Market Roundup – NYSE After Market Close Bullish as of February 13, 2026 05:00 ct

After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

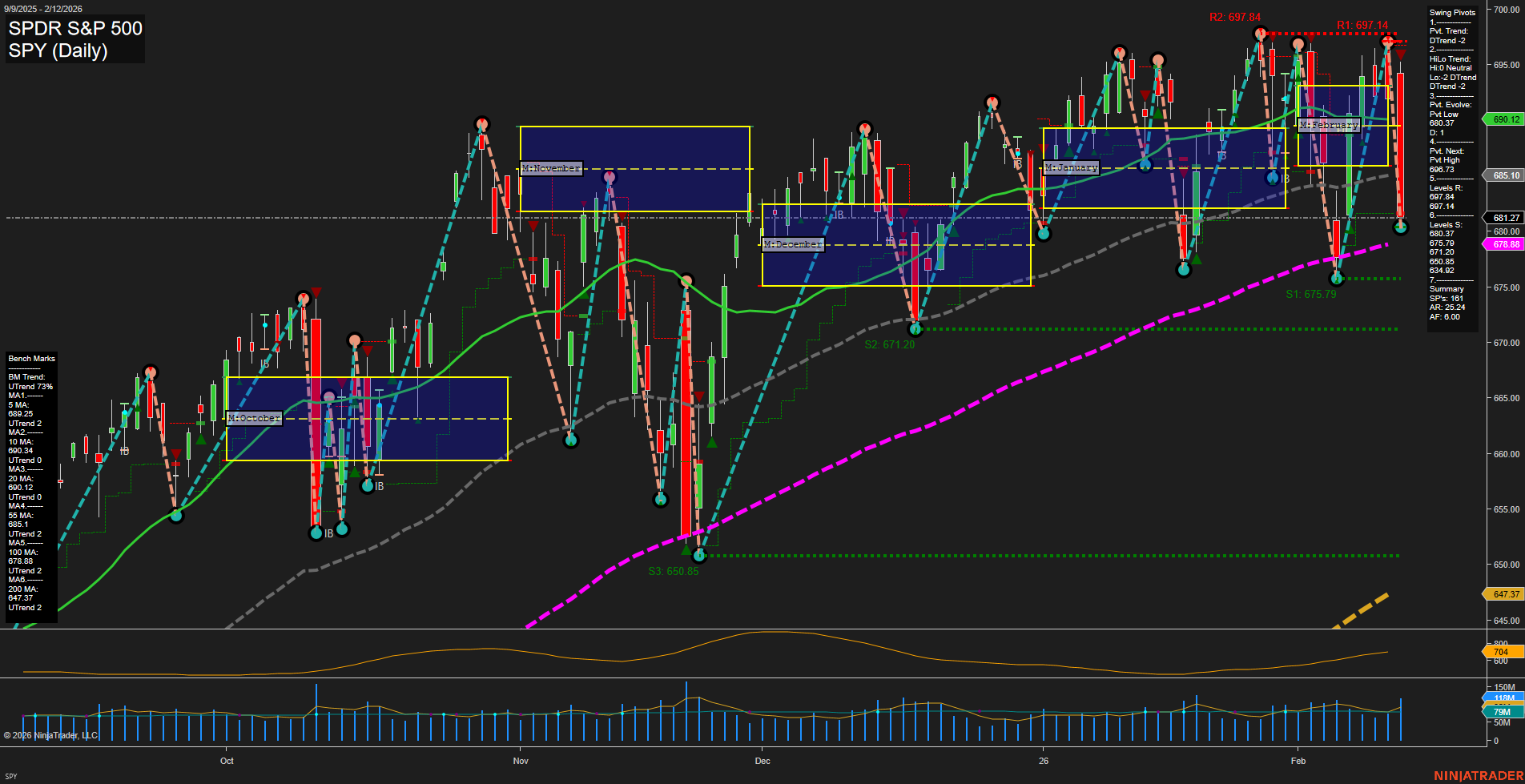

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Inflation data: January CPI came in cooler than expected, with headline inflation rising just 0.2% monthly and annual inflation at 2.4%. Core CPI matched expectations at 0.3%. This sparked a sharp rally during the day as investors increased bets on earlier Fed rate cuts. However, despite the positive momentum, all major US indices posted a weekly loss of 1.2% or more, as ongoing AI sector volatility and industry disruption fears weighed on sentiment.

- Equity indices: US markets were boosted midday by the softer inflation print, with the Dow gaining around 250 points. Overall earnings season continues to provide a backdrop, but momentum remains choppy. Some skepticism remains about the S&P 500 breaking out of its recent range, with some analysts expecting a near-term correction rather than a major crash.

- Sector focus: AI and semiconductors remained center stage. Chip stocks are attracting renewed interest on valuation grounds, especially around AI infrastructure investments. Conversely, AI-driven disruption is now spreading concerns from software and tech to credit markets, with analysts highlighting potential risks for leverage loans and private credit.

- Software stocks: Large-cap SaaS names are being highlighted for their value case after repricing, but volatility persists across the space, and some stocks experienced sharp moves lower during the week, attributed in part to AI disruption narratives.

- Gold and metals: Precious metals, especially gold, climbed back above the $5,000 level, helped by the soft CPI and search for inflation hedges. Gold looks poised for further upside technically, but volatility remains high. Silver and platinum also saw increased activity. Analysts continue to point to choppy action as traders digest shifting inflation expectations.

- Energy markets: The US eased sanctions on Venezuela, allowing oil majors like Chevron to resume operations and negotiate new energy investments. Oil rebounded from session lows amid Middle East geopolitical pressure and policy headlines. Major producers are in talks about recouping losses from previous nationalization in Venezuela.

- Global context: Canadian stocks have been less affected by AI disruption so far, but trade friction with the US remains a wild card for the TSX. Across the board, the week’s tape was dominated by crosscurrents: AI disruption narratives, strong jobs data, softer CPI, and sector-specific volatility.

News Conclusion

- This week’s market action reflected mixed investor sentiment: cooling inflation and strong jobs data offered tailwinds, but AI disruption fears sparked outsized sector volatility and capped index gains.

- Despite a strong rally post-CPI, US stocks finished their worst week since November due to uncertainty around AI’s industry impact and possible near-term correction risks.

- The inflation landscape is improving, easing rate hike concerns and supporting both equities and precious metals in the near term.

- Commodities attracted increased focus, with gold benefitting from macro moves and oil responding to both US policy shifts and geopolitical developments.

- Opportunities and risks are emerging from repriced tech and energy sectors, while volatility across asset classes remains elevated heading into the weekend.

Market News Sentiment:

Market News Articles: 42

- Neutral: 40.48%

- Positive: 33.33%

- Negative: 26.19%

GLD,Gold Articles: 17

- Neutral: 47.06%

- Positive: 47.06%

- Negative: 5.88%

USO,Oil Articles: 10

- Positive: 40.00%

- Negative: 30.00%

- Neutral: 30.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 13, 2026 05:00

- IBIT 38.97 Bullish 5.18%

- GLD 462.62 Bullish 2.49%

- IWM 262.96 Bullish 1.32%

- IJH 71.24 Bullish 0.99%

- TLT 89.72 Bullish 0.55%

- QQQ 601.92 Bullish 0.21%

- DIA 495.28 Bullish 0.12%

- TSLA 417.44 Bullish 0.09%

- SPY 681.75 Bullish 0.07%

- MSFT 401.32 Bearish -0.13%

- USO 76.22 Bearish -0.21%

- AMZN 198.79 Bearish -0.41%

- GOOG 306.02 Bearish -1.08%

- META 639.77 Bearish -1.55%

- NVDA 182.81 Bearish -2.21%

- AAPL 255.78 Bearish -2.27%

Market Summary: State of Play as of 02/13/2026

ETF Stocks Overview

- SPY – 681.75 (+0.07%): Up modestly, continuing its bullish momentum.

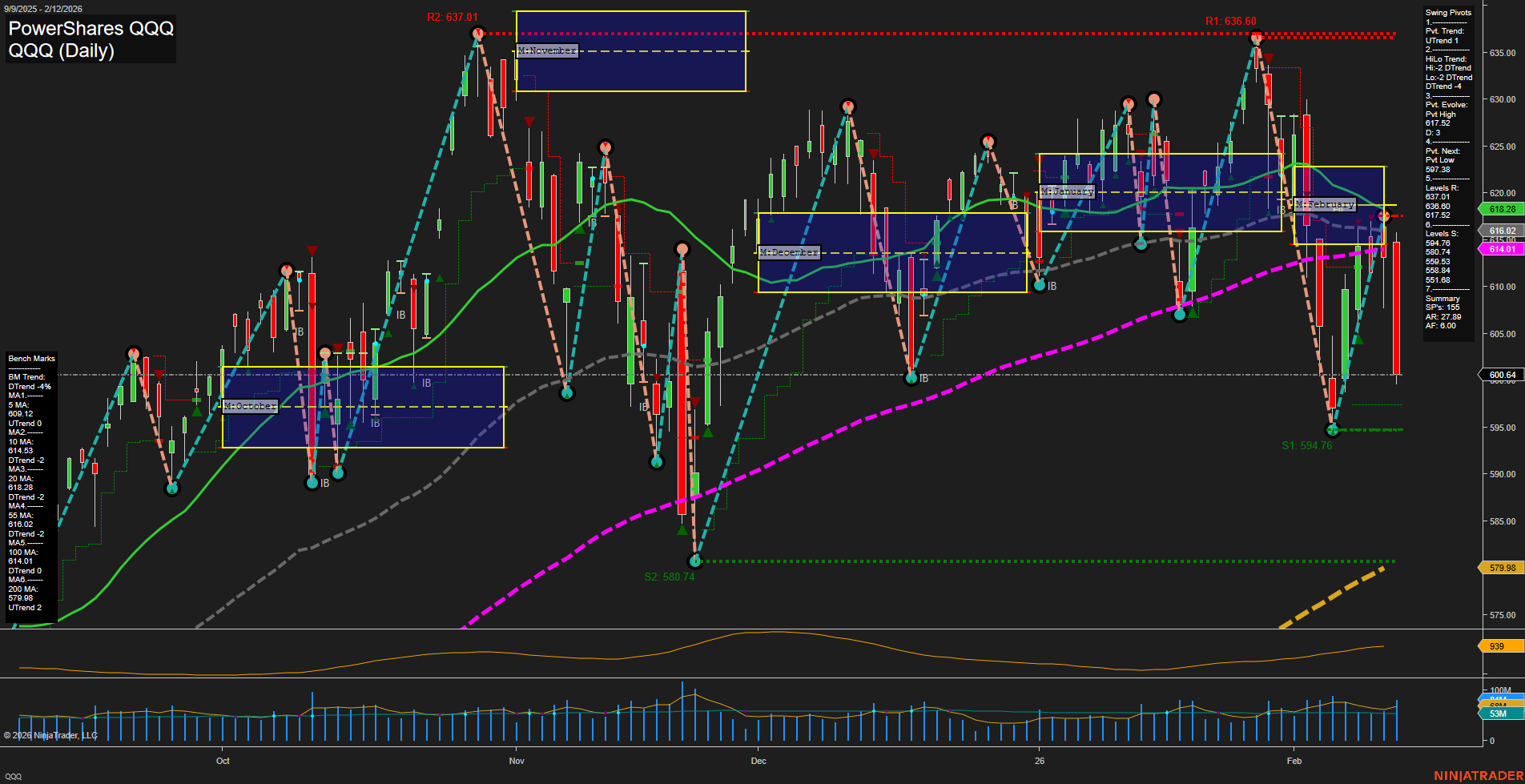

- QQQ – 601.92 (+0.21%): Trading slightly higher, maintaining a bullish bias.

- IWM – 262.96 (+1.32%): Outperformed major ETFs, showing strong bullish action in small caps.

- IJH – 71.24 (+0.99%): Positive move, echoing strength in mid-caps.

- DIA – 495.28 (+0.12%): Marginal gain, reflecting stable blue-chip performance.

Magnificent 7 Snapshot

- TSLA – 417.44 (+0.09%): Slight gain, relatively flat performance.

- MSFT – 401.32 (−0.13%): Minor downside, heading lower amid weakness in tech mega caps.

- AMZN – 198.79 (−0.41%): Down on the session, continuing a bearish streak.

- GOOG – 306.02 (−1.08%): Extended selling, marking notable underperformance.

- META – 639.77 (−1.55%): Accelerating losses, leading the Mag7 decline.

- NVDA – 182.81 (−2.21%): Under pressure, deepening its pullback.

- AAPL – 255.78 (−2.27%): Largest drop among the group, extending recent softness.

Other Major ETFs

- IBIT – 38.97 (+5.18%): Robust bullish activity, showing outsized relative strength.

- GLD – 462.62 (+2.49%): Significant upside, gold rally in focus.

- TLT – 89.72 (+0.55%): Bonds modestly higher, reflecting demand for duration.

- USO – 76.22 (−0.21%): Slightly weaker session for energy exposure.

Theme: Market Divergence

The snapshot shows bullish momentum in major equity ETFs and select assets like small caps, mid caps, Bitcoin (IBIT), and Gold (GLD). In contrast, the Magnificent 7 mega-caps are broadly mixed to negative, led lower by technology names. Treasury (TLT) and broad market ETFs are modestly higher, while energy (USO) edges down.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts