Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

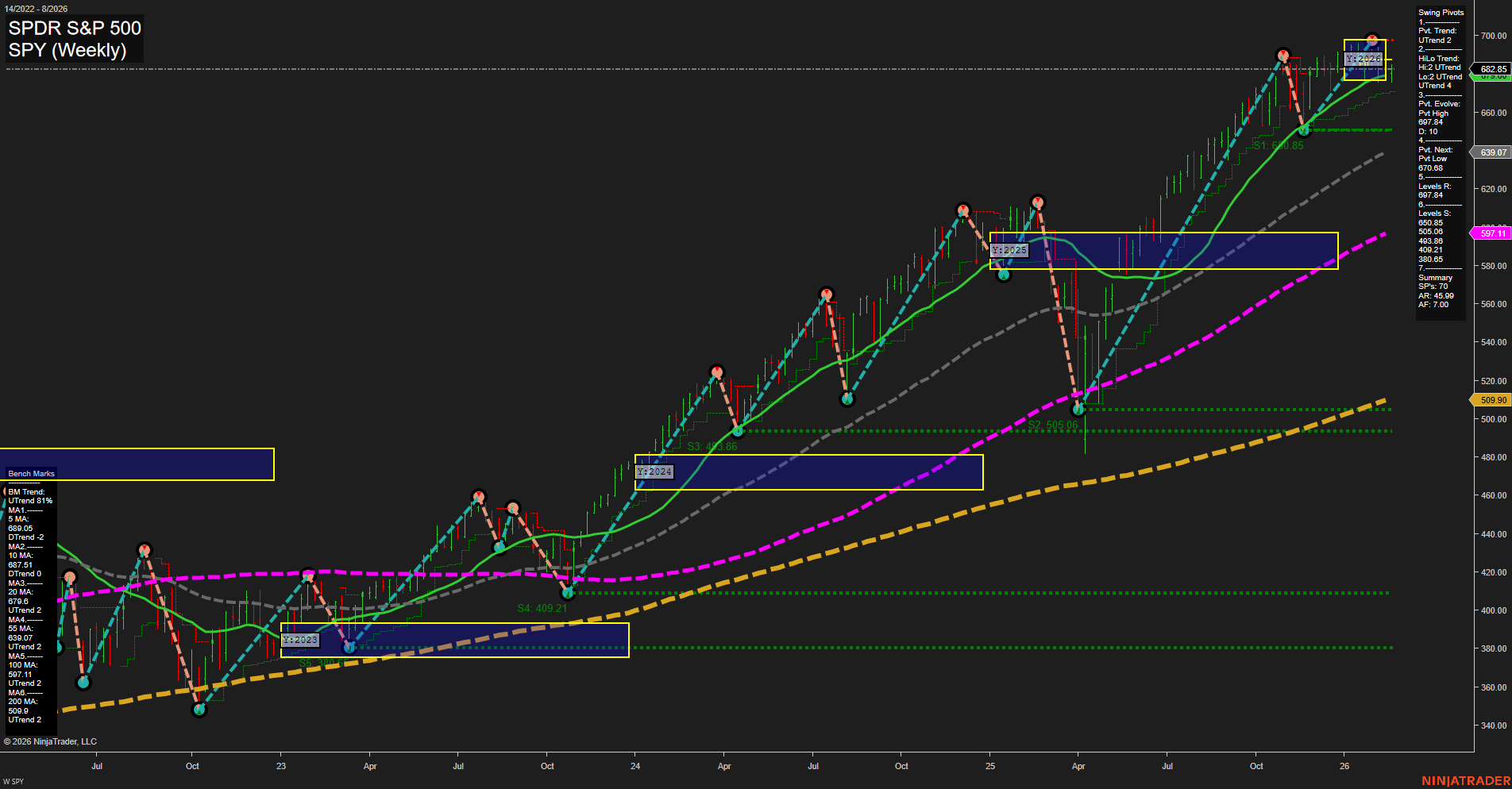

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Wednesday 14:00 – USD FOMC Meeting Minutes (High Impact): Markets will focus on the Fed’s monetary policy outlook and any hints of future rate hikes or easing measures. The release often triggers increased volatility as traders reassess Fed stance.

- Thursday 08:30 – USD Unemployment Claims (High Impact): Weekly jobless data provides a real-time gauge of labor market strength. Sharp surprises can prompt swift index futures moves as they shape Fed expectations.

- Friday 08:30 – USD Advance GDP q/q (High Impact): Advance GDP is a primary growth metric, driving both risk appetite and Fed policy forecasts. A significant miss or beat typically results in fast, broad market reactions.

- Friday 08:30 – USD Core PCE Price Index m/m (High Impact): As the Fed’s preferred inflation measure, unexpected results in Core PCE can sharply move indices on policy repricing.

- Friday 09:45 – USD Flash Manufacturing PMI (High Impact): PMI data offers an early snapshot of economic momentum; strong deviations impact growth sentiment and futures direction.

- Friday 09:45 – USD Flash Services PMI (High Impact): Closely watched for changes in service sector activity, with the power to alter intraday market momentum.

- Thursday 12:00 – USD Crude Oil Inventories (Low Impact for indices, mention per instructions): Oil prices remain a market risk due to inflation and geopolitical concerns. Inventory changes can indirectly impact indices if energy prices move sharply.

EcoNews Conclusion

- Indices futures traders should remain vigilant around Wednesday’s FOMC Minutes and Friday’s GDP & Core PCE, as these are key directional catalysts for market volatility and liquidity.

- Crude oil inventory data and price changes can affect the broader market given inflationary pressures and global risks.

- Advance GDP and Core PCE releases are likely to generate pre-event caution and potential slowdowns in momentum and volume leading up to Friday morning.

- Expect heightened volatility, especially around the 10 AM ET time frame with notable economic reports and typical cycle-based reversals or continuations.

For full details visit: Forex Factory EcoNews

Market News Summary

- Indices & Equities: U.S. stock benchmarks showed mixed signals with the S&P 500 edging higher, though investor sentiment remains cautious as indicated by the ‘Fear’ zone on the Greed Index. Stocks rallied off recent lows with outperformance from specific sectors. Tech shares maintained gains, supporting broader equity indices as quarterly earnings held steady. However, concerns about the sustainability of the AI-driven rally and concentration in top stocks have surfaced, with some strategists warning of possible correction risks.

- Earnings: Corporate earnings have so far been robust, with 13.2% year-over-year EPS growth for Q4 2025 and most S&P 500 companies beating expectations. Upcoming retail and tech earnings releases add rotational pressure as market participants digest sector-specific moves.

- Metals: Gold and silver prices experienced notable volatility. Gold rebounded from an overnight dip and builds a bullish technical structure ahead of the FOMC minutes, trading above key support levels despite a firm U.S. dollar. Silver consolidates below its 50-day moving average, with attention on longer-term support.

- Energy & Commodities: Oil prices seesawed as traders focused on U.S.-Iran negotiations: early declines on de-escalation hopes reversed as military risks resurfaced. Crude output increases and inventory build capped gains, yet underlying geopolitical concerns kept volatility high. Developments in South America and major oil companies’ trading activity highlight shifting supply dynamics.

- Rates & Macro: Market expectations are building for at least two Federal Reserve rate cuts this year, based on inflation and employment trends. Traders are awaiting key economic data for further clues, while global investment themes shift with calls for non-U.S. opportunities.

- Sentiment & Flows: News flow remains choppy. Some institutions are rotating toward equal-weight and non-U.S. exposures, while large U.S. tech companies are expected to boost bond issuance to fund ongoing innovation and AI-related spending.

News Conclusion

- Market tone is narrowly positive with equities finding footing from tech strength and solid earnings, though there are growing signs of risk fatigue tied to concentration in leadership stocks and macro policy uncertainty.

- Commodities—especially gold, silver, and oil—are subject to elevated headline risk, with underlying technical signals becoming more prominent as traders look ahead to central bank commentary and geopolitical developments.

- Market participants are closely monitoring upcoming economic data, central bank actions, and global strategic shifts for further direction amid persistent volatility and sector rotation.

Market News Sentiment:

Market News Articles: 39

- Neutral: 38.46%

- Negative: 33.33%

- Positive: 28.21%

Sentiment Summary:

Out of 39 market news articles reviewed, 38.46% of the coverage was neutral, 33.33% negative, and 28.21% positive.

Conclusion:

Market news sentiment is currently mixed, with neutral and negative articles comprising the majority of coverage, while positive sentiment is less prominent.

GLD,Gold Articles: 16

- Neutral: 43.75%

- Positive: 37.50%

- Negative: 18.75%

Sentiment Summary:

Recent news articles regarding GLD and gold show a largely neutral sentiment (43.75%), with positive sentiment present in 37.50% of the coverage and negative sentiment at 18.75%.

This distribution suggests that the market news flow is currently balanced, with some positive developments, but also a notable proportion of neutral and negative coverage.

USO,Oil Articles: 16

- Positive: 43.75%

- Neutral: 37.50%

- Negative: 18.75%

Sentiment Summary: Out of 16 recent articles covering USO and Oil, 43.75% presented a positive outlook, 37.50% were neutral, and 18.75% were negative.

This indicates that current news coverage is predominantly positive to neutral, with a smaller proportion reflecting negative sentiment.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 18, 2026 07:16

- AAPL 263.88 Bullish 3.17%

- AMZN 201.15 Bullish 1.19%

- NVDA 184.97 Bullish 1.18%

- IJH 71.37 Bullish 0.18%

- TLT 89.87 Bullish 0.17%

- SPY 682.85 Bullish 0.16%

- DIA 495.85 Bullish 0.12%

- IWM 263.04 Bullish 0.03%

- META 639.29 Bearish -0.07%

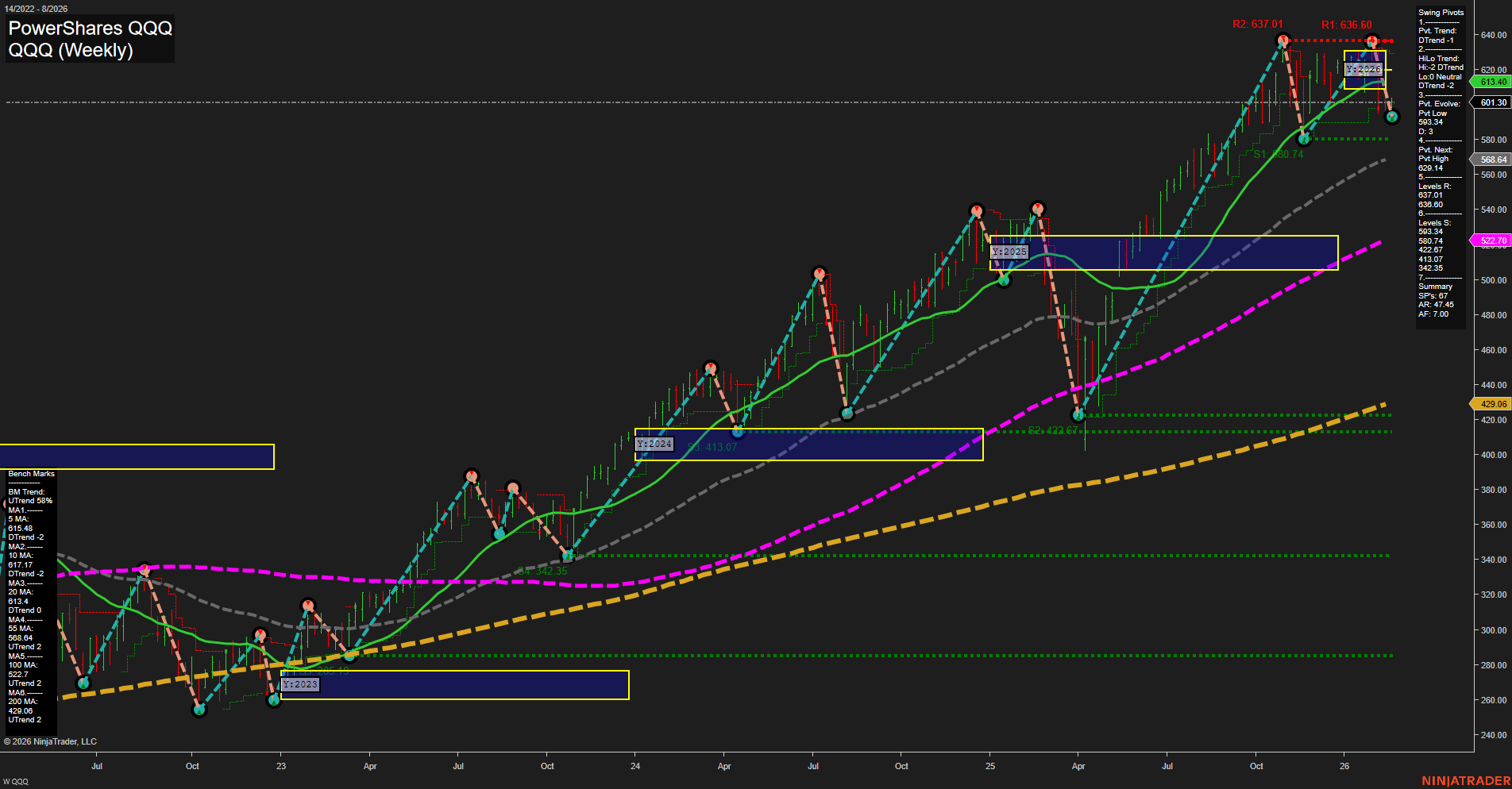

- QQQ 601.30 Bearish -0.10%

- USO 75.73 Bearish -0.64%

- GOOG 302.82 Bearish -1.05%

- MSFT 396.86 Bearish -1.11%

- IBIT 38.39 Bearish -1.49%

- TSLA 410.63 Bearish -1.63%

- GLD 448.20 Bearish -3.12%

Market Summary: ETF Stocks, Mag7 & Key ETFs (As of 02/18/2026)

ETF Stocks Overview

- SPY: 682.85 Bullish (+0.16%)

- QQQ: 601.30 Bearish (-0.10%)

- IWM: 263.04 Bullish (+0.03%)

- IJH: 71.37 Bullish (+0.18%)

- DIA: 495.85 Bullish (+0.12%)

ETF stocks are showing mostly bullish sentiment with modest gains across SPY, IWM, IJH, and DIA. QQQ, however, reflects slight bearishness, hinting at mixed performance within the technology-focused segment.

Mag7 Large Cap Tech Summary

- AAPL: 263.88 Bullish (+3.17%)

- AMZN: 201.15 Bullish (+1.19%)

- NVDA: 184.97 Bullish (+1.18%)

- META: 639.29 Bearish (-0.07%)

- GOOG: 302.82 Bearish (-1.05%)

- MSFT: 396.86 Bearish (-1.11%)

- TSLA: 410.63 Bearish (-1.63%)

Mag7 stocks present a highly mixed picture: Apple leads with a strong move, accompanied by gains in Amazon and Nvidia. In contrast, Tesla, Microsoft, and Google are under pressure with losses; Meta is marginally negative.

Other Key ETFs

- TLT: 89.87 Bullish (+0.17%)

- GLD: 448.20 Bearish (-3.12%)

- USO: 75.73 Bearish (-0.64%)

- IBIT: 38.39 Bearish (-1.49%)

Key ETFs outside of equities are mostly seeing bearish action, notably with Gold (GLD) leading losses. Treasury bonds (TLT) are modestly higher, while Oil (USO) and Bitcoin-related IBIT are under selling pressure.

Summary: State of Play

- Long/Bullish: Major index ETFs show overall strength, led by Apple in the Mag7.

- Mixed: Tech heavyweights present a split direction, with both sizable gainers and losers.

- Short/Bearish: Gold, Oil, and several mega-cap techs reflect downside momentum, indicating divergence among key market assets.

The session displays sectoral divergence with select leadership in large-cap equities, while commodities and some tech giants exhibit weakness.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2026-02-18: 07:17 CT.

US Indices Futures

- ES Long-term bullish, price above major MAs & YSFG/WSFG, mixed MSFG, recent high resistance, strong long-term, corrective near-term, well-defined S/R pivots.

- NQ Short/intermediate-term bearish, below MSFG/YSFG, swing pivots confirm downtrend, long-term structure bullish, 200MA support proximity, recent shorts, corrective within LT uptrend.

- YM Bullish across all timeframes, above YSFG/MSFG/WSFG and all MAs, new highs, support levels below, uptrend in swing pivots, no reversal signs, strong trend extension.

- EMD Persistent uptrend, above all FSFGs, higher-high pivots, MAs all up, resistance tested/broken, supports below, strong extension, no exhaustion, consistent bullish signals.

- RTY Bullish on all timeframes, price above NTZ/F0% on all grids, swing pivots higher highs/lows, MAs up, healthy S/R, continued uptrend, recent long signals align with structure.

- FDAX Bullish multi-timeframe, above YSFG/MSFG/WSFG, strong MA alignment, pivot highs, resistance above, supports well below, higher-high/low pattern, trend continuation, no reversal signs.

Overall State

- Short-Term: Bullish (except NQ/ES which are near-term bearish/corrective)

- Intermediate-Term: Bullish (except NQ/ES, intermediate-term bearish/neutral)

- Long-Term: Bullish (all indices maintain bullish structure except NQ Daily/ES Daily, which are at neutral)

Conclusion

HTF technicals indicate broad bullish structure for US Indices Futures, with price action above key YSFG/MSFG/WSFG and major MA benchmarks on YM, EMD, RTY, and FDAX. ES and NQ show short/intermediate-term bearish or corrective momentum, trading below some session fib grid centers with downward swing pivots and clustered resistance, yet their long-term structure remains intact, supported by uptrending long-term MAs and sustained levels above major support. YM, EMD, RTY, and FDAX maintain clear trend continuation with higher-highs/lows and technical alignment across grids and pivots. No immediate large-scale reversal signs are present. Overall direction is led by YM, EMD, RTY, and FDAX, while ES and NQ are digesting gains but retain higher timeframe support. S/R and swing pivots remain key for monitoring further structural changes or breakout setups.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts