Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

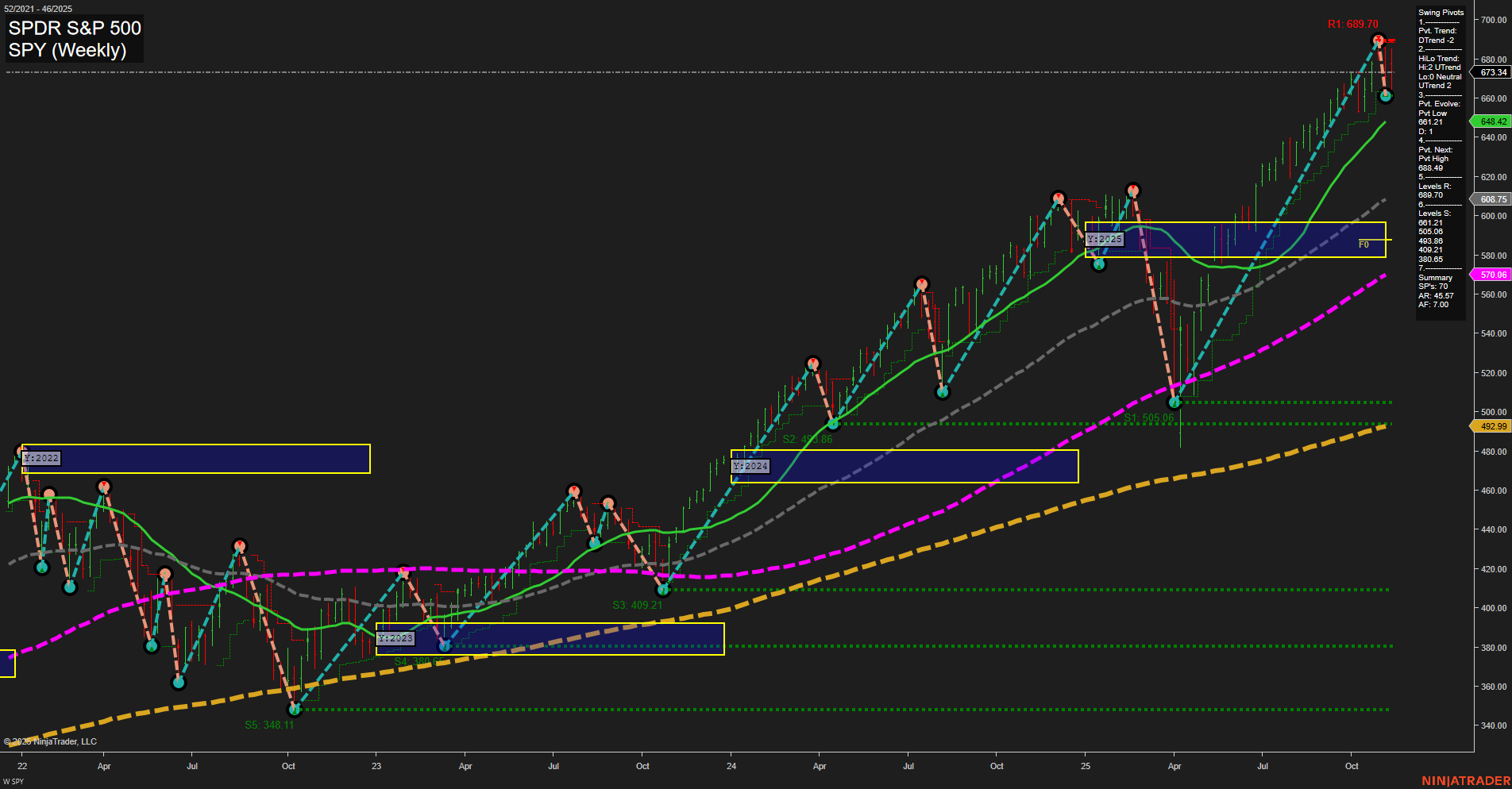

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- NVDA Release: 2025-11-19 T:AMC

With NVIDIA (NVDA) set to report earnings after market close on November 19, 2025, futures traders should note that broader index momentum and volume often decelerate in the lead-up to major tech earnings, particularly those involving NVDA—now a bellwether for the MAG7 and AI-driven market themes. Anticipation around NVDA’s results typically induces a “wait-and-see” stance across S&P 500 and Nasdaq futures, as market participants gauge potential impacts on the tech sector and related indices. Price moves may remain muted or range-bound until the release, with increased attention on NVDA’s forward guidance and AI segment performance, as these frequently set the tone for broader sentiment and volatility across the major indices, especially given the weighting and influence of MAG7 and AI-related stocks in index composition.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

Wednesday

- 10:30 – USD Crude Oil Inventories (Medium Impact – Oil)

Oil inventory data may influence overall sentiment in equities, as shifts in oil supply affect input costs, inflation expectations, and energy sector performance. - 14:00 – USD FOMC Meeting Minutes (High Impact)

Detailed Fed meeting minutes can significantly sway indices futures as they provide insight into policymakers’ stance on inflation, rates, and economic outlook; increased market volatility is common around their release.

Thursday

- 08:30 – USD Average Hourly Earnings m/m (High Impact)

Wage growth data is closely watched for inflationary pressures; above- or below-expectation prints can quickly impact indices pricing due to implications for Fed policy. - 08:30 – USD Non-Farm Employment Change (High Impact)

The NFP report is a primary labor market gauge; surprise readings tend to trigger sharp and sustained moves in futures. - 08:30 – USD Unemployment Rate (High Impact)

Unemployment readings paired with NFP can alter fed policy expectations and market sentiment. - 08:30 – USD Unemployment Claims (High Impact)

Often supportive for near-term trend confirmation when viewed with the other Thursday labor indicators.

EcoNews Conclusion

- Wednesday’s FOMC Minutes is the key event for policy outlook insight and is expected to raise volatility and impact the session’s direction.

- Thursday is highly concentrated with labor market data (NFP, Unemployment Rate, Average Hourly Earnings, and Claims) expected to trigger significant index futures movement at 8:30 AM.

- Crude Oil Inventories midweek may influence the broader market, especially if there is a notable price response. Any spike in oil prices could elevate inflation concerns and weigh on index futures.

- Expect market momentum and volume to moderate ahead of the FOMC Minutes and Thursday’s major labor data.

- Pay attention to moves around both the 8:30 AM and 10:00 AM cycles as catalysts for reversals or continuations in index futures.

For full details visit: Forex Factory EcoNews

Market News Summary

- Gold: Gold prices have stalled below $4245.20 as traders watch if the $4133.95 support holds. Despite recent volatility from tightening liquidity, rising yields, and weak freight data, gold maintains a bullish structure supported by seasonality and momentum. Gold returns in 2025 outpace the S&P 500, but investors face higher capital gains taxes on strong gains.

- Oil: Crude oil is approaching its 52-week moving average with market participants weighing demand optimism against ongoing supply and inventory concerns. Major producers such as Chevron and Exxon intend to boost production regardless of falling prices, reflecting a long-term outlook.

- ETFs: ETFs remain popular, but there is a notable risk in covered call ETFs heavily exposed to AI-linked indices like QQQ and SPY, as stretched valuations could prompt correction risks. Nonetheless, some market participants believe that both passive and active investors can find value in ETFs.

- Stock Market & Indices: The S&P 500 maintains a bullish trend, with recent volatility viewed by some as a temporary shakeout, not a new bearish phase. Concerns about AI-driven stock valuations and concentration continue, yet major indices are near all-time highs. Large investors like Berkshire Hathaway have taken new stakes in major tech, signaling confidence among institutional players.

- Economic Sentiment & Fed News: While over 60% of Americans are financially comfortable, a significant portion remain pessimistic about the broader economic outlook. Investors await delayed economic data releases, raising uncertainty. There are ongoing discussions about the Federal Reserve’s performance and meetings concerning key lending facilities with Wall Street primary dealers.

News Conclusion

- Gold markets are at a pivotal level with both technical and liquidity factors creating volatility, but long-term momentum remains supportive.

- Oil prices are influenced by developments at the 52-week moving average and diverging expectations between demand and supply from leading producers.

- ETFs continue to play a significant role in portfolios, though concentration risks, especially in AI-related sectors, have increased, drawing attention to the potential for corrections.

- The S&P 500 shows resilience despite short-term volatility and sector rotations, with institutional investors sustaining interest in leading tech names.

- Economic and policy uncertainties persist, focusing attention on upcoming data releases and Federal Reserve actions, while consumer confidence shows a split between personal comfort and broader pessimism about future conditions.

Market News Sentiment:

Market News Articles: 6

- Neutral: 33.33%

- Negative: 33.33%

- Positive: 33.33%

GLD,Gold Articles: 4

- Negative: 50.00%

- Positive: 25.00%

- Neutral: 25.00%

USO,Oil Articles: 2

- Neutral: 100.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: November 16, 2025 06:15

- USO 71.38 Bullish 2.19%

- NVDA 190.17 Bullish 1.77%

- MSFT 510.18 Bullish 1.37%

- TSLA 404.35 Bullish 0.59%

- IWM 237.48 Bullish 0.29%

- QQQ 608.86 Bullish 0.08%

- SPY 671.93 Bearish -0.02%

- META 609.46 Bearish -0.07%

- AAPL 272.41 Bearish -0.20%

- IJH 64.20 Bearish -0.22%

- TLT 88.87 Bearish -0.57%

- DIA 471.80 Bearish -0.62%

- GOOG 276.98 Bearish -0.77%

- AMZN 234.69 Bearish -1.22%

- GLD 375.96 Bearish -1.80%

- IBIT 53.48 Bearish -3.80%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-11-16: 18:15 CT.

US Indices Futures

- ES Strong bullish structure on weekly (YSFG/MSFG/WSFG above NTZ, bullish pivots), daily in short/intermediate-term pullback (downtrends), long-term uptrend intact, support 6713.75, resistance 6953.75.

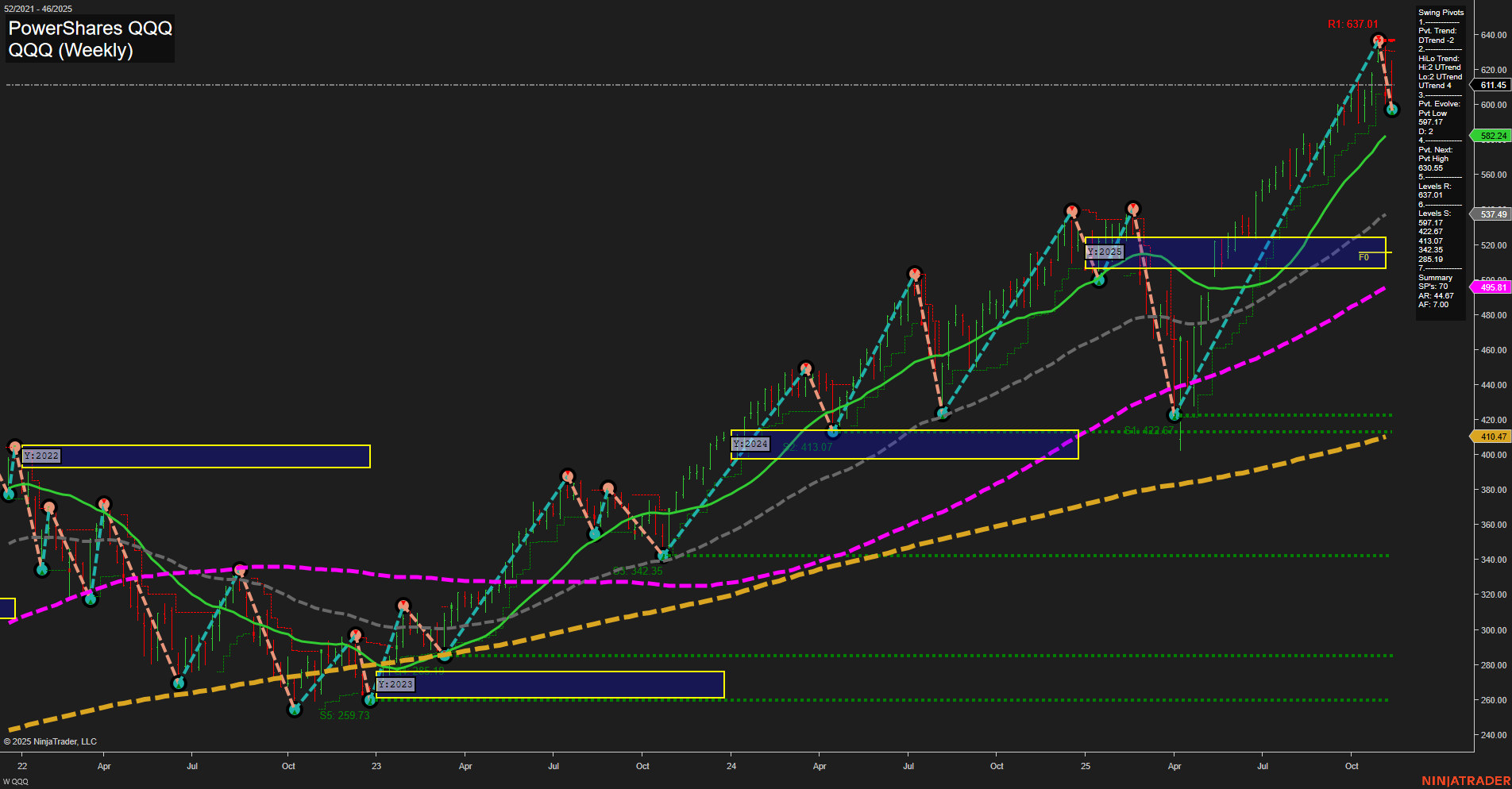

- NQ Long-term/intermediate uptrend (weekly YSFG/MA above NTZ), current short/intermediate-term downtrend (daily pivots/MA), resistance 26399.00, support 24202.00, volatility and consolidation ongoing.

- YM Data currently unavailable; no summary possible for YM futures.

- EMD Weekly chart bearish short/intermediate-term (WSFG/MSFG below NTZ, pivots down), daily all trends bearish (below F0%), long-term neutral above major MA, support 3149/3114.9, resistance 3325–3352.

- RTY Daily chart: bearish short/intermediate-term (below MSFG NTZ, pivots down), long-term bullish (above 100/200-MA), volatility elevated, resistance 2487.6/2450.4, support 2165.2/2128.8, weekly unavailable.

- FDAX Weekly consolidating (bearish short-term, intermediate neutral, long-term bullish on YSFG/MA), daily in bearish short/intermediate-term (below MSFG NTZ), long-term trend up (200-MA), support 23419, resistance 24891.

Overall State

- Short-Term: Bearish/Neutral (majority in pullback/corrective)

- Intermediate-Term: Bearish/Neutral (most in correction; ES/NQ long-term up)

- Long-Term: Bullish (all major indices structurally intact long-term uptrends)

Conclusion

HTF structure shows US indices in long-term bullish uptrends, as confirmed by YSFG, MSFG, and major moving averages. Most indices are in short- and intermediate-term corrective phases, with pivots and moving averages trending down on daily/weekly frames, and price action below intermediate SR levels/NTZ on MSFG and WSFG. Weekly ES and NQ remain above key long-term benchmarks and moving averages, with consolidations and pullbacks playing out within established uptrends. EMD and RTY exhibit sharper near-term retracements yet remain structurally anchored to long-term bullish benchmarks. FDAX is in a transitionary consolidation with underlying long-term strength. No immediate signs of HTF trend reversals, but current direction shows short/intermediate-term downside and high volatility across most contracts. Correlation is present between US indices futures in corrective retracement structure, while long-term bullish context remains, anchored by higher timeframe pivots and support/resistance benchmarks.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts