Market Roundup – NYSE After Market Close Bearish as of February 10, 2026 05:00 ct

After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

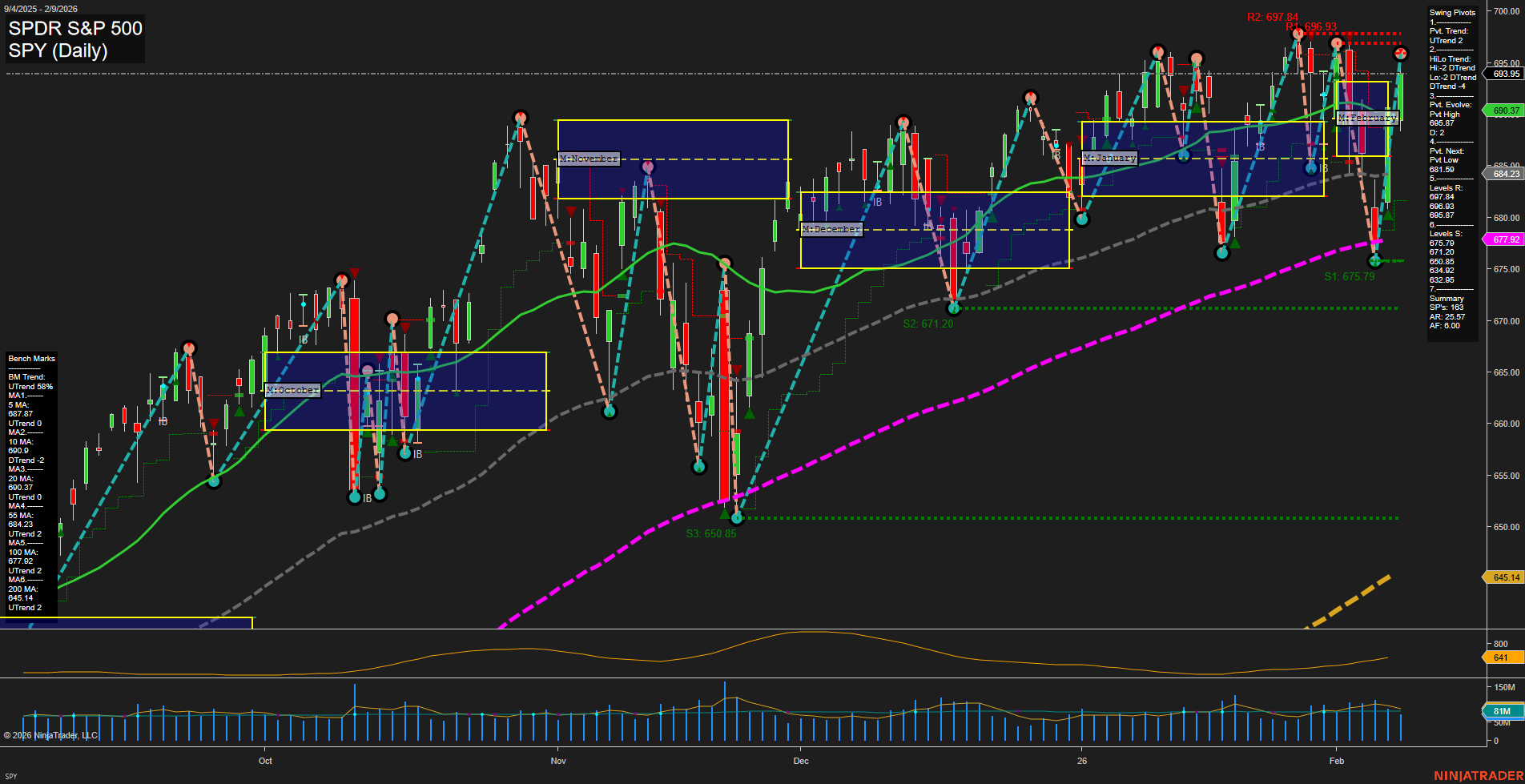

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Equities & Indices: The Dow Jones hit its third straight record close, outperforming as the S&P 500 and tech names slipped. Sector rotation is accelerating in early 2026, with non-tech sectors outperforming thanks to moves out of mega-cap tech and into small- and mid-cap growth stocks. However, the S&P 500 remains dependent on large-cap tech for gains, and major cycles point to an elevated period of volatility ahead. State Street strategists see potential for the S&P 500 to rally to 8,000 in 2026, citing productivity gains. However, a major Wall Street firm cautions that tech stock risks are rising, and hedge funds are heavily shorting tech, suggesting the recent tech rebound may have been short covering.

- Federal Reserve & Macro: Fed officials signal a steady course with recent rate cuts fully absorbed, emphasizing patience and no rush for further easing. The jobs market remains under scrutiny, with the delayed January employment report expected to show minimal gains. Policy stances are seen as appropriately calibrated for current risks.

- Gold & Precious Metals: Gold traded lower despite a weaker dollar and declining Treasury yields, but continues to hold above the $5,000 level even as retail investment flows add to volatility. The secular bull case for gold and silver is underpinned by sustained investment and central bank demand, though asset allocations remain modest by historical standards. Volatility is considered a structural feature of these markets rather than a flaw.

- Oil & Commodities: Crude oil is showing bullish technical formation with a potential upside breakout. Petrobras reported an 18% year-over-year increase in Q4 production, while Record Resources targets expansion in Gabon, signaling global ambitions from energy names.

- ETFs & Flows: Virtus Investment Partners expanded its ETF presence with a new emerging markets dividend product. Covered call ETFs, despite offering high yields, face criticism for long-term wealth erosion due to structural risks.

- Political & Trade: President Trump emphasized readiness to sustain tariffs even if legal setbacks occur, as prior trade policy moves are credited with boosting market sentiment and productivity. Debate continues over the economic impact of tariff policies and a potential change at the Fed’s helm.

- Other Market Developments: NYSE short interest data shows rising interest across major exchanges. The S&P 500 set a historic milestone, with analysts forecasting further turbulence. Globally, shifts in energy and industrial policy, particularly in China, are prompting debate over the outlook for domestic versus international equities.

News Conclusion

- Markets are reflecting a complex interplay of sector rotation, elevated volatility, and divergent performance across major indices, with the Dow maintaining momentum as other benchmarks waver.

- Ongoing caution among Fed officials and investors signals a wait-and-see approach to monetary policy, with the labor market and inflation trends crucial for future market direction.

- Precious metals remain volatile but attract interest on structural demand themes, while oil markets show technical strength and growth signals from key producers.

- Fund flow dynamics and ETF strategies are under scrutiny amid concerns over hidden risks and changes in investor behavior.

- Trade policy and legal developments are adding to headline risk, with potential implications for multinational companies and global indices.

- Overall, 2026 has started with record highs, increased uncertainty, and shifts in market leadership, setting the stage for potentially turbulent but opportunity-rich trading conditions.

Market News Sentiment:

Market News Articles: 44

- Neutral: 47.73%

- Positive: 34.09%

- Negative: 18.18%

GLD,Gold Articles: 17

- Neutral: 58.82%

- Positive: 29.41%

- Negative: 11.76%

USO,Oil Articles: 10

- Negative: 40.00%

- Neutral: 30.00%

- Positive: 30.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 10, 2026 05:00

- TSLA 425.21 Bullish 1.89%

- TLT 88.53 Bullish 1.15%

- DIA 501.90 Bullish 0.14%

- USO 78.03 Bullish 0.01%

- IJH 71.76 Bearish -0.04%

- MSFT 413.27 Bearish -0.08%

- SPY 692.12 Bearish -0.26%

- IWM 266.16 Bearish -0.27%

- AAPL 273.68 Bearish -0.34%

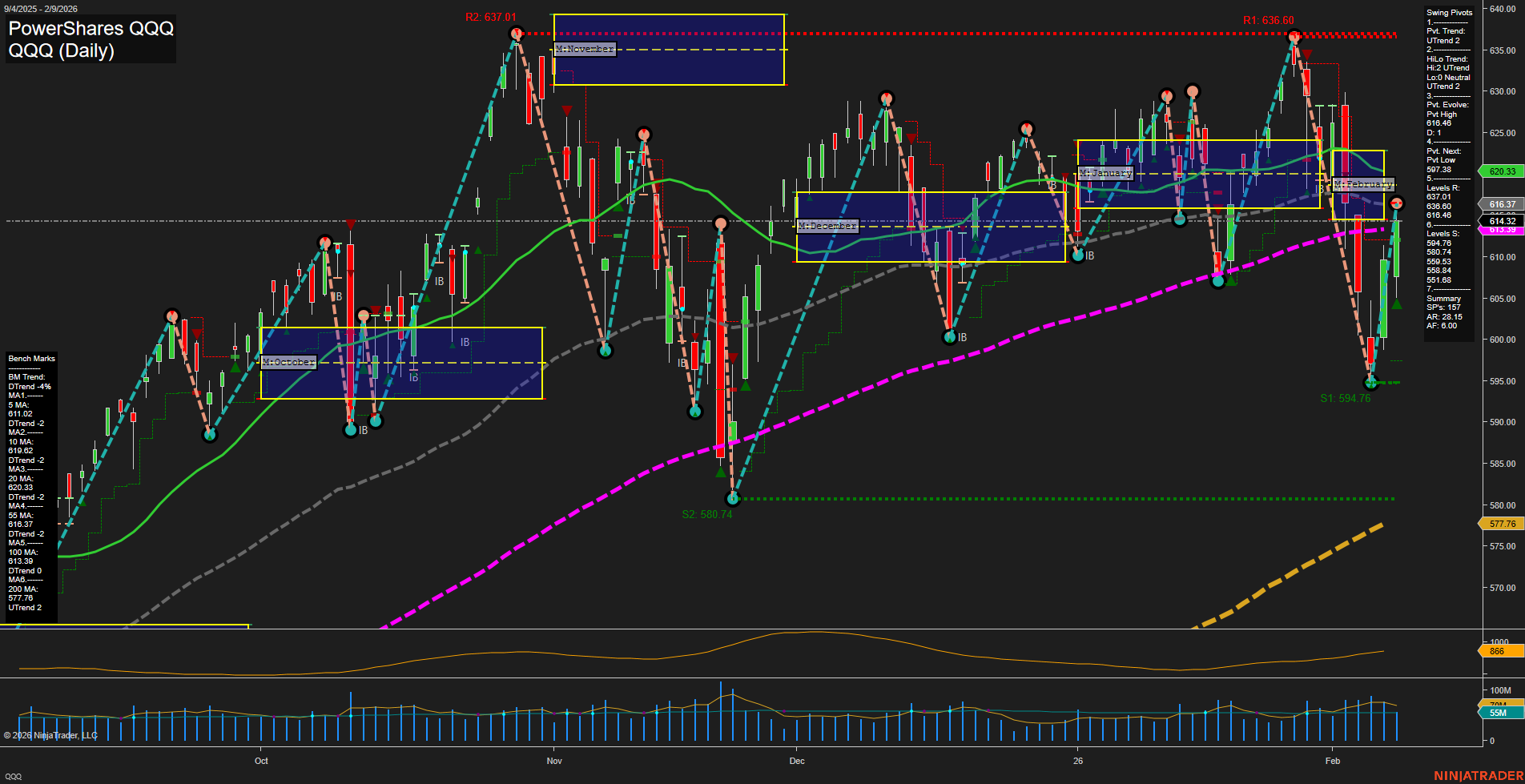

- QQQ 611.47 Bearish -0.46%

- NVDA 188.54 Bearish -0.79%

- AMZN 206.96 Bearish -0.84%

- META 670.72 Bearish -0.96%

- GLD 462.40 Bearish -0.99%

- GOOG 318.63 Bearish -1.78%

- IBIT 38.97 Bearish -2.84%

ETF Stocks: Broad Indices

- SPY (S&P 500): Bears are prevailing with a move of -0.26%. Sentiment on large caps is negative, echoing broader caution.

- QQQ (NASDAQ 100): Bearish, down -0.46%. The technology-heavy index is facing more selling pressure than the S&P 500.

- DIA (Dow 30): Bullish, up +0.14%. The Dow components outperform the high-growth and broader indices today.

- IWM (Russell 2000): Bearish, off -0.27%. Small caps continue to lag.

- IJH (Mid Cap): Bearish, down -0.04%. Mid-caps echo the downside, though declines are modest.

MAG7 Performance Snapshot

- AAPL (Apple): Bearish, -0.34%.

- MSFT (Microsoft): Bearish, -0.08%.

- GOOG (Alphabet): Bearish, -1.78%.

- AMZN (Amazon): Bearish, -0.84%.

- META (Meta): Bearish, -0.96%.

- NVDA (Nvidia): Bearish, -0.79%.

- TSLA (Tesla): Bullish standout, up +1.89%.

Summary: Most of the MAG7 are under pressure with losses among the tech bellwethers, while Tesla is the notable outperformer in the group with a significant gain.

Other Key ETFs

- TLT (Long-Term Treasuries): Bullish, +1.15%. Bonds are showing strength today, often a risk-off signal.

- GLD (Gold): Bearish, -0.99%. Precious metals are under pressure despite risk-off trade elsewhere.

- USO (Oil): Bullish, +0.01%. Marginal gains in crude; little momentum either way.

- IBIT (Bitcoin ETF): Bearish, -2.84%. The crypto space is notably weak compared to traditional asset classes.

Market Summary of State of Play

- The market mood is predominantly mixed-to-bearish with most major index ETFs and mega cap tech names in the red.

- Defensive flows appear with strength in long-duration Treasuries (TLT), while equities and gold (GLD) both trade lower, suggesting nuanced risk sentiment.

- Tesla is a notable outperformer today, standing out in a sea of red across the MAG7.

- Crypto exposure via IBIT is sharply lower, underperforming all listed assets.

- Dow components (DIA) show relative strength vs. growth leaders and small/mid caps, indicating a possible rotation toward blue-chip stability.

This summary is for informational overview without trading advice or recommendations.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts