Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

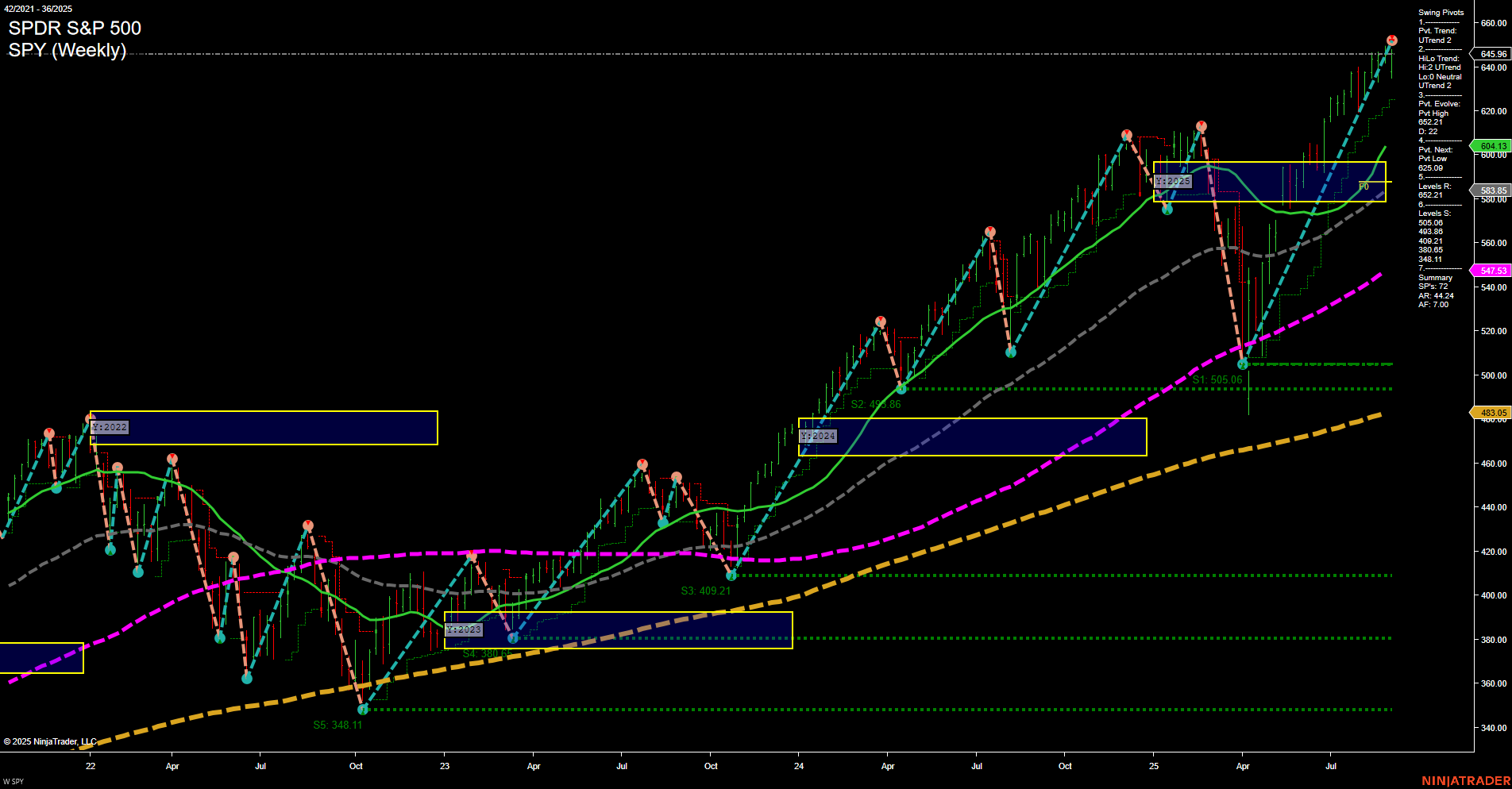

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- ADBE Release: 2025-09-11 T:AMC

- ORCL Release: 2025-09-09 T:AMC

Looking ahead to the upcoming earnings releases, attention is focused on Oracle (ORCL) reporting after the close on September 9, followed by Adobe (ADBE) after the close on September 11. As both companies are key players in cloud, enterprise software, and AI-related segments, their updates have the potential to drive notable moves in technology indices. Historically, sessions leading up to these major tech earnings—especially with anticipation also building for NVDA and other MAG7 names—can see a slowdown in momentum and trading volume as market participants await clarity from these bellwether reports. Expect index futures, particularly those tracking the Nasdaq and S&P 500, to remain sensitive to earnings surprises or guidance from ORCL and ADBE, with the potential for increased volatility around their release times as traders react to the new information.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Wednesday 08:30: High-impact reports on Core PPI m/m and PPI m/m could set early tone for index futures, influencing expectations for producer-side inflation and future margins across sectors.

- Wednesday 10:30: Low-impact Crude Oil Inventories may slightly affect energy sector and broader inflation sentiment if inventories are notably above or below forecasts.

- Thursday 08:30: High-impact releases including Core CPI m/m, CPI m/m, CPI y/y, and Unemployment Claims are scheduled simultaneously. These data points can drive sharp volatility across indices, rapidly recalibrating rate and inflation outlooks.

- Friday 10:00: High-impact Prelim UoM Consumer Sentiment and Prelim UoM Inflation Expectations may prompt strong market moves, particularly as they coincide with the known reversal-prone 10AM time cycle.

EcoNews Conclusion

- Major focus will be on the Thursday CPI suite and unemployment data, setting the week’s inflation trajectory and rate expectations for equity indices.

- Wednesday’s PPI may provide early direction, but broader risk moves may be reserved for Thursday’s data.

- The Friday 10:00 AM University of Michigan reports align with a typical “market pivot” window, potentially accelerating reversals or fueling momentum started by earlier data.

- Traders should note: News events around the 10 AM time cycle often act as a catalyst for reversals or continuations.

For full details visit: Forex Factory EcoNews

Market News Summary

- U.S. Markets & ETFs: Long-term investment in broad-market ETFs like the SPDR S&P 500 ETF Trust (SPY) has delivered solid returns, reinforcing the outperformance of diversified, index-based strategies. Meanwhile, international value stocks represented by PXF are showing even higher returns and dividend growth relative to SPY, highlighting global opportunities.

- Oil & Energy Markets: OPEC+ will boost oil output again in October, scaling back earlier production cuts. Despite this, weaker global demand and recession fears are keeping oil prices under bearish pressure. Some energy equities, such as Kolibri Global Energy, exhibit resilience and strong financials even as sector risks remain elevated.

- U.S. Economic Data & Politics: Jobs data reliability is questioned after a leadership change at the Bureau of Labor Statistics. Upcoming employment revisions and inflation data will play a role in the Federal Reserve’s rate decisions. Concurrently, continuing debate surrounds the economic impact and legal status of U.S. tariffs, with possible substantial financial consequences depending on future court rulings.

- Market Sentiment & Technicals: While the S&P 500 hit new all-time highs last week, technical analysis flags caution: momentum is weakening, and follow-through buying is absent. Broader concerns about high valuations, technical fragility, and global economic headwinds contribute to rising correction risks.

News Conclusion

- The market landscape remains mixed: certain ETFs and international assets are outperforming, yet technical signals in U.S. indices point to potential short-term vulnerability.

- Energy news is dominated by supply increases from OPEC+, counterbalanced by signs of demand weakness and macroeconomic concerns affecting oil prices and broader market sectors.

- Political developments and legal uncertainties around economic policy—especially relating to tariffs and the reliability of official data—add an additional layer of uncertainty influencing market outlook and volatility.

- Upcoming data releases, particularly related to employment and inflation, are likely to serve as key catalysts for near-term market sentiment and direction.

Market News Sentiment:

Market News Articles: 7

- Negative: 42.86%

- Positive: 28.57%

- Neutral: 28.57%

No stock-related news items found.

USO,Oil Articles: 5

- Negative: 40.00%

- Neutral: 40.00%

- Positive: 20.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: September 7, 2025 06:15

- TSLA 350.84 Bullish 3.64%

- IBIT 63.42 Bullish 1.72%

- TLT 88.56 Bullish 1.52%

- GLD 331.05 Bullish 1.33%

- GOOG 235.17 Bullish 1.08%

- META 752.45 Bullish 0.51%

- IWM 237.77 Bullish 0.50%

- IJH 66.05 Bullish 0.49%

- QQQ 576.06 Bullish 0.14%

- AAPL 239.69 Bearish -0.04%

- SPY 647.24 Bearish -0.29%

- DIA 454.99 Bearish -0.45%

- AMZN 232.33 Bearish -1.42%

- USO 72.63 Bearish -2.09%

- MSFT 495.00 Bearish -2.55%

- NVDA 167.02 Bearish -2.70%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-09-07: 18:15 CT.

US Indices Futures

- ES Strong bullish across YSFG, MSFG, WSFG; price above NTZ levels, swing pivots confirm uptrend, all MAs up, key supports below, trend continuation phase.

- NQ Confirmed uptrend via YSFG, MSFG, WSFG, price above NTZ, swing pivots up, MA benchmarks rising, resistance near highs, trend continuation with no immediate reversal signals.

- YM Data unavailable.

- EMD WSFG short-term neutral, MSFG and YSFG bullish, price near NTZ, higher pivots, MAs up, resistance at 3328.5/3501.9, support at 3111.7/2602.7, V-recovery structure.

- RTY WSFG short-term neutral, MSFG/YSFG bullish, price near NTZ center, higher swing pivots, MAs up, resistance 2537.1, support 2225.2, uptrend continuation.

- FDAX WSFG short/intermediate bearish, YSFG bullish, price below NTZs, MAs down except 200, swing pivots confirm downtrend, support 22235, resistance 23056+, corrective in longer uptrend.

Overall State

- Short-Term: Bullish (ES, NQ, EMD-daily, RTY-daily), Neutral (EMD-weekly, RTY-weekly), Bearish (FDAX)

- Intermediate-Term: Bullish (ES, NQ, EMD, RTY), Neutral (FDAX-weekly), Bearish (FDAX-daily)

- Long-Term: Bullish (all US indices, FDAX)

Conclusion

US equity futures (ES, NQ, EMD, RTY) maintain a broad bullish structure on higher timeframes, with trend continuation in YSFG/MSFG/WSFG, higher swing pivot highs, and all major moving averages rising. Current price is well above key support on most instruments, consolidating near highs or recent resistance. Short-term consolidation or minor pullbacks are observed in EMD and RTY weekly, with EMD and RTY daily resuming uptrends. FDAX is showing a corrective decline on short and intermediate timeframes, trading below NTZ levels with bearish swing pivots and moving averages, though the long-term structural trend remains up. Directional correlations indicate US futures remain in uptrends with price structure favoring continuation, while FDAX lags with a short-term correction within the broader uptrend.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

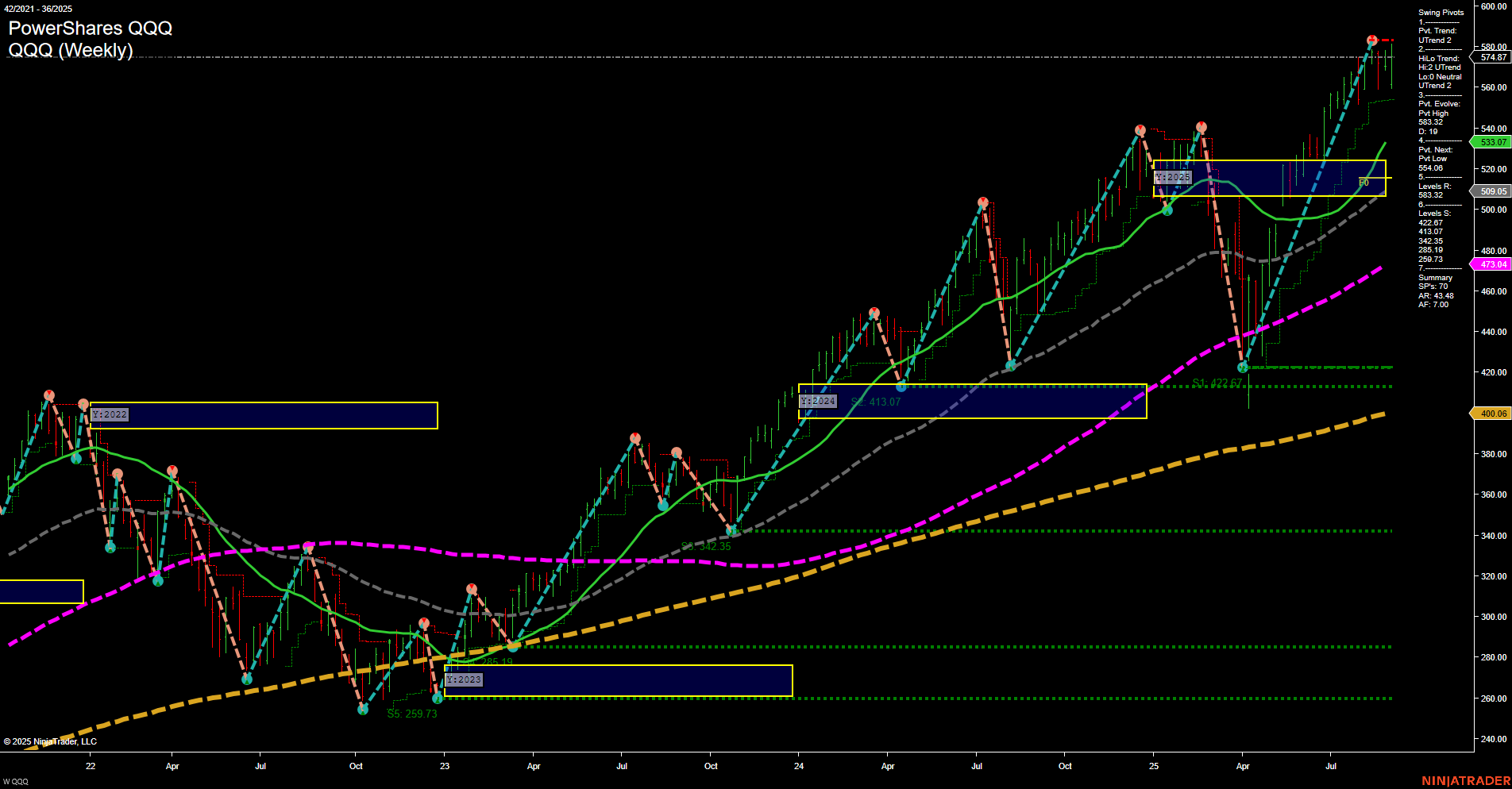

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts