Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

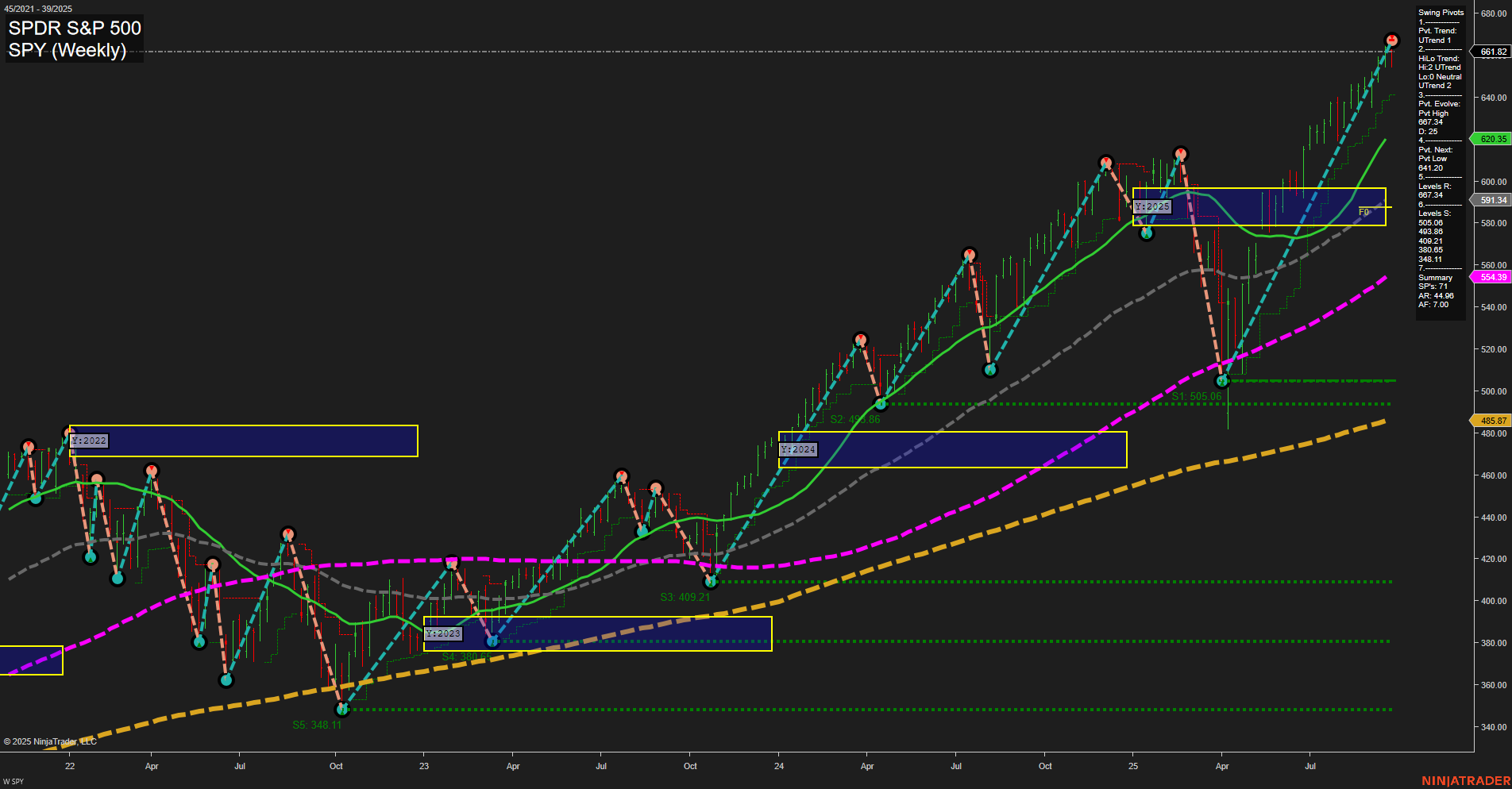

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Tuesday 10:00 – USD JOLTS Job Openings (High Impact): The JOLTS report is a key labor market indicator watched for signs of labor demand and economic health. Sharp moves in US indices futures often occur if actual numbers diverge widely from forecasts, influencing Fed rate expectations.

- Wednesday 08:15 – USD ADP Non-Farm Employment Change (High Impact): ADP data is an early signal of private sector job growth ahead of Friday’s NFP report. Surprises here can drive pre-market volatility and initiate directional moves in index futures.

- Wednesday 10:00 – USD ISM Manufacturing PMI (High Impact): A leading gauge of US manufacturing strength. Readings above or below consensus can rapidly shift sentiment in equities and index futures, especially if reflecting clear expansion or contraction.

- Wednesday 06:15 – OPEC Meetings (Medium Oil Impact): OPEC decisions can move crude oil prices. Higher oil prices may elevate inflationary pressures, which could spill over to equity indices through inflation expectations and sector rotation.

- Thursday 08:30 – USD Unemployment Claims (High Impact): Weekly jobless claims are closely monitored for signs of labor market cracks. Significant deviation from estimates can impact market sentiment and drive futures volatility at the open.

- Friday 08:30 – USD Average Hourly Earnings, Non-Farm Employment Change, Unemployment Rate (All High Impact): The monthly jobs report (“NFP”) and related metrics are among the most impactful data for US indices. Strong jobs growth or wage inflation could fuel speculation on Fed policy, often leading to elevated volatility and wide trading ranges.

- Friday 10:00 – USD ISM Services PMI (High Impact): As services dominate the US economy, this index’s surprise swings can cause sharp and directional market reactions, especially if data conflicts with earlier jobs numbers.

EcoNews Conclusion

- The ADP, ISM Manufacturing, Unemployment Claims, NFP, Unemployment Rate, and ISM Services PMI represent clusters of high-impact catalysts, especially as several release just after the open or at the 10 AM cycle—often a turning point for index futures.

- OPEC meetings may influence oil prices, and if prices move higher, expect potential knock-on effects for indices due to inflation and geopolitical concerns.

- Friday’s NFP and related labor metrics are the week’s primary market-movers. Market momentum and volume may slow in the days leading up to NFP, with traders positioning ahead of these key releases.

- News events around the 10 AM time cycle (Tue/Wed/Fri) often act as a catalyst for reversals or continuations in intraday index futures trends.

For full details visit: Forex Factory EcoNews

Market News Summary

- U.S. stock futures were mostly flat to slightly higher late Sunday and early Monday, reflecting caution as markets await clarity on potential government shutdown talks. Prediction markets are increasingly tilting toward a shutdown scenario. Economic data from September remains mixed: GDP growth was revised up to 3.8%, but consumer spending is moderating and labor market signals are a concern.

- President Trump reignited trade tensions by announcing a new round of steep tariffs, particularly in the pharmaceuticals sector, contributing to renewed recession concerns. Business spending slipped amid ongoing trade disputes. Fears of stagflation are emerging as inflation remains stubborn alongside signs of slowing growth and employment.

- Despite seasonal weakness and negative headlines, leading money managers remain largely bullish, betting on continued market highs. A notable “pain trade” narrative suggests investors remain positioned for further gains through the coming earnings season, although volatility and sideway moves are possible until earnings results are in.

- The S&P 500 continues its long-term bullish trend, with technical analysis pointing to possible short-term rallies, but potential for a break in momentum persists should current support levels fail. October’s historic volatility is raising caution, with divergent views on whether a typical correction or a deeper downturn may develop.

- Technology stocks have posted strong second quarter earnings, outperforming expectations. For Q3, expectations for tech sector EPS growth have been revised upward significantly, setting a high bar for upcoming reports and raising questions about whether tech can continue its earnings momentum.

- Oil markets are facing counteracting pressures. OPEC+ will hike output in November even as oil prices slip following the resumption of crude exports from Iraq’s Kurdistan region. Meanwhile, oil inventory data and rising cost pressures among shale producers indicate mixed signals and potential headwinds for energy prices as October approaches.

- Gold and silver prices surged to new records, driven by increased safe-haven demand, expectations for Fed rate cuts, central bank buying, and shutdown fears. Gold is targeting further highs around $3,880–$4,000, with silver eyeing previous all-time peaks. A weaker dollar and geopolitical concerns are fueling the technical breakout in precious metals.

- Investor worries about a tech bubble are present but not yet at extreme levels. The VIX index remains at the low end of its historical range, suggesting a lack of widespread fear or panic despite bubbling headlines about volatility and macro risk. Major IPOs continue to attract strong valuation expectations.

News Conclusion

- Stocks are coming off a period of resilience amid mixed macroeconomic signals but face imminent challenges, including the risk of a U.S. government shutdown, trade policy shocks, and emerging stagflation fears.

- The recent surge in gold and silver prices underscores persistent safe-haven demand amid heightened uncertainty, central bank accumulation, and monetary easing expectations.

- Ongoing volatility—both realized and expected—remains a feature of the market, with significant focus on upcoming U.S. economic data, earnings results, and political developments as potential cues for the next market move.

- Energy markets are seeing cross-currents, balancing short-term output gains against structural cost concerns within U.S. shale and international supply dynamics.

- Overall market sentiment is divided between expectations for continued gains—especially in tech and growth sectors—and caution about macro headwinds, with technical, fundamental, and geopolitical factors all converging to create an environment ripe for sharp moves in either direction.

Market News Sentiment:

Market News Articles: 23

- Neutral: 43.48%

- Negative: 30.43%

- Positive: 26.09%

Sentiment Summary:

Of the 23 market news articles reviewed, 43.48% conveyed a neutral sentiment, 30.43% were negative, and 26.09% were positive.

Overall, the news sentiment leans neutral, with a slightly higher proportion of negative articles compared to positive ones.

GLD,Gold Articles: 6

- Positive: 66.67%

- Neutral: 33.33%

Sentiment Summary: Of the six recent articles covering GLD and gold, 66.67% reflect a positive sentiment, while 33.33% are neutral.

This indicates that the current market news flow for GLD and gold is predominantly positive, with no negative articles reported in this set.

USO,Oil Articles: 4

- Negative: 50.00%

- Neutral: 25.00%

- Positive: 25.00%

Sentiment Summary: The latest coverage on USO and oil-related articles is predominantly negative, with 50% of the articles conveying a negative sentiment. Neutral and positive sentiment articles are evenly split at 25% each.

This suggests that recent news has leaned more toward negative developments or outlooks in the oil market, with fewer positive or neutral viewpoints represented.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: September 29, 2025 07:16

- TSLA 440.40 Bullish 4.02%

- IJH 65.34 Bullish 1.02%

- MSFT 511.46 Bullish 0.87%

- IWM 241.34 Bullish 0.86%

- AMZN 219.78 Bullish 0.75%

- DIA 462.28 Bullish 0.62%

- GLD 346.74 Bullish 0.58%

- SPY 661.82 Bullish 0.57%

- QQQ 595.97 Bullish 0.41%

- NVDA 178.19 Bullish 0.28%

- GOOG 247.18 Bullish 0.25%

- USO 77.02 Bullish 0.04%

- TLT 88.90 Bearish -0.09%

- IBIT 61.94 Bearish -0.26%

- AAPL 255.46 Bearish -0.55%

- META 743.75 Bearish -0.69%

Market Summary: ETF Stocks

The major U.S. ETF indexes are largely holding bullish momentum, with all tracked funds in positive territory for the session, except for longer-duration bonds and crypto-linked products. The S&P 500 ETF (SPY +0.57%), Nasdaq 100 ETF (QQQ +0.41%), and Dow Jones ETF (DIA +0.62%) are all gaining. The small-cap (IWM +0.86%) and mid-cap (IJH +1.02%) ETFs are showing notable strength, leading relative performance.

Among sector ETFs, Gold (GLD +0.58%) is maintaining its upward bias, while Oil (USO +0.04%) is relatively flat. Treasury Bonds (TLT -0.09%) and Bitcoin ETF (IBIT -0.26%) are both trading lower, signaling defensive and risk assets remain under some pressure.

Market Summary: Magnificent 7 (Mag7)

Sentiment in the Mag7 is mixed this session. Tesla (TSLA +4.02%) leads the group sharply higher, followed by Microsoft (MSFT +0.87%), Amazon (AMZN +0.75%), Nvidia (NVDA +0.28%), and Google (GOOG +0.25%). On the downside, Apple (AAPL -0.55%) and Meta Platforms (META -0.69%) are seeing modest pullbacks, tempering the group’s overall bullish bias.

Market Summary: Other Key ETFs

- TLT (Treasury Bonds): -0.09%, Bearish — Continues to reflect pressure in longer-dated U.S. Treasuries.

- GLD (Gold): +0.58%, Bullish — Modestly higher as a safe-haven asset.

- USO (Oil): +0.04%, Bullish — Flat to slightly higher, little momentum.

- IBIT (Bitcoin ETF): -0.26%, Bearish — Trading lower, mirroring cautious crypto sentiment.

Overall State of Play

The session is dominated by bullish trends across most major ETFs and large-cap tech leaders, with risk-on sentiment in equities and precious metals, while select large-cap tech and defensive/risk assets (AAPL, META, TLT, and IBIT) display a more defensive or consolidative tone. Market participants are tracking continued rotation and sector leadership as the session unfolds.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-09-29: 07:16 CT.

US Indices Futures

- ES Rallying above all session fib grids, all pivot highs being surpassed, major support 6360.15, strong uptrend, all MAs sloping up, new highs, trend continuation pattern.

- NQ All-time highs, YSFG, MSFG, WSFG trending upward, recent pivots confirm uptrend, support at 22047.86, above NTZ/F0% levels, MAs rising, momentum phase, intermediate and long-term bullish.

- YM Above weekly/monthly/yearly NTZ, all MAs rising, swing high 47055, support layered 46014+, short/intermediate pivots up, strong trend continuation, resistance being tested, momentum strong.

- EMD Above YSFG, MSFG, WSFG NTZs, swing pivot high 3342.2, key support 3243.1, all major MAs up, trend continuation, long-term and intermediate bull trend, short-term consolidation.

- RTY Short-term rally above NTZ, resistance 2510.3/2555.5, support 2427.3, intermediate consolidation, all MAs trending up on higher TFs, recent short-term neutral, long-term bullish structure.

- FDAX Short/intermediate below NTZs, swing high 24,089, key support 23,419, short/intermediate MAs down, corrective phase, long-term above YSFG/200MA, bullish structure intact on HTF.

Overall State

- Short-Term: Bullish to Neutral (ES, NQ neutral, YM, EMD neutral, RTY neutral, FDAX bearish)

- Intermediate-Term: Bullish (major US indices), Neutral (RTY, FDAX)

- Long-Term: Bullish (all covered indices)

Conclusion

US Indices Futures (ES, NQ, YM, EMD, RTY) remain in established uptrends on HTF, trading above YSFG, MSFG, WSFG NTZ benchmarks. ES, YM exhibit strong upside momentum; NQ, EMD, RTY show short-term consolidation but maintain intermediate/long-term strength. All major MAs trend upwards for US indices, with recent highs and supports well-defined. FDAX is correcting below session grid NTZs, with short/intermediate-term weakness, but its long-term upstructure persists above key yearly benchmarks and 200MA. Directional correlation remains high among US indices, with no major exhaustion or reversals apparent in the current session structure.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

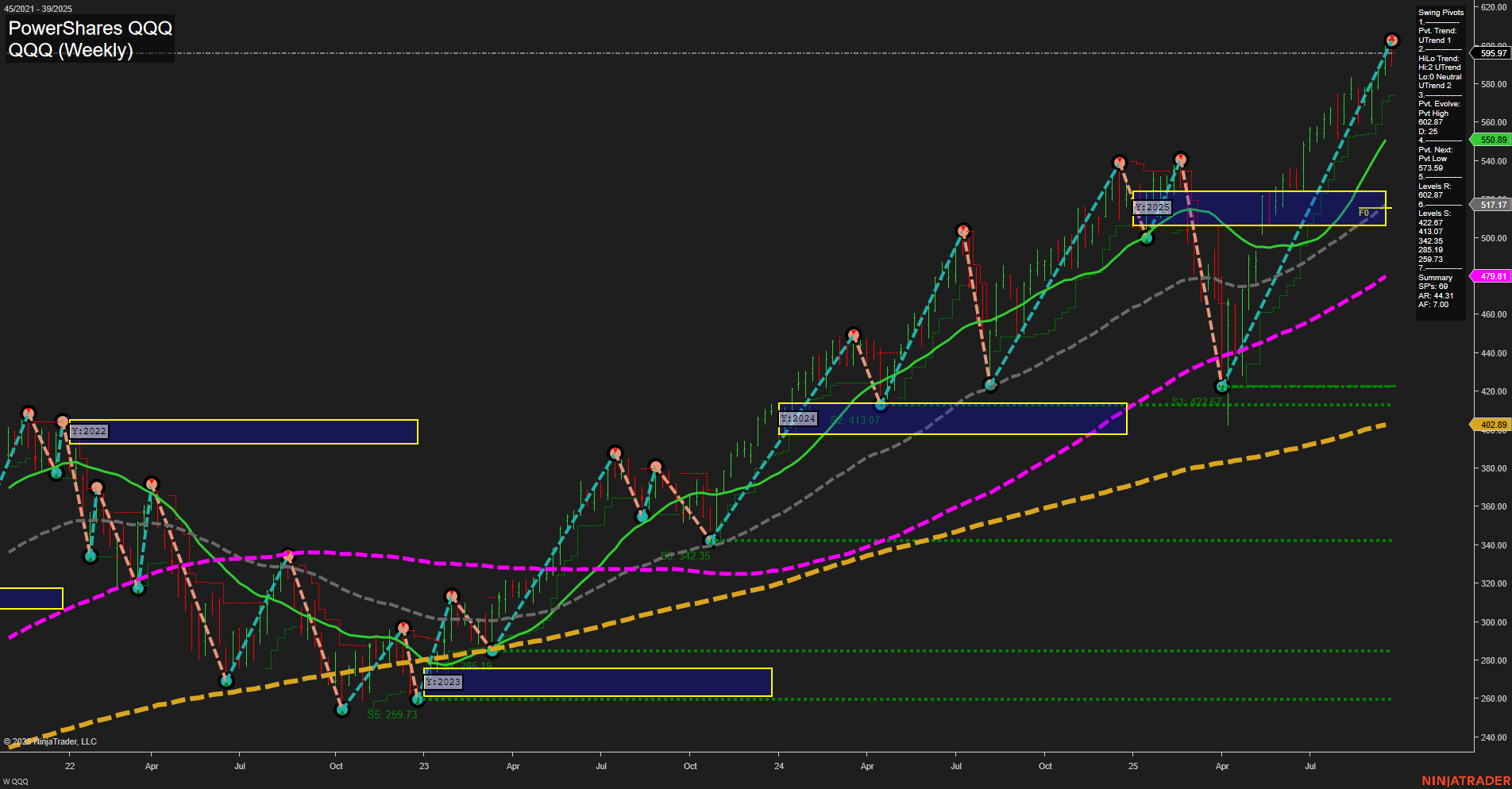

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts