Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

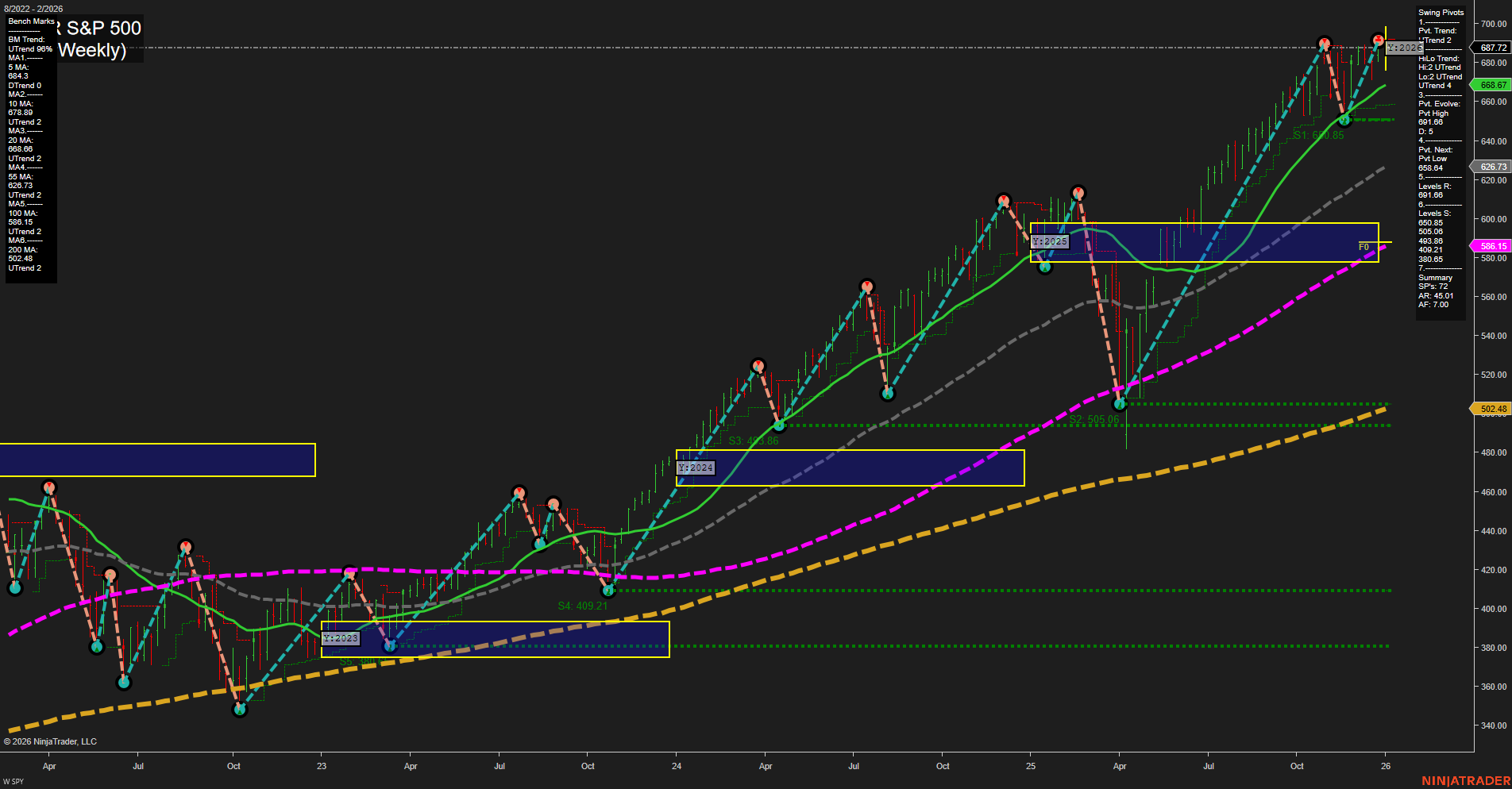

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Wednesday 08:15 – ADP Non-Farm Employment Change (High Impact): Early jobs data release can trigger immediate spikes in index futures, serving as a gauge for labor market strength ahead of the official NFP. Strong numbers typically support bullish sentiment, while weak numbers may spark risk-off moves.

- Wednesday 10:00 – ISM Services PMI (High Impact): Key sentiment measure for the services sector, highly correlated with GDP. Markets will react to surprises, with readings above or below expectations priming intraday volatility.

- Wednesday 10:00 – JOLTS Job Openings (High Impact): Labor demand signals; large deviations influence job market outlook and wage inflation expectations. Released alongside ISM data, contributing to pronounced volatility around the 10:00 AM cycle.

- Wednesday 10:30 – Crude Oil Inventories (Low/Medium Impact): While typically a sector-specific catalyst, notable inventory changes or price spikes can spill over to indices, especially if oil’s trajectory fuels inflation or geopolitical concerns.

- Thursday 08:30 – Unemployment Claims (High Impact): Weekly check on labor market health, with abrupt shifts drawing market attention. Tight labor data may sustain hawkish policy sentiment; higher claims may foster risk aversion.

- Friday 08:30 – Average Hourly Earnings m/m, Non-Farm Employment Change, Unemployment Rate (All High Impact): The NFP trio defines U.S. jobs momentum and wage inflation, with outsized influence over index direction and rate expectations. Abrupt moves at release likely; volume and volatility are typically elevated.

- Friday 10:00 – Prelim UoM Consumer Sentiment & UoM Inflation Expectations (High Impact): Forward-looking gauges for spending and inflation beliefs. Surprises here often provoke swift intraday market reactions and set tone for afternoon flows.

EcoNews Conclusion

- This week’s concentrated high-impact events—especially Wednesday’s jobs and ISM releases, Thursday’s unemployment data, and Friday’s NFP cluster—set the stage for outsized index futures volatility at their respective times.

- News releases around the 10 AM ET cycle (Wednesday and Friday) should be watched closely for potential reversals or momentum extensions as traders digest multiple data points concurrently.

- Oil inventory data midweek warrants attention only if it triggers significant price responses that could stoke inflationary concerns and spill into broader index trading.

- Expect momentum and volume in indices to build into Friday’s NFP report. Market activity may exhibit unusual spikes or whipsaws immediately after key labor releases.

For full details visit: Forex Factory EcoNews

Market News Summary

- US stocks rallied following the ouster of Venezuelan President Nicolás Maduro, with energy and oil-related equities seeing the most upside as oil prices initially surged. The Dow jumped over 590 points, while tech stocks are positioned for a rebound.

- Expectations of increased Venezuelan oil supply led to volatility in crude oil futures. While initial market reaction drove oil higher, prices edged lower as traders weighed the likelihood of sanction relief and a larger global oil surplus.

- US refineries and energy companies are viewed as potential winners from renewed Venezuelan exports. Speculation around Venezuela has also driven gains in select energy stocks, although some analysts question the sustainability given global supply trends.

- Wall Street investors holding distressed Venezuelan assets may benefit from improved prospects. Hedge funds such as Elliott have positioned to capitalize on restored production and export flows.

- Views are mixed on the long-term oil price impact. Some foresee a “slippery slope” to lower prices if Venezuelan output ramps up, while others highlight continued uncertainty and the risk of instability during Venezuela’s transition.

- Broader equity markets gained modestly, with the S&P 500 finishing a third consecutive year of strong returns. Notably, market strategists foresee ongoing upside for US equities into 2026 and a regime shift from growth-at-all-costs toward earnings quality.

- Gold and silver prices are trending more bullish, as commodity investors respond to geopolitical uncertainty.

- Bonds are gaining attention relative to stocks and gold as some analysts cite changing macro risks. Hedge funds are shifting allocations within the industry in response to global market changes.

- Economic concerns linger globally, especially from China’s deepening slowdown, which is raising recession risks in major economies.

- Despite heightened political risks, energy markets appear less reactive than in previous cycles due to diversified supply, renewables growth, and strategic reserves.

News Conclusion

- Major indices and futures markets are digesting rapidly shifting dynamics following Venezuela’s political upheaval, with energy, tech, and commodity sectors at the focal point.

- Crude oil faces volatile trading as optimism on new supply from Venezuela vies with worries over oversupply and muted demand.

- Positioning within both equities and fixed income reflects evolving expectations around geopolitical risks, macroeconomic headwinds, and shifting investor preferences into 2026.

Market News Sentiment:

Market News Articles: 38

- Positive: 57.89%

- Neutral: 26.32%

- Negative: 15.79%

Sentiment Summary:

Out of 38 market news articles analyzed, 57.89% conveyed a positive sentiment, 26.32% were neutral, and 15.79% carried a negative tone.

Conclusion:

The majority of recent market news articles have been characterized by positive sentiment, with a smaller proportion reflecting neutral or negative perspectives.

GLD,Gold Articles: 11

- Positive: 54.55%

- Neutral: 27.27%

- Negative: 18.18%

Sentiment Summary: The recent news flow on GLD and gold is predominantly positive, with 54.55% of articles expressing a positive sentiment. Neutral coverage accounts for 27.27%, while negative sentiment is present in 18.18% of the articles.

This indicates that current market news is generally favorable toward GLD and gold, with a moderate presence of neutral and negative perspectives.

USO,Oil Articles: 22

- Neutral: 63.64%

- Positive: 22.73%

- Negative: 13.64%

Sentiment Summary:

The majority of recent articles on USO and oil are neutral (63.64%), with a smaller proportion reflecting positive sentiment (22.73%) and an even lower share expressing negative sentiment (13.64%).

This indicates that most current market commentary is balanced, with a slight skew toward neutral and positive viewpoints in the coverage.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: January 6, 2026 07:16

- IBIT 53.46 Bullish 4.95%

- TSLA 451.67 Bullish 3.10%

- AMZN 233.06 Bullish 2.90%

- GLD 408.76 Bullish 2.63%

- USO 70.22 Bullish 1.83%

- IWM 252.73 Bullish 1.59%

- IJH 67.78 Bullish 1.30%

- META 658.79 Bullish 1.29%

- DIA 489.77 Bullish 1.27%

- QQQ 617.99 Bullish 0.79%

- SPY 687.72 Bullish 0.67%

- GOOG 317.32 Bullish 0.63%

- TLT 87.46 Bullish 0.49%

- MSFT 472.85 Bearish -0.02%

- NVDA 188.12 Bearish -0.39%

- AAPL 267.26 Bearish -1.38%

Market Summary: ETF Stocks & Major Holdings (2026-06-01)

ETF Stocks (SPY, QQQ, IWM, IJH, DIA)

- SPY 687.72 Bullish (0.67%) – S&P 500 ETF saw moderate gains, reflecting broad market strength.

- QQQ 617.99 Bullish (0.79%) – Nasdaq-100 ETF advanced, supported by growth-sector optimism.

- IWM 252.73 Bullish (1.59%) – Russell 2000 ETF outperformed, indicating risk appetite for small caps.

- IJH 67.78 Bullish (1.30%) – Midcap ETF rose steadily in line with broader positive sentiment.

- DIA 489.77 Bullish (1.27%) – Dow Jones ETF gained, participating in overall equity strength.

Summary: All major US equity ETFs showed positive momentum, with small and mid-caps leading gains. The overall market tone appears bullish within this snapshot.

Magnificent Seven (AAPL, MSFT, GOOG, AMZN, META, NVDA, TSLA)

- TSLA 451.67 Bullish (3.10%) – Tesla surged noticeably, standing out among mega-cap stocks.

- AMZN 233.06 Bullish (2.90%) – Amazon saw robust gains on this session.

- META 658.79 Bullish (1.29%) – Meta participated in the upward move, but with more modest strength.

- GOOG 317.32 Bullish (0.63%) – Alphabet advanced in line with tech peers.

- MSFT 472.85 Bearish (-0.02%) – Microsoft edged slightly backwards, trimming sector gains.

- NVDA 188.12 Bearish (-0.39%) – Nvidia pulled back slightly, pausing after recent momentum.

- AAPL 267.26 Bearish (-1.38%) – Apple lagged, posting the largest decline among peers.

Summary: The Mag7 cohort presented a mixed picture: TSLA and AMZN outperformed, while AAPL, NVDA, and MSFT traded slightly lower, tempering upside in the tech-heavy indices.

Other ETFs (IBIT, TLT, GLD, USO)

- IBIT 53.46 Bullish (4.95%) – Bitcoin ETF led with a strong upward move, highlighting ongoing crypto enthusiasm.

- GLD 408.76 Bullish (2.63%) – Gold ETF gained solidly, reflecting demand for safe-haven assets.

- USO 70.22 Bullish (1.83%) – Crude oil ETF advanced in pace with commodity markets.

- TLT 87.46 Bullish (0.49%) – Long-term Treasury ETF rose slightly, indicating some bond buying interest.

Summary: Alternative ETFs (crypto, gold, oil, treasuries) caught a bid, especially IBIT and GLD, underlining a wide-ranging risk-on sentiment but also some defensive allocation.

Overall State of Play

- Bullish: The majority of listed ETFs and stocks closed higher, led by crypto, energy, precious metals, and small caps.

- Bearish/Mixed: Some major technology names (AAPL, NVDA, MSFT) traded slightly lower, suggesting selective sector rotation.

- Market Tone: Strong risk-taking appetite, with a tilt toward growth, alternative assets, and cyclicals; however, some mega-cap tech weakness worth note for short-term traders.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2026-01-06: 07:17 CT.

US Indices Futures

- ES Uptrend on WSFG, MSFG; price above all MAs; new weekly high 7013.50; next support 6448.87; yearly grid flat; trend continuation ST/IT, neutral LT near yearly resistance.

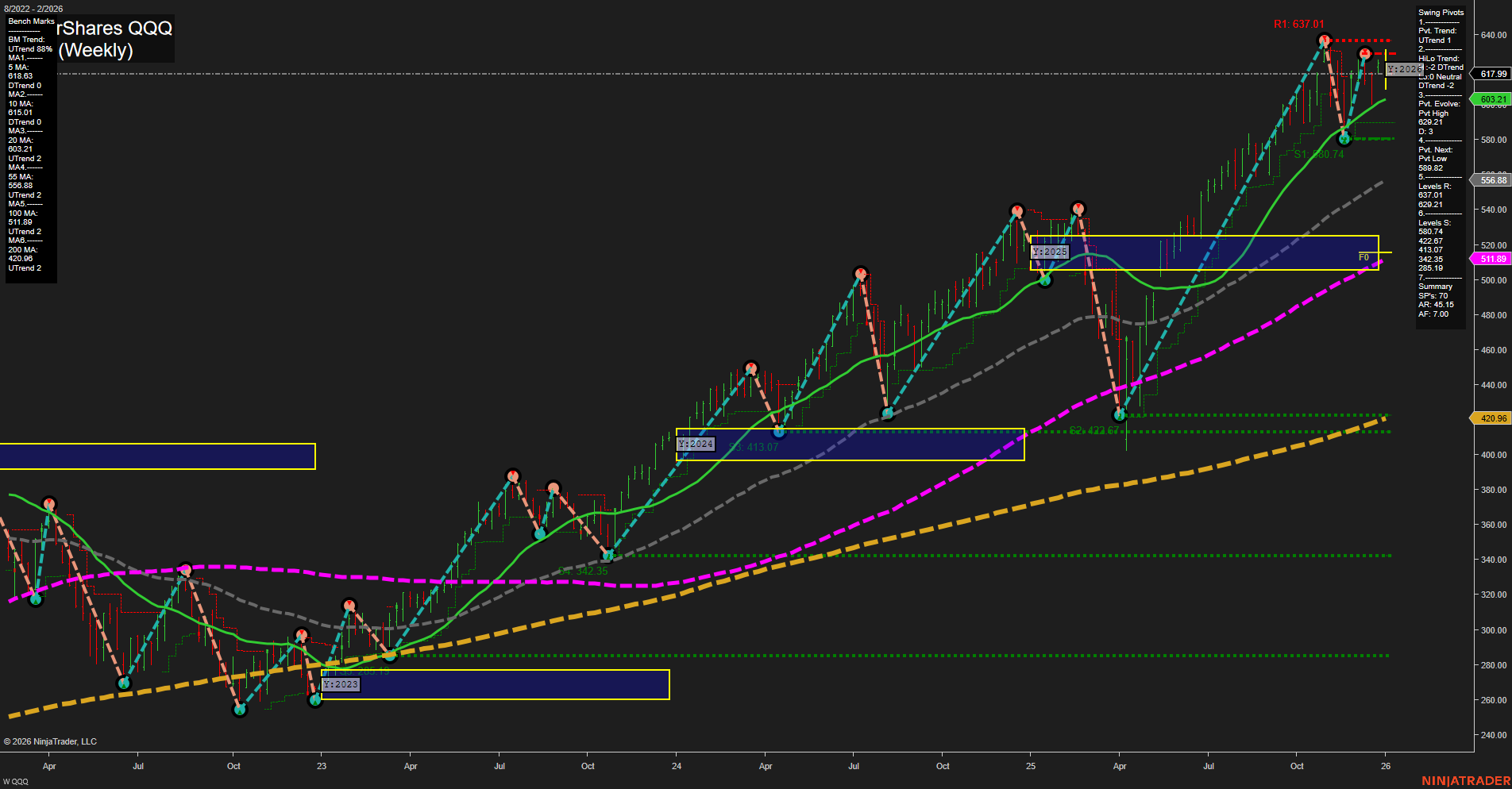

- NQ Bullish on WSFG, MSFG; above key MAs; swing high 26655.50, support 25161.00; YSFG trend down, price below Y NTZ; range/consolidation risk LT, uptrend ST/IT.

- YM Persistent uptrend all session grids; price at new highs 49,234; support 45,609; all MAs upward; bullish pivots; no immediate reversal signals; stacked trend alignment HTF.

- EMD Strong bullish trend on WSFG, MSFG, YSFG; above NTZ across grids; high at 3434.7; next support 3287.0; all benchmark MAs rising; new long signals, trend continuation.

- RTY Bullish on WSFG, MSFG, YSFG; above all MAs; high at 2633.9; support 2483.0; short/long-term bullish, IT trend digesting recent correction; ATR elevated, volume robust.

- FDAX Persistent uptrend on WSFG, MSFG, YSFG; price above all MAs; highs 25,061–25,081; next support 23,133; recent breakouts; strong pullback structure, broad-based strength.

Overall State

- Short-Term: Bullish

- Intermediate-Term: Bullish

- Long-Term: Neutral to Bullish (index-dependent)

Conclusion

Broad HTF technical structure for US Indices Futures is trending bullish on short- and intermediate-term horizons, with price above major session fib grid levels and all benchmark moving averages rising. Recent swing pivots and long signals confirm uptrends, while higher highs and higher lows persist across most contracts. Main benchmarks (WSFG, MSFG, YSFG) are aligned upward or holding above NTZ for YM, EMD, RTY, FDAX; ES and NQ show minor long-term consolidation under yearly resistance. Support levels are layered beneath recent tops, but no material HTF exhaustion. The current state indicates ongoing trend continuity, with ES and NQ exhibiting more neutral long-term profiles as they approach yearly fib grid ceilings. Directional correlations favor continued upward structure, with all contracts showing structured support and controlled volatility within broad rally phases.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts