After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

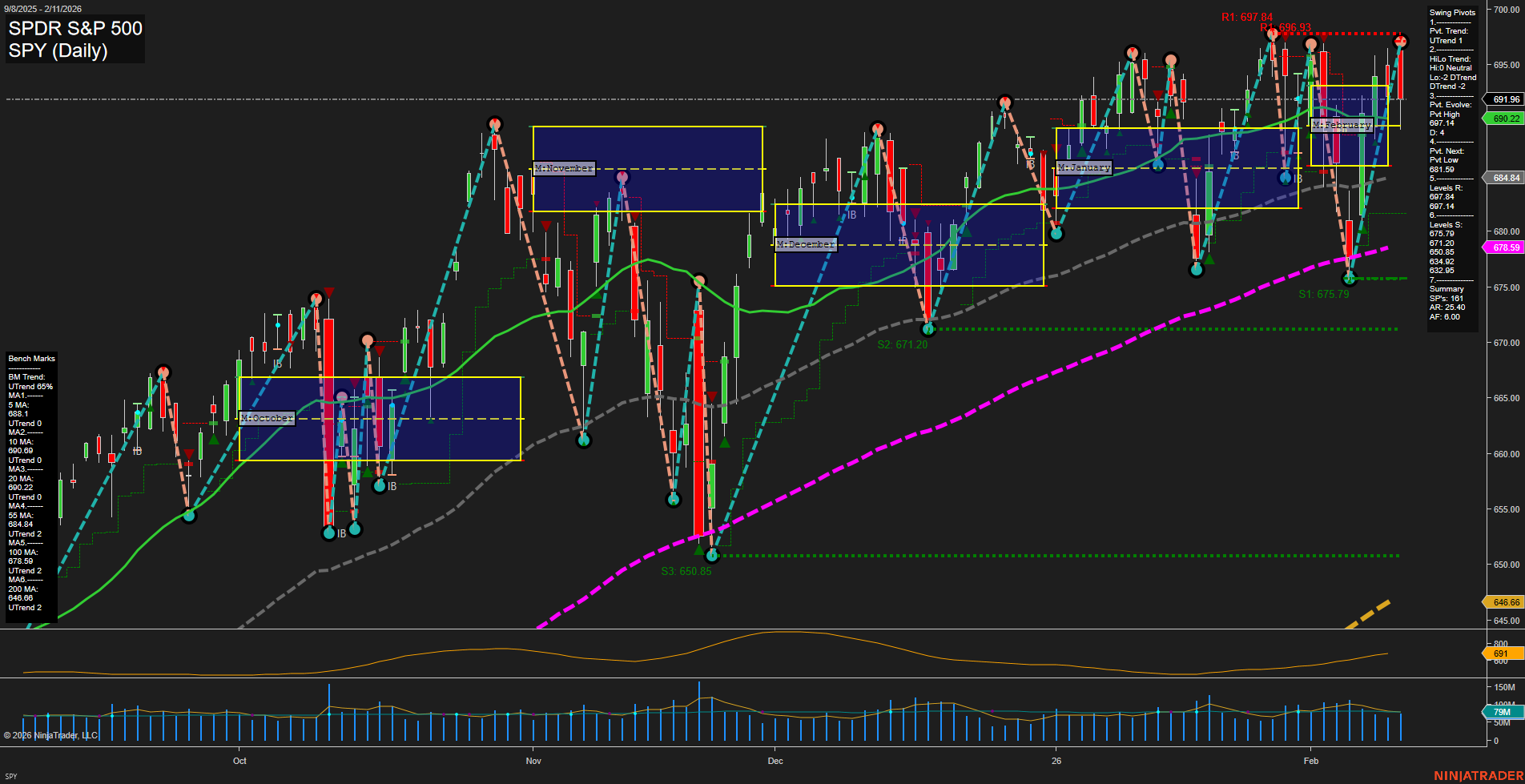

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Major Indices Volatility: The S&P 500 fell by more than 1% and the Nasdaq Composite dropped over 350 points during Thursday’s session, showing heightened volatility even as the S&P 500 remains rangebound for the year.

- Sector Movements: The energy sector remains the strongest performer in the S&P 500 year-to-date, while “old economy” stocks and small caps are showing renewed strength. In contrast, trucking/logistics and wealth management stocks are under pressure, with AI-related disruptions fueling further declines in selected sectors.

- Commodity Action: Oil prices plunged over 3% amid demand worries, while gold and silver struggled, yet mining stocks are finding value buyers. Gold also experienced a pullback after a failed breakout, currently testing near-term support.

- Bonds & Currencies: Long-term Treasurys rallied as equities faced a broad-based selloff; the iShares 20+ Year Treasury Bond ETF is drawing positive attention. The dollar index (DXY) is projected to soften through 2026, supporting a bullish stance in precious metals as Bitcoin consolidates.

- ETF Trends: Dividend-oriented funds and technology-heavy ETFs like QQQ remain in focus, with historical trends favoring tech and small cap outperformance. Defensive rotation is noted with GLD preferred for stability over more volatile silver mining funds.

- Macro & Policy Developments: The Bank of Japan’s resumed rate hikes are impacting global bond flows; President Takaichi’s fiscal stimulus raises Japan’s debt/GDP concerns. US-EU and US-Taiwan trade deals aim to lower barriers and enhance purchases, with the US stepping up influence in Venezuela’s oil market.

- Regulatory and Central Bank Backdrop: The Fed shows little urgency for rate cuts amid strong employment and persistent inflation, despite political calls for lower rates. Wall Street regulators are gradually restoring jobs after previous cuts.

- Market Sentiment: Persistent anxiety centers on the disruptive potential of AI, contributing to sharp sectoral swings. Investors are retreating from stocks perceived as vulnerable to AI-driven changes, preferring safer assets in the current environment.

- Regional Performance: Asia-Pacific, Japan, emerging markets, and European equities outperformed the FTSE All-World index in January, while US large caps (Russell 1000) lagged.

News Conclusion

- The market session was defined by heightened equity volatility, marked sector rotation, and a defensive tilt as investors responded to fears about AI, commodity price swings, and ongoing policy uncertainties.

- Bond markets saw significant inflows amid stock selloffs, with long-duration Treasurys benefitting from risk-off sentiment and relative global yield appeal.

- Commodities are showing mixed signals, as oil and gold retreat after failed rallies, but selected mining equities and energy sector stocks attract positive flows on fundamental shifts.

- Global policy and trade developments may recalibrate capital flows and influence specific regional and sectoral performances in coming sessions.

- Traders are encountering rapidly shifting leadership between sectors, varying by headlines and macroeconomic updates, with the underlying environment dominated by caution around new technology-driven disruptions.

Market News Sentiment:

Market News Articles: 49

- Positive: 38.78%

- Neutral: 32.65%

- Negative: 28.57%

GLD,Gold Articles: 13

- Neutral: 38.46%

- Negative: 38.46%

- Positive: 23.08%

USO,Oil Articles: 14

- Neutral: 35.71%

- Positive: 35.71%

- Negative: 28.57%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 12, 2026 05:00

- TLT 89.23 Bullish 1.33%

- MSFT 401.84 Bearish -0.63%

- GOOG 309.37 Bearish -0.63%

- DIA 494.67 Bearish -1.33%

- IJH 70.54 Bearish -1.47%

- SPY 681.27 Bearish -1.54%

- NVDA 186.94 Bearish -1.64%

- QQQ 600.64 Bearish -2.03%

- IWM 259.54 Bearish -2.04%

- AMZN 199.60 Bearish -2.20%

- TSLA 417.07 Bearish -2.62%

- META 649.81 Bearish -2.82%

- USO 76.38 Bearish -3.18%

- IBIT 37.05 Bearish -3.24%

- GLD 451.39 Bearish -3.47%

- AAPL 261.73 Bearish -5.00%

ETF Stocks: Market Summary (as of 2026-02-12)

- SPY 681.27 -1.54% (Bearish)

Significant pressure on the S&P 500, marking a clear down day for large-cap US stocks. - QQQ 600.64 -2.03% (Bearish)

NASDAQ-100 is exhibiting notable weakness; tech sector underperforms relative to broader market. - IWM 259.54 -2.04% (Bearish)

Small caps sell off in line with tech, indicating broad market risk aversion. - IJH 70.54 -1.47% (Bearish)

Mid-cap index echoing the negative sentiment in both large and small caps. - DIA 494.67 -1.33% (Bearish)

The Dow under pressure, with industrials and blue-chips participating in the market-wide decline.

MAG7 Stocks: Market Summary

- AAPL 261.73 -5.00% (Bearish)

Undergoing pronounced selling, notably underperforming its peers. - MSFT 401.84 -0.63% (Bearish)

Relative stability compared to other tech giants, but still in negative territory. - GOOG 309.37 -0.63% (Bearish)

Similar modest losses as MSFT, avoiding the sharpest drops seen elsewhere in tech. - AMZN 199.60 -2.20% (Bearish)

Suffers a sharper decline, aligning with broad tech/media weakness. - META 649.81 -2.82% (Bearish)

Meta sees heavy selling, lagging broader market performance. - NVDA 186.94 -1.64% (Bearish)

Semiconductors also negatively affected in line with tech sector woes. - TSLA 417.07 -2.62% (Bearish)

Tesla experiences significant downside, reflecting both sector and company-specific pressures.

Other ETFs: State of Play

- TLT 89.23 +1.33% (Bullish)

Bucking the broader equity trend. Long-term Treasuries see a bid, indicating flight to safety. - GLD 451.39 -3.47% (Bearish)

Gold ETF sharply lower, potentially signaling liquidity-driven moves or profit-taking. - USO 76.38 -3.18% (Bearish)

Oil ETF under pressure, paralleling risk-off sentiment or commodity-specific catalysts. - IBIT 37.05 -3.24% (Bearish)

Bitcoin-related ETF declines, following risk-assets lower in an adverse macro backdrop.

Overall Market Context (for Traders)

Snapshot shows widespread bearish momentum across major equity ETFs and “Magnificent 7” tech leaders. Defensive flows are visible in long-term Treasuries, while typical safe havens like gold also see sharp declines. Crypto and oil-linked assets are also weak. Today’s session is marked by risk aversion and heavy selling across sectors, with only TLT displaying strong buying interest.

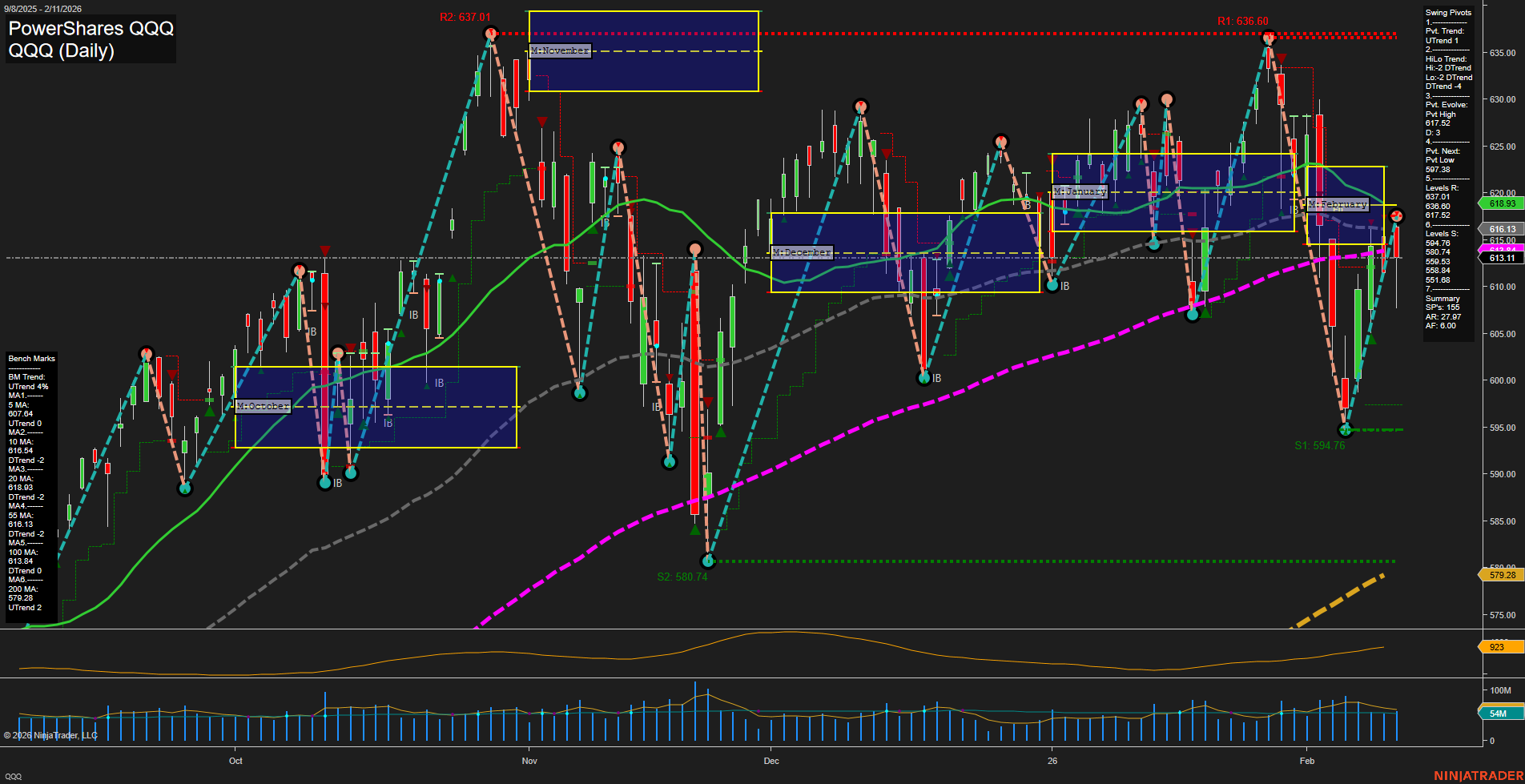

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts