Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

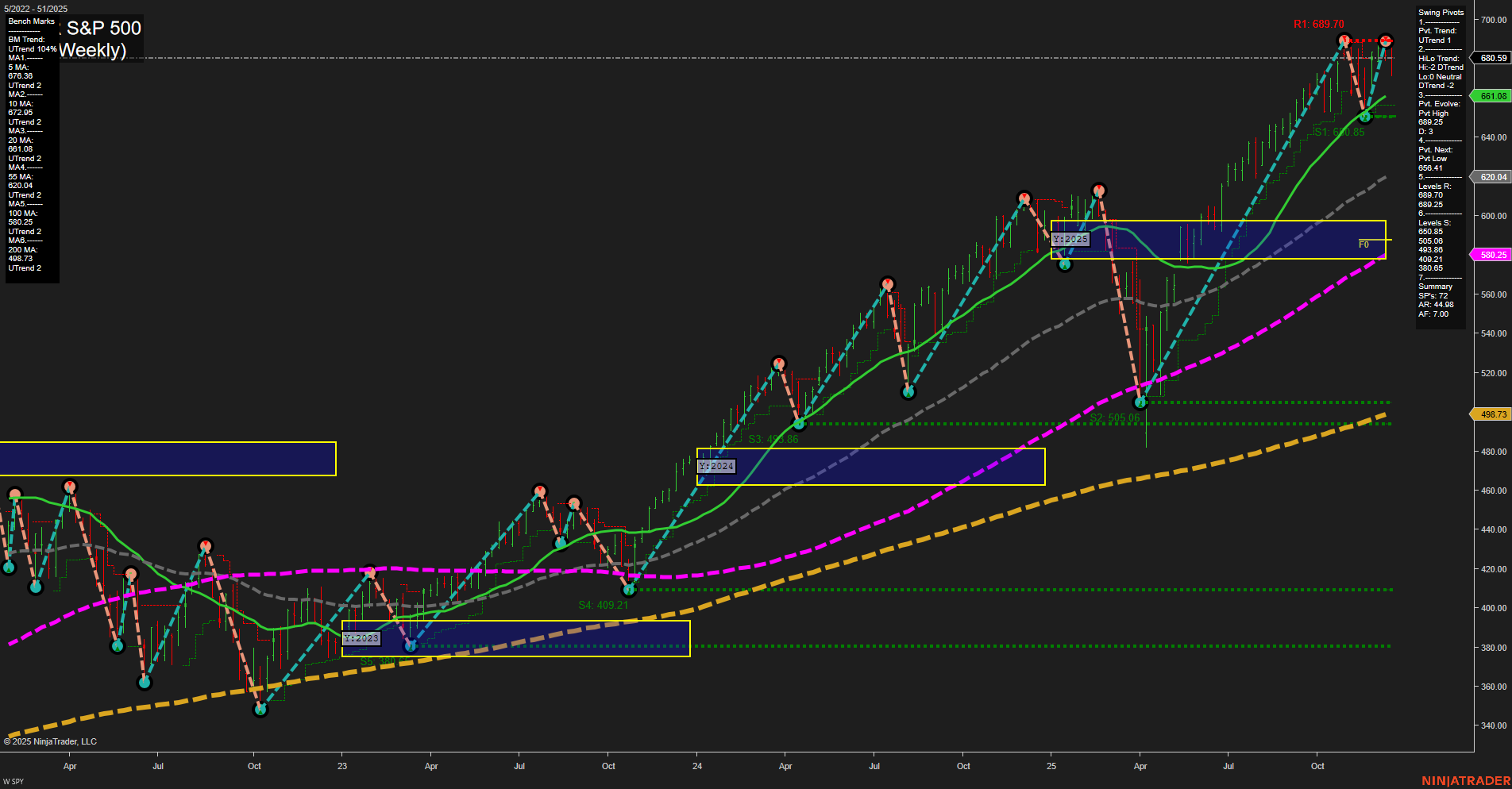

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

- 2025-12-24 Christmas (09:30-13:00)

- 2025-12-25 Christmas

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Tuesday 08:30 – USD Prelim GDP q/q (High Impact):

This is the most significant economic release of the day and will be a key driver of immediate market direction. GDP growth figures directly influence market sentiment regarding U.S. economic strength and may cause notable volatility in index futures upon release. - Wednesday 08:30 – USD Unemployment Claims (High Impact):

Weekly jobless claims will offer fresh insight into labor market conditions and could trigger sharp, short-term moves in equity futures if the data deviates meaningfully from expectations. - Wednesday 10:30 – USD Crude Oil Inventories (Medium, Oil):

While classified as low impact for broad indices, the oil inventory report is watched for any keys to supply-side or price shocks. High oil prices can influence inflation expectations and weigh on equity sentiment due to concerns over input costs and global stability.

EcoNews Conclusion

The Prelim GDP and Unemployment Claims releases are the primary high-impact drivers for U.S. index futures this week, likely to generate notable movement at their scheduled times. Additionally, the Crude Oil Inventories report bears watching for potential spillover impact if oil prices move sharply, as elevated prices can directly influence index sentiment. News events clustered in the 10 AM window (especially on Wednesday) may act as a catalyst for reversals or momentum continuations.

For full details visit: Forex Factory EcoNews

Market News Summary

- S&P 500: The S&P 500 saw an early-week slump but quickly recovered to eke out a small weekly gain. Technicals remain firm, with the 50-day moving average trending above the 200-day since midsummer, indicating sustained momentum into year-end despite a rocky start to December.

- Market Sentiment: Optimism around a potential Santa Claus rally is building, fueled by a favorable market setup and support from strong consumer spending and reduced imports in the latest GDP data.

- Gold: Gold prices are pushing toward highs, buoyed by softening inflation, labor weakness, and a weaker dollar. Recession risks and prospects for Fed rate cuts support continued bullishness, with traders monitoring breakout and dip opportunities.

- Oil: Crude oil markets are under downward pressure, grappling with excess inventory and weak demand. Ongoing OPEC production adds to the bearish narrative, and futures remain at risk of further declines.

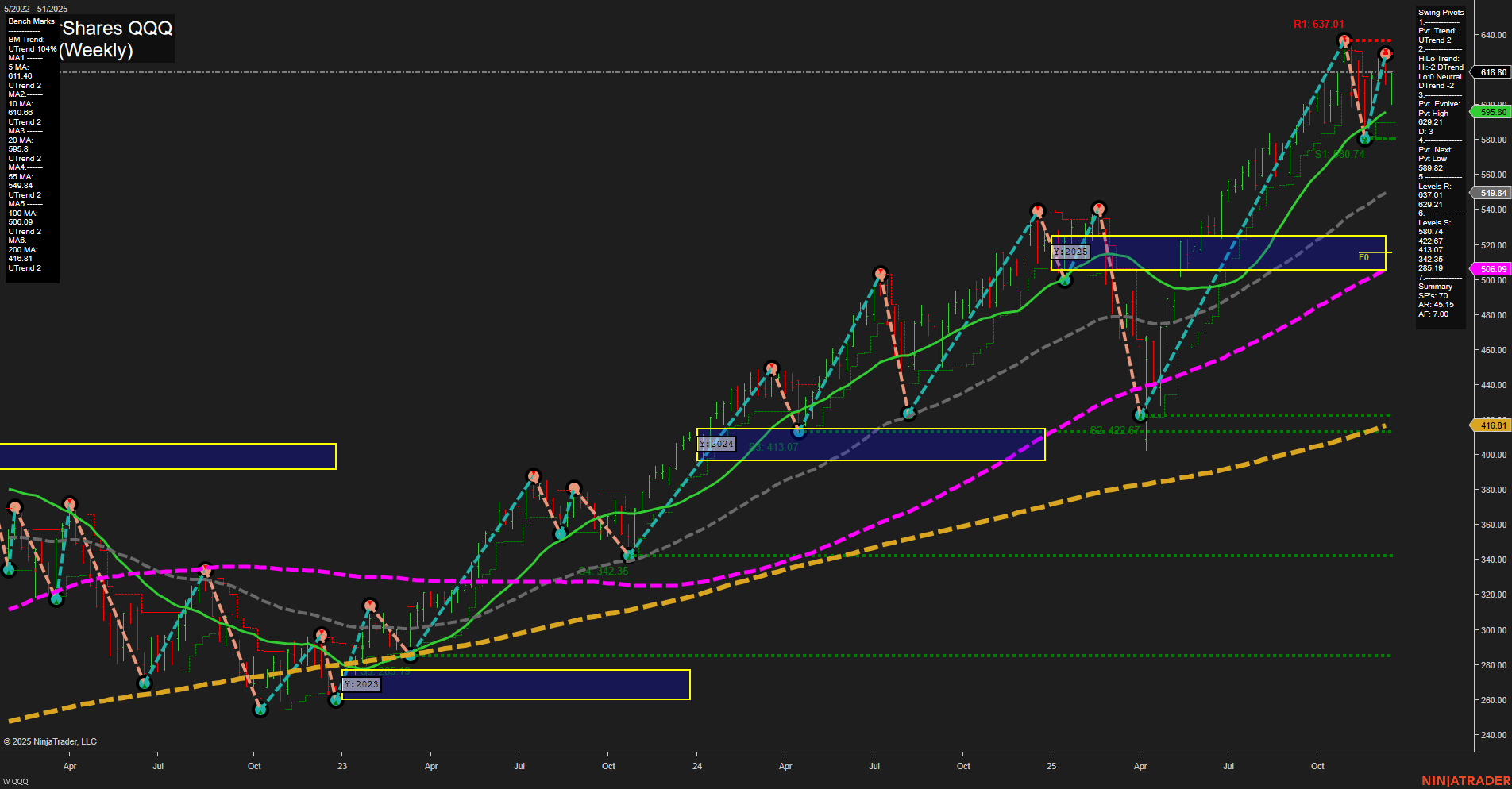

- ETF Focus: SPY offers stability and a better yield at a lower cost, while QQQ has delivered higher growth but with greater volatility and drawdowns.

- Yield Curve: A bear steepener is anticipated, as Fed policy shifts and global rate trends are set to drive up the 10-year Treasury yield, raising questions about term premiums and future market dynamics.

- Cryptocurrency: Crypto is underpinned by growing institutional interest, with Bitcoin and Ethereum being likened to digital gold and digital oil respectively. The narrative around digital assets is gaining traction for long-term market impact.

- Other: A simple retirement portfolio is highlighted for reliable income, while also cautioning about indiscriminately chasing high yields. Meanwhile, regulatory changes may reintroduce conflicts of interest involving Wall Street analysts.

News Conclusion

- The S&P 500 shows resilience amid December volatility, with technicals and sentiment favoring a positive year-end tilt.

- Gold continues to benefit from defensive flows and macroeconomic uncertainty, while oil struggles with oversupply and stagnant demand.

- Market participants are watching ETF performance differences, potential yield curve shifts, and regulatory developments as the year closes.

- Cryptocurrency and simple, income-focused portfolios are drawing attention as investors evaluate market risks and opportunities.

Market News Sentiment:

Market News Articles: 8

- Positive: 50.00%

- Neutral: 37.50%

- Negative: 12.50%

GLD,Gold Articles: 4

- Positive: 100.00%

USO,Oil Articles: 2

- Negative: 50.00%

- Positive: 50.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 21, 2025 06:15

- IBIT 49.91 Bullish 4.07%

- NVDA 180.99 Bullish 3.93%

- GOOG 308.61 Bullish 1.60%

- QQQ 617.05 Bullish 1.30%

- USO 68.03 Bullish 1.25%

- IWM 250.79 Bullish 0.84%

- IJH 66.85 Bullish 0.81%

- SPY 680.59 Bullish 0.61%

- AAPL 273.67 Bullish 0.54%

- MSFT 485.92 Bullish 0.40%

- AMZN 227.35 Bullish 0.26%

- DIA 481.15 Bullish 0.13%

- GLD 399.02 Bullish 0.11%

- TSLA 481.20 Bearish -0.45%

- TLT 87.55 Bearish -0.76%

- META 658.77 Bearish -0.85%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-12-21: 18:15 CT.

US Indices Futures

- ES Price above YSFG/MSFG/WSFG NTZ, all MAs upward, short/long-term bullish, intermediate-term neutral, higher highs, strong support, testing resistance, swing pivots up, momentum moderate.

- NQ Above MSFG/WSFG NTZ, all benchmarks rising, all timeframes bullish, resistance at 26127.25 and 26655.50, swing pivots up, trend continuation, volatility high, V-shaped recovery, no major reversal.

- YM All session grids upward, MAs trending up, new swing highs, supports below at 45,638, strong bullish structure, trend continuation, moderate volatility, pivot at 49,308, higher highs/lows.

- EMD Price above all NTZs, robust MA uptrend, swing pivot high at 3434.7, support at 3133.2, breakout momentum, large bars, consolidating near resistance, structure favors upside, no signs of exhaustion.

- RTY Above NTZ zones for all session fib grids, bullish MAs, weekly swing high at 2555.8, supports at 2263.3/2501.0, short-term neutral on daily, intermediate/long-term bullish, ATR elevated, range-bound short-term.

- FDAX All major grids upward, MAs rising, pivot low at 22,963, resistance at 24,891, short-term neutral/consolidating, intermediate/long-term bullish, new long signals, moderate volatility, steady trend.

Overall State

- Short-Term: Neutral to Bullish

- Intermediate-Term: Bullish

- Long-Term: Bullish

Conclusion

US Indices Futures are predominantly in bullish structures across intermediate and long-term horizons, with price action holding above key moving averages and session fib grid NTZs (YSFG, MSFG, WSFG). Swing pivot analysis and benchmarks confirm uptrends in ES, NQ, YM, EMD, RTY, and FDAX. Short-term conditions reflect some consolidation or neutral phases in RTY and FDAX, aligned with pullbacks after recent rallies. Support and resistance levels remain well-defined, and there is no evidence of major reversal patterns. The current HTF context favors upward continuation, with trend structures intact and volatility moderate to elevated, especially near upper resistance references.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts