Market Roundup – NYSE After Market Close Bearish as of February 11, 2026 05:00 ct

After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

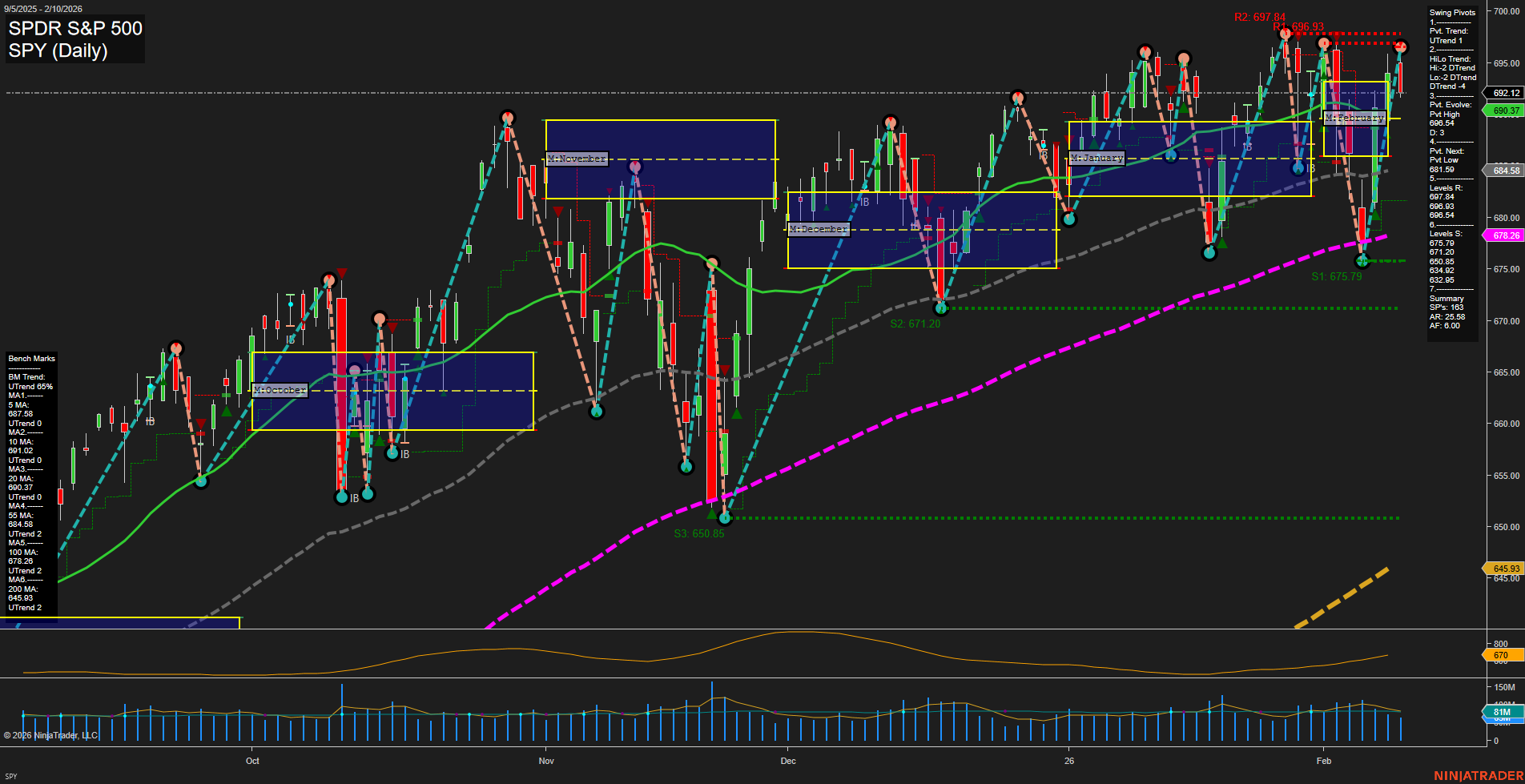

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- US Economic Data: January’s jobs report beat expectations with 130,000 jobs added and an unemployment rate falling to 4.3%. The surprising strength fueled volatility and contributed to rallies in the S&P 500 — which approaches record highs — and mixed performance across other indices. Despite positive job gains, some concern remains as volatility returns to Wall Street, and many job seekers continue to face challenges.

- Stocks & Indices: Markets reacted to the jobs data with a rotation into old economy stocks (boosting the Dow) and renewed resistance among technology stocks, especially as the Nasdaq tests key moving averages. Market momentum remains positive, but signs suggest a defensive shift as value and consumer staples sectors show strength. Energy led with notable gains, partly offsetting weakness in software and financial stocks.

- Commodities: Gold, silver, and platinum maintained gains and extended upward momentum, even with rising Treasury yields and strong job numbers. Gold tested resistance near the $5,100 level, fostered partly by expectations for future Federal Reserve rate cuts. Meanwhile, WTI oil climbed over 1% despite an unexpected surge in crude inventories, with geopolitical risk and macro developments providing added support. Natural gas and Brent oil also moved higher.

- ETFs and Flows: AI-driven semiconductor demand boosted sentiment for related ETFs, while leveraged ETFs highlight ongoing speculative trading. Retail investors are channeling flows into innovation-focused themes such as AI, quantum computing, and next-generation infrastructure. The S&P MidCap 400 ETF attracted attention for its factor mix and valuation advantages versus large-cap counterparts.

- Global Macro: Brazil has drawn focus on the back of a rare alignment involving falling rates, dollar weakness, and strength in commodities. The local market outlook is robust under these conditions. Looking ahead, the US market faces a holiday-shortened week, Federal Reserve minutes, and releases on consumer spending and manufacturing.

- Policy & Regulatory: Federal Reserve commentary indicates that even with strong labor data, rate cuts remain possible in 2026. Tariff moves made headlines amid reported diplomatic tensions.

News Conclusion

- Strong job growth provided an initial boost to equities, though mixed sentiment and sector rotation emerged as the session progressed. Defensive signals are increasing as investors weigh the sustainability of gains, particularly in light of renewed volatility and sector-specific risks.

- Gold’s continued resilience and the upward moves in energy commodities illustrate persistent demand for hedges and safe havens, even as economic data remains robust.

- ETF and retail investment trends showcase ongoing interest in tech innovation, commodity exposure, and mid-cap value, suggesting a broadening market focus amid headline risks.

- Monetary policy remains a key variable, with central bank officials open to easing even after impressive labor market data. Upcoming economic releases and policy signals are likely to shape near-term volatility in indices futures and the broader market.

Market News Sentiment:

Market News Articles: 47

- Neutral: 46.81%

- Positive: 34.04%

- Negative: 19.15%

GLD,Gold Articles: 16

- Neutral: 50.00%

- Positive: 43.75%

- Negative: 6.25%

USO,Oil Articles: 12

- Negative: 50.00%

- Positive: 25.00%

- Neutral: 25.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 11, 2026 05:00

- GLD 467.63 Bullish 1.13%

- USO 78.89 Bullish 1.10%

- NVDA 190.05 Bullish 0.80%

- TSLA 428.27 Bullish 0.72%

- AAPL 275.50 Bullish 0.67%

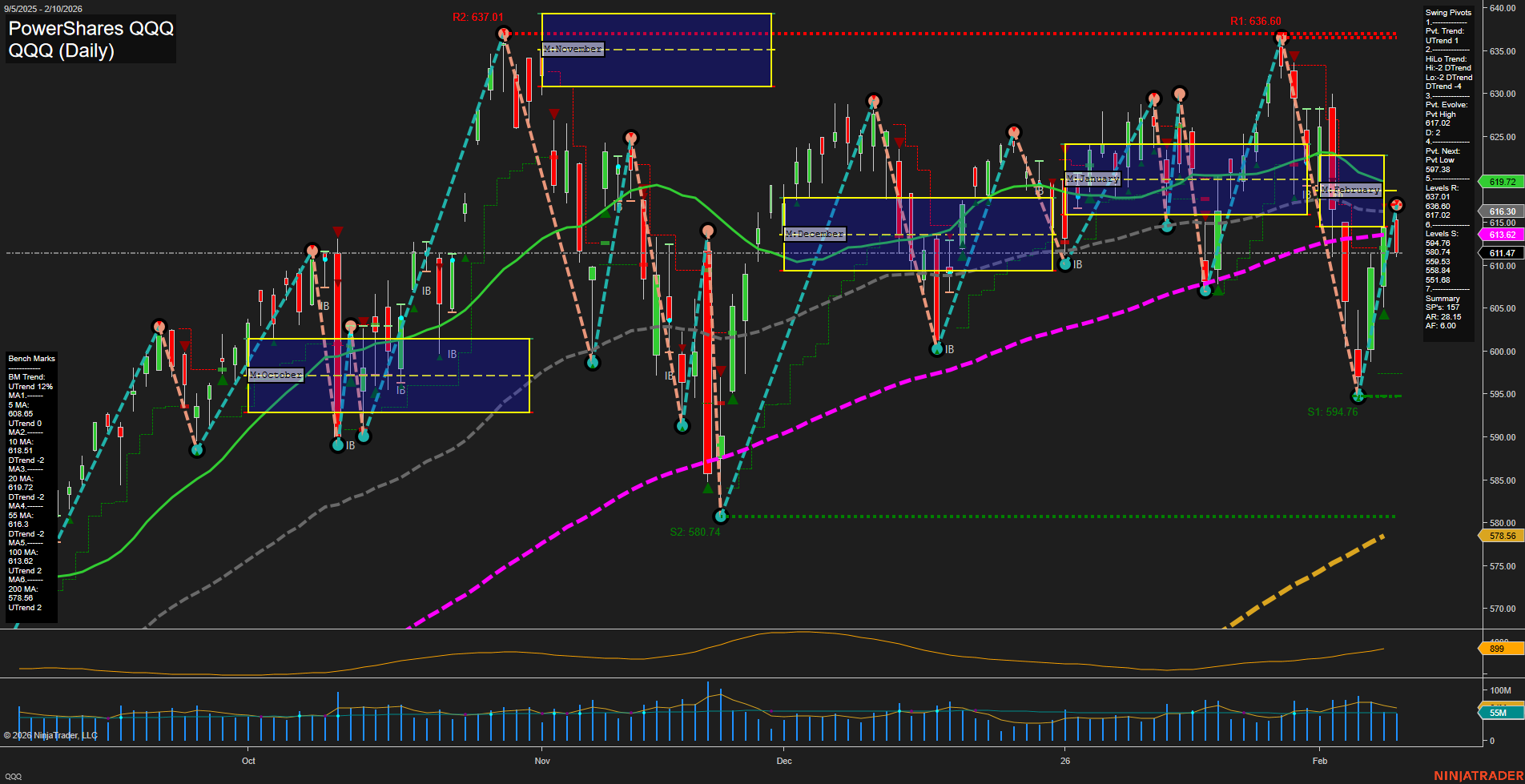

- QQQ 613.11 Bullish 0.27%

- SPY 691.96 Bearish -0.02%

- DIA 501.33 Bearish -0.11%

- IJH 71.59 Bearish -0.24%

- META 668.69 Bearish -0.30%

- IWM 264.95 Bearish -0.45%

- TLT 88.06 Bearish -0.53%

- AMZN 204.08 Bearish -1.39%

- IBIT 38.29 Bearish -1.74%

- MSFT 404.37 Bearish -2.15%

- GOOG 311.33 Bearish -2.29%

Market Summary: ETFs, Mag7 Stocks & Key Assets (as of 02/11/2026 17:00)

ETF Stocks Overview

- SPY: 691.96 — Bearish (-0.02%)

The S&P 500 tracker is hovering just below even, with slight downside pressure. - QQQ: 613.11 — Bullish (+0.27%)

Nasdaq 100 shows modest upward momentum, supported by tech strength. - IWM: 264.95 — Bearish (-0.45%)

Small-caps display relative weakness and are underperforming the major indices. - IJH: 71.59 — Bearish (-0.24%)

Mid-cap segment continues its mild decline in line with small-caps. - DIA: 501.33 — Bearish (-0.11%)

Dow 30 ETF dips slightly, reflecting broader market caution.

Trend: Mixed — Tech-heavy ETFs are stronger, while broad indices lean bearish.

Mag7 Stocks Summary

- NVIDIA (NVDA): 190.05 — Bullish (+0.80%)

- Tesla (TSLA): 428.27 — Bullish (+0.72%)

- Apple (AAPL): 275.50 — Bullish (+0.67%)

- Meta (META): 668.69 — Bearish (-0.30%)

- Amazon (AMZN): 204.08 — Bearish (-1.39%)

- Microsoft (MSFT): 404.37 — Bearish (-2.15%)

- Google (GOOG): 311.33 — Bearish (-2.29%)

Trend: Mixed — NVDA, TSLA, and AAPL post gains, but the rest of the Mag7, especially MSFT and GOOG, trade lower.

Other Key ETFs & Assets

- GLD: 467.63 — Bullish (+1.13%)

Gold ETF enjoys strong upside, suggesting defensive positioning or inflation hedges at play. - USO: 78.89 — Bullish (+1.10%)

Crude oil ETF advances, indicating continued interest in energy. - TLT: 88.06 — Bearish (-0.53%)

Long-term Treasuries ETF slips, pointing to higher yields or risk-off sentiment in bonds. - IBIT: 38.29 — Bearish (-1.74%)

Bitcoin ETF declines notably in this session.

Trend: Divergent: Gold and oil ETFs rise, while bonds and crypto ETFs give up ground.

Overall State of Play

- Bullish Momentum: Seen in gold, oil, and a subset of tech leaders (NVDA, TSLA, AAPL).

- Bearish/Mixed Action: Broad indices (SPY, DIA, IWM, IJH) lean weaker; several Mag7 and risk assets (MSFT, GOOG, IBIT) underperform.

- Rotational Themes: Flows appear defensive with a tilt toward hard assets, while core equity indices and growth sectors are mixed-to-negative.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts