Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

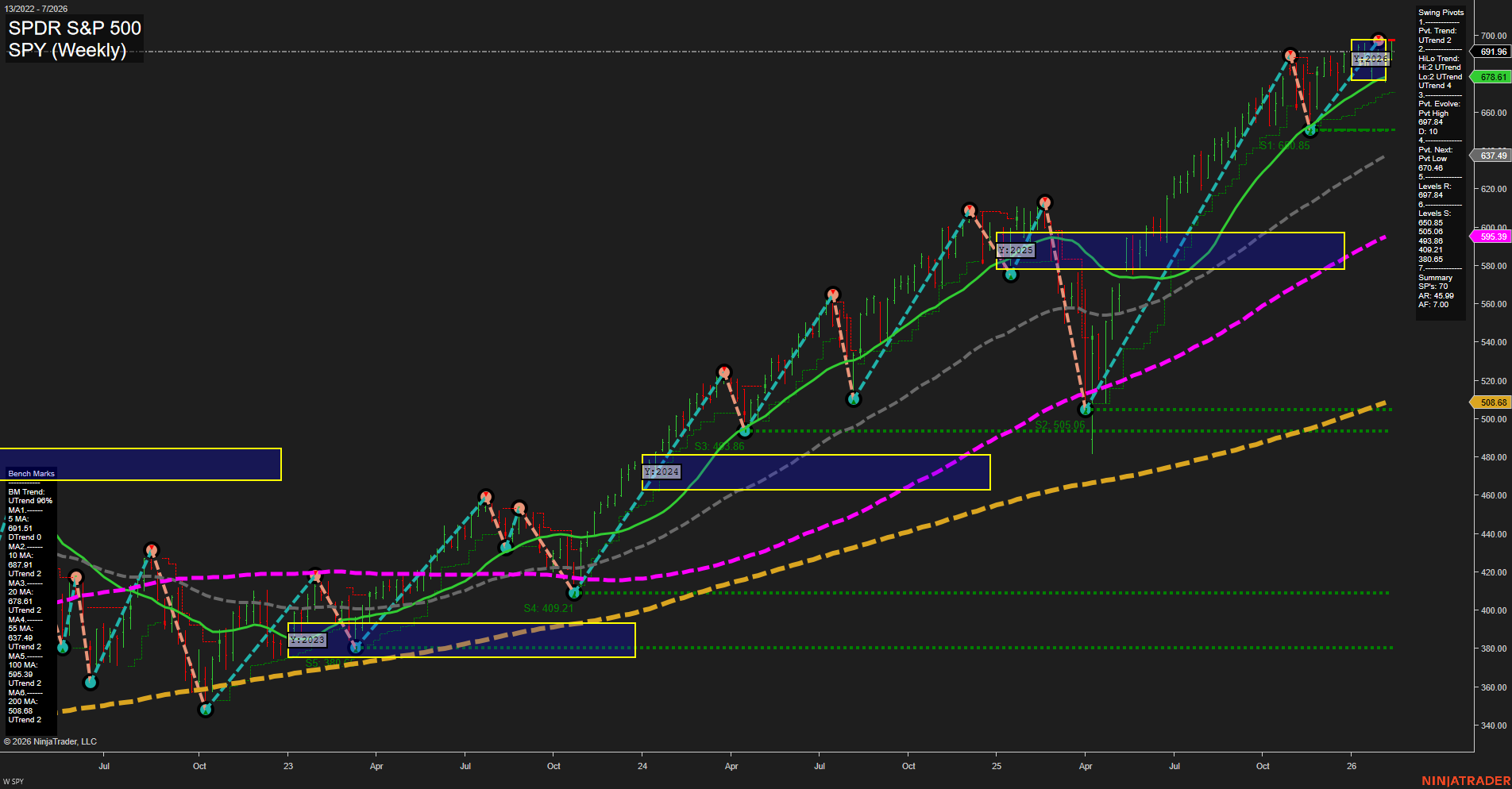

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

- 2026-02-16 Washington’s Birthday

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Thursday 08:30 – USD Unemployment Claims (High Impact): Weekly claims provide a near real-time snapshot of labor market health. Significant deviations from forecasts often trigger swift index futures response as market participants recalibrate growth and policy outlook.

- Friday 08:30 – USD Core CPI m/m (High Impact): Core CPI strips out volatile food and energy. A key Fed inflation gauge; surprise upside could increase expectations for tighter policy, often putting pressure on risk assets, including equity indices.

- Friday 08:30 – USD CPI m/m & CPI y/y (High Impact): Headline CPI readings are pivotal to market direction. Higher-than-expected prints typically raise rate hike odds or postpone rate cuts, dampening index futures, while softer numbers can spark relief rallies.

EcoNews Conclusion

- This week’s focus centers on Friday’s CPI data, a primary market driver with the potential to reset market expectations for Fed rate policy and trigger notable moves in index futures.

- Thursday’s Unemployment Claims will set the tone ahead of the inflation data, with strong or weak labor signals able to sway early market sentiment.

For full details visit: Forex Factory EcoNews

Market News Summary

- Stocks & Indices: Equity markets began steady but lost steam after robust jobs data reduced expectations of imminent rate cuts. The Dow and S&P 500 futures responded with choppy but mildly higher price action as focus shifted to upcoming CPI and corporate earnings. Cyclical stocks received fresh attention as labor data showed a strong jobs market with falling unemployment and heightened payroll growth.

- Federal Reserve & Bonds: A strong jobs report further dampened prospects for rate cuts in March, while analysts debated policy direction under new Fed leadership. U.S. Treasury bond futures showed technical signs of a multi-month rally, with long-duration ETFs like TLT in focus.

- Commodities (Oil, Gold, Silver): Oil prices fluctuated on U.S.–Iran tensions, a large U.S. crude inventory build, and supply outlooks. The IEA expects a global oil supply rebound post-U.S. winter storm. Brent tested $70, but oil edged lower as risk premiums persisted. Gold hovered above $5,000, pressured near-term by a strong dollar and anticipation of CPI data; silver also faced resistance at higher levels.

- International & Sector Themes: Chinese stocks rallied, notably AI players, following new product launches. Chinese manufacturing and shipping showed strong pre-holiday growth despite tariffs. Reports indicated Russia facing oil export difficulties due to sanctions, while U.S. diplomatic visits signaled optimism for Venezuelan crude. The tech sector is experiencing a surge in debt issuance, tempering IPO excitement.

- Sentiment & Caution: Market sentiment reflected caution, with some analysts citing warning signs of potential correction and investor sentiment gauges slipping, yet remaining neutral. Speculation markets proliferate, raising concerns among regulators and market participants.

- Fundamentals & Earnings: Investor focus sharpened on earnings and forward guidance, supporting the ongoing bull market in equities. AI continues to be a dominant driver for market trends.

News Conclusion

- Markets are navigating a transition phase, adjusting to robust U.S. economic data that challenges earlier expectations on monetary policy.

- Attention is shifting to inflation reports and corporate earnings as crucial short-term drivers for stock index futures.

- Oil and gold remain sensitive to geopolitical developments and upcoming economic data releases.

- Underlying market sentiment is mixed, with both optimism about fundamentals and caution due to technical and macroeconomic signals.

Market News Sentiment:

Market News Articles: 45

- Positive: 42.22%

- Neutral: 37.78%

- Negative: 20.00%

Sentiment Summary:

Out of 45 market news articles, sentiment distribution is as follows: 42.22% are positive, 37.78% are neutral, and 20.00% are negative.

Conclusion:

Current market news leans slightly positive, with a sizable share of neutral sentiment and a smaller proportion of negative coverage.

GLD,Gold Articles: 14

- Neutral: 50.00%

- Positive: 35.71%

- Negative: 14.29%

Sentiment Summary:

Gold-related news coverage is predominantly neutral (50.00%), with a notable portion of positive sentiment (35.71%) and a smaller share of negative sentiment (14.29%) among recent articles.

This distribution reflects a balanced market perspective, with current reporting offering a mix of viewpoints.

USO,Oil Articles: 12

- Positive: 41.67%

- Negative: 33.33%

- Neutral: 25.00%

Sentiment Summary: Out of 12 recent articles covering USO and Oil, 41.67% conveyed a positive tone, 33.33% were negative, and 25.00% remained neutral.

This distribution indicates a moderately positive news sentiment, with positive articles outnumbering negative ones, but a notable portion of negative and neutral perspectives is also present within the coverage.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 12, 2026 07:16

- GLD 467.63 Bullish 1.13%

- USO 78.89 Bullish 1.10%

- NVDA 190.05 Bullish 0.80%

- TSLA 428.27 Bullish 0.72%

- AAPL 275.50 Bullish 0.67%

- QQQ 613.11 Bullish 0.27%

- SPY 691.96 Bearish -0.02%

- DIA 501.33 Bearish -0.11%

- IJH 71.59 Bearish -0.24%

- META 668.69 Bearish -0.30%

- IWM 264.95 Bearish -0.45%

- TLT 88.06 Bearish -0.53%

- AMZN 204.08 Bearish -1.39%

- IBIT 38.29 Bearish -1.74%

- MSFT 404.37 Bearish -2.15%

- GOOG 311.33 Bearish -2.29%

Market Summary: ETF Stocks

- SPY: Bears are applying modest pressure (-0.02%).

- QQQ: Buyers hold the edge (+0.27%).

- IWM: Sellers are in control (-0.45%).

- IJH: Showing weakness (-0.24%).

- DIA: Trend is slightly negative (-0.11%).

Market Summary: Magnificent 7

- AAPL: Momentum leans bullish (+0.67%).

- MSFT: Heavy selling in play (-2.15%).

- GOOG: Experiencing considerable pressure (-2.29%).

- AMZN: Downtrend evident (-1.39%).

- META: Sentiment turning bearish (-0.30%).

- NVDA: Strong buyers in the session (+0.80%).

- TSLA: Stock is trending up (+0.72%).

Market Summary: Other ETFs

- GLD: Gold ETF surging (+1.13%).

- USO: Energy/fuel ETF showing strength (+1.10%).

- TLT: Long bonds under pressure (-0.53%).

- IBIT: Bitcoin ETF experiences notable decline (-1.74%).

Combined Market Picture

The current market snapshot displays mixed signals across sectors and strategies. Tech leadership is divided, with notable bullishness (NVDA, TSLA, AAPL) as well as significant selling pressure (MSFT, GOOG, AMZN). Major broad-market ETFs such as SPY, DIA, IJH, and IWM display mostly modest to moderate bearish signals, while QQQ holds up in positive territory. Notably, commodity-related ETFs (GLD, USO) show marked bullish momentum, standing out among the asset classes.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2026-02-12: 07:16 CT.

US Indices Futures

- ES Consolidating near highs, all YSFG/MSFG/WSFG grids up, strong bullish pivots at 7043/7015.5 resistances, 6900/6771.5 supports, all MAs upward, no exhaustion or reversal detected.

- NQ Weekly consolidation, YSFG uptrend, MSFG/WSFG mixed, short-term DTrend at 23930.57 support, resistances 26655.5/26340, MAs up long-term, mixed trade signals, range-bound context.

- YM Strong rally, all YSFG/MSFG/WSFG grids up, bullish pivots to new highs, next support well below, all MAs trend up, large bars with fast momentum, trend extension phase.

- EMD Bullish across YSFG/MSFG/WSFG, uptrend pivots at 3611.2/3611.9 highs, support at 3511.2, price above NTZ/F0%, all MAs up, robust momentum, breakout environment, trend continuation.

- RTY Uptrend on MSFG/YSFG/WSFG, recent pivot high 2749.2 resistance, 2410.9 support, all MAs upward, short-term neutral, intermediate/long-term bullish, short entries signal possible minor pullback.

- FDAX Intermediate/long-term bullish YSFG/MSFG/WSFG, short-term consolidation, pivot high 25209, support at 24805, all MAs up, momentum steady, no reversal signs, uptrend intact.

Overall State

- Short-Term: Bullish to Neutral across instruments

- Intermediate-Term: Predominantly Bullish, NQ exception (Bearish)

- Long-Term: Bullish (NQ Daily Bearish exception), uptrends persist

Conclusion

Major US indices (ES, YM, EMD, RTY, FDAX) are in robust uptrends across intermediate and long-term HTF grids, with ES, YM, and EMD displaying trend continuation and healthy extension above support. NQ presents short-term bullish recovery but remains in an intermediate and long-term bearish phase, exhibiting countertrend characteristics against the broader market. RTY and FDAX reflect minor short-term hesitation, yet maintain strong higher timeframe uptrends supported by moving averages and swing pivot structure. Support and resistance levels remain well-defined and layered, with benchmark moving averages aligned upward for most instruments. No significant exhaustion or HTF reversal patterns are present; directional correlations confirm ongoing broad market strength with localized consolidations and pullbacks.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

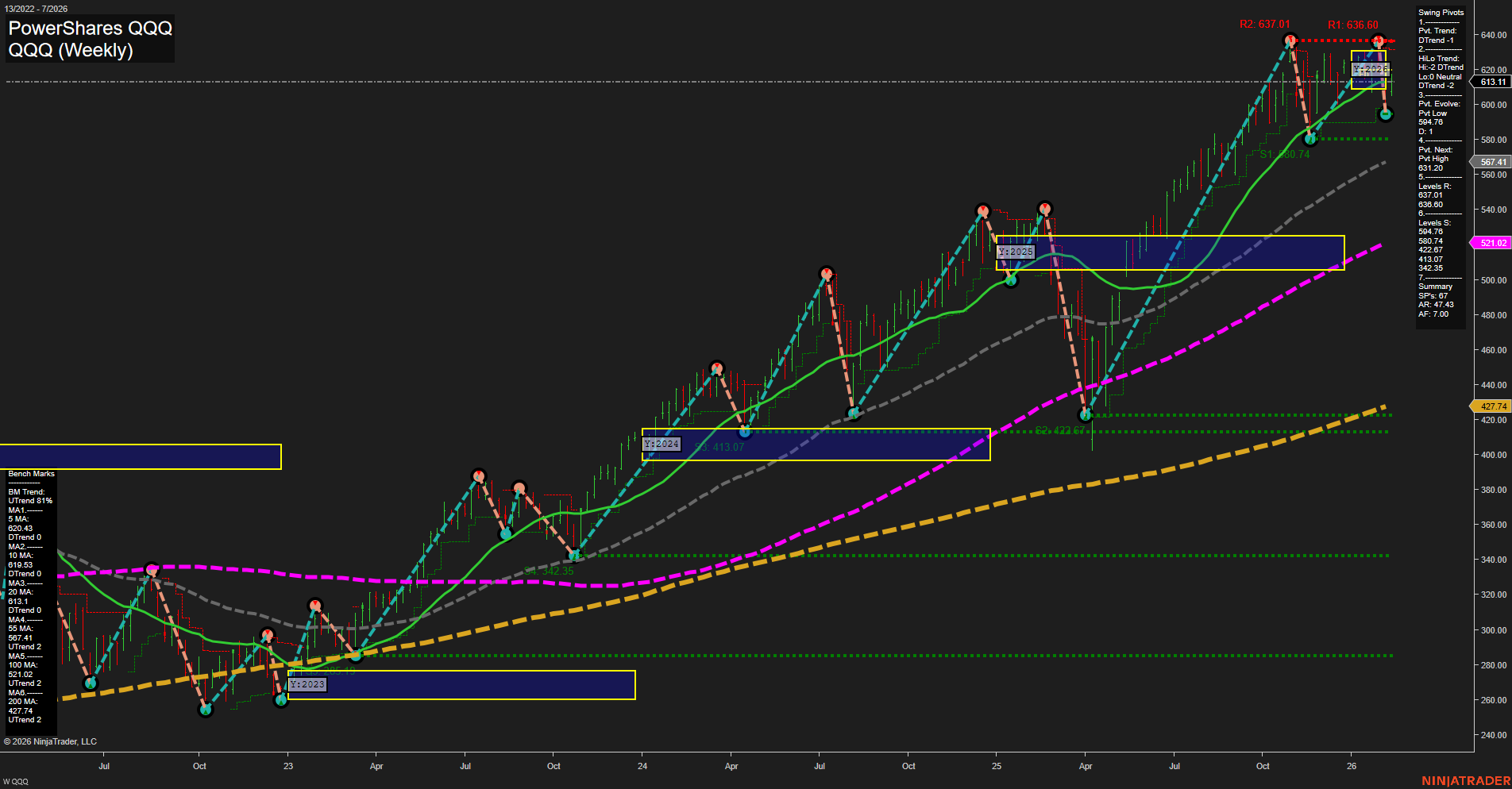

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts