After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

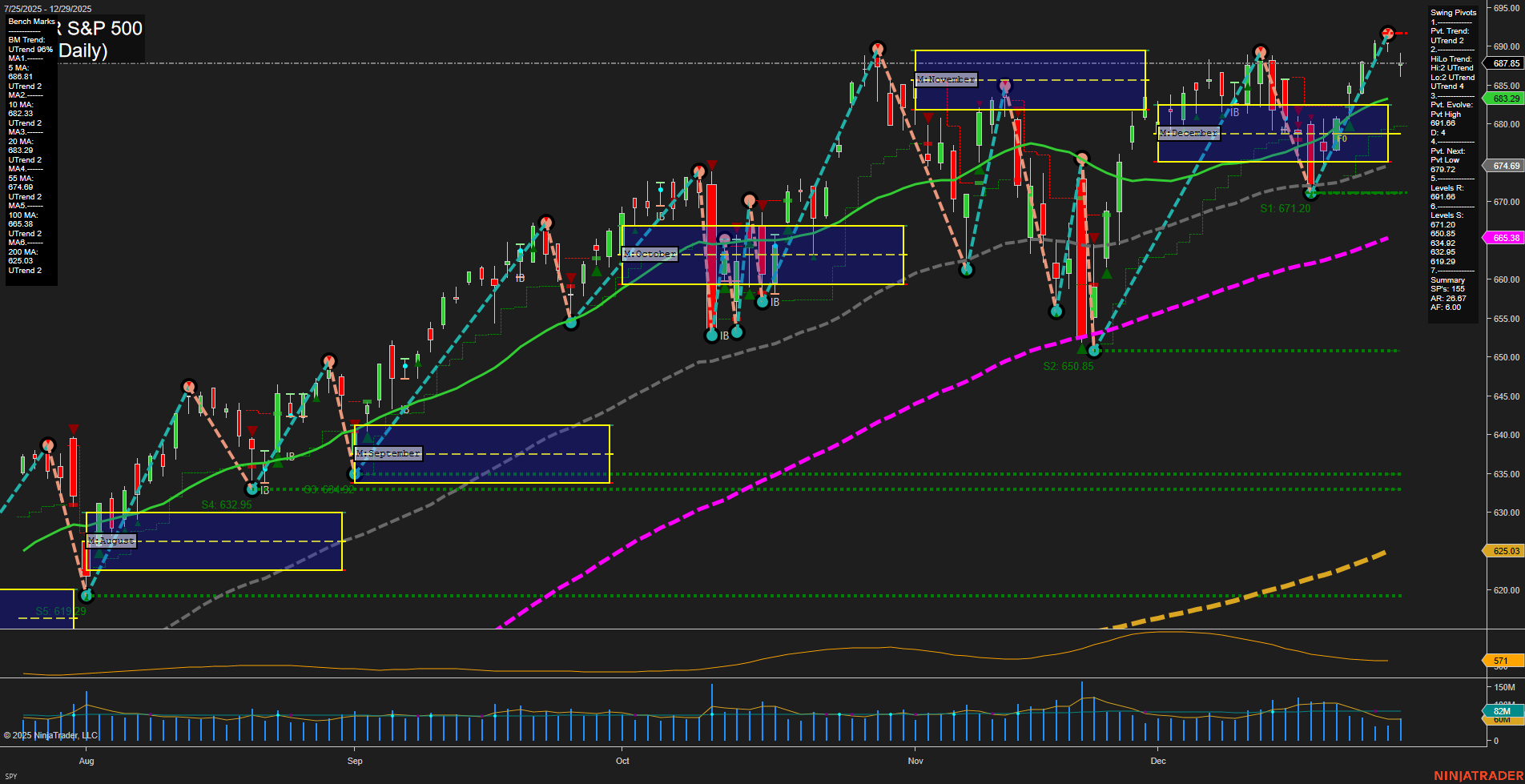

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- S&P 500 Strength: US stocks have posted strong gains for 2025, led by storage and memory companies driven by AI and manufacturing tailwinds. Overall, the S&P 500 remains near record highs as the year ends, with projections calling for a possible 20% gain by 2026, led heavily by top tech names.

- Sector Leadership: Storage and memory hardware, AI-related firms, and gaming stocks have outperformed. Bank, metals, and clean energy ETFs are expected to be influential in 2026.

- Gold and Metals: Gold and silver have rallied sharply amid geopolitical tensions, with gold holding near record highs. Some analysts highlight gold’s attractiveness as an asset class, while others caution on technical support levels and potential volatility for precious metals heading into 2026. Divergent views persist on gold’s trajectory, with potential further upside and risks for corrections both noted.

- Oil Markets: Oil prices show short-term bullish signs but remain under long-term pressure from a persistent global glut. A key resistance zone continues to challenge price advances.

- Macroeconomic Themes: The Federal Reserve appears divided on rates going into 2026; inflation, unemployment, and credit markets are monitored closely. Global markets have shown mixed performance as the year closes.

- Market Risks and Valuation: Several voices warn of elevated US equity valuations and a possible correction for large-cap stocks in early to mid-2026. Historical signals, such as the Dow-to-Gold ratio, are flashing caution—comparable to pre-correction years like 2008 and 1929.

- Sentiment: While optimism remains high in parts of the market, a meaningful portion of participants sees increased risk and volatility for the year ahead. Surveys indicate a wide range of expectations for a substantial market pullback.

- Other Headlines: US political commentary and economic policy remain in focus, with debate around Fed leadership and central bank actions.

News Conclusion

- Strong performance in US equities, especially in AI and related sectors, has characterized 2025, placing the S&P 500 near highs heading into 2026.

- Precious metals, notably gold and silver, have surged amid global uncertainty, though market opinions differ on whether this trend will extend or reverse.

- Oil’s oversupply and conflicting signals in macro themes such as Fed policy add complexity to market outlooks for the new year.

- While many expect continued gains, there is growing discussion around stretched valuations, historical warning signals, and the possibility of increased volatility or corrections in the first half of 2026.

- Consensus views on market direction remain divided, with both bullish and cautious perspectives informing sentiment as 2026 begins.

Market News Sentiment:

Market News Articles: 45

- Neutral: 48.89%

- Positive: 33.33%

- Negative: 17.78%

GLD,Gold Articles: 16

- Positive: 56.25%

- Neutral: 37.50%

- Negative: 6.25%

USO,Oil Articles: 8

- Negative: 62.50%

- Positive: 25.00%

- Neutral: 12.50%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 30, 2025 05:00

- META 665.95 Bullish 1.10%

- IBIT 49.83 Bullish 0.91%

- AMZN 232.53 Bullish 0.20%

- USO 69.74 Bullish 0.19%

- MSFT 487.48 Bullish 0.08%

- GLD 398.89 Bullish 0.07%

- GOOG 314.55 Bullish 0.05%

- SPY 687.01 Bearish -0.12%

- DIA 483.59 Bearish -0.21%

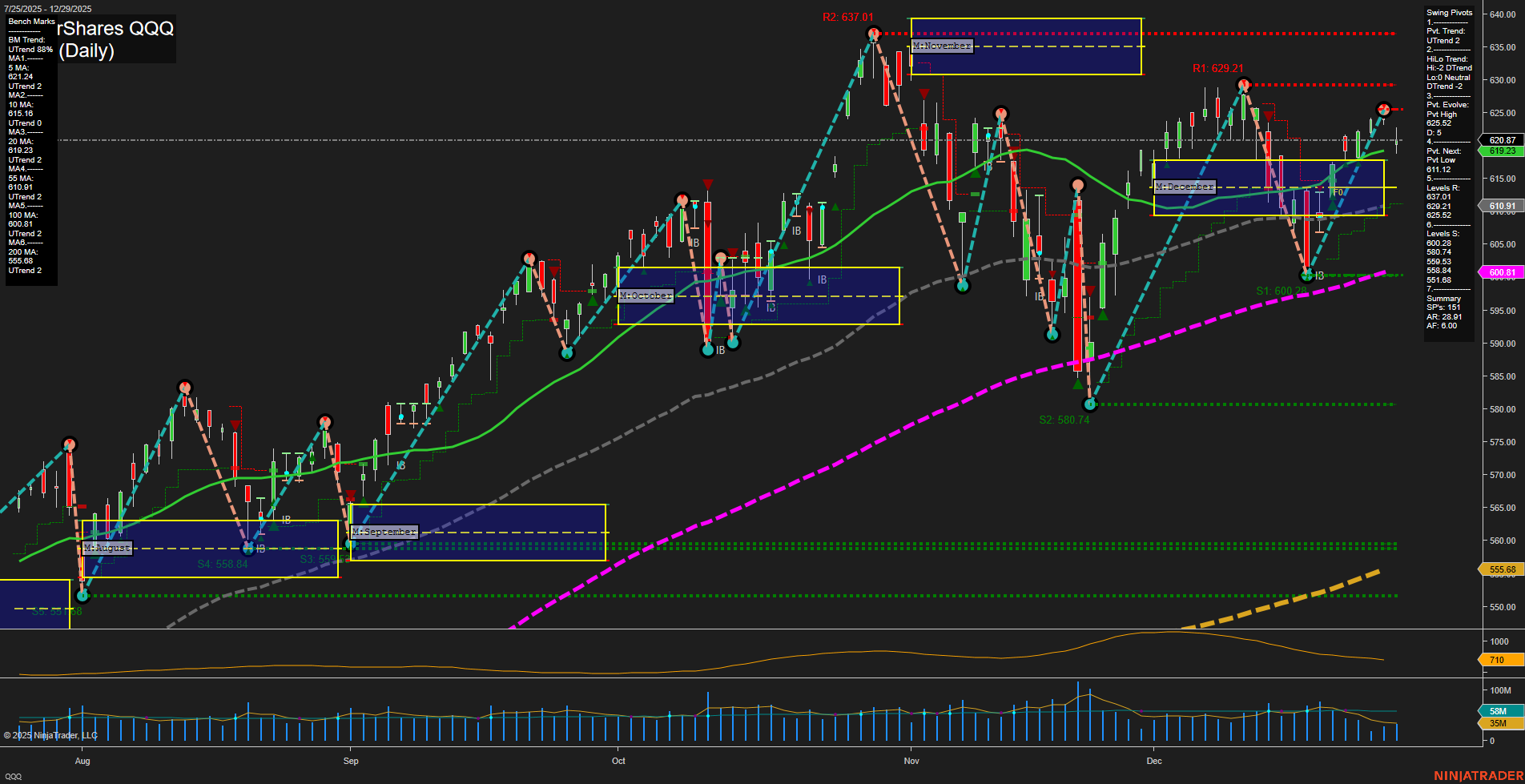

- QQQ 619.43 Bearish -0.23%

- TLT 87.86 Bearish -0.24%

- AAPL 273.08 Bearish -0.25%

- IJH 66.70 Bearish -0.34%

- NVDA 187.54 Bearish -0.36%

- IWM 248.03 Bearish -0.74%

- TSLA 454.43 Bearish -1.13%

Market Overview: ETF Stocks, Mag7, and Key ETFs (as of 12/30/2025 17:00)

This snapshot summarizes the trading sentiment and recent movements for major ETF indices, Mag7 stocks, and pivotal ETFs. Traders may note distinct sector divergences and momentum tone as outlined below.

ETF Stocks: Sentiment & Performance

- SPY 687.01 (Bearish -0.12%) – S&P 500 tracking ETF shows slight weakness and mild negative bias.

- QQQ 619.43 (Bearish -0.23%) – NASDAQ 100 ETF tilts lower, underlining recent tech retraces.

- IWM 248.03 (Bearish -0.74%) – Russell 2000 ETF, deeper decline, highlighting small-cap underperformance.

- IJH 66.70 (Bearish -0.34%) – S&P Midcap 400 ETF extends modest losses.

- DIA 483.59 (Bearish -0.21%) – Dow Jones ETF slides further, reflecting blue-chip caution.

Mag7 Stocks: Mixed Tone

- META 665.95 (Bullish +1.10%) – Strong upward move; among today’s top-performing tech leaders.

- IBIT 49.83 (Bullish +0.91%) – Bitcoin ETF shows notable resilience in the digital asset space.

- AMZN 232.53 (Bullish +0.20%) – Mild gains; sentiment remains positive.

- MSFT 487.48 (Bullish +0.08%) – Maintains bullish tone, albeit with slower momentum.

- GOOG 314.55 (Bullish +0.05%) – Slight uptick, with a steady outlook.

- AAPL 273.08 (Bearish -0.25%) – Encounters selling pressure after a period of consolidation.

- NVDA 187.54 (Bearish -0.36%) – Loses ground as profit-taking emerges.

- TSLA 454.43 (Bearish -1.13%) – Registers the steepest loss among the group, extending volatility.

Other Key ETFs: Diverse Drivers

- GLD 398.89 (Bullish +0.07%) – Gold ETF holds positive territory, indicating renewed safe-haven interest.

- USO 69.74 (Bullish +0.19%) – Oil ETF modestly firmer, reflecting commodity market strength.

- TLT 87.86 (Bearish -0.24%) – U.S. Treasury Bond ETF under pressure, signaling yield curve headwinds.

Summary

- Bullish Movers: META, IBIT, AMZN, MSFT, GOOG, GLD, USO are demonstrating pockets of strength amid sectoral divergences.

- Bearish/Mixed: Major broad-market ETFs (SPY, QQQ, DIA, IWM, IJH), several Mag7 constituents (AAPL, NVDA, TSLA), and TLT are retreating, highlighting defensive posturing or rotation out of select leaders.

Market conditions appear rotational with clear divide between selective tech strength and broad index softness. Traders can observe pronounced leadership shifts and short-term divergence across major asset classes and sectors.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts