Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

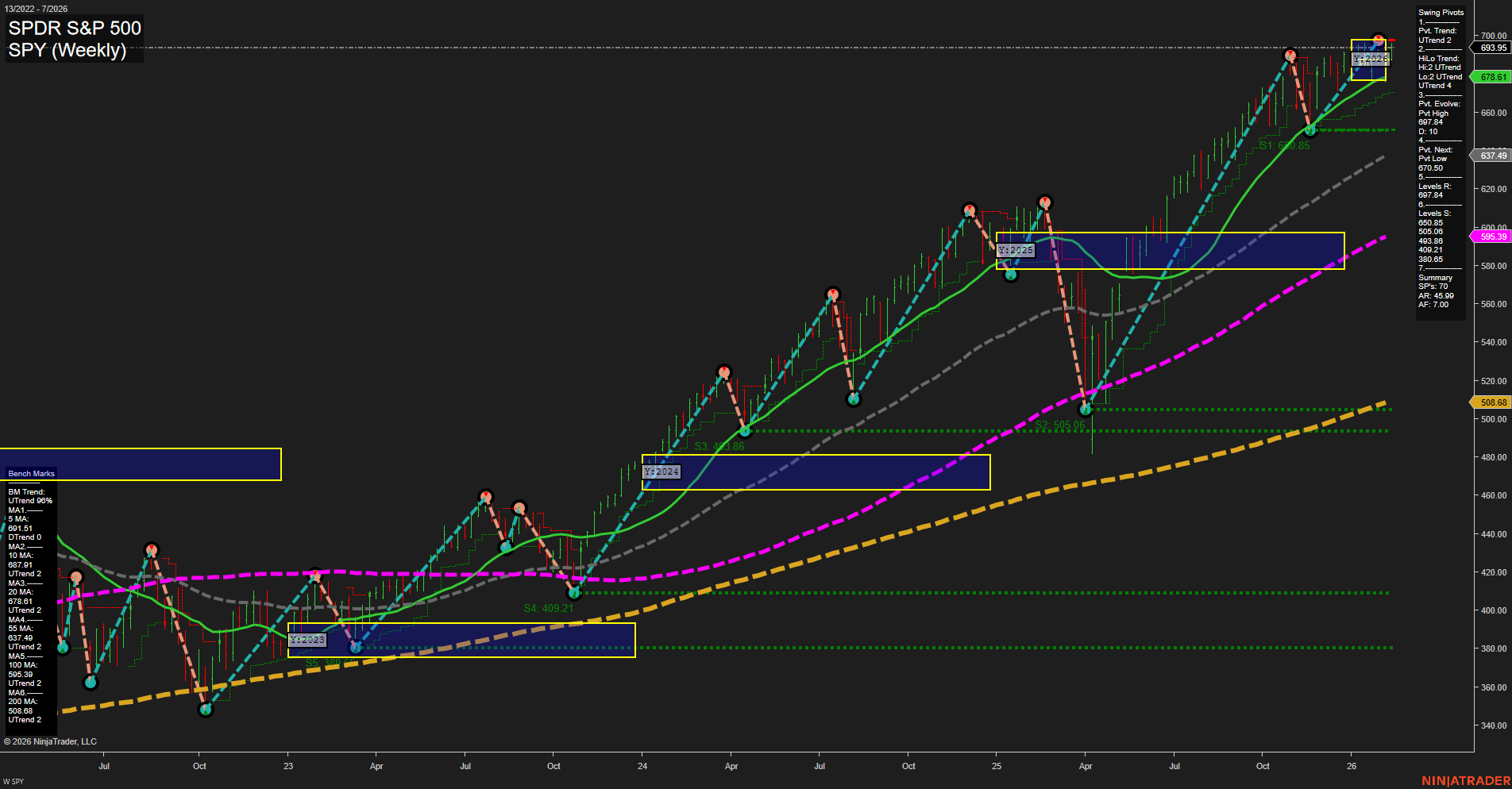

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

- 2026-02-16 Washington’s Birthday

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Tuesday 08:30 – High Impact: Core Retail Sales m/m and Retail Sales m/m will provide crucial insight into consumer spending strength, with volatility likely in equity futures. Both indicators can shift market sentiment on economic growth and Fed policy outlook.

- Wednesday 08:30 – High Impact: Average Hourly Earnings m/m, Non-Farm Employment Change, and Unemployment Rate dominate premarket. Together, these labor data points can drive sharp moves in indices, as traders assess potential shifts in inflation pressures and monetary policy trajectory.

- Thursday 08:30 – High Impact: Unemployment Claims will gauge labor market resilience; notable surprises can spark futures volatility ahead of Friday’s inflation data.

- Friday 08:30 – High Impact: Core CPI m/m, CPI m/m, and CPI y/y are all in focus as the week’s key inflation events. Markets may reprioritize Fed path expectations based on any divergence from consensus; this is typically a major turning point for index futures momentum and direction.

EcoNews Conclusion

- This week’s calendar is skewed to high-impact events, with back-to-back labor and inflation data likely to keep volatility and volume elevated in index futures.

- Market momentum and volume may slow in the days leading up to Friday’s CPI, as traders position ahead of this critical inflation release.

For full details visit: Forex Factory EcoNews

Market News Summary

- Commodities and Global Markets: Commodities posted double-digit gains to start 2026, lifting world stocks and supporting managed futures. U.S. equities rose in premarket trading, with the S&P 500 and Dow futures supported by tech rebound and anticipation around key data releases.

- Indices Rotation: Value and small-cap stocks outperformed large-cap growth. American equities are seeing rising competition from non-U.S. markets as investors watch high valuations and a softening U.S. dollar.

- Gold and Silver: Gold experienced a technical correction after a historic close but remains in a broad bullish cycle with analysts noting the potential for much higher price targets. Silver encountered resistance. Overall sentiment is shaped by policy uncertainty and momentum divergence.

- Energy Markets: Oil prices softened on position adjustments and supply risk reassessment, with market attention fixed on geopolitical tensions—specifically U.S.-Iran relations and EU actions on Russian supply. Major oil firms flagged earnings and buyback pressures, while natural gas tested key support as traders weighed demand and supply factors.

- Sector Performance: The software and services sector saw declines in market representation due to AI-related disruption fears, with large-cap tech names increasingly acting as a source of funds for value and international equities.

- U.S. Dollar and Treasuries: The dollar began the week with weakness. Discussion persists on the implications of China further reducing U.S. Treasury holdings, particularly through indirect channels.

- Macro Events: Traders are focused on upcoming Non-Farm Payrolls, CPI, and retail sales data for directional cues. Notably, labor growth in the U.S. has been concentrated in healthcare and social assistance over the past year.

- Alternative Assets and ETF Strategy: Crypto volatility is influencing ETF investment approaches, while some analysts highlight bargains in high-yielding assets amid recent volatility in mega-cap growth names.

News Conclusion

- Markets have started 2026 with strong risk-on sentiment, notably in commodities and select equity indices, even as investors reposition toward value and international exposure.

- Gold remains resilient amid volatility, with bullish longer-term projections coexisting with short-term correction signals.

- Oil and gas markets continue to trade on supply risk and headline-driven volatility, while major energy firms signal tightening margins and cautious spending.

- The U.S. dollar’s decline and China’s Treasury positioning introduce cross-asset headwinds, further contributing to the rotation toward global and value assets.

- The market awaits key economic data releases, with sectoral and asset class rotations driven by evolving macro expectations and geopolitical developments.

- Overall, price action reflects a mix of technical adjustments, macroeconomic positioning, and heightened sensitivity to geopolitical risk and asset flow dynamics.

Market News Sentiment:

Market News Articles: 35

- Neutral: 40.00%

- Positive: 37.14%

- Negative: 22.86%

Sentiment Summary: Out of 35 market news articles, 40% were neutral, 37.14% positive, and 22.86% negative.

Conclusion: The news flow appears balanced overall, with a slightly higher proportion of neutral and positive sentiment compared to negative.

GLD,Gold Articles: 13

- Neutral: 46.15%

- Positive: 38.46%

- Negative: 15.38%

Sentiment Summary:

Recent coverage on GLD and gold shows a majority neutral sentiment (46.15%), with positive sentiment accounting for 38.46% and negative sentiment at 15.38%.

This distribution indicates that news flow is currently balanced to slightly positive, with a notable proportion of neutral commentary and limited negative outlooks.

USO,Oil Articles: 10

- Negative: 50.00%

- Neutral: 30.00%

- Positive: 20.00%

Sentiment Summary: Recent coverage on USO and Oil shows a predominantly negative tone, with 50% of articles reflecting negative sentiment, 30% neutral, and only 20% positive.

This distribution suggests that recent news for the sector has skewed cautious, with relatively limited optimism in the latest reporting.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 10, 2026 07:16

- MSFT 413.60 Bullish 3.11%

- GLD 467.03 Bullish 2.54%

- NVDA 190.04 Bullish 2.50%

- META 677.22 Bullish 2.38%

- TSLA 417.32 Bullish 1.51%

- USO 78.02 Bullish 1.34%

- IBIT 40.11 Bullish 1.08%

- QQQ 614.32 Bullish 0.77%

- IWM 266.88 Bullish 0.70%

- SPY 693.95 Bullish 0.48%

- GOOG 324.40 Bullish 0.40%

- IJH 71.79 Bullish 0.08%

- DIA 501.22 Bullish 0.04%

- TLT 87.52 Bearish -0.02%

- AMZN 208.72 Bearish -0.76%

- AAPL 274.62 Bearish -1.26%

Market Summary: ETF Stocks, Mag7, & Key ETFs (Snapshot as of 02/10/2026)

ETF Stocks: General Indices

- SPY 693.95 Bullish +0.48% – The S&P 500 ETF continues a modest upward move, reflecting broad market strength.

- QQQ 614.32 Bullish +0.77% – NASDAQ 100 ETF is showing higher relative momentum, supported by large-cap tech names.

- IWM 266.88 Bullish +0.70% – Small-cap ETF is advancing, matching broader market sentiment.

- IJH 71.79 Bullish +0.08% – Mid-cap ETF remains positive but with minimal gains versus other segments.

- DIA 501.22 Bullish +0.04% – Dow Jones ETF posts slim gains, lagging other indices.

MAG7: Mega Cap Tech Stocks

- MSFT 413.60 Bullish +3.11% – Strong leadership among mega-caps, notable upward momentum.

- NVDA 190.04 Bullish +2.50% – Continues its high-growth trajectory, positive sentiment holds.

- META 677.22 Bullish +2.38% – Advances solidly, joining sector leaders.

- TSLA 417.32 Bullish +1.51% – Higher, but pacing below the top performers in the group.

- GOOG 324.40 Bullish +0.40% – Firms up with tepid gains, still trending positive.

- AMZN 208.72 Bearish -0.76% – Diverges from peer mega-caps, moving modestly lower.

- AAPL 274.62 Bearish -1.26% – Weakest among the group, currently under pressure.

Other Key ETFs

- GLD 467.03 Bullish +2.54% – Strong rally in gold, indicating robust demand for safe havens.

- USO 78.02 Bullish +1.34% – Oil ETF showing continued upside, suggesting firming commodity prices.

- IBIT 40.11 Bullish +1.08% – Bitcoin ETF advances, capturing continued crypto enthusiasm.

- TLT 87.52 Bearish -0.02% – Slight weakness in long-term Treasuries ETF, signaling a mixed outlook for bond traders.

State of Play

- Long/Bullish: Majority of ETF stocks and MAG7 names are advancing, with tech and precious metals outperforming.

- Short/Bearish: AAPL and AMZN show pockets of weakness among mega-caps. TLT signals some pressure in bonds.

- Mixed: Despite the majority bullish tilt, select mega-caps and fixed income remain weak, suggesting an uneven risk environment.

This summary is provided purely as a market state overview for traders. No trading advice or recommendations included.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2026-02-10: 07:16 CT.

US Indices Futures

- ES Bullish across YSFG/MSFG/WSFG, price above all benchmarks, uptrend in swing pivots, key S/R: 7043 (resist), 6771.5 (support), all MAs rising, trend continuation phase.

- NQ YSFG bullish, MSFG/WSFG bearish to neutral, swing pivots mixed, consolidation near 23933.57 support and 26655.50 resistance, long-term MA up, short-term rallies in a corrective structure.

- YM YSFG/MSFG bullish, WSFG short-term neutral, price near all-time highs, last pivot 50349 (high), strong MA alignment, minor short-term pullback, support well below price, uptrend intact.

- EMD All grids bullish, price at new highs, swing pivots up, last high 3597.9, support 3416.1, all benchmark MAs up, recent signals long, WSFG pullback within multi-timeframe uptrend.

- RTY YSFG/MSFG/WSFG bullish, price above key NTZs, strong uptrend in pivots, latest high 2696.1, support at 2556.6, all MAs up, trend continuation, no reversal signs.

- FDAX YSFG/MSFG/WSFG bullish, short-term corrective pivot, last high 25198–25641 (resist), uptrend in MAs, support at 24368, swing pivots trend up, daily momentum supports continuation.

Overall State

- Short-Term: Bullish to Neutral on select indices

- Intermediate-Term: Predominantly Bullish, NQ lagging

- Long-Term: Bullish, NQ Daily/Weekly mixed

Conclusion

US Indices Futures exhibit multi-timeframe bullish structures, supported by higher highs/lows, price above session fib grid NTZs, and rising MA benchmarks. ES, YM, EMD, RTY, and FDAX maintain trend continuation across all grids. NQ shows consolidation with short-term rebounds but intermediate-term bearish pressure, leading broader indices. Key resistance and support levels remain well-defined for each instrument, with minor pullbacks within a prevailing uptrend context. Leading indices support the overall HTF structure; no exhaustion or major reversal signals are present.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

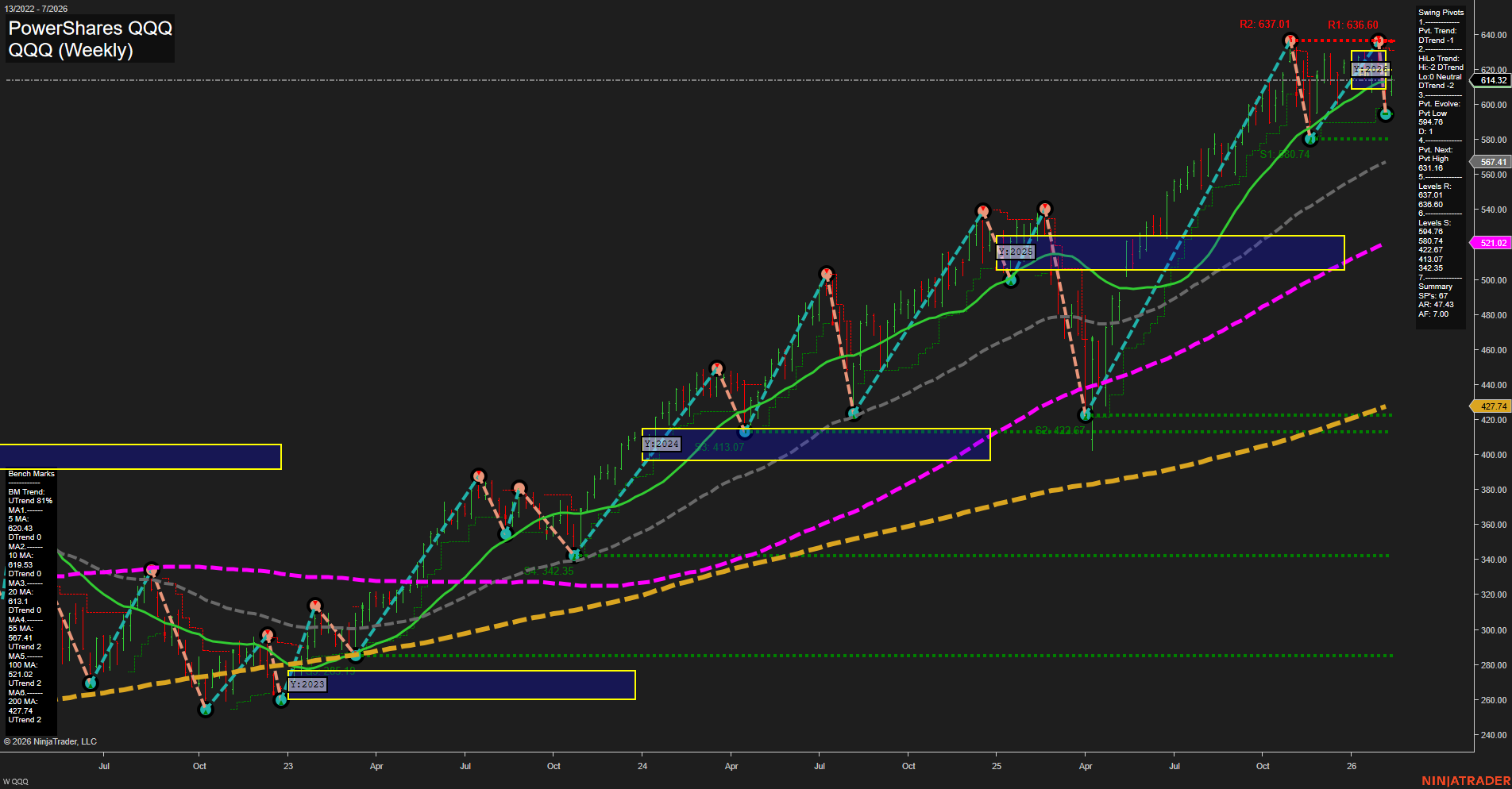

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts