Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

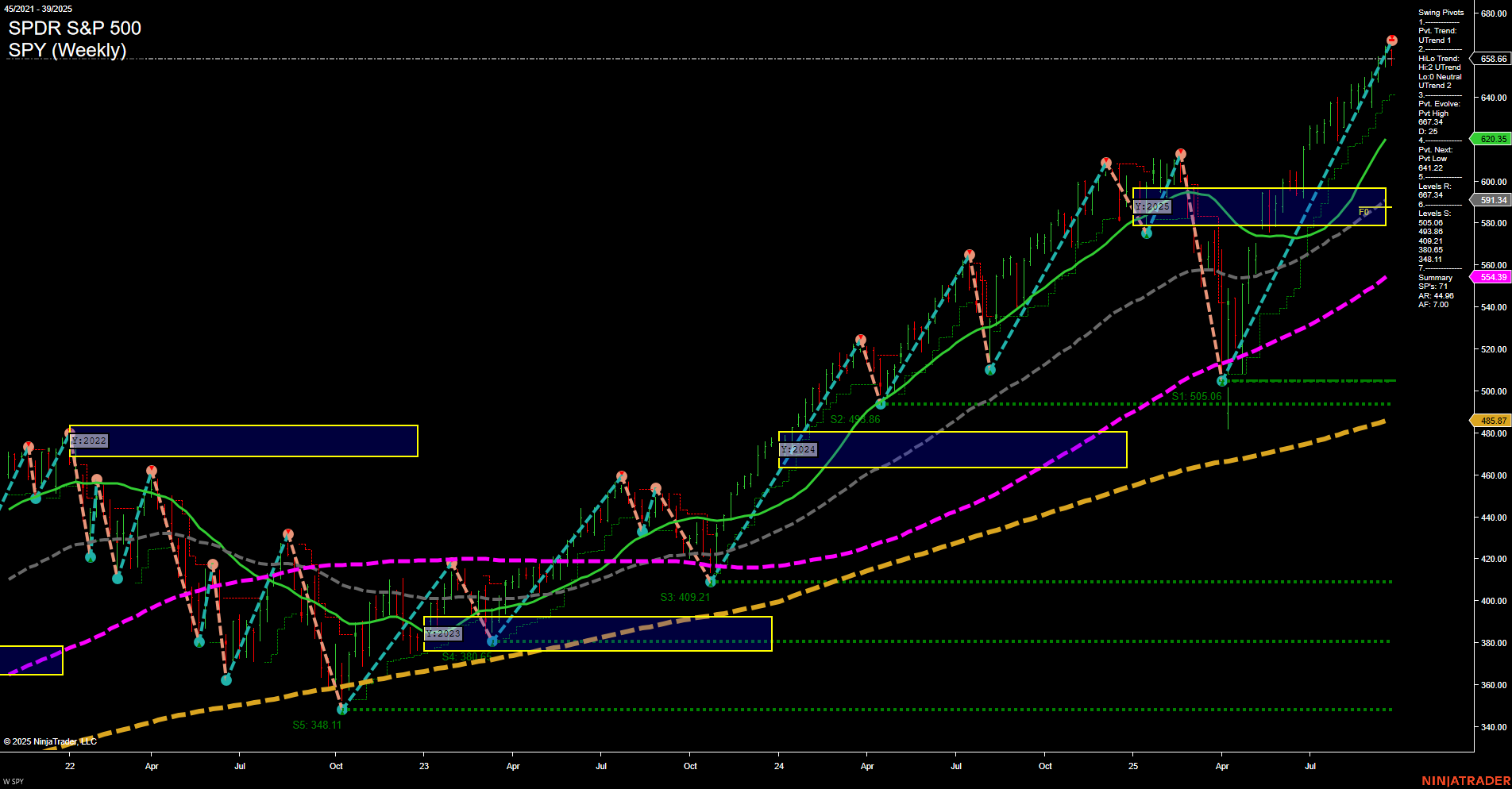

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Friday 08:30 – USD Core PCE Price Index m/m (High Impact): The Core PCE Price Index is the Federal Reserve’s preferred inflation gauge. A stronger or weaker than expected result is likely to cause significant moves in index futures as traders reassess the Fed’s policy outlook. Any surprises can quickly shift market sentiment and volatility.

EcoNews Conclusion

- Core PCE at 08:30 will be closely watched, and the result is expected to drive initial momentum and direction during the U.S. session.

- Market momentum and volume may slow in the days leading up to major events such as PCE.

- News events around the 10 AM time cycle often act as a catalyst for reversals or continuations.

For full details visit: Forex Factory EcoNews

Market News Summary

- Active ETFs: The active ETF space continues strong growth, with substantial issuance seen since 2021, signaling increased buy-side interest in active portfolio management products.

- Equities: The S&P 500 extended its losing streak, experiencing its longest downturn in a month. U.S. equity futures show the Dow Jones poised for modest gains while the Nasdaq appears muted heading into Friday’s session.

- Gold & Silver: Gold rallied to new highs but paused, displaying signs of short-term exhaustion as traders await key U.S. inflation data (PCE). Both gold and silver consolidate near record levels as recession concerns and safe-haven flows persist, though a firmer dollar has pressured prices.

- Oil Markets: Oil is tracking its biggest weekly gain in three months, supported by Russian export curbs and Ukrainian attacks on Russian energy infrastructure. WTI prices maintain support above $65, though OPEC+ production is likely to fall short of stated targets later this year.

- Tariffs & Policy Developments: The U.S. administration announced a broad set of tariffs—25% or higher—on imports of heavy trucks, pharmaceuticals, and household furnishings, to go into effect starting October 1. This has unsettled global pharma stocks and impacted sentiment in related sectors. Policy moves affecting Fed independence have also come into focus.

- AI & Investment Trends: Family offices increasingly favor investing in AI via public equities over startups and venture capital. However, caution emerges around excessive AI infrastructure spending, with concerns it may lead to significant losses should returns disappoint.

- Dividends: Global dividend growth continues to accelerate, propelled by strong earnings and a weak dollar despite concerns from corporate executives.

- Other Market Themes: Investors weigh the impact of potential Fed rate cuts, productivity gains, and economic neutrality, with market direction appearing linked to macro data releases and evolving rate policy expectations.

News Conclusion

- Markets reflect mixed sentiment, with defensive positioning in gold and cautious optimism in oil, while equity indices face volatility amid economic and policy uncertainties.

- Elevated tariffs are generating sector-specific volatility, especially in pharmaceuticals and industrials, with broader implications for global trade sentiment.

- Uncertainty around U.S. central bank independence and broad-based rate policy continues to exert influence on risk sentiment and asset allocation trends.

- While AI remains a focal point for investors, growing warnings about overexuberance highlight possible risks to related tech valuations.

- Macro data, including U.S. inflation reports, are central to near-term price trends, especially for gold and rates-sensitive assets.

- The investment landscape reflects a nuanced approach as market participants react to cross-currents from policy initiatives, global macroeconomic data, and corporate earnings.

Market News Sentiment:

Market News Articles: 17

- Negative: 41.18%

- Neutral: 41.18%

- Positive: 17.65%

Sentiment Summary: Out of 17 market news articles, 41.18% conveyed a negative tone, 41.18% were neutral, and 17.65% were positive in sentiment.

The current news flow reflects a predominantly cautious or mixed market environment, with negative and neutral sentiment making up the majority of recent reporting.

GLD,Gold Articles: 8

- Neutral: 37.50%

- Negative: 37.50%

- Positive: 25.00%

Sentiment Summary: Recent coverage on GLD and gold is evenly split between neutral (37.5%) and negative (37.5%) sentiment, with positive sentiment making up a smaller portion (25%).

Conclusion: The news flow reflects a cautious to slightly negative tone overall, with neutral and negative perspectives dominating recent articles.

USO,Oil Articles: 4

- Neutral: 50.00%

- Positive: 25.00%

- Negative: 25.00%

Sentiment Summary: The market news sentiment for USO and Oil is evenly split, with 50% of articles presenting a neutral outlook, and the remaining divided equally between positive (25%) and negative (25%) sentiment.

This suggests that recent news coverage on USO and Oil is balanced, lacking a clear dominant sentiment. Traders may interpret the current environment as one of mixed perspectives.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: September 26, 2025 07:16

- AAPL 256.87 Bullish 1.81%

- USO 76.99 Bullish 0.79%

- GLD 344.75 Bullish 0.42%

- NVDA 177.69 Bullish 0.41%

- TLT 88.98 Bearish 0.00%

- DIA 459.43 Bearish -0.34%

- QQQ 593.53 Bearish -0.43%

- SPY 658.05 Bearish -0.46%

- GOOG 246.57 Bearish -0.51%

- IJH 64.68 Bearish -0.55%

- MSFT 507.03 Bearish -0.61%

- AMZN 218.15 Bearish -0.94%

- IWM 239.29 Bearish -0.96%

- META 748.91 Bearish -1.54%

- IBIT 62.10 Bearish -3.60%

- TSLA 423.39 Bearish -4.38%

ETF Stocks Market Summary

- SPY: 658.05 (Bearish, -0.46%) – The S&P 500 ETF is trending lower in this snapshot, implying broad-based selling pressure across large-cap stocks.

- QQQ: 593.53 (Bearish, -0.43%) – Tech-heavy QQQ is also in a declining phase, reflecting weakness in tech and growth names.

- IWM: 239.29 (Bearish, -0.96%) – Russell 2000 small-caps are underperforming with the largest loss among major equity indices, suggesting broad risk-off sentiment towards riskier equities.

- IJH: 64.68 (Bearish, -0.55%) – S&P 400 MidCap ETF is showing modest declines, tracking the risk-off move seen in small- and mega-cap segments.

- DIA: 459.43 (Bearish, -0.34%) – The Dow ETF is trading lower, indicating weakness in blue-chip, industrial-heavy stocks.

Mag7 Snapshot

- AAPL: 256.87 (Bullish, +1.81%) – Apple stands out with strong outperformance, bucking the broader market downtrend.

- NVDA: 177.69 (Bullish, +0.41%) – Nvidia is also in positive territory but is showing a more subdued move compared to AAPL.

- GOOG: 246.57 (Bearish, -0.51%) – Alphabet is under modest selling pressure, reflecting tech weakness overall.

- MSFT: 507.03 (Bearish, -0.61%) – Microsoft is facing moderate declines amid a down day for tech.

- AMZN: 218.15 (Bearish, -0.94%) – Amazon is under notable pressure, underperforming the broader tech sector.

- META: 748.91 (Bearish, -1.54%) – Meta Platforms is exhibiting significant downside, leading the Mag7 declines.

- TSLA: 423.39 (Bearish, -4.38%) – Tesla displays the sharpest drop within the Mag7 group, accelerating market losses in the space.

Other Key ETFs

- USO: 76.99 (Bullish, +0.79%) – The oil ETF is rising, signaling strength in energy despite general equity weakness.

- GLD: 344.75 (Bullish, +0.42%) – Gold ETF is firm, suggesting some safe-haven demand amid broad equity declines.

- TLT: 88.98 (Bearish, 0.00%) – The long-term Treasury ETF is flat but holds a bearish tilt, reflecting continued uncertainty or risk aversion in bond markets.

- IBIT: 62.10 (Bearish, -3.60%) – The Bitcoin ETF sees substantial losses, aligning with risk-off sentiment extending into alternative assets.

State of Play Summary

The current landscape shows broad-based weakness across major U.S. equity indices and most of the Mag7 stocks, with only Apple and Nvidia demonstrating resilience. Notably, Tesla and Meta show accelerated declines. Energy (USO) and Gold (GLD) are bucking the risk-off trend, while long-duration Treasuries and digital asset proxies like IBIT remain pressured or volatile. This mix reflects heightened caution and selective strength, with traders closely watching leadership rotation and defensive asset flows.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-09-26: 07:16 CT.

US Indices Futures

- ES YSFG/MSFG bullish, WSFG downtrend, above key S/R; swing pivots at new highs, correction ongoing, supports below 6470.25, all major MAs trending up, intermediate/long-term uptrend.

- NQ YSFG/MSFG bullish, WSFG downtrend, price at new highs, resistance 25,027.25, swing pivots up, supports at 24,452. Short-term corrective, all higher MAs up, trend intact intermediate/long-term.

- YM YSFG/MSFG bullish, WSFG downtrend, above key S/R, resistance 47,065, support 44,465, swing pivots up. Short-term corrective/consolidating, but intermediate/long trends remain up, MAs rising on HTF.

- EMD YSFG bullish, MSFG/WSFG bearish, correction below NTZ/F0%, swing pivot down short/intermediate term, recent short signals, support at 3240.7, long-term MAs remain uptrend, corrective within bullish structure.

- RTY YSFG/MSFG bullish, WSFG downtrend, retracing from highs, resistance 2555.5, support 2412.1, swing pivots down short-term, higher MAs up. Corrective within uptrend, long-term structure intact above major grids.

- FDAX YSFG bullish, MSFG/WSFG bearish to neutral, swing pivots down, resistance 24,700–24,900, support 23,419, all ST/IT MAs down. Long-term above fib grid & major MAs, corrective phase prevailing short/intermediate.

Overall State

- Short-Term: Bearish

- Intermediate-Term: Bullish

- Long-Term: Bullish

Conclusion

US Indices Futures are in corrective phases on the short-term timeframe, indicated by prevailing bear trends in the WSFG, swing pivots, and short-term MAs, with prices below key weekly NTZ zones and recent short trade signals on ES, NQ, YM, EMD, RTY, and FDAX. Despite this, intermediate- and long-term structures remain robustly bullish: prices sit above major monthly and yearly session fib grids, and all higher timeframe moving averages trend up, confirming broad uptrends since major 2023–2024 lows. Key swing pivots and support levels are being tested, with ES, NQ, YM, RTY, and FDAX in correction but maintaining long-term structure, while EMD shows near-term weakness yet holds above yearly benchmarks. The overall context remains bullish on the HTF, with current pullbacks and consolidations appearing as technical retracements within broader sustained uptrends. Directional correlations confirm leading indices remain structurally intact above critical support levels.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

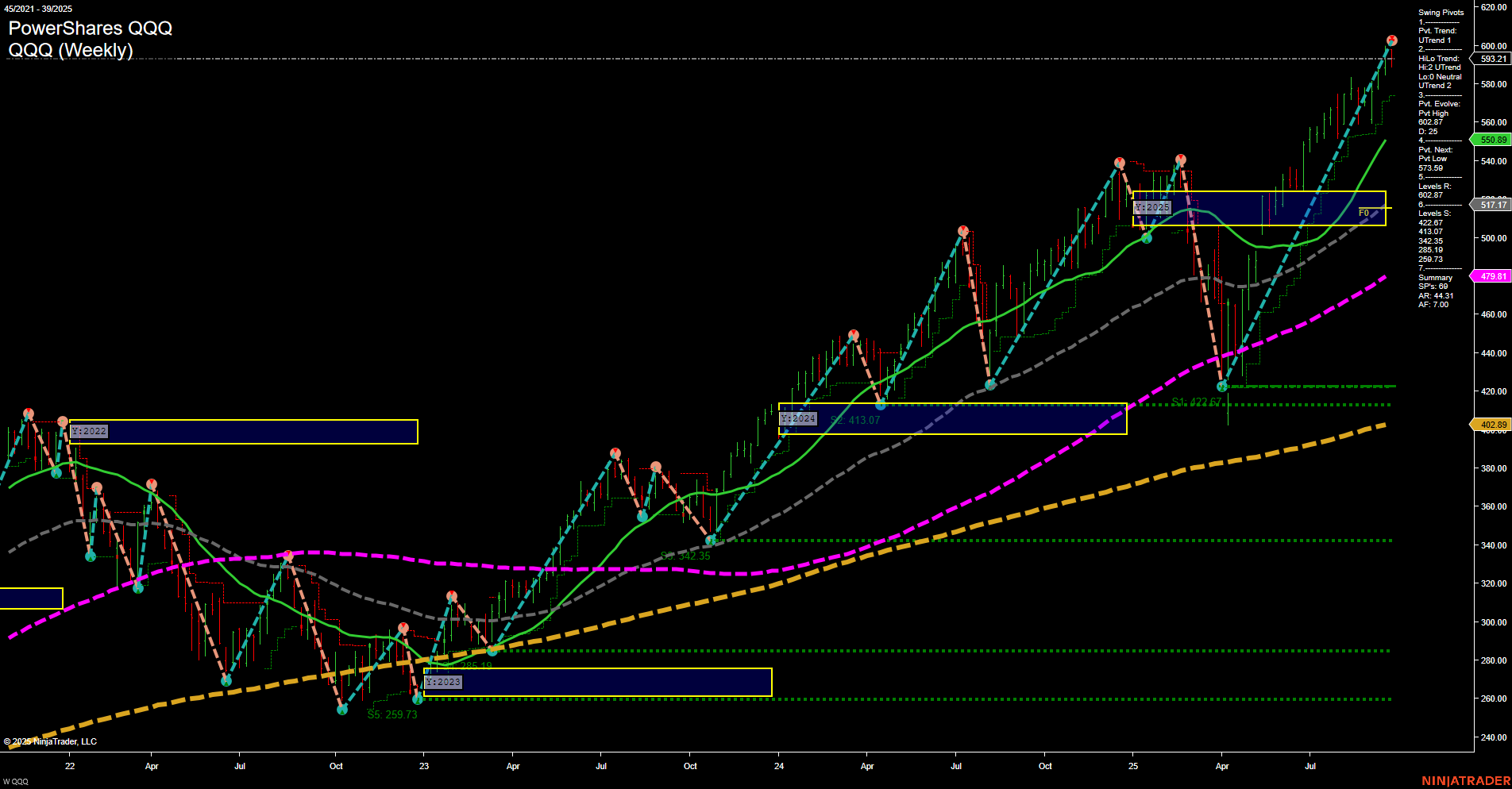

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts