Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

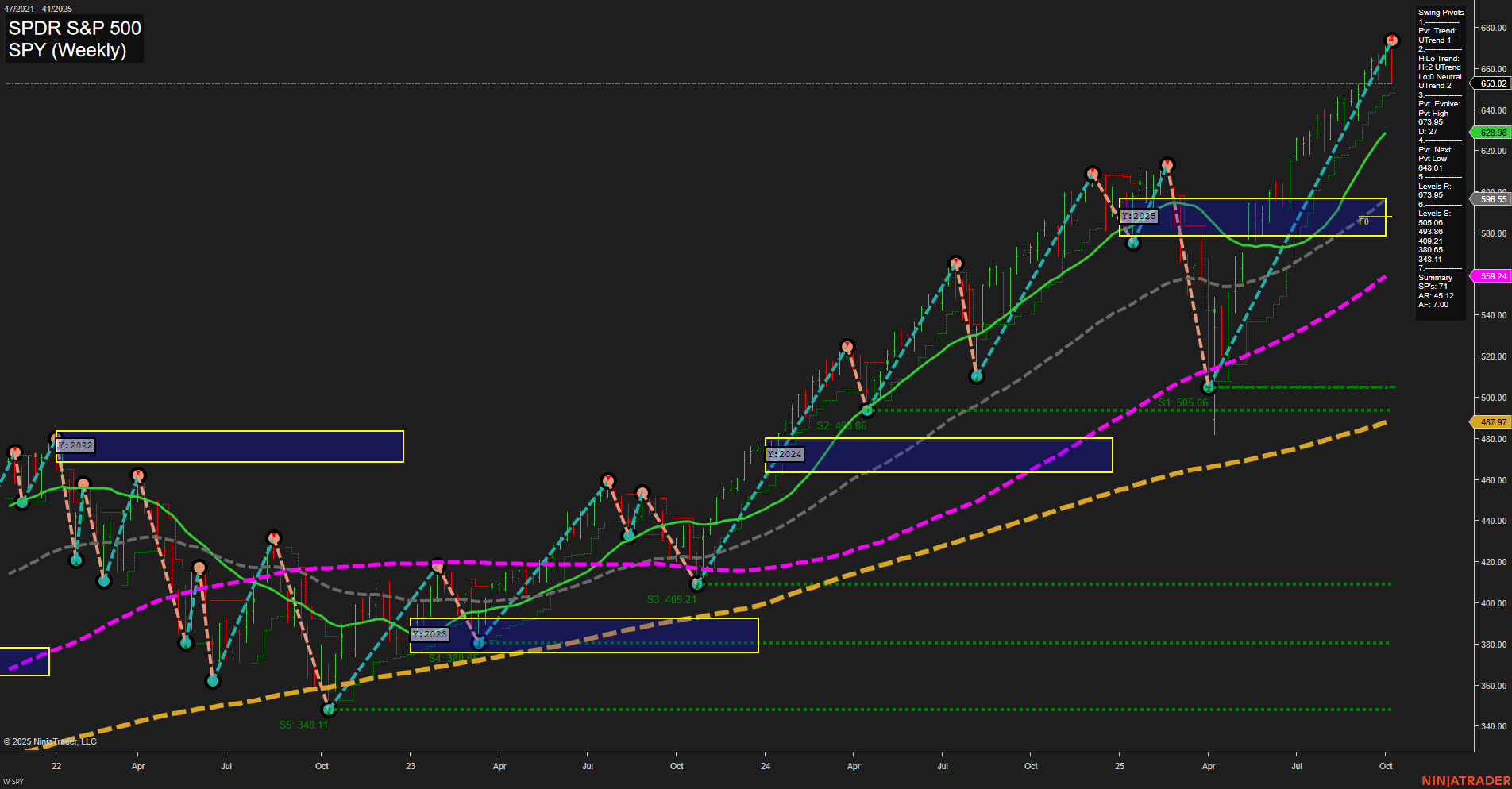

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- MS Release: 2025-10-15 T:BMO

- BAC Release: 2025-10-15 T:BMO

- C Release: 2025-10-14 T:BMO

- GS Release: 2025-10-14 T:BMO

- WFC Release: 2025-10-14 T:BMO

- JPM Release: 2025-10-14 T:BMO

Looking ahead to the week of October 14, 2025, indices futures traders should be aware that the major U.S. banks—JPMorgan Chase (JPM), Wells Fargo (WFC), Citigroup (C), and Goldman Sachs (GS)—are set to release earnings before market open on Tuesday, followed by Morgan Stanley (MS) and Bank of America (BAC) on Wednesday morning. These releases will be closely watched for signals on credit quality, loan growth, and broader economic sentiment. Historically, earnings from the banking sector set the early tone for S&P 500 and Dow futures trading, with heightened sensitivity to any commentary about consumer health and corporate lending trends. In the days leading up to these reports, futures markets may experience lighter volume and tighter ranges as participants await clarity. This cautious stance is further amplified by anticipation around upcoming NVDA earnings and broader ‘MAG7’/AI tech news, which tend to be major sentiment drivers for the Nasdaq and S&P. Expect the pre-release period to be characterized by consolidation and reduced directional conviction until the earnings data is fully digested.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Tuesday 12:20 – Fed Chair Powell Speaks (High Impact): Powell’s remarks are closely watched for any signals on rate policy, inflation outlook, or economic risks. Markets may experience elevated volatility and rapid futures repricing.

- Thursday 08:33 – Core PPI m/m, Core Retail Sales m/m, PPI m/m, Retail Sales m/m, Unemployment Claims (All High Impact): This concentration of top-tier US macro releases in a single time window can trigger abrupt moves in major index futures. Hotter-than-expected inflation or strong retail sales may raise concerns for hawkish Fed action, while soft numbers may spark optimism for a dovish pivot.

EcoNews Conclusion

- Day traders should expect increased volatility surrounding Tuesday’s Powell speech and Thursday’s economic data cluster at 8:33am ET, as both are likely to set directional tone for US index futures.

- Market momentum and volume may slow in the days leading up to these high-impact events as traders anticipate potential regime shifts.

For full details visit: Forex Factory EcoNews

Market News Summary

- Oil: Crude futures dropped sharply due to renewed U.S.-China tariffs, softening global demand expectations, and technical breaks below key levels. Further declines are forecast as supply increases and chart support is lost.

- Stocks & Indices: S&P 500 futures and ETFs faced a significant reversal after tariff announcements. Technical signals and volatility patterns resemble previous major corrections, with the index under pressure and at risk of further selling. The government shutdown and uncertainty over earnings season add to market nerves.

- Consumer & Market Sentiment: University of Michigan survey reveals steady U.S. consumer sentiment for October, but economists highlight underlying labor market concerns and expect future declines as shutdown effects filter in.

- Earnings Calendar: The upcoming earnings season, especially big bank results, is in focus as a source of potential market stabilization or further volatility.

- Gold: Gold extended its rally amid heightened geopolitical, inflation, and recession fears. Options strategies such as “collars” on gold ETFs are noted as ways to protect gains. Trade headlines and central bank commentary are anticipated as short-term drivers.

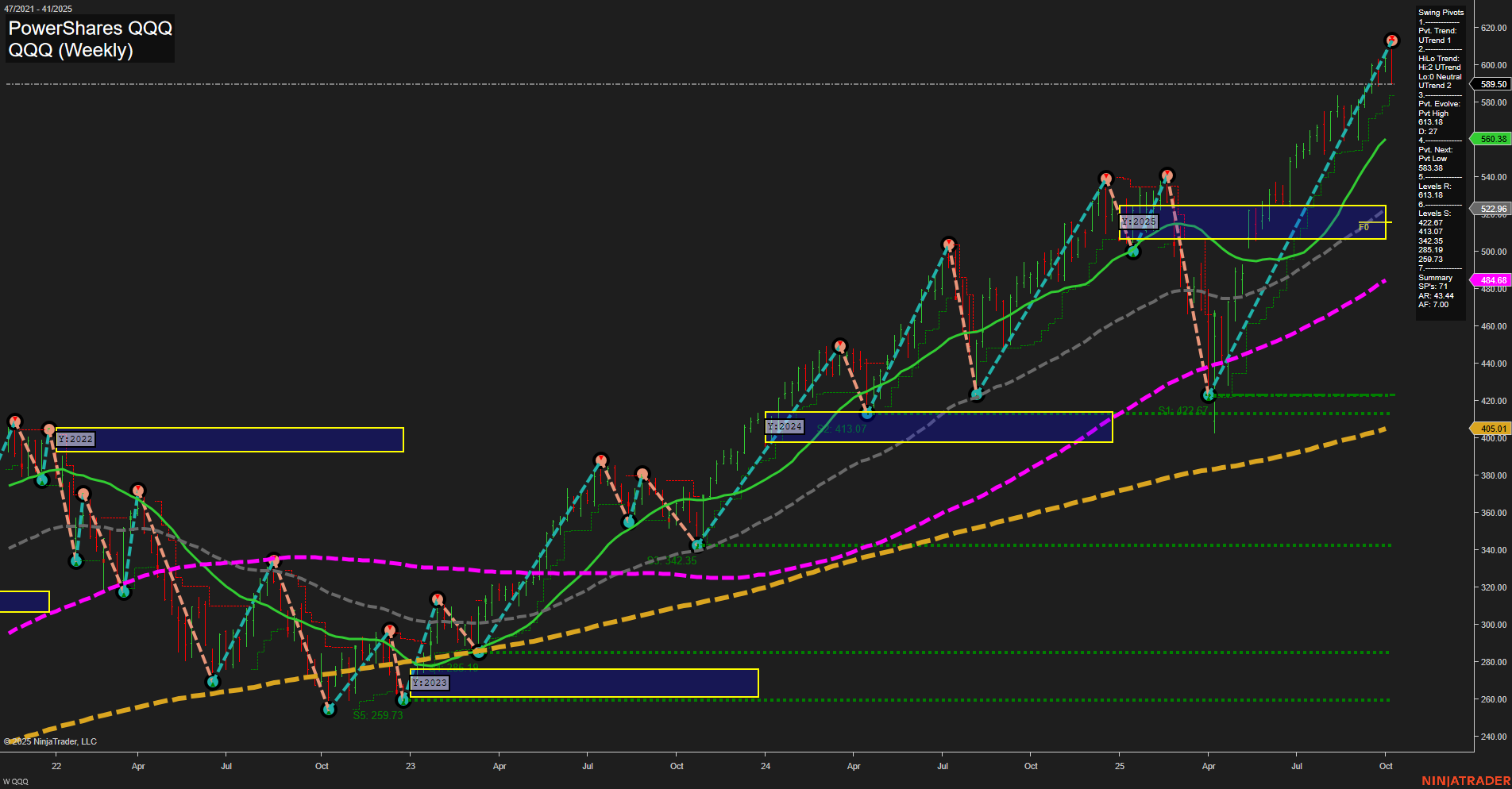

- ETFs: Megacap technology stocks have propelled significant outperformance in major growth ETFs, positioning funds like VUG and QQQ for potential continued leadership over the broader S&P 500 into the next year.

- General Market Tone: Volatility is historically low despite sharp index declines. Market commentary notes frothy conditions, comparisons to previous bubble environments, and the risk of deeper corrections.

News Conclusion

- Recent market turbulence has stemmed from renewed trade tensions, technical breakdowns, and a volatile macro backdrop. Oil and equities are under pressure, while gold is seeing safe-haven demand.

- Earnings season and continued central bank and trade policy developments will remain influential for index futures and major ETFs in the short term.

- Markets are exhibiting characteristics associated with past corrections, including stretched volatility and increased sensitivity to policy headlines.

- Opportunities and risks are elevated across asset classes, with divergent sentiment between sectors like tech and commodities, and caution flagged in general commentary.

Market News Sentiment:

Market News Articles: 9

- Negative: 44.44%

- Neutral: 44.44%

- Positive: 11.11%

GLD,Gold Articles: 4

- Negative: 50.00%

- Positive: 25.00%

- Neutral: 25.00%

USO,Oil Articles: 2

- Negative: 100.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: October 12, 2025 06:15

- TLT 90.62 Bullish 1.61%

- GLD 369.12 Bullish 1.01%

- DIA 454.87 Bearish -1.86%

- GOOG 237.49 Bearish -1.95%

- MSFT 510.96 Bearish -2.19%

- SPY 653.02 Bearish -2.70%

- IJH 63.25 Bearish -2.83%

- IWM 237.79 Bearish -2.99%

- AAPL 245.27 Bearish -3.45%

- QQQ 589.50 Bearish -3.47%

- IBIT 66.20 Bearish -3.70%

- META 705.30 Bearish -3.85%

- USO 69.39 Bearish -4.30%

- NVDA 183.16 Bearish -4.89%

- AMZN 216.37 Bearish -4.99%

- TSLA 413.49 Bearish -5.06%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-10-12: 18:15 CT.

US Indices Futures

- ES Short- and long-term bullish (YSFG, WSFG rising), MSFG downtrend, new swing high 6812.25, nearest support 6540–6557, above key resistance, intermediate-term signals mixed.

- NQ Weekly structure bullish (YSFG, WSFG up), MSFG downtrend, new highs, short-term short signal, support at 24116, resistance at 25394, long-term moving averages rising.

- YM Long-term bullish (YSFG, MA benchmarks up), MSFG negative, short-term neutral, weekly swing pivots show consolidation, resistance near highs, support at 43817, 42427, volatility elevated.

- EMD Bearish short- and intermediate-term (below YSFG/MSFG), swing pivots down, key support 3140, further at 3096, resistance stacking above, long-term neutral, persistent downside momentum.

- RTY Weekly uptrend (YSFG rising), MSFG/price below NTZ, short-term neutral, intermediate-term bearish, swing high at 2518, support 2381, 2253, structure at critical juncture.

- FDAX Strong intermediate and long-term uptrend (YSFG/MSFG up), short-term bearish, WSFG down, swing high 24319 (weekly) / 24891 (daily), support at 24160/24043, above major NTZ/fib grid levels.

Overall State

- Short-Term: Bearish to Neutral

- Intermediate-Term: Bearish to Neutral

- Long-Term: Bullish (all indices except EMD daily: bearish)

Conclusion

US Indices Futures are experiencing short-term and intermediate-term downside momentum, reflected in bearish MSFG and WSFG readings, increased volatility, and recent short signals. Price action has tested or broken below key monthly/weekly fib grid NTZs across ES, NQ, YM, EMD, RTY, and FDAX. Swing pivots confirm lower highs/lows in short-term, while long-term structures remain supported by rising YSFGs and primary benchmarks (100–200 MA) for ES, NQ, YM, RTY, and FDAX. EMD exhibits the weakest long-term structure. All markets are within corrective phases, with major support levels in focus and the underlying uptrend maintained on higher timeframes—especially if key yearly or long-term supports hold. Short-term pullbacks are ongoing, with broader bullish structure intact unless long-term pivots or supports break. Directional correlations show equity indices aligned in the corrective phase, with FDAX strength lagging only in short-term.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts