Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

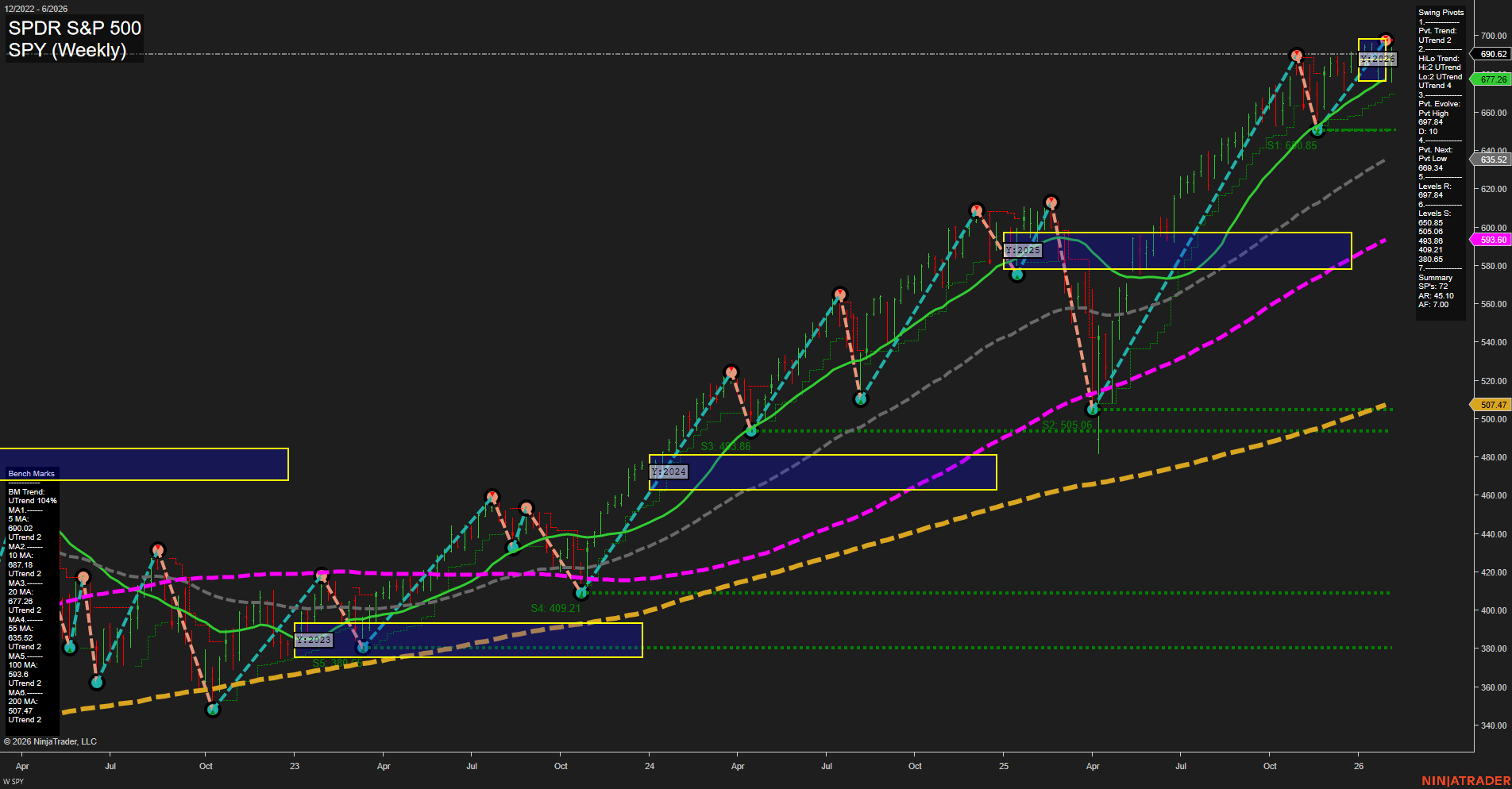

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

- 2026-02-16 Washington’s Birthday

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Tuesday 08:30 – USD Core Retail Sales & Retail Sales m/m

Both reports are high-impact and signal the strength of consumer spending, a key driver of US economic growth. A strong reading could increase expectations for tighter Federal Reserve policy, often leading to higher volatility and potential gains in US indices. Weak figures could encourage dovish sentiment, supporting index futures. - Wednesday 08:30 – USD Average Hourly Earnings m/m, Non-Farm Employment Change, Unemployment Rate

The simultaneous release of these major labor market reports creates significant market-moving potential. Stronger-than-expected job gains and wage growth may revive inflation worries, pressuring indices and raising the odds of rate hikes or holding higher for longer. Conversely, soft data may reduce rate hike fears and support bullish index action. - Thursday 08:30 – USD Unemployment Claims

Fresh labor market data can amplify or reverse momentum created by Wednesday’s jobs releases. An unexpected spike signals economic fragility, typically bearish for indices, while steady or declining claims are supportive. - Friday 08:30 – USD Core CPI m/m, CPI m/m, CPI y/y

CPI inflation data are some of the most-watched market movers. Hot prints can trigger sharp sell-offs in index futures as traders anticipate tighter monetary policy; softer prints often produce rapid rallies on dovish hopes. Expect significant volume and price swings at the release.

EcoNews Conclusion

- Index futures volatility is likely to be elevated around the 08:30 EST time slot on Tuesday (Retail Sales), Wednesday (Jobs Reports), and especially Friday (CPI data), with high momentum risk and swift direction changes.

- Markets may experience position adjustments or reduced momentum in the lead-up to Friday’s CPI print, as CPI is a major data point for Federal Reserve policy expectations and overall market sentiment.

For full details visit: Forex Factory EcoNews

Market News Summary

- Equity Markets: The Dow Jones Industrial Average topped 50,000 amid optimism from technology rebounds, sector rotation, and expectations for lower interest rates. Index futures showed mild gains or drifted higher entering a week with key delayed economic data, but sentiment turned more cautious ahead of unemployment and CPI releases. S&P 500 earnings expectations rose, reflecting strong tech sector performance, but past midweek volatility was tied to heavy AI capital expenditures. Technical analysis showed a lack of strong directional bias in the S&P 500 after sharp swings.

- Sector Rotation & Dividends: Attention remained on dividend powerhouses yielding over 8% for retirement income, alongside continued interest in high-yield bond ETFs like SPLB and TLT, each with distinct risk-return profiles.

- Volatility & Event Risks: $62 billion in Treasury settlements poised to pull liquidity this week, historically pressuring the S&P 500. Recent market rebounds have not fully quelled underlying investor concerns or anxiety over an uncertain labor market and delayed January jobs data.

- Global Markets & Japan: Japan’s LDP election victory is expected to fuel fiscal stimulus and affect the yen, with strategies including long Japanese equities and a weaker yen momentum. Japanese government bonds face pressure from changing rate environments, and the end of a long deflation period is speculated.

- Commodities: Oil prices dropped by over 1% as US-Iran tensions eased, but underlying support persisted from supply uncertainty, OPEC dynamics, and inventory reports, with position adjustments seen in early Asian trade. Gold prices rose amid safe-haven flows linked to geopolitical concerns; central bank demand and key resistance levels are in focus for gold futures.

- Other Headlines: Big Tech experienced substantial valuation losses over the past week. Bitcoin stabilized after high volatility. The US and India advanced trade relations, including removal of some tariffs.

News Conclusion

- Equity markets are approaching major data releases—including jobs and inflation—with cautious optimism after last week’s volatility and strong late-week bounce.

- Liquidity withdrawals and the long-awaited economic data could continue to inject volatility, with attention on both the S&P 500 and Dow Jones Industrial Average futures.

- Sector rotation persists alongside renewed interest in dividend yield and select high-yield bond products, as market participants assess risk-adjusted return profiles into 2026.

- Japan’s decisive election outcome and rising rates introduce identifiable global trade themes and shifts in currency markets.

- Energy and safe-haven commodities remain sensitive to geopolitical developments and macroeconomic data, with oil and gold reacting to both event risk and technical levels.

- Overall, traders are navigating a landscape shaped by macroeconomic crosscurrents, geopolitical risks, and evolving sector leadership.

Market News Sentiment:

Market News Articles: 18

- Neutral: 44.44%

- Positive: 33.33%

- Negative: 22.22%

Sentiment Summary:

The majority of market news articles are neutral (44.44%), with a smaller portion reflecting positive sentiment (33.33%) and fewer showing negative sentiment (22.22%).

Conclusion:

Market news coverage currently maintains a balanced to slightly positive tone, with neutral sentiment prevailing in the majority of reports.

GLD,Gold Articles: 6

- Positive: 66.67%

- Neutral: 33.33%

Sentiment Summary: Gold-related market news is predominantly positive, with 66.67% of articles reflecting a positive sentiment and 33.33% presenting a neutral stance.

This indicates that the majority of recent coverage on gold maintains an optimistic tone, while a significant portion remains neutral.

USO,Oil Articles: 4

- Negative: 50.00%

- Positive: 25.00%

- Neutral: 25.00%

Sentiment Summary: Among recent USO and oil-related articles, 50% reflected negative sentiment, 25% were positive, and 25% were neutral.

This indicates that recent market commentary on USO and oil is skewed towards a negative outlook, with a minority of articles expressing positive or neutral views.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 9, 2026 07:16

- IBIT 39.68 Bullish 9.92%

- NVDA 185.41 Bullish 7.87%

- IWM 265.02 Bullish 3.59%

- TSLA 411.11 Bullish 3.50%

- IJH 71.73 Bullish 3.16%

- GLD 455.46 Bullish 3.07%

- DIA 501.03 Bullish 2.48%

- QQQ 609.65 Bullish 2.11%

- SPY 690.62 Bullish 1.92%

- MSFT 401.14 Bullish 1.90%

- AAPL 278.12 Bullish 0.80%

- USO 76.99 Bullish 0.39%

- TLT 87.54 Bullish 0.07%

- META 661.46 Bearish -1.31%

- GOOG 323.10 Bearish -2.48%

- AMZN 210.32 Bearish -5.55%

Market Overview: ETF Stocks, Mag7, and Key ETFs (Snapshot: 02/09/2026)

This summary presents the current market positioning for popular ETFs, “Mag7” stocks, and other notable ETFs, highlighting bullish, bearish, and mixed momentum in today’s session.

ETF Stocks

- SPY (690.62, Bullish +1.92%): S&P 500 ETF continues upward momentum with steady broad market performance.

- QQQ (609.65, Bullish +2.11%): Nasdaq-100 ETF extends its rally, reflecting tech sector strength.

- IWM (265.02, Bullish +3.59%): Russell 2000 ETF posts robust gains, highlighting small-cap outperformance.

- IJH (71.73, Bullish +3.16%): Mid-cap ETF surges, suggesting healthy risk appetite beyond mega-caps.

- DIA (501.03, Bullish +2.48%): Dow Jones ETF strengthens, broadening the rally across major indices.

Mag7 Stocks

- AAPL (278.12, Bullish +0.80%): Apple posts modest gains amid overall tech optimism.

- MSFT (401.14, Bullish +1.90%): Microsoft rises on the session, in line with tech-focused ETF moves.

- NVDA (185.41, Bullish +7.87%): Nvidia leads with a significant advance, signaling strong chip-sector momentum.

- TSLA (411.11, Bullish +3.50%): Tesla jumps, reflecting renewed risk-taking in growth favorites.

- META (661.46, Bearish -1.31%): Meta faces a pullback, diverging from broader tech gains.

- GOOG (323.10, Bearish -2.48%): Alphabet slides, highlighting selective weakness within mega-cap tech.

- AMZN (210.32, Bearish -5.55%): Amazon underperforms with a pronounced decline, contrasting the broader bullish tone.

Other Key ETFs

- IBIT (39.68, Bullish +9.92%): Bitcoin ETF soars, marking a clear risk-on sentiment in digital assets.

- GLD (455.46, Bullish +3.07%): Gold ETF advances, possibly as investors hedge or diversify.

- USO (76.99, Bullish +0.39%): Oil ETF edges higher, signaling steady movement in energy markets.

- TLT (87.54, Bullish +0.07%): Long-term Treasury ETF is almost unchanged, indicating calm in fixed income.

Summary Table: State of Play

| Name | Price | Direction | % Change |

|---|---|---|---|

| IBIT | 39.68 | Bullish | +9.92% |

| NVDA | 185.41 | Bullish | +7.87% |

| IWM | 265.02 | Bullish | +3.59% |

| TSLA | 411.11 | Bullish | +3.50% |

| IJH | 71.73 | Bullish | +3.16% |

| GLD | 455.46 | Bullish | +3.07% |

| DIA | 501.03 | Bullish | +2.48% |

| QQQ | 609.65 | Bullish | +2.11% |

| SPY | 690.62 | Bullish | +1.92% |

| MSFT | 401.14 | Bullish | +1.90% |

| AAPL | 278.12 | Bullish | +0.80% |

| USO | 76.99 | Bullish | +0.39% |

| TLT | 87.54 | Bullish | +0.07% |

| META | 661.46 | Bearish | -1.31% |

| GOOG | 323.10 | Bearish | -2.48% |

| AMZN | 210.32 | Bearish | -5.55% |

Note: For informational purposes only. No trading advice or recommendations expressed.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2026-02-09: 07:16 CT.

US Indices Futures

- ES Consolidation below 7040 swing high, YSFG down, MSFG up, WSFG down, price above key supports, all MAs up, mixed short-term signals, intermediate/long-term bullish structure.

- NQ Weekly consolidation after pullback, WSFG up/above NTZ, MSFG down/below NTZ, LTF MAs down, HTF MAs up, support at pivot lows, resistance above, mixed trade signals.

- YM Persistent uptrend, new highs, all Session Fib Grids (YSFG, MSFG, WSFG) up/above NTZ, all MAs rising, uptrend in swing pivots/HiLo, no reversal signs, resistance surpassed, support rising.

- EMD Strong momentum, breakout, YSFG/MSFG up/above NTZ, WSFG minor pullback, all MAs up, recent long signals, higher lows, resistance close, trending structure.

- RTY Breakout/rally, YSFG/MSFG/WSFG up/above NTZ, large bars/fast momentum, uptrend on pivots, all MAs rising, next resistance 2704.9, next support 2589.0, trend-continuation environment.

- FDAX YSFG/MSFG up, WSFG down (short-term pullback), all weekly MAs up, swing pivot down, support at 23,133, resistance 25,641, recent long signals, overall bullish with periodic retracements.

Overall State

- Short-Term: Bullish to Neutral (mild rotation in ES/NQ/FDAX, broad up elsewhere)

- Intermediate-Term: Bullish (slight correction in NQ, strong elsewhere)

- Long-Term: Bullish (broad strength remains, NQ daily/ES daily exception)

Conclusion

US Indices Futures exhibit predominantly bullish higher time frame structures, confirmed by intermediate and long-term uptrends in Fib Grids (YSFG/MSFG), upward momentum in bench-mark moving averages, and consistently higher swing pivots/support levels. ES consolidates beneath resistance with mixed short-term signals but maintains upside context. NQ is correcting from highs short- and intermediate-term, though the long-term bullish framework persists. YM, EMD, and RTY continue trend-continuation phases, all at or near highs with support from HTF structures and recent breakout behavior. FDAX maintains strong intermediate/long-term uptrends with a short-term pullback within overall bullish structure. Overall, momentum and structure across key indices support ongoing HTF uptrends barring breakdown of pivotal support. Directional correlation among US indices generally favors the bull cycle, with NQ lagging short-term and YM/EMD/RTY leading.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

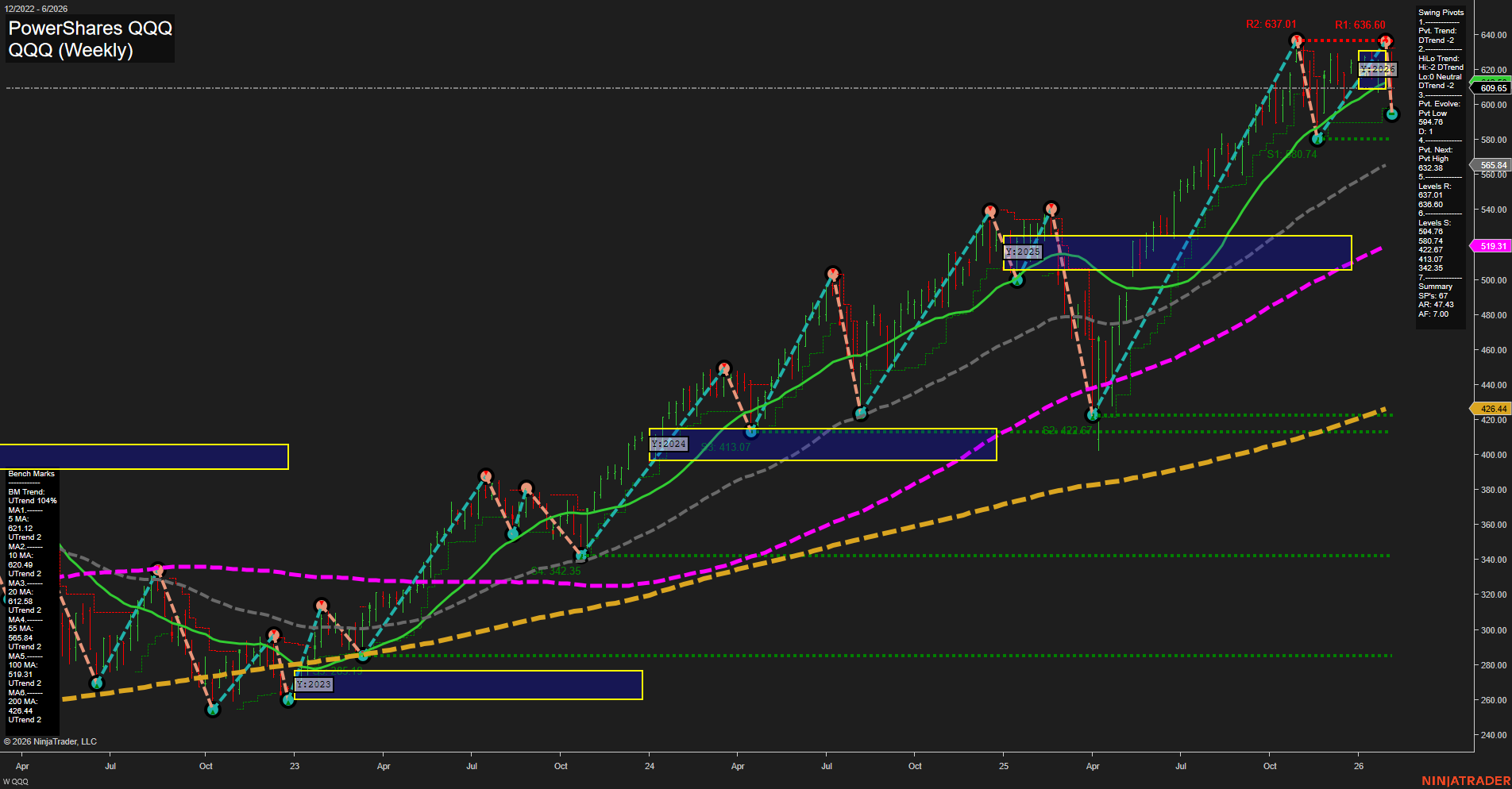

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts