After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

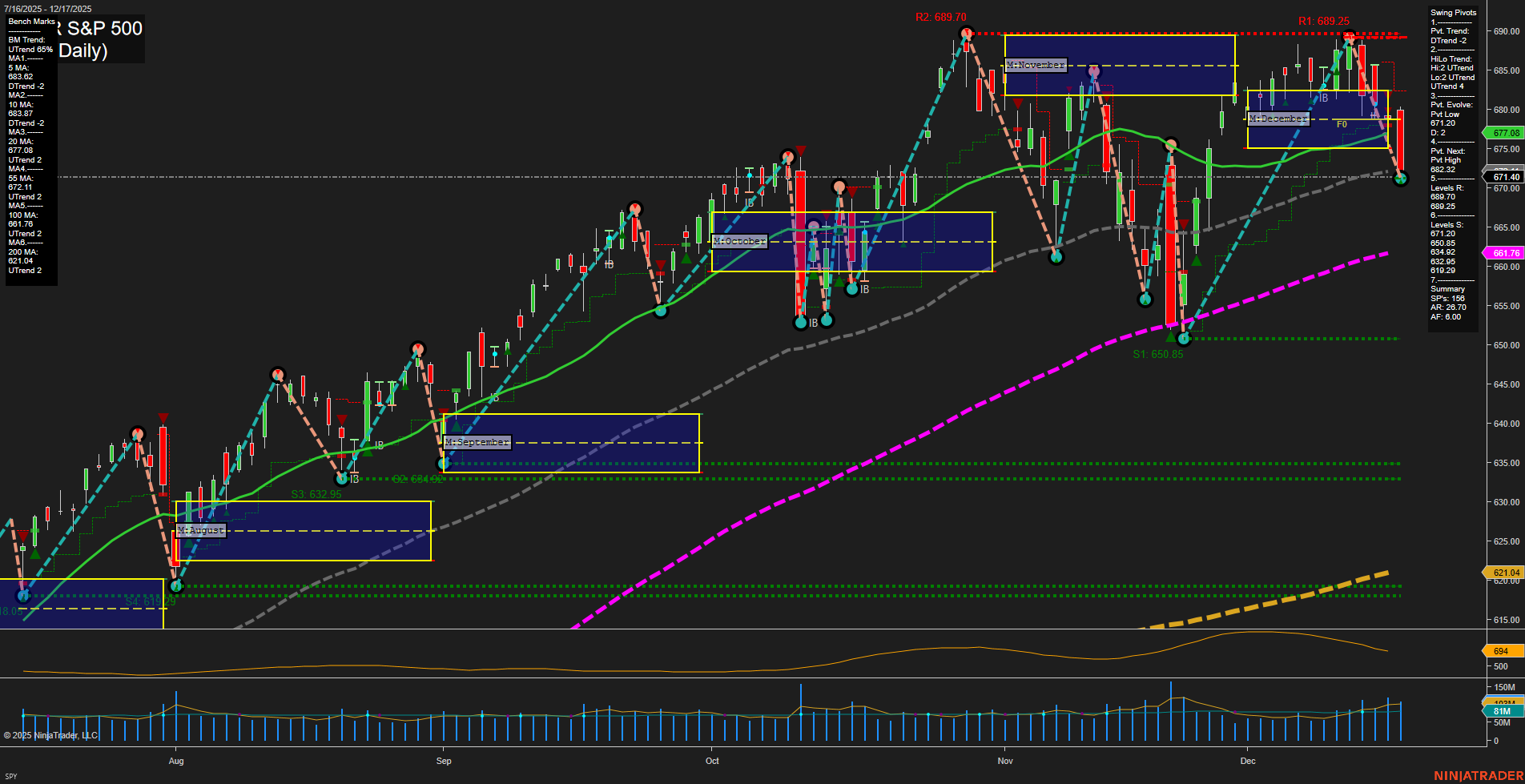

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- US major indices showed stabilization attempts: the NASDAQ 100 rallied on strong earnings, while the Dow Jones and S&P 500 hovered near technical levels. Sentiment across indices was boosted by a cooler-than-expected inflation report, driving a tech and semiconductor rally, especially in Micron Technology shares. Small-cap stocks outperformed relative to other sectors.

- Inflation Data: November’s CPI came in at 2.7% annually, below the 3.1% estimate. Despite some skepticism from economists regarding the delayed and methodologically adjusted report, equity markets responded positively, breaking recent losing streaks.

- Federal Reserve officials remained cautious on future rate cuts, emphasizing a ‘wait and see’ approach, with the Chicago Fed president seeking ‘sustained’ progress before supporting monetary easing.

- Option Expirations: An unusually large $7.1 trillion in notional options exposure is set to expire on Friday, indicating potential for increased volatility.

- Commodities: Gold prices spiked after the tame CPI data but faded from session highs as silver faced profit-taking. Crude oil prices also attempted a bounce but remained in a long-term downtrend due to supply pressures.

- Sector rotation may become prominent in 2026, with ongoing debate over the sustainability of AI-driven gains and a possible shift toward sectors with more stable cash flows.

- Other headlines: President Trump moved forward with rescheduling marijuana classification, and analysts maintain a constructive underlying trend for equities despite noted data uncertainties.

News Conclusion

- A softer inflation reading reinvigorated risk appetite, lifting tech shares and supporting a rebound in major US indices. Economic growth outlook appears cautiously optimistic, though skepticism persists regarding the robustness and accuracy of the recent inflation data.

- Upcoming major options expirations could introduce sharp moves into index and futures markets into the end of the week. Fed policy remains data-dependent, with rate cut timing still uncertain.

- Overall, the market mood has improved on cooling inflation and earnings strength, yet questions about inflation data reliability, sector leadership transitions, and commodity price pressure continue to inject an undercurrent of caution.

Market News Sentiment:

Market News Articles: 49

- Neutral: 42.86%

- Positive: 36.73%

- Negative: 20.41%

GLD,Gold Articles: 11

- Positive: 45.45%

- Neutral: 36.36%

- Negative: 18.18%

USO,Oil Articles: 9

- Neutral: 44.44%

- Negative: 33.33%

- Positive: 22.22%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 18, 2025 05:00

- TSLA 483.37 Bullish 3.45%

- AMZN 226.76 Bullish 2.48%

- META 664.45 Bullish 2.30%

- GOOG 303.75 Bullish 1.91%

- NVDA 174.14 Bullish 1.87%

- MSFT 483.98 Bullish 1.65%

- QQQ 609.11 Bullish 1.45%

- SPY 676.47 Bullish 0.76%

- IWM 248.71 Bullish 0.59%

- IJH 66.31 Bullish 0.50%

- TLT 88.22 Bullish 0.48%

- DIA 480.51 Bullish 0.15%

- AAPL 272.19 Bullish 0.13%

- GLD 398.57 Bearish -0.18%

- USO 67.19 Bearish -1.16%

- IBIT 47.96 Bearish -1.54%

Market Summary: ETF Stocks, MegaCap Tech (MAG7), & Key Asset ETFs (as of 12/18/2025 17:00 EDT)

ETF Stocks Overview

- SPY (S&P 500 ETF): 676.47, Bullish +0.76%

- QQQ (Nasdaq 100 ETF): 609.11, Bullish +1.45%

- IWM (Russell 2000 ETF): 248.71, Bullish +0.59%

- IJH (Midcap ETF): 66.31, Bullish +0.50%

- DIA (Dow Jones ETF): 480.51, Bullish +0.15%

Summary: Broad equity ETF benchmarks remain bullish across the board, with technology-tilted QQQ showing particular strength. Gains are moderate in SPY and DIA, with continued resilience in small-caps (IWM) and mid-caps (IJH).

MegaCap Tech (MAG7)

- TSLA: 483.37, Bullish +3.45%

- AMZN: 226.76, Bullish +2.48%

- META: 664.45, Bullish +2.30%

- GOOG: 303.75, Bullish +1.91%

- NVDA: 174.14, Bullish +1.87%

- MSFT: 483.98, Bullish +1.65%

- AAPL: 272.19, Bullish +0.13%

Summary: All MAG7 components are bullish, with TSLA and AMZN exhibiting standout momentum. Gains are broad-based among major tech leaders, contributing to wider market strength, especially in QQQ.

Other Key ETFs – Fixed Income, Commodities & Crypto

- TLT (Long-Term Treasuries): 88.22, Bullish +0.48%

- GLD (Gold ETF): 398.57, Bearish -0.18%

- USO (Oil ETF): 67.19, Bearish -1.16%

- IBIT (Bitcoin ETF): 47.96, Bearish -1.54%

Summary: Fixed income (TLT) is holding slight gains. In contrast, commodity and crypto ETFs (GLD, USO, IBIT) are trending bearish, facing moderate to notable declines.

Overall Market State

The snapshot depicts a bullish equity environment, led by mega-cap tech stocks and key ETF indices, although there is a mixed performance in alternative assets with commodities and Bitcoin ETFs under some pressure.

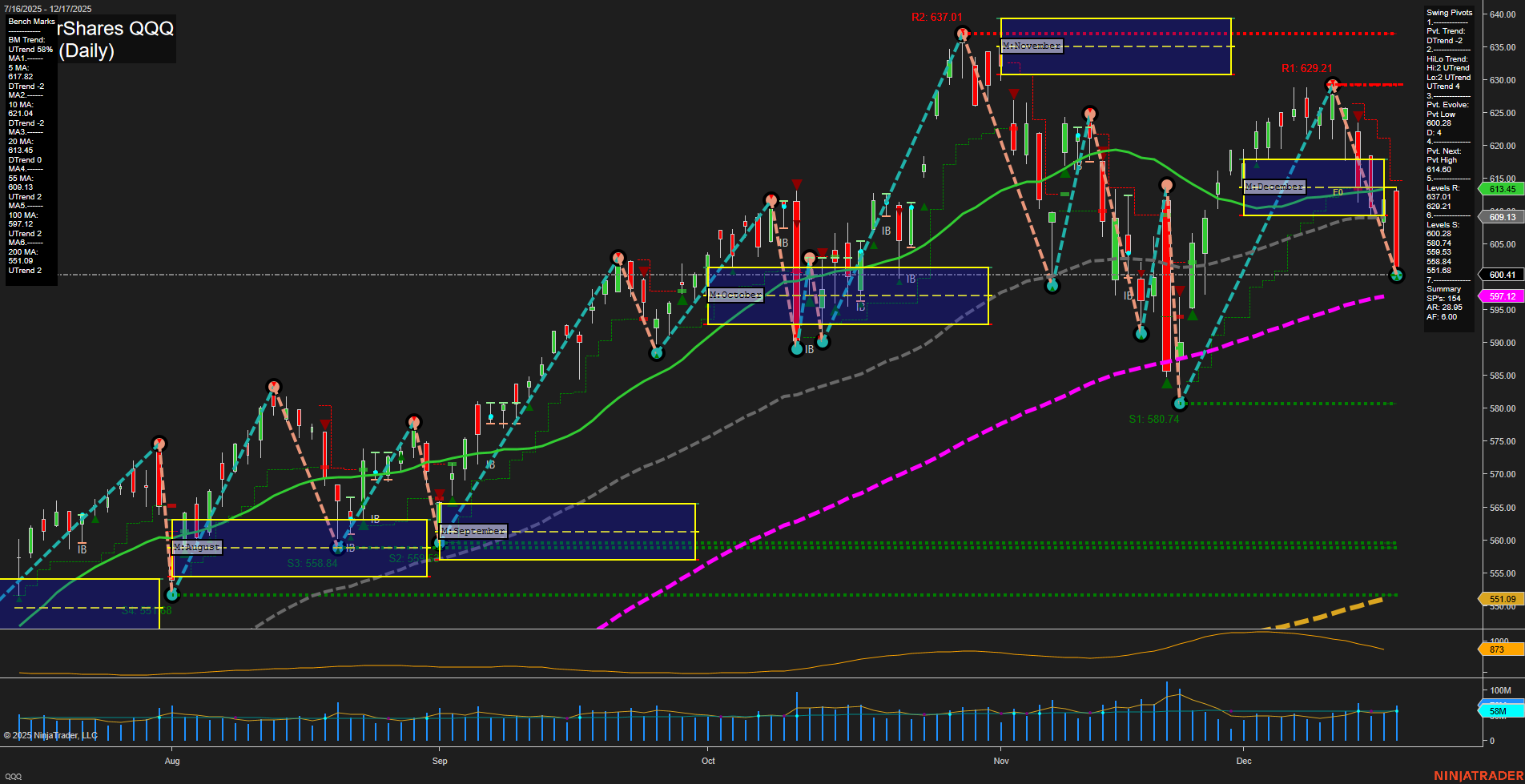

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts