Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- MCHP Release: 2025-11-06 T:AMC

Microchip Technology (MCHP) reported earnings after the close on November 6, 2025, with results largely in line with expectations. While the company’s outlook and sector performance didn’t trigger outsized moves, the broader futures and indices space saw a slight moderation in momentum and trading volume ahead of upcoming major tech earnings—particularly from NVDA and the MAG7 group. This reflects typical market behavior, as traders and investors often pull back in anticipation of potential market-moving news from high-profile AI and technology names. Until these key releases occur, index price action may remain more subdued, with participants awaiting clearer direction from sector leaders.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

No monitored EcoNews market events.

For full details visit: Forex Factory EcoNews

Market News Summary

- Covered Call ETFs: Growing interest in covered call ETFs for generating portfolio income is noted, with benefits seen as outweighing flaws.

- Oil Market: Downward pressure on oil continues as US output and inventories stay high. OPEC+ cuts and Chinese demand have not offset these bearish factors.

- Precious Metals: Widening divergence between gold and platinum reflects rising macro uncertainty, with gold benefiting from risk aversion and platinum trending lower due to weak industrial activity.

- Gold Forecast: Gold’s next move could be driven by the US government shutdown and possible Fed reaction to weak labor data, presenting volatility risk.

- S&P 500 Caution: Several market red flags are highlighted for equities, with risk management discussions intensifying after rallying in major tech and AI names.

- Shutdown Impact: Some executive management teams are expressing heightened concern over the ongoing US government shutdown, reflected in more cautious corporate guidance.

- Duration Risk: The current interest rate and inflation environment suggests limited appeal for long duration fixed income strategies, with macro uncertainty persisting.

- GDP Warning: The White House signals that a protracted government shutdown could result in negative US GDP for Q4.

- Market Momentum Shift: Stock market gains and broad risk asset rallies appear to be slowing, with focus shifting to tech and speculative segments following a weak week for the Nasdaq.

- 13F Filings & Earnings: Upcoming 13F filings will provide insight on hedge fund and institutional positioning after most S&P 500 firms have reported better-than-expected earnings but offered cautious outlooks.

- S&P 500 Technical View: A recent 4% market correction is being characterized as orderly by some, with the current pullback seen as less severe than recent negative sentiment implies.

News Conclusion

- Overall, recent headlines highlight a cautious macro and risk backdrop—with continuing concerns about government shutdowns, weak global demand, and diverging asset performance. Market participants are closely watching policy developments, especially relating to the Fed and fiscal matters.

- Equity markets have experienced heightened volatility and increased defensive sentiment. Earnings results are mostly beating expectations, but forward guidance remains conservative.

- Markets for oil and long duration bonds reflect ongoing caution, while the divergence in precious metals signals persistent investor nerves amid macro uncertainty.

Market News Sentiment:

Market News Articles: 7

- Negative: 71.43%

- Neutral: 14.29%

- Positive: 14.29%

GLD,Gold Articles: 3

- Negative: 66.67%

- Positive: 33.33%

USO,Oil Articles: 1

- Negative: 100.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: November 9, 2025 06:15

- IBIT 58.88 Bullish 2.83%

- IJH 64.93 Bullish 1.20%

- GLD 368.31 Bullish 0.61%

- AMZN 244.41 Bullish 0.56%

- USO 71.26 Bullish 0.54%

- IWM 241.61 Bullish 0.52%

- META 621.71 Bullish 0.45%

- DIA 469.86 Bullish 0.12%

- SPY 670.97 Bullish 0.10%

- NVDA 188.15 Bullish 0.04%

- MSFT 496.82 Bearish -0.06%

- TLT 89.57 Bearish -0.21%

- QQQ 609.74 Bearish -0.32%

- AAPL 268.47 Bearish -0.48%

- GOOG 279.70 Bearish -1.98%

- TSLA 429.52 Bearish -3.68%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-11-09: 18:15 CT.

US Indices Futures

- ES Short-term downtrend, intermediate/long-term bullish, above YSFG/MSFG/WSFG NTZs, lower highs, testing support near 6055, resistances 6963.75, all major MA’s upward, corrective phase within uptrend.

- NQ Short-term neutral, intermediate/long-term bullish, above all Fib grid levels, short-term pullback in uptrend, support 24,701.25, resistance 26,399, all weekly/daily MAs upward, volatility elevated.

- YM Data unavailable for current analysis.

- EMD Short/intermediate-term bearish, long-term bullish, below MSFG NTZ, above YSFG, resistance 3352–3523, support 3110/2881, downward swing pivots, corrective move within larger uptrend.

- RTY Weekly bullish all timeframes, above all fib grids, new high 2566.5, support 2371.5, strong trend in MAs; daily short/intermediate-term bearish, long-term bullish, new swing low 2435.9, resistance 2484.6.

- FDAX Short/intermediate-term bearish, long-term bullish, below WSFG/MSFG NTZ, above YSFG, support 23,419, resistance 24,891/24,498, all major long-term MAs trend up, corrective/consolidation phase within uptrend.

Overall State

- Short-Term: Bearish to Neutral across most indices

- Intermediate-Term: Predominantly Bullish, except EMD, FDAX (Bearish)

- Long-Term: Bullish across all indices

Conclusion

US Indices Futures, led by ES, NQ, and RTY, maintain long-term bullish structures with price consistently above key YSFG/MSFG/WSFG levels and major moving averages in uptrends. Most indices exhibit short-term corrections or consolidations, as reflected in swing pivot downtrends and recent retracements toward support. EMD and FDAX are in intermediate-term bearish phases but retain bullish long-term context. Technical benchmarks, volatility measures, and session fib grid positions collectively suggest ongoing HTF uptrends interrupted by near-term corrective activity, with major support and resistance zones established via recent pivots. Directional correlations align with a typical corrective phase within persistent higher timeframe uptrends.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

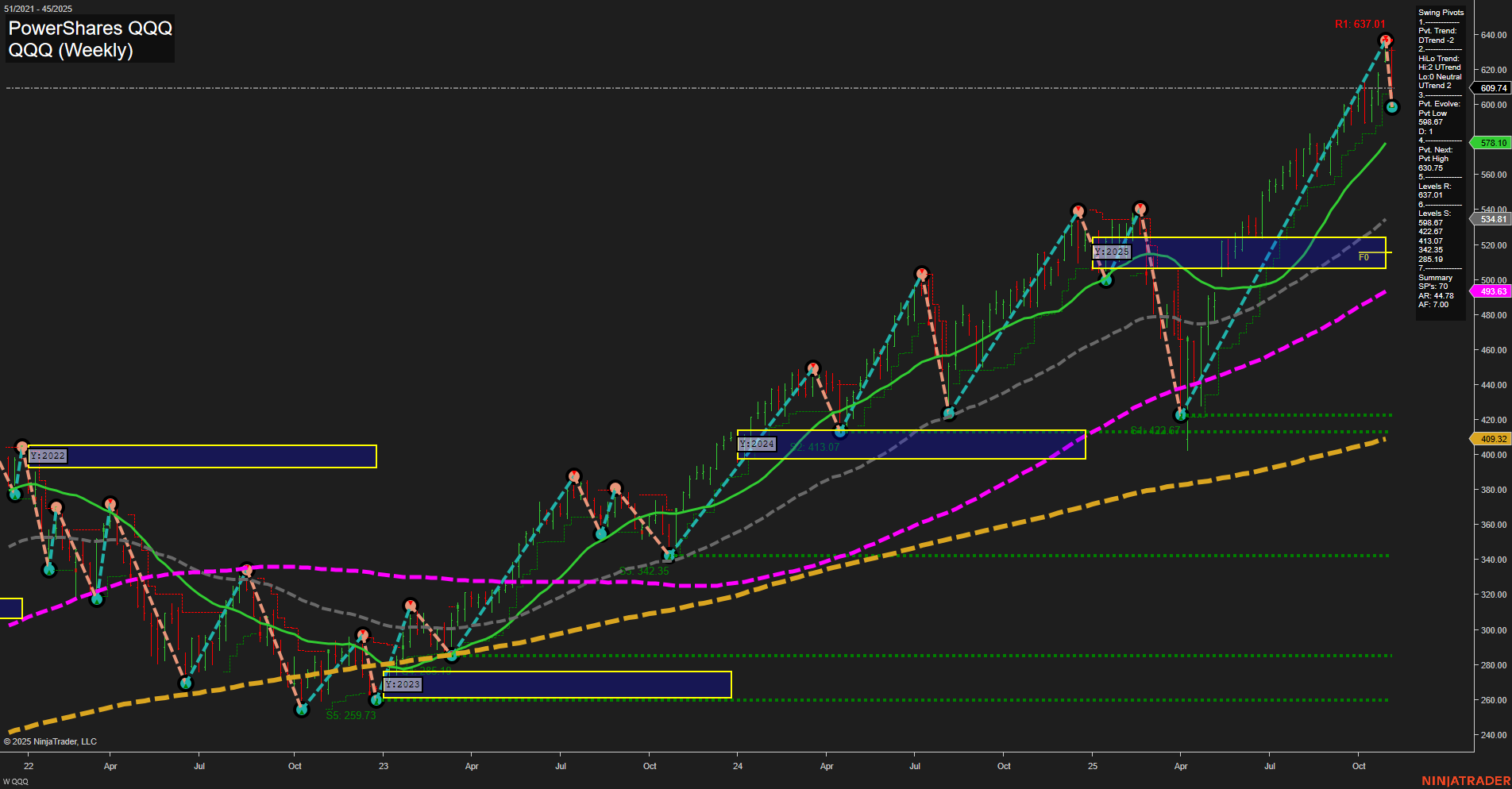

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts