After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

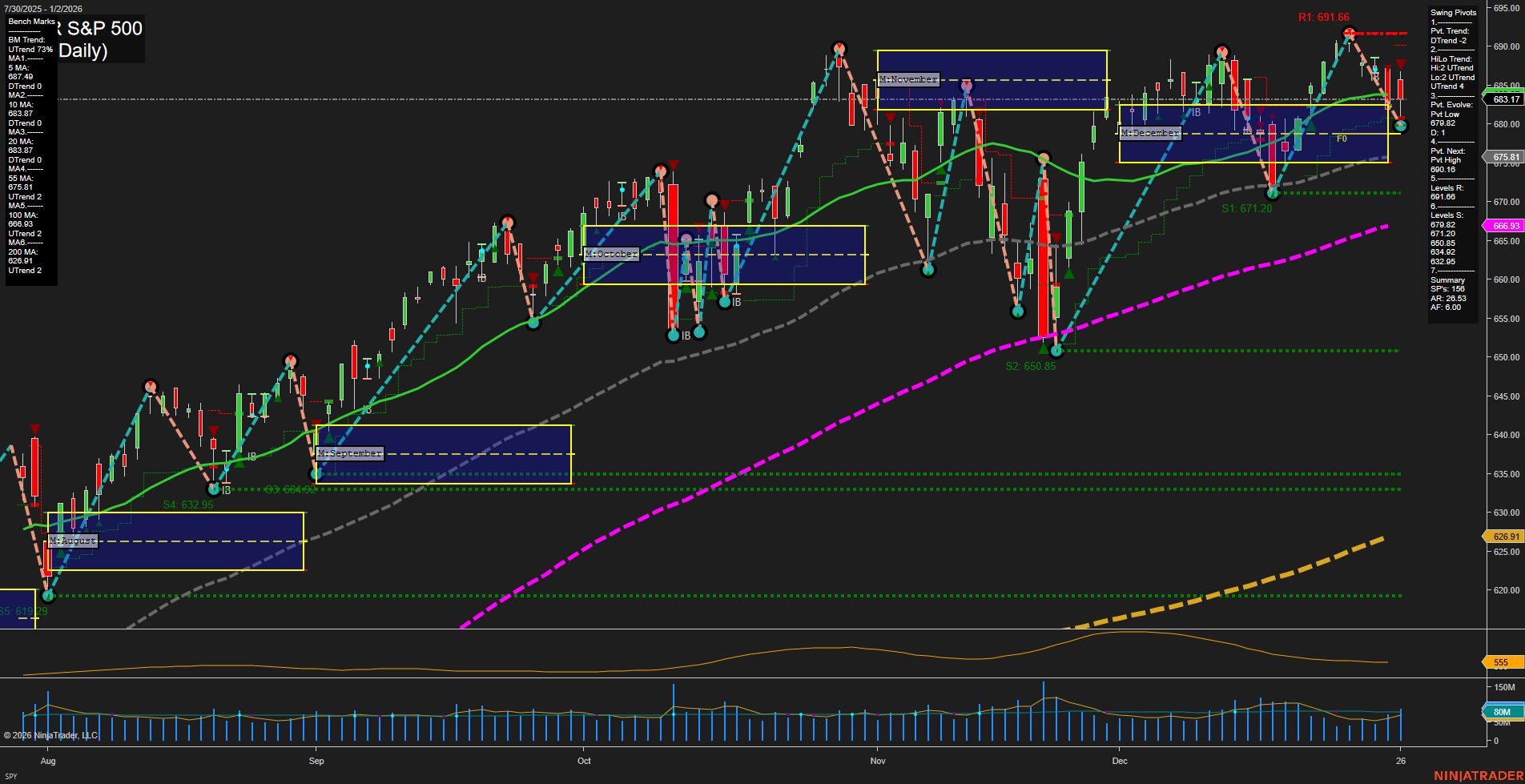

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Major Indices Hit Records: The Dow surged over 700 points, surpassing 49,000 for the first time and closing at a record high, with the S&P 500 also setting new records. Gains were driven by rallies in defense stocks, banking giants, and standout energy sector performance following geopolitical shocks.

- Venezuelan Geopolitical Impact: The U.S. capture of Venezuela’s President Maduro sparked a Wall Street rally, particularly in energy and oil stocks like Chevron. Investors anticipate U.S. involvement in rebuilding Venezuela’s oil industry, with the energy sector posting notable gains on hopes of sector revitalization.

- Oil & Energy Sector Moves: Oil and gasoline prices edged up on projected Venezuelan export losses and geopolitical uncertainty, though supply and oil infrastructure assessments continue. Oil majors like Chevron are seen as beneficiaries, but potential payoffs may be longer term.

- U.S. Equities and Sector Dynamics: The S&P 500 ended 2025 up 16~18% for the year despite late volatility, with strong showings from select sectors, including energy, industrials, technology, and blockbuster gains in ARK ETFs and memory chip stocks like Micron.

- Volatility and Outlook: Opinions diverge on 2026 with some warnings of elevated valuations and potential correction risks, while others highlight the persistent bull run and sector rotation themes. AI momentum and U.S. strength continue to drive major equity benchmarks.

- Commodities: Gold rallied in tandem with oil on geopolitical unrest, with both spot prices and mining stocks gaining, though some moderation in returns is expected over the year.

- Global Markets and International Equities: International stocks remain under scrutiny for high U.S. correlation and currency-driven gains, while U.S. indices dominate performance tables. Global tension and election dynamics add mixed sentiment.

- Other Assets: Bitcoin and memory chip stocks experienced heightened volatility as the market digested new macro and geopolitical developments.

News Conclusion

- Record highs in major U.S. stock indices were driven by optimism following the Venezuela news and strong momentum across select key sectors.

- Energy, defense, and banking stocks led today’s gains with pronounced moves in oil majors, as market participants positioned for a developing U.S. role in Latin American energy.

- 2026 opens with both positive momentum and warnings about sustained volatility and elevated valuations, setting the stage for a year of increased sector rotation and macro-driven moves.

- Commodities such as oil and gold are closely tracking geopolitical headlines, with expectations for further swings tied to developments in Venezuela and beyond.

- U.S. equities continue to outpace global counterparts, buoyed by AI growth, sector leadership, and rotation into high-performing ETFs, while international stocks lag amid relative currency and macro headwinds.

Market News Sentiment:

Market News Articles: 40

- Positive: 57.50%

- Neutral: 30.00%

- Negative: 12.50%

GLD,Gold Articles: 12

- Positive: 66.67%

- Neutral: 25.00%

- Negative: 8.33%

USO,Oil Articles: 24

- Neutral: 45.83%

- Negative: 29.17%

- Positive: 25.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: January 5, 2026 05:00

- IBIT 53.46 Bullish 4.95%

- TSLA 451.67 Bullish 3.10%

- AMZN 233.06 Bullish 2.90%

- GLD 408.76 Bullish 2.63%

- USO 70.22 Bullish 1.83%

- IWM 252.73 Bullish 1.59%

- IJH 67.78 Bullish 1.30%

- META 658.79 Bullish 1.29%

- DIA 489.77 Bullish 1.27%

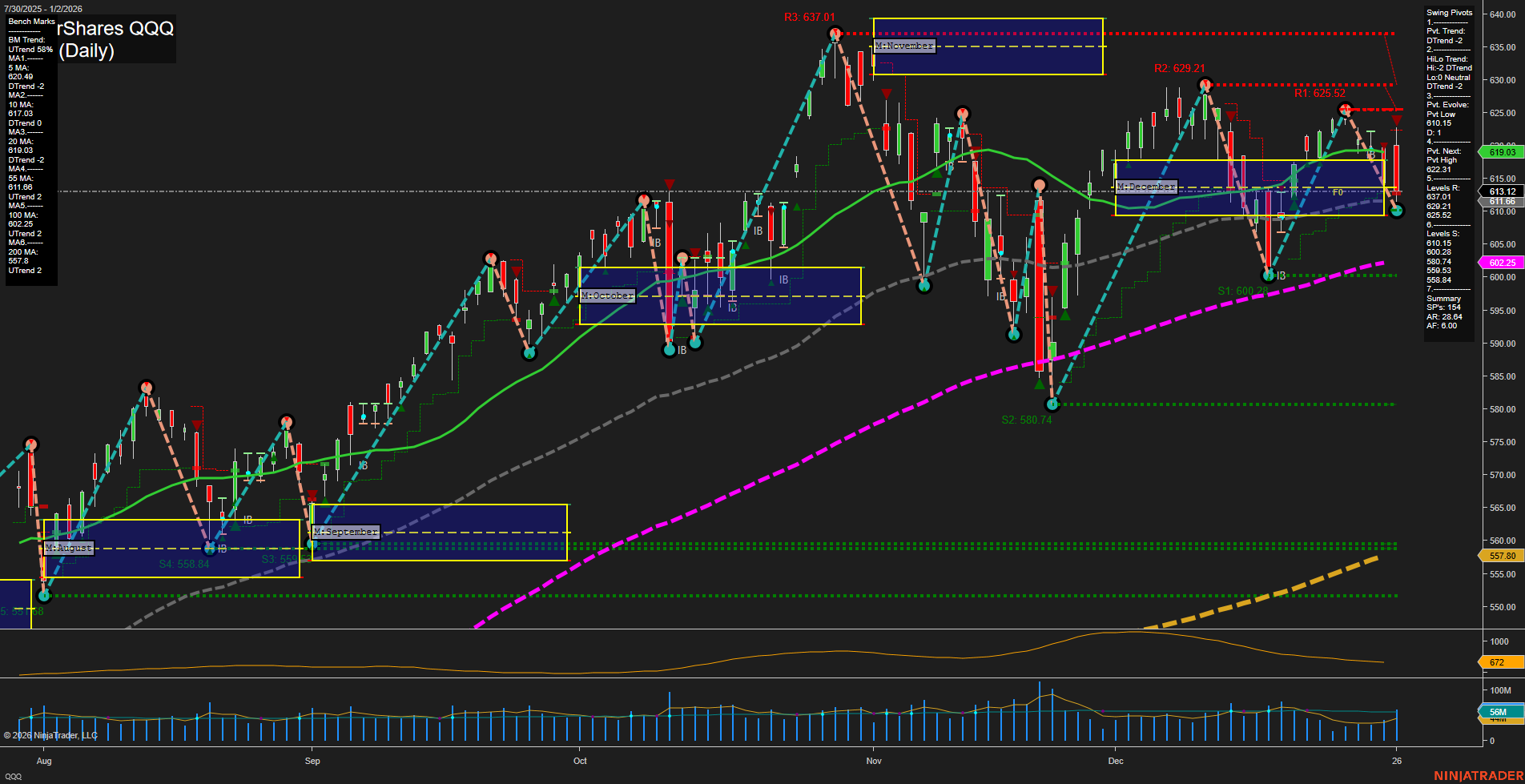

- QQQ 617.99 Bullish 0.79%

- SPY 687.72 Bullish 0.67%

- GOOG 317.32 Bullish 0.63%

- TLT 87.46 Bullish 0.49%

- MSFT 472.85 Bearish -0.02%

- NVDA 188.12 Bearish -0.39%

- AAPL 267.26 Bearish -1.38%

ETF Stocks Overview

- SPY: 687.72 Bullish (+0.67%) — S&P 500 ETF holding uptrend, modest gain as large caps find some support.

- QQQ: 617.99 Bullish (+0.79%) — Nasdaq 100 ETF posts a stronger uptick, reflecting relative tech resilience despite mixed action among tech leaders.

- IWM: 252.73 Bullish (+1.59%) — Russell 2000 ETF leads with a sharp gain. Risk appetite apparent for small caps.

- IJH: 67.78 Bullish (+1.30%) — Midcaps participate in rally, broadening the advance.

- DIA: 489.77 Bullish (+1.27%) — Dow Industrials ETF joins the bullish move, with gains across most constituents.

Mag7 Mega Caps Snapshot

- TSLA: 451.67 Bullish (+3.10%) — Tesla surges ahead, outpacing other Mag7 names for the session.

- AMZN: 233.06 Bullish (+2.90%) — Amazon rallies strongly.

- META: 658.79 Bullish (+1.29%) — Meta Platforms trades up, tracking big-cap tech strength.

- GOOG: 317.32 Bullish (+0.63%) — Alphabet moves higher but lags other big gainers.

- MSFT: 472.85 Bearish (-0.02%) — Microsoft slips slightly, diverging from most peers.

- NVDA: 188.12 Bearish (-0.39%) — Nvidia underperforms, adding to tech divergence.

- AAPL: 267.26 Bearish (-1.38%) — Apple declines, marking the weakest showing among the Mag7.

Other Major ETFs

- IBIT: 53.46 Bullish (+4.95%) — Bitcoin spot ETF posts significant outperformance, reflecting strong digital asset momentum.

- GLD: 408.76 Bullish (+2.63%) — Gold ETF climbs as safe-haven demand remains elevated.

- USO: 70.22 Bullish (+1.83%) — Oil ETF extends gains, echoing energy sector strength.

- TLT: 87.46 Bullish (+0.49%) — Long Treasury ETF edges higher; bond prices gain modestly amid bullish market tone.

Market Summary: State of Play

At the current snapshot, broad equity ETFs are advancing in sync, with small and midcaps leading the charge, signaling broadening market participation. Mag7 stocks see mixed action: Tesla and Amazon stand out with outsized gains, while Microsoft, Nvidia, and especially Apple lag or decline. Bitcoin, gold, and oil ETFs all outperform most equity benchmarks, with IBIT spiking notably. There is an overall bullish bias across major sectors and asset classes, but notable dispersion within key mega cap leaders.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts