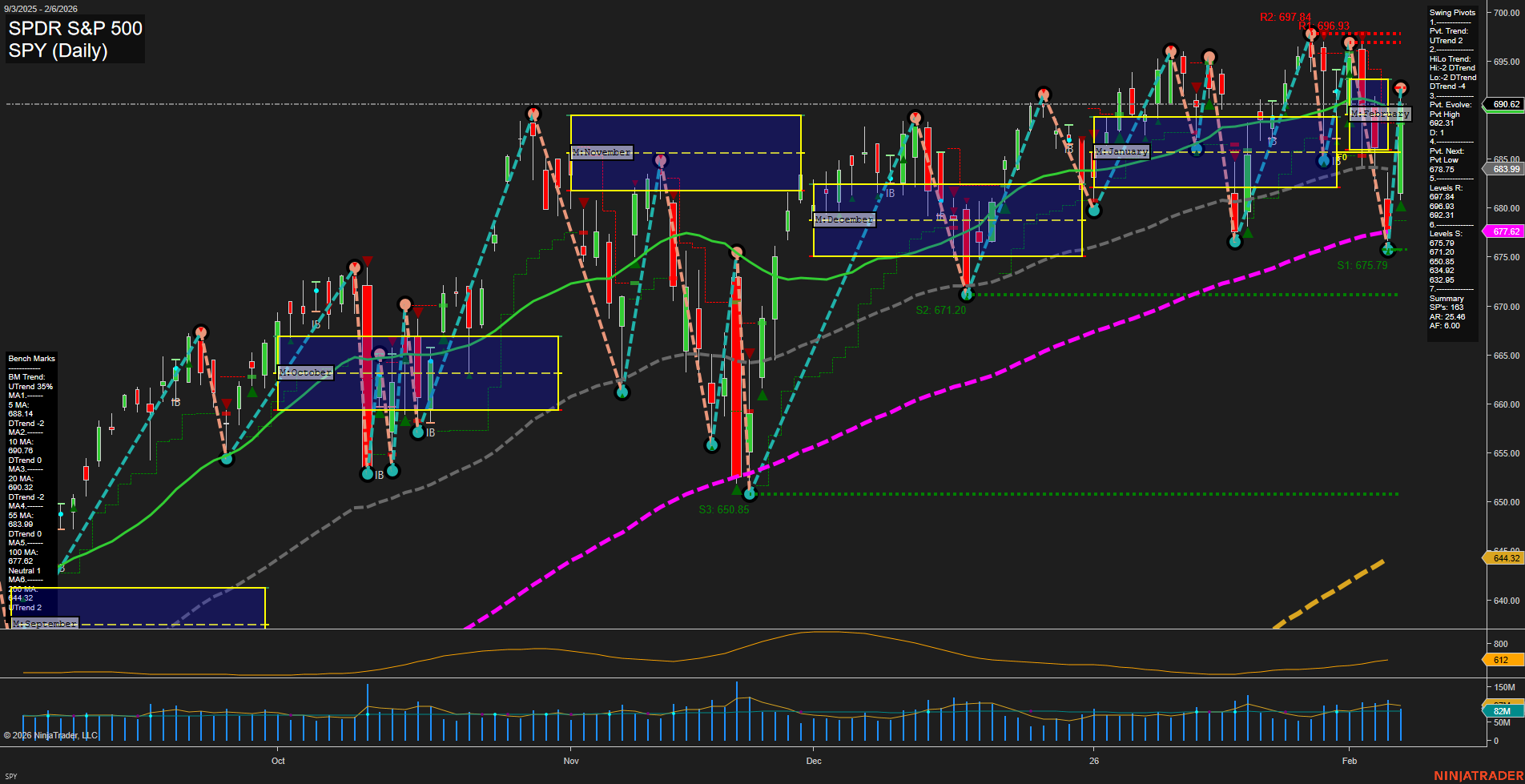

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- ECB & Inflation Policy: The ECB is unlikely to respond to a brief dip in inflation below target, suggesting a steady stance on interest rates in the near term.

- Gold & Precious Metals: Gold surged above $5000 as the U.S. dollar weakened, driven by safe-haven demand and outside market factors. Ongoing investment interest includes big new gold mining projects and the influence of tokenized gold on broader bullion trading. The latest rally is viewed by some as unsustainable and has led to profit-taking, but underlying demand remains robust amid market uncertainty.

- U.S. Jobs & Economic Indicators: Anticipation surrounds the upcoming jobs report, with forecasts for weaker hiring as private sector demand declines and population growth slows. Despite softer labor data, consumer sentiment has improved, and markets are closely watching employment and inflation data for signals on Fed policy.

- Energy Markets: Oil markets tightened, with prices buoyed by concerns over geopolitical risks around Iran and the Strait of Hormuz as well as a weaker U.S. dollar. Market insiders contest concerns of an oil supply glut, highlighting underinvestment in both oil and metals.

- Tech & Equity Trends: Tech stocks led by software and AI recovered after last week’s sell-off. Major hyperscalers are ramping up AI capital expenditures, underscoring confidence in long-term growth. Some analysis calls into question the sustainability of recent tech-driven gains, especially as free cash flow lags reported earnings and market P/E ratios climb.

- Market Sentiment & Risk Appetite: There’s increased caution around covered call ETFs and speculative assets, with suggestions that some popular risk mitigation strategies may not perform as expected in a downturn. Volatility in treasuries and equities is anticipated, with skepticism about sustaining recent highs in U.S. stocks.

- Earnings & Capital Flows: Select financial firms are reporting strong earnings and record capital raising, supporting broader market confidence. Investor appetite for long-dated tech bonds remains high, with fresh issues significantly oversubscribed.

- AI Bubble Concerns: Despite market anxiety around an AI-driven bubble, current valuations in tech show only modest increases in P/E ratios versus historical averages.

News Conclusion

- Markets remain focused on central bank policies and key economic reports for direction amid signs of moderating U.S. labor demand and persistent inflation concerns.

- Gold and oil markets are benefitting from safe-haven flows, a weaker dollar, and geopolitical tensions, with some voices warning of overbought conditions but strong underlying demand.

- Technology equities are regaining ground from recent weakness, supported by aggressive investment in AI infrastructure, though questions persist about the sustainabilty of earnings and the risks of crowded positions.

- Defensive positioning, profit-taking, and hedging strategies are prominent as investors assess the risk of a potential economic slowdown or increased market volatility despite recent positive earnings headlines.

- While fundamental and macro divergences are present, sentiment in equities, commodities, and credit remains constructive in the absence of immediate policy or economic shocks.

Market News Sentiment:

Market News Articles: 34

- Positive: 41.18%

- Neutral: 32.35%

- Negative: 26.47%

GLD,Gold Articles: 12

- Neutral: 50.00%

- Positive: 41.67%

- Negative: 8.33%

USO,Oil Articles: 7

- Positive: 42.86%

- Negative: 42.86%

- Neutral: 14.29%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 9, 2026 05:00

- MSFT 413.60 Bullish 3.11%

- GLD 467.03 Bullish 2.54%

- NVDA 190.04 Bullish 2.50%

- META 677.22 Bullish 2.38%

- TSLA 417.32 Bullish 1.51%

- USO 78.02 Bullish 1.34%

- IBIT 40.11 Bullish 1.08%

- QQQ 614.32 Bullish 0.77%

- IWM 266.88 Bullish 0.70%

- SPY 693.95 Bullish 0.48%

- GOOG 324.40 Bullish 0.40%

- IJH 71.79 Bullish 0.08%

- DIA 501.22 Bullish 0.04%

- TLT 87.52 Bearish -0.02%

- AMZN 208.72 Bearish -0.76%

- AAPL 274.62 Bearish -1.26%

Market Summary: ETF Stocks, Mag7 & Select ETFs (as of 02/09/2026 17:00:00)

ETF Stocks (SPY, QQQ, IWM, IJH, DIA)

- SPY: 693.95 (Bullish +0.48%)

S&P500-tracking ETF sustained moderate upward momentum, indicating continued index-wide optimism. - QQQ: 614.32 (Bullish +0.77%)

Tech-heavy Nasdaq ETF led above SPY, reflecting sector outperformance by growth and large-cap tech stocks. - IWM: 266.88 (Bullish +0.70%)

Small-cap ETF displayed strength, echoing risk appetite and possible rotation into smaller names. - IJH: 71.79 (Bullish +0.08%)

Mid-cap ETF hovered near flatline, suggesting balanced sentiment in the segment. - DIA: 501.22 (Bullish +0.04%)

Dow ETF marginally positive; blue chips appeared steady but lacking strong direction.

Mag7 (Mega-Cap Technology & Growth Leaders)

- Microsoft (MSFT): 413.60 (Bullish +3.11%)

Led Mag7 gains with strong upward move, signaling robust bullish sentiment. - Nvidia (NVDA): 190.04 (Bullish +2.50%)

Continued AI sector leadership with high momentum. - Meta Platforms (META): 677.22 (Bullish +2.38%)

Meta advanced solidly, reinforcing overall big tech strength. - Tesla (TSLA): 417.32 (Bullish +1.51%)

TSLA continued recovery, contributing positively within Mag7 cohort. - Google (GOOG): 324.40 (Bullish +0.40%)

Posted modest gains—participating in the tech-led rally. - Amazon (AMZN): 208.72 (Bearish -0.76%)

Notably bucked group trend with a decline, hinting at divergent factors. - Apple (AAPL): 274.62 (Bearish -1.26%)

Marked the weakest performance, presenting headwinds within the Mag7 complex.

Other Notable ETFs

- GLD (Gold): 467.03 (Bullish +2.54%)

Precious metals ETF rose strongly, indicating safe-haven flows or inflation protection interest. - USO (Oil): 78.02 (Bullish +1.34%)

Crude oil ETF posted healthy gains, possibly reflecting energy market strength or supply/demand shifts. - IBIT (Bitcoin ETF): 40.11 (Bullish +1.08%)

Cryptocurrency ETF positive, suggesting broad risk-on sentiment or digital asset demand. - TLT (20+ Yr Treasury): 87.52 (Bearish -0.02%)

Long-duration bond ETF edged lower, continuing yield-sensitive underperformance.

State of Play: Bulls Dominate with Mixed Mega-Cap Action

The market landscape showed prevailing bullish activity across major index ETFs, growth leaders, and alternative assets. The Mag7 cohort largely drove tech sector optimism, led by MSFT, NVDA, and META, while AAPL and AMZN lagged. GLD and energy (USO) also attracted capital, balancing risk-on behavior with safe-haven interest. Bond proxy TLT weakened amid the risk rally.

No trading advice or recommendations.

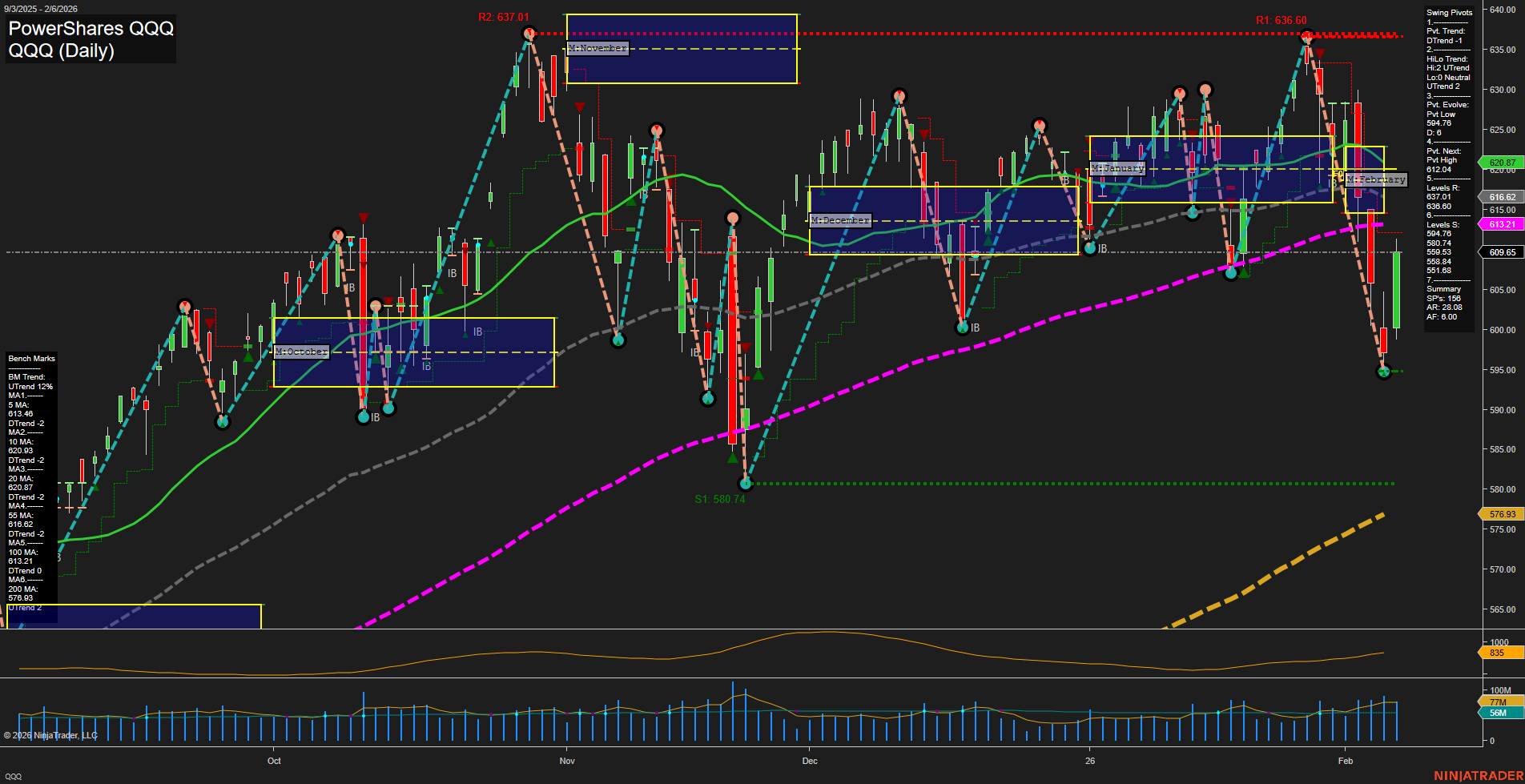

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts