Market Roundup – NYSE After Market Close Bearish as of December 16, 2025 05:00 ct

After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

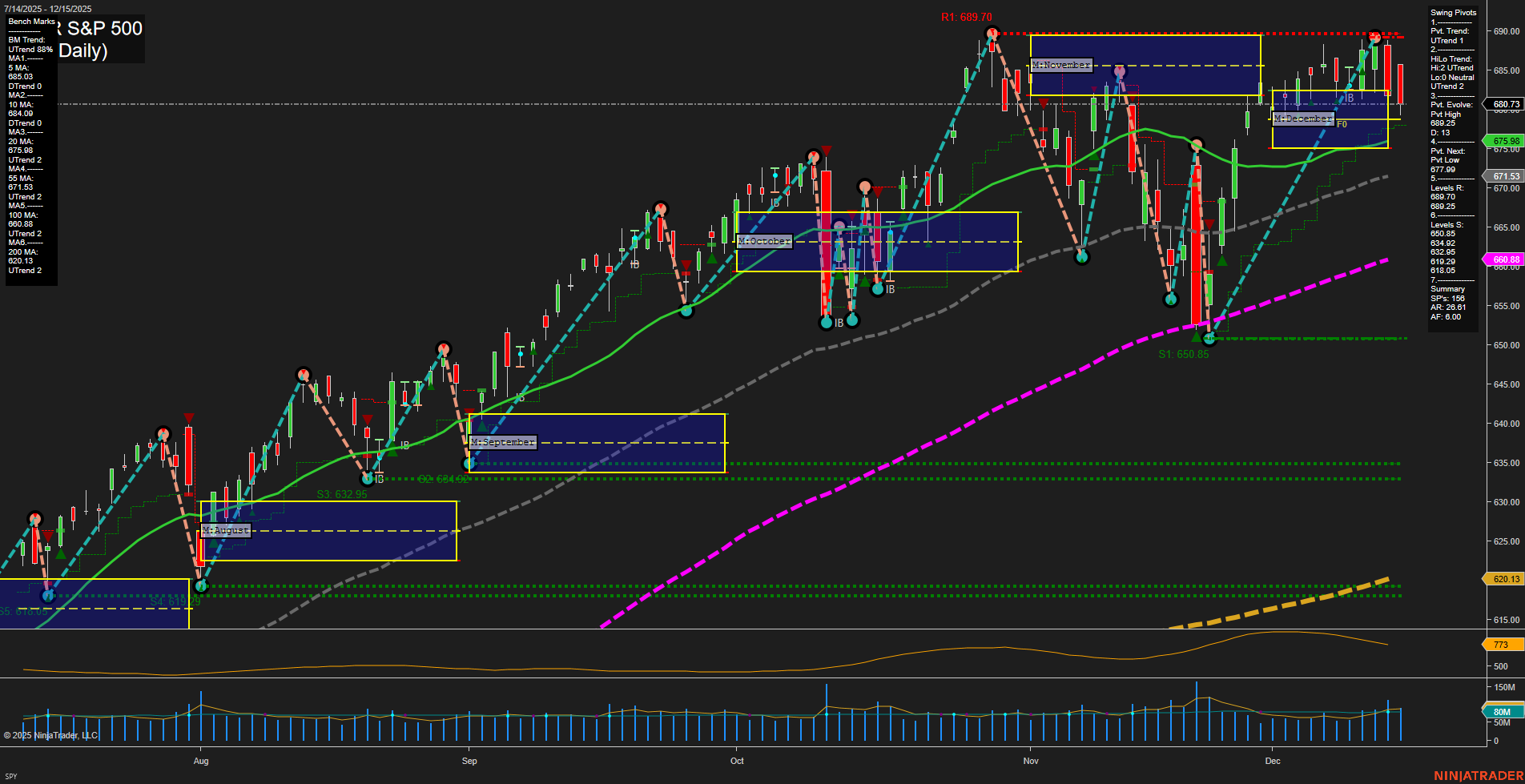

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Labor Markets: November’s U.S. payrolls grew 64,000 following a prior decline—less than forecasts—with unemployment rising to 4.6% and wage growth coming in below consensus. Upcoming and delayed reports highlight persistent employer caution and subdued hiring, partly amid policy and technology uncertainty. The job market’s sluggishness weighed on sentiment, and the Dow posted a 300-point drop as energy stocks lagged.

- Indices: Despite rotation out of large-cap tech, the S&P 500 remains resilient above 6,800, supported by defensive sectors. Bullish projections from Goldman Sachs and JPMorgan suggest potential for further earnings and index gains through 2026, contingent on Fed policy. Contrasting voices warn of stretched valuations in megacaps and underperformance in U.S. small-cap stocks.

- Commodities – Oil: Oil prices slid to $55 per barrel, reaching the lowest levels since 2021 amid rising supply and possible Russia-Ukraine peace progress. Energy sector pressure intensified as multiple analysts flagged excess supply as a driver. Some forecasts see potential for even lower crude prices in 2026.

- Commodities – Precious Metals: Silver doubled in 2025, reaching record highs above $62/oz, while gold saw strong performance and robust positioning above significant technical levels. However, some analysts caution the metals could be approaching the end of their bull runs, flagging the risk of a prolonged bear market ahead. Gold miner equities have outpaced the underlying metal.

- Sector & Macro Themes: Debate intensified over nearly 24-hour equity trading, citing market-structure risks. Calls emerged to diversify portfolios—including adding fixed income. There is growing discussion around bubbles in AI and housing, while AI investment and funding narratives remain prominent. European capital markets are seen as insufficiently deep, and the long-standing “US assets are safest” assumption is coming into question.

- Outlooks: 2026 market outlooks are divided—some investors foresee bullish conditions and strong sectoral growth, particularly where AI and cybersecurity are concerned. Others advise caution based on concentration in large tech stocks, potential rate policy shifts, and macroeconomic uncertainties.

News Conclusion

- U.S. equities are navigating a complex environment marked by uneven labor data, commodity price volatility, and sectoral rotation. Headline indices remain near highs, but undercurrents—such as elevated tech valuations, commodity weakness, and cautious employment trends—temper outright risk appetite.

- Divergent 2026 projections reflect both optimism from anticipated earnings growth and skepticism regarding market concentration and macro risks. Commodities, especially oil and precious metals, are experiencing heightened volatility and changing narratives.

- Traders face a period of market transition, with debates around liquidity, global capital flows, and evolving risk perceptions shaping near-term price action and sentiment.

Market News Sentiment:

Market News Articles: 52

- Negative: 36.54%

- Positive: 34.62%

- Neutral: 28.85%

GLD,Gold Articles: 15

- Neutral: 46.67%

- Positive: 33.33%

- Negative: 20.00%

USO,Oil Articles: 15

- Negative: 80.00%

- Neutral: 13.33%

- Positive: 6.67%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 16, 2025 05:00

- TSLA 489.88 Bullish 3.07%

- IBIT 49.71 Bullish 2.16%

- META 657.15 Bullish 1.49%

- NVDA 177.72 Bullish 0.81%

- TLT 87.88 Bullish 0.55%

- MSFT 476.39 Bullish 0.33%

- QQQ 611.75 Bullish 0.20%

- AAPL 274.61 Bullish 0.18%

- GLD 395.89 Bullish 0.02%

- AMZN 222.56 Bullish 0.01%

- SPY 678.87 Bearish -0.27%

- GOOG 307.73 Bearish -0.51%

- DIA 481.98 Bearish -0.66%

- IWM 249.90 Bearish -0.81%

- IJH 66.28 Bearish -1.15%

- USO 66.17 Bearish -2.53%

Market Summary: State of Play for Traders

ETF Stocks Overview

- SPY (S&P 500): 678.87 Bearish (-0.27%) — S&P 500 showing mild weakness, indicating hesitancy among broader large caps.

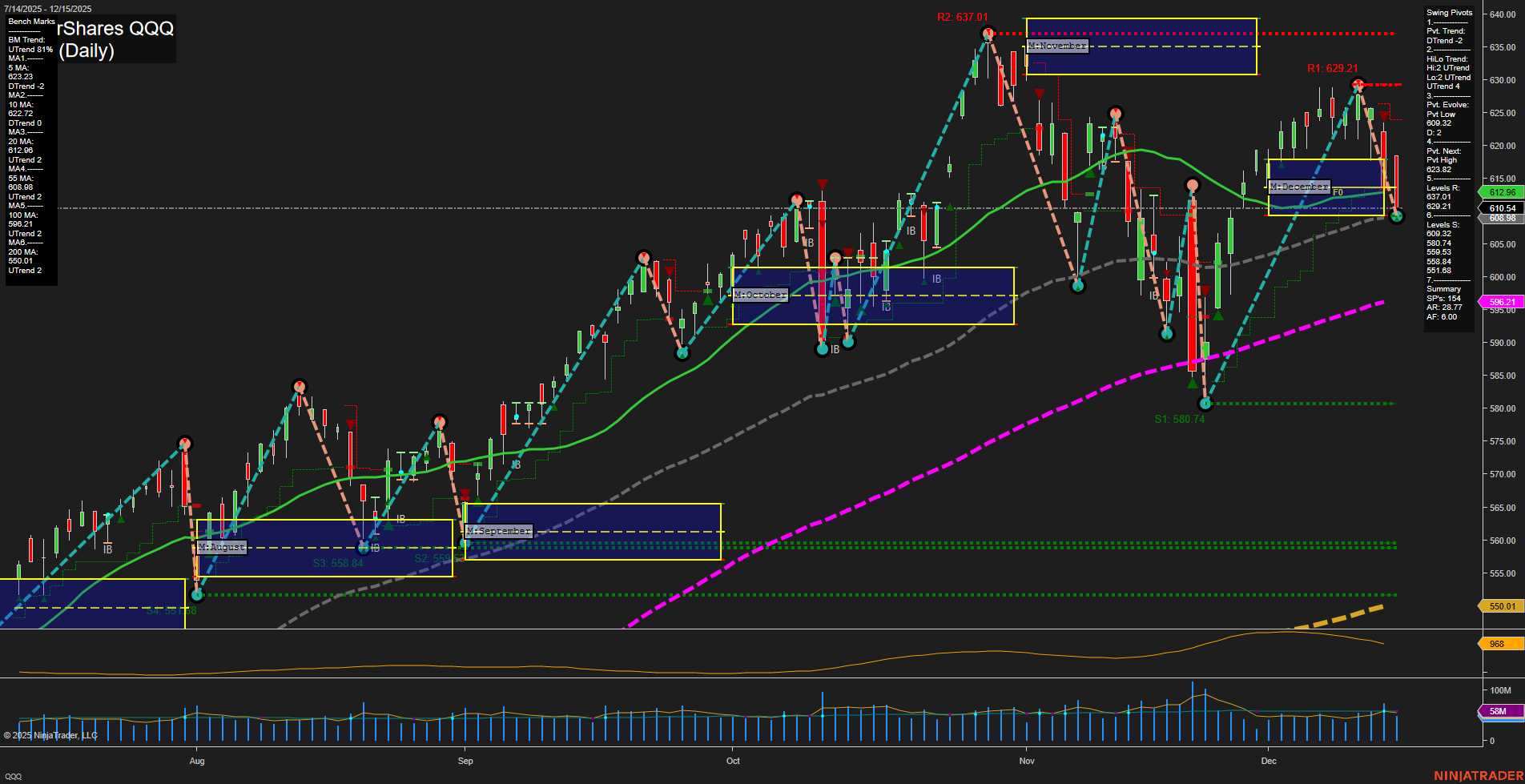

- QQQ (Nasdaq 100): 611.75 Bullish (+0.20%) — Tech-heavy Nasdaq ETF holding slightly positive on the session.

- IWM (Russell 2000): 249.90 Bearish (-0.81%) — Small caps continue to feel pressure.

- IJH (S&P MidCap 400): 66.28 Bearish (-1.15%) — Mid-cap stocks underperforming today.

- DIA (Dow Jones Industrials): 481.98 Bearish (-0.66%) — Blue-chip stocks are under a cloud with moderate declines.

MAG7: Mega Cap Technology Stocks

- AAPL (Apple): 274.61 Bullish (+0.18%) — A steady upward move, albeit modest.

- MSFT (Microsoft): 476.39 Bullish (+0.33%) — Continues its positive trend with incremental gains.

- GOOG (Alphabet): 307.73 Bearish (-0.51%) — Underperforming versus its megacap peers, slightly negative.

- AMZN (Amazon): 222.56 Bullish (+0.01%) — Little changed but holding the bullish bias.

- META (Meta): 657.15 Bullish (+1.49%) — Strong outperformance among tech heavyweights.

- NVDA (Nvidia): 177.72 Bullish (+0.81%) — Tech leadership on display today, continuing its upward momentum.

- TSLA (Tesla): 489.88 Bullish (+3.07%) — Leading the charge with notable gains and buyer interest.

Other ETFs

- TLT (20+ Year Treasury Bond): 87.88 Bullish (+0.55%) — Long bond ETF showing strength as yields soften.

- GLD (Gold): 395.89 Bullish (+0.02%) — Little changed; gold remains firm in risk environment.

- USO (United States Oil): 66.17 Bearish (-2.53%) — Energy weakness, sharp drop in oil prices today.

- IBIT (iShares Bitcoin ETF): 49.71 Bullish (+2.16%) — Crypto exposure is outperforming with a solid move higher.

Long/Short/Mixed Summary

- Bullish Momentum: MAG7 names (except GOOG), QQQ, TLT, GLD, IBIT leading with strong and moderate gains; focus on growth and tech-related plays.

- Bearish Action: Broader equities (SPY, DIA, IWM, IJH) and USO under pressure, reflecting weakness outside mega caps and growth assets.

- Mixed Dynamics: Despite weakness in major broad-market ETFs, select mega caps and related ETFs are driving positive sentiment.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts