Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

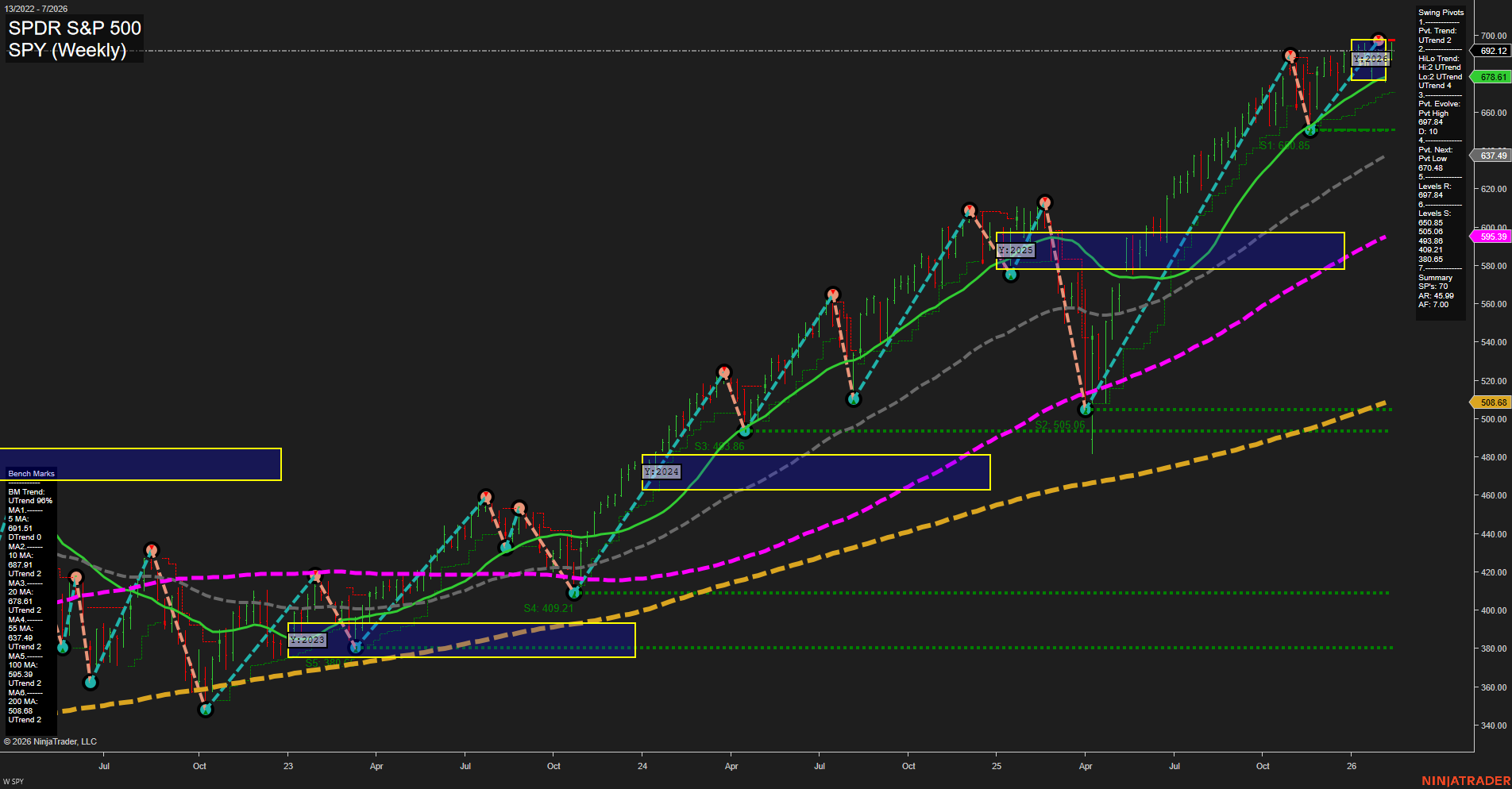

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

- 2026-02-16 Washington’s Birthday

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Wednesday 08:30 – USD Average Hourly Earnings m/m, Non-Farm Employment Change, Unemployment Rate (High Impact):

The employment report cluster will be critical for indices futures. Surprises in wage inflation or significant deviations in jobs created or unemployment rates can trigger volatility, influencing expectations on Fed policy. Strong employment readings may stoke rate hike fears, while misses could fuel dovish bets. - Wednesday 10:30 – USD Crude Oil Inventories (Low Impact):

Although typically medium/low impact for indices, sharp moves in crude inventories could influence sentiment, especially if high oil prices further stoke inflation and geopolitical concerns. - Thursday 08:30 – USD Unemployment Claims (High Impact):

Weekly jobless claims provide updated insight into labor market trends. A sudden rise or fall can move short-term sentiment and expectations on economic strength ahead of Friday inflation data. - Friday 08:30 – USD Core CPI m/m, CPI m/m, CPI y/y (High Impact):

The CPI release is a marquee event for US equity indices futures. Core and headline inflation prints will set the tone for Fed policy expectations. Hotter-than-expected inflation could pressure equities, while softer data may drive rallies on hopes of policy easing.

EcoNews Conclusion

- The week is loaded with critical jobs and inflation data, prime movers for indices futures given their outsized influence on Federal Reserve rate outlook.

- Market momentum and volume may slow in the days leading up to the Friday CPI print as traders anticipate this major release.

- Watch for a possible shift in sentiment midweek after NFP-day data and around 10:30 AM Wednesday, when oil inventories can act as a secondary catalyst, especially if energy prices are elevated.

- Elevated oil prices can have a direct impact on broader market sentiment through inflation and geopolitical risk channels.

For full details visit: Forex Factory EcoNews

Market News Summary

- Fed Policy, Interest Rates & US Macro:

Federal Reserve officials signaled patience on rate cuts, though some strategists still expect multiple cuts in 2026. US Treasury yields edged lower ahead of crucial employment data, with futures pricing in expectations for Fed rate moves. Flat US retail sales and mixed labor market signals contributed to market volatility, while the S&P 500 and Nasdaq retreated even as the Dow hit new record highs. - Commodities & Metals:

Oil prices remained steady to higher, supported by US–Iran tensions and regulatory changes, such as the US Treasury’s new license for supplies to Venezuela. Gold and silver prices held or rallied at key support levels, bolstered by weaker US dollar, expectations of Fed rate cuts, and retail-driven volatility. Traders watched for the US jobs data as potential catalyst for further technical breakouts in the metals. - Global Economic Data & Central Banks:

China’s consumer inflation rose less than expected, highlighting persistent weak demand; policymakers signaled a more accommodative stance. EU business leaders urged action on energy prices to stay competitive as high input costs weigh on industrial output. The yen strengthened amid softer US data. - Equity and Futures Markets:

US futures traded cautiously to higher as investors awaited delayed jobs and inflation data. Markets noted a rotation from growth to value and cyclical sectors, with energy, industrials, and materials showing relative strength, while Big Tech faces challenges. The Nikkei 225 outperformed on domestic political support, while European indices faced headwinds from energy cost concerns. - Corporate & Industry Shifts:

AI disruption triggered selloffs in finance-related stocks, with new tools raising concerns over the impact on traditional firms. Nasdaq continues to battle for major IPO listings, including high-profile tech firms. Airlines suspended Cuba flights due to a Jet fuel crisis linked to US tariff threats, impacting travel and logistics. - Sector Snapshots:

Palm oil faces pressure from supply increases and Indonesia’s policy pause, TotalEnergies reported lower profits from weaker fossil fuel prices, and retail traders increased volatility in gold and silver, also impacting related industries in AI and EVs.

News Conclusion

- Markets remain sensitive to central bank communication and key macro data, especially in the US, with immediate focus on labor and inflation releases.

- Commodity markets are being shaped by geopolitical risks, regulatory developments, and technical factors, while metals maintain an upward bias ahead of jobs numbers.

- A sector rotation toward value and cyclicals is underway, even as high-profile tech companies and IPO competition remain in focus.

- Geopolitical developments, energy pricing, and AI-driven disruption are notable drivers of volatility across equities, commodities, and sector indices.

- Overall, a mixed but event-driven landscape is keeping futures, spot markets, and individual sectors in flux as participants position around upcoming economic reports and global headlines.

Market News Sentiment:

Market News Articles: 49

- Neutral: 48.98%

- Positive: 32.65%

- Negative: 18.37%

Sentiment Summary:

Based on the latest data from 49 market news articles, sentiment distribution is as follows: 48.98% neutral, 32.65% positive, and 18.37% negative.

Conclusion:

The majority of news coverage is neutral, with a greater proportion of articles conveying positive sentiments compared to negative ones.

GLD,Gold Articles: 15

- Neutral: 53.33%

- Positive: 33.33%

- Negative: 13.33%

Sentiment Summary: The majority of recent articles on GLD and Gold are neutral in tone (53.33%), with positive sentiment accounting for 33.33% and negative sentiment at 13.33%.

This distribution suggests a generally balanced news environment, with a slight tilt toward positive coverage over negative.

USO,Oil Articles: 11

- Positive: 45.45%

- Negative: 36.36%

- Neutral: 18.18%

Sentiment Summary:

Out of 11 recent articles on USO and Oil, 45.45% conveyed a positive tone, 36.36% were negative, and 18.18% were neutral.

This indicates a moderately positive tilt in current media sentiment, with notable negative perspectives and a smaller share of neutral reporting.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 11, 2026 07:16

- TSLA 425.21 Bullish 1.89%

- TLT 88.53 Bullish 1.15%

- DIA 501.90 Bullish 0.14%

- USO 78.03 Bullish 0.01%

- IJH 71.76 Bearish -0.04%

- MSFT 413.27 Bearish -0.08%

- SPY 692.12 Bearish -0.26%

- IWM 266.16 Bearish -0.27%

- AAPL 273.68 Bearish -0.34%

- QQQ 611.47 Bearish -0.46%

- NVDA 188.54 Bearish -0.79%

- AMZN 206.96 Bearish -0.84%

- META 670.72 Bearish -0.96%

- GLD 462.40 Bearish -0.99%

- GOOG 318.63 Bearish -1.78%

- IBIT 38.97 Bearish -2.84%

Market Summary: State of Play for Major ETFs, MAG7 Stocks, and Thematic ETFs (as of 2026-02-11)

ETF Stocks Overview

- SPY (S&P 500 ETF): Bearish (-0.26%)

The broad market S&P 500 is drifting lower, reflecting institutional caution and potential sector rotation. - QQQ (Nasdaq 100 ETF): Bearish (-0.46%)

Tech-heavy ETF is weaker, tracking a broader move out of high-growth equities. - DIA (Dow Jones ETF): Bullish (+0.14%)

Defensive value is showing relative strength, with the Dow slightly up amid mixed market action. - IWM (Russell 2000 ETF): Bearish (-0.27%)

Small caps under pressure, underlining risk-off sentiment for smaller growth-oriented equities. - IJH (S&P 400 Midcap ETF): Bearish (-0.04%)

Midcaps are nearly flat but tilted negative, mirroring weakness in growth segments.

MAG7 Stocks Snapshot

- AAPL (Apple): Bearish (-0.34%)

- MSFT (Microsoft): Bearish (-0.08%)

- GOOG (Alphabet): Bearish (-1.78%)

- AMZN (Amazon): Bearish (-0.84%)

- META (Meta Platforms): Bearish (-0.96%)

- NVDA (Nvidia): Bearish (-0.79%)

- TSLA (Tesla): Bullish (+1.89%)

The mega-cap growth cohort is broadly under pressure, with exception of Tesla showing notable relative strength. Alphabet leads the downside among tech giants.

Other Thematic & Sector ETFs

- TLT (Long-Term Treasuries): Bullish (+1.15%)

Treasury bonds attract buying, signaling demand for safety or falling yields. - GLD (Gold ETF): Bearish (-0.99%)

Gold is underperforming despite broader equity weakness, indicating limited flight to hard assets. - USO (Oil Fund): Bullish (+0.01%)

Oil is steady to slightly higher, reflecting stability in the commodity sector. - IBIT (Bitcoin ETF): Bearish (-2.84%)

Crypto sentiment is weak, as risk-off flows spill into digital asset ETFs.

Summary: Sentiment & Themes

- Major equity ETFs (SPY, QQQ, IWM, IJH) are under pressure, with the exception of DIA (Dow) holding positive ground.

- The MAG7 mega-cap tech names are mostly weaker, with TSLA notably bucking the trend.

- Defensive assets see a mixed picture: Bonds (TLT) are bid, gold (GLD) is weak, and oil (USO) is flat to positive.

- Risk appetite appears to be rotating defensively, with a notable absence of momentum in growth and speculative sectors.

No trading advice or recommendations. This is a data-driven market visualization only.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2026-02-11: 07:17 CT.

US Indices Futures

- ES Bullish ST/IT, Neutral LT; Above WSFG, MSFG key levels, MA benchmarks rising, recent swing high at 7022.5, support 6847.25, overall uptrend with possible consolidation near YSFG resistance.

- NQ Neutral ST, Bearish IT, Bullish LT; WSFG up, MSFG/YSFG down, swing low forming at 25236.5, below MSFG/YSFG NTZ, mixed pivots, MA short-term down, elevated volatility, corrective phase within longer-term uptrend.

- YM Bullish across all timeframes; Above all Fib grid NTZ, MA benchmarks up, swing high at 50375, support 49107, higher highs/lows, trend continuation, multiple recent long signals, no immediate reversal signals.

- EMD Bullish across all timeframes; WSFG, MSFG, YSFG all trending up, price above NTZ/F0%, swing high at 3604.4, support 3421.3, MA benchmarks rising, robust momentum, no signs of exhaustion.

- RTY Bullish across all timeframes; Breakout above resistance to 2693.2, swing high 2742.9, support 2585.4, MA benchmarks up, price above all Fib grid NTZ/F0%, strong rally phase, healthy structure.

- FDAX Neutral ST, Bullish IT/LT; Weekly pullback after high at 25641, strong MA trends, support at 24436/23133, price above key Fib grid levels, intermediate/long-term grids up, consolidating gains.

Overall State

- Short-Term: Bullish

- Intermediate-Term: Bullish

- Long-Term: Bullish

Conclusion

US Indices Futures display dominant bullish momentum on both short- and intermediate-term timeframes, with key benchmarks, swing pivots, and MA trends confirming trend continuation in YM, EMD, RTY, and FDAX. ES is holding an uptrend with consolidation potential near crucial YSFG resistance, while NQ consolidates with a corrective structure but maintains LT uptrend. Support levels remain firmly below current price action across most indices, with key resistances recently tested or surpassed. HTF context signals established uptrends, supported by rising moving averages, upward pivot structures, and alignment above session Fib grid benchmarks, though periods of consolidation or retracement remain possible given volatility and proximity to higher timeframe grid resistances.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

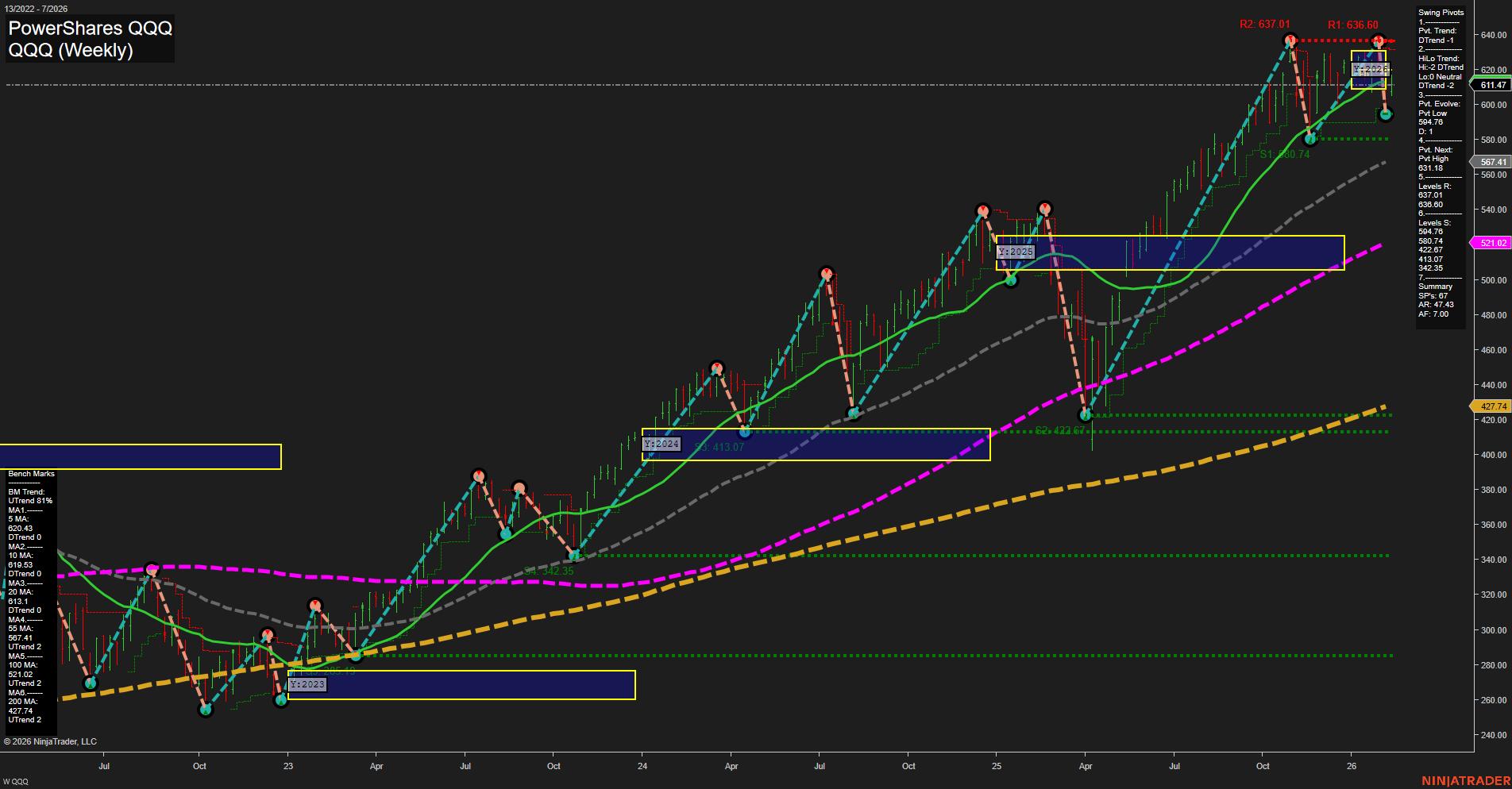

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts