After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

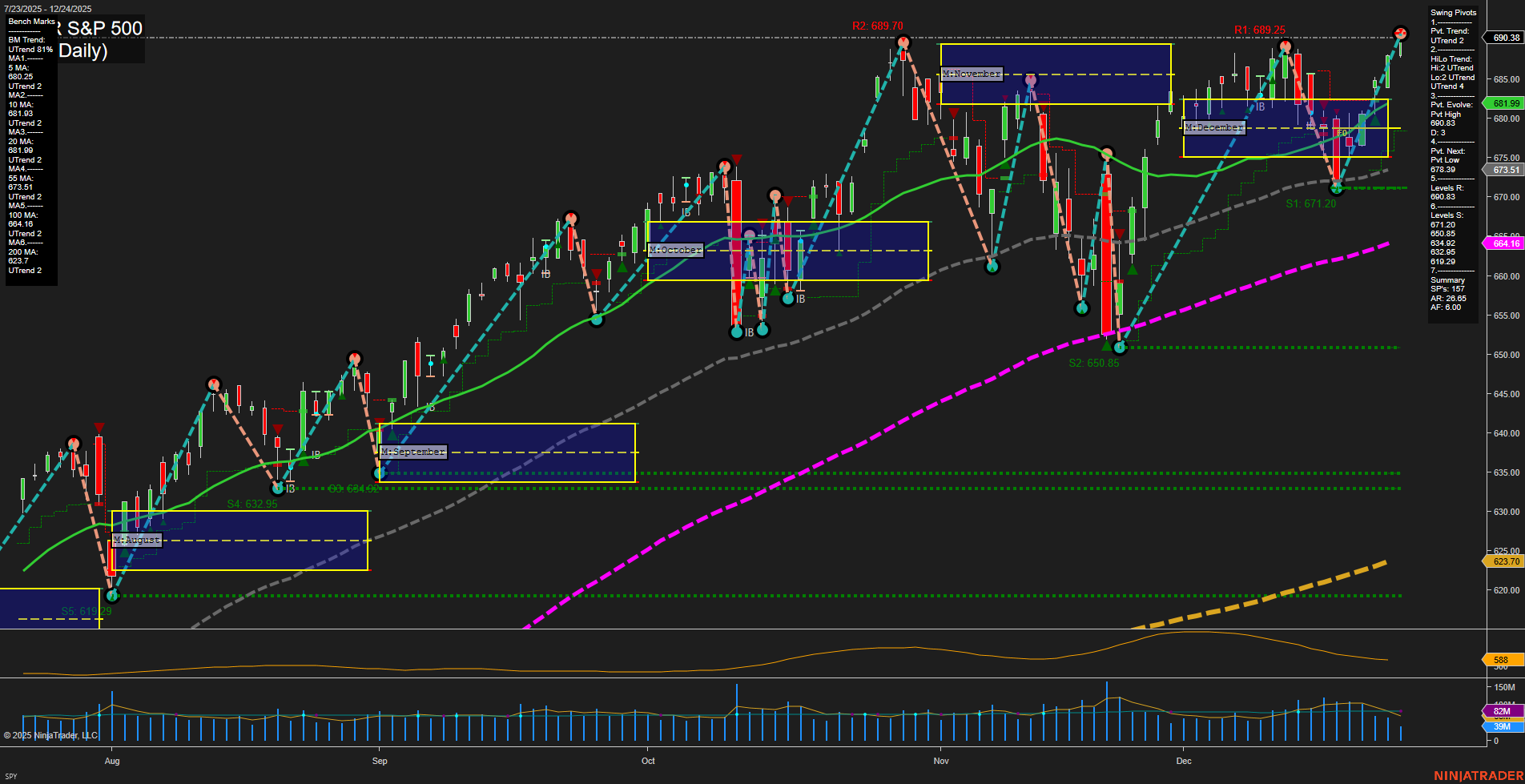

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Sentiment:

No news items with sentiment found in the last 24 hours.

No news items with sentiment found in the last 24 hours.

No news items with sentiment found in the last 24 hours.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 25, 2025 06:00

- TLT 88.03 Bullish 0.61%

- DIA 487.01 Bullish 0.57%

- AAPL 273.81 Bullish 0.53%

- META 667.55 Bullish 0.39%

- SPY 690.38 Bullish 0.35%

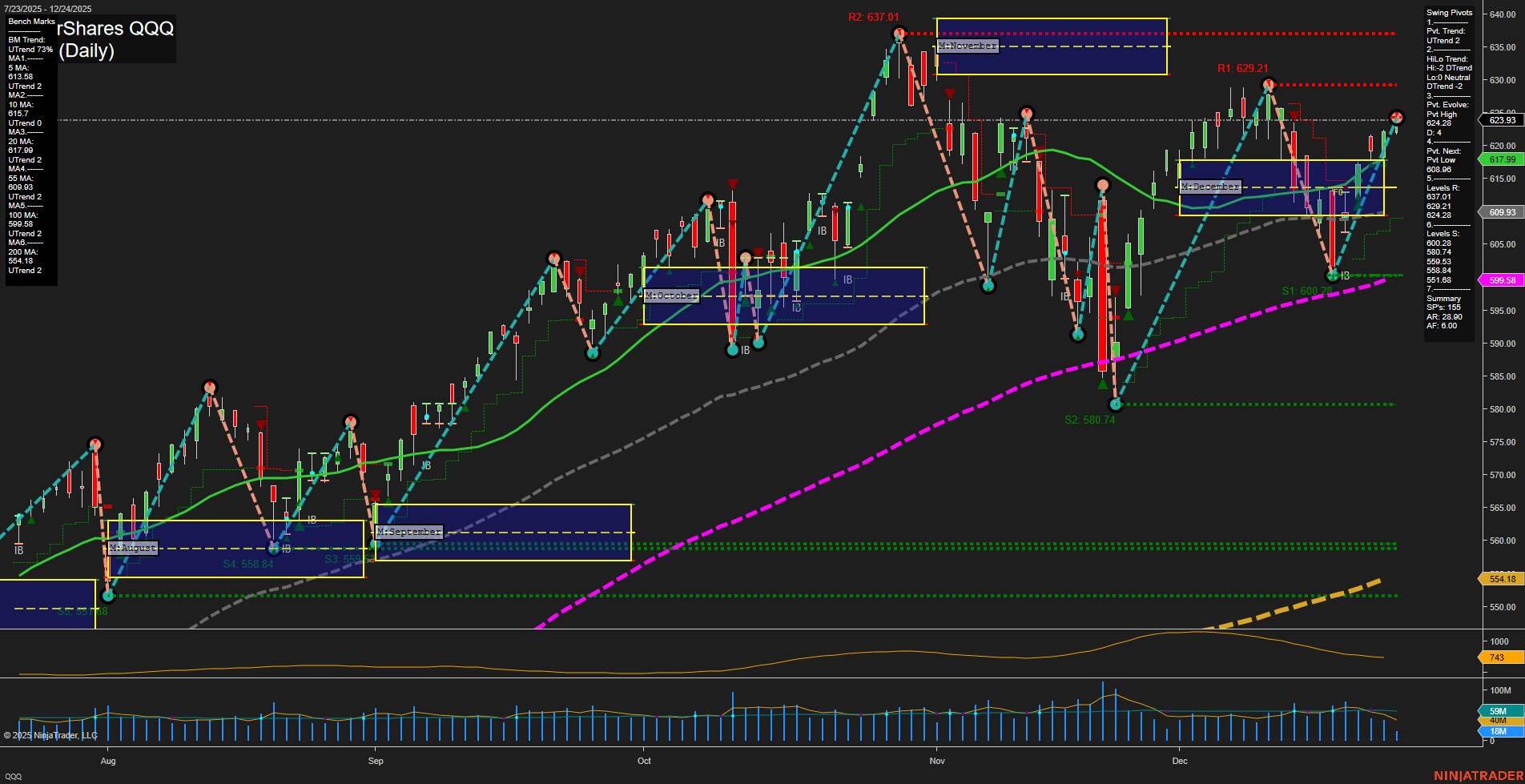

- QQQ 623.93 Bullish 0.29%

- IWM 252.71 Bullish 0.25%

- MSFT 488.02 Bullish 0.24%

- IJH 67.32 Bullish 0.15%

- AMZN 232.38 Bullish 0.10%

- GOOG 315.67 Bearish -0.00%

- TSLA 485.40 Bearish -0.03%

- USO 70.20 Bearish -0.14%

- NVDA 188.61 Bearish -0.32%

- IBIT 49.46 Bearish -0.38%

- GLD 411.93 Bearish -0.41%

Market Summary: ETF Stocks, Mag7, and Notable ETFs (as of 12/25/2025)

Snapshot Overview: The market shows a predominantly bullish tone among major ETFs and large-cap tech, with only a handful of notable stocks and alternative assets showing mild bearishness or flat results.

ETF Stocks

- SPY – 690.38, Bullish (+0.35%): S&P 500 tracking ETF continues to sustain bullish momentum, suggesting broad-based positive sentiment.

- QQQ – 623.93, Bullish (+0.29%): The Nasdaq 100 ETF is also moving higher, supported by tech leadership despite a mixed showing in Mag7 components.

- IWM – 252.71, Bullish (+0.25%): Small caps are part of the bullish wave, indicating risk appetite persists.

- IJH – 67.32, Bullish (+0.15%): Midcap ETF reflects milder but steady bullishness.

- DIA – 487.01, Bullish (+0.57%): Dow Jones ETF leads the main indices on relative intra-day strength.

Mag7 Stocks

- AAPL – 273.81, Bullish (+0.53%): Apple extends recent gains, contributing to tech sector strength.

- MSFT – 488.02, Bullish (+0.24%): Microsoft trends higher within the positive market tone.

- AMZN – 232.38, Bullish (+0.10%): Amazon in modest uptrend, stabilizing after recent volatility.

- META – 667.55, Bullish (+0.39%): Meta holds a strong advance among large caps.

- GOOG – 315.67, Bearish (-0.00%): Alphabet is flat-to-slightly-negative, providing a counterpoint among tech giants.

- NVDA – 188.61, Bearish (-0.32%): Nvidia ticks lower, highlighting some rotation away from recent leaders.

- TSLA – 485.40, Bearish (-0.03%): Tesla slips marginally; remains soft within the mega cap cohort.

Noteworthy ETFs and Assets

- TLT – 88.03, Bullish (+0.61%): Long-term Treasuries strong, possibly reflecting demand for duration or flight to safety.

- GLD – 411.93, Bearish (-0.41%): Gold slides, diverging from TLT’s risk-off bid.

- USO – 70.20, Bearish (-0.14%): Oil ETF edges lower, suggesting commodity pressure persists.

- IBIT – 49.46, Bearish (-0.38%): Bitcoin ETF in decline, mirroring softening sentiment in digital assets.

Trend Summary

- Long/Bullish: Main equity indices (SPY, QQQ, DIA, IWM, IJH), most Mag7 names (AAPL, MSFT, AMZN, META), and Treasuries (TLT).

- Short/Bearish: Select tech leaders (GOOG, NVDA, TSLA), Gold (GLD), Oil (USO), and Bitcoin ETF (IBIT).

- Mixed: The overall market leans bullish, but isolated weakness is appearing in prominent names and alternatives.

Note: This summary is strictly informational and does not constitute trading advice or recommendations.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts