After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

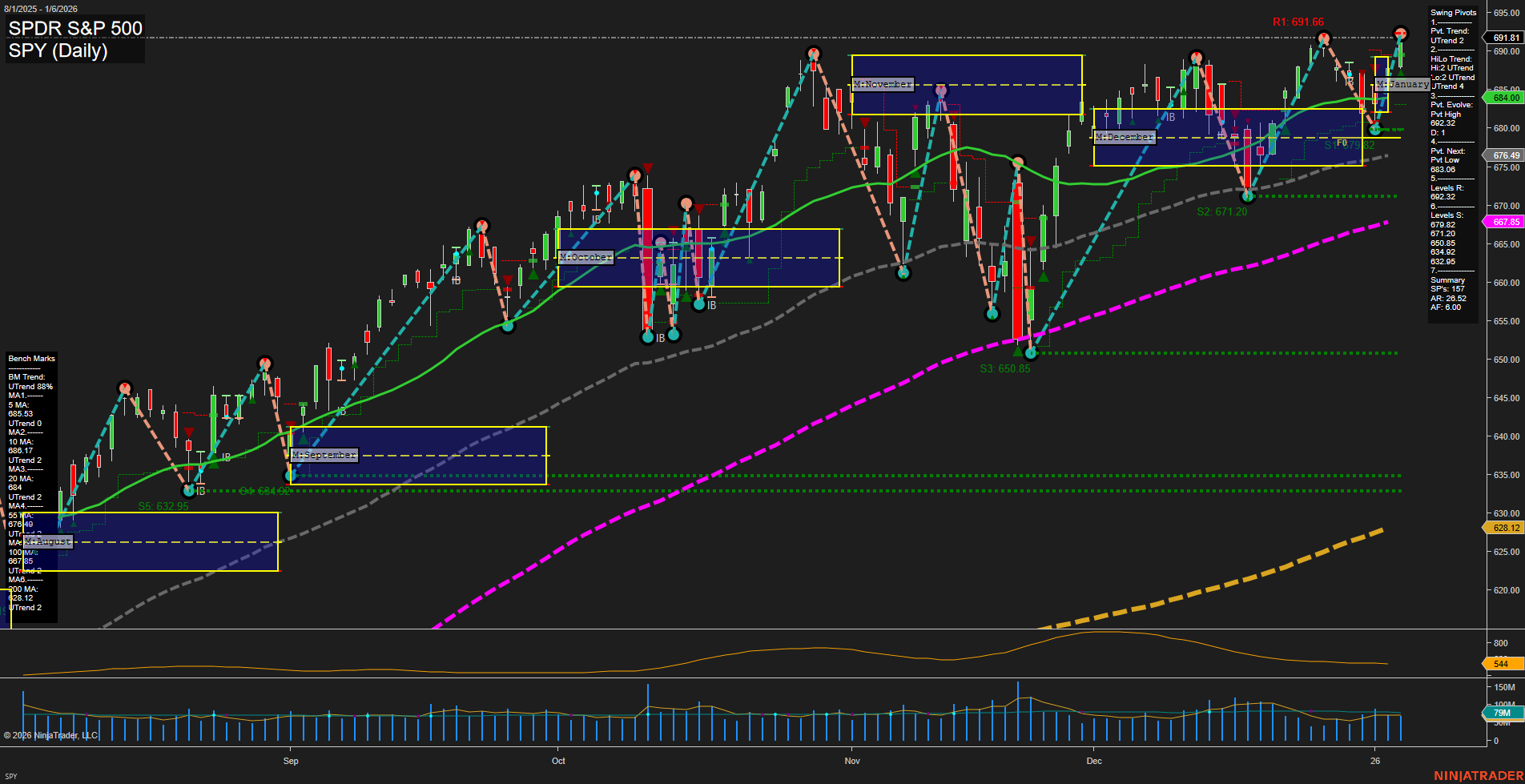

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- S&P 500 Sets New Highs, Alphabet Surpasses Apple: The S&P 500 reached fresh record levels amid a multi-day rally, with Alphabet overtaking Apple in market capitalization during midday trade.

- Small-Cap Stocks in Focus: The Russell 2000 posted robust returns in 2025 and the small-cap segment is attracting renewed interest, with experts citing attractive valuations and early-stage earnings momentum.

- Tech Sector Appeal Rises: Big Tech stock valuations have come down due to earnings improvements and price corrections, making the sector more attractive. Market commentary highlights opportunity in both established names and underappreciated AI/networking stocks.

- Dividend and Gold-Related Momentum: Certain dividend-paying stocks exhibit strong performance into 2026, while gold holds support above key technical levels, maintaining an upside bias.

- Oil & Commodities Developments: U.S. policy on Venezuelan oil remains a headline, with proceeds from oil sales routed through U.S.-controlled accounts and ongoing control measures communicated by the administration. Oil prices fell on oversupply and rising gasoline inventory concerns. WTI and Brent are under pressure.

- Macro Data and Policy: Upcoming releases will include catchup GDP, inflation, and consumer spending data. Economic surprises and administration announcements have caused intraday volatility, with swings in investor sentiment.

- Geopolitical Risk and Volatility: Ongoing tensions regarding Venezuela, as well as warnings of broader geopolitical risks, have added to expectations for market volatility. Discussions indicate potential long-term implications for energy, international relations, and market stability.

- Earnings Outlook: The absence of major Q4 earnings warnings has prompted optimism for the current reporting season. Some strategists see potential for a notable quarter, while also warning of possible pullbacks amid elevated index targets.

- Corporate and Sector Highlights: PDVSA-U.S. negotiations continue, Berkshire Hathaway’s successor announced with a top-tier S&P 500 CEO salary, and notable lessons from the past year cited regarding risk management in high-profile stocks.

News Conclusion

- Major U.S. indices are demonstrating strength, particularly in large-cap tech and small-cap segments; market participants are also watching for shifts in oil and commodity prices as well as emerging policy headlines.

- The market environment remains sensitive to economic data releases, geopolitical events, and earnings season developments, resulting in intermittent volatility and sector rotation.

- Ongoing policy actions tied to Venezuela’s oil sector and their downstream effects on energy and broader international relations continue to serve as a key macro risk factor.

- While some strategic calls highlight optimism for specific asset classes, market history underscores the importance of risk assessment and adaptability amid changing fundamentals and sentiment.

Market News Sentiment:

Market News Articles: 42

- Positive: 42.86%

- Neutral: 35.71%

- Negative: 21.43%

GLD,Gold Articles: 10

- Neutral: 40.00%

- Positive: 30.00%

- Negative: 30.00%

USO,Oil Articles: 28

- Neutral: 35.71%

- Positive: 35.71%

- Negative: 28.57%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: January 7, 2026 05:00

- GOOG 322.43 Bullish 2.51%

- MSFT 483.47 Bullish 1.04%

- NVDA 189.11 Bullish 1.00%

- TLT 87.79 Bullish 0.58%

- AMZN 241.56 Bullish 0.26%

- QQQ 624.02 Bullish 0.10%

- IWM 255.48 Bearish -0.23%

- SPY 689.58 Bearish -0.32%

- TSLA 431.41 Bearish -0.36%

- IJH 68.26 Bearish -0.73%

- AAPL 260.33 Bearish -0.77%

- DIA 489.96 Bearish -0.94%

- GLD 409.23 Bearish -0.96%

- USO 67.79 Bearish -1.05%

- IBIT 51.54 Bearish -1.74%

- META 648.69 Bearish -1.81%

Market Summary – Trader Snapshot (as of 2026-07-01 17:00)

ETF Stocks

- SPY 689.58 Bearish (-0.32%)

S&P 500 proxy trades slightly lower, reflecting weakness in overall large-cap equities. - QQQ 624.02 Bullish (0.10%)

Nasdaq-100 maintains positive momentum, in sync with gains across major tech names. - IWM 255.48 Bearish (-0.23%)

Russell 2000 exposes continued pressure on small caps. - IJH 68.26 Bearish (-0.73%)

S&P Midcap 400 sees steeper declines, lagging majors. - DIA 489.96 Bearish (-0.94%)

Dow 30 underperforms, pulling back more than broader indices.

MegaCap (Mag7) Stocks

- GOOG 322.43 Bullish (2.51%)

Google/Alphabet leads Mag7 with notable upside, boosting tech sentiment. - MSFT 483.47 Bullish (1.04%)

Microsoft continues its upward trend, supporting the QQQ. - NVDA 189.11 Bullish (1.00%)

Nvidia remains in demand amid ongoing semiconductor momentum. - AMZN 241.56 Bullish (0.26%)

Amazon extends modest gains, tracking the tech sector. - AAPL 260.33 Bearish (-0.77%)

Apple softens despite broader tech strength, diverging from peers. - TSLA 431.41 Bearish (-0.36%)

Tesla slips lower, echoing recent volatility in the EV space. - META 648.69 Bearish (-1.81%)

Meta Platforms registers a sharp drop, highlighting sector divergence.

Other Major ETFs

- TLT 87.79 Bullish (0.58%)

Long-duration Treasury ETF edges higher, signaling potential risk aversion. - GLD 409.23 Bearish (-0.96%)

Gold ETF slides, suggesting limited safe-haven bid at this juncture. - USO 67.79 Bearish (-1.05%)

Oil proxy weakens, tracking global commodity softness. - IBIT 51.54 Bearish (-1.74%)

Bitcoin ETF under pressure, reflecting cryptocurrency volatility.

Summary

The overall market snapshot shows mixed dynamics. Several major tech names and growth/innovation leaders (GOOG, MSFT, NVDA) are in rally mode, bolstering QQQ, while many broad-market and cyclical ETFs (SPY, DIA, IWM, IJH) are seeing modest-to-moderate declines. Defensive or alternative asset ETFs (GLD, USO, IBIT) face pressure, with only TLT (long Treasury) showing a supportive bid. Performance is sector and theme dependent, reinforcing intraday rotational trends. No trading advice; information for reference only.

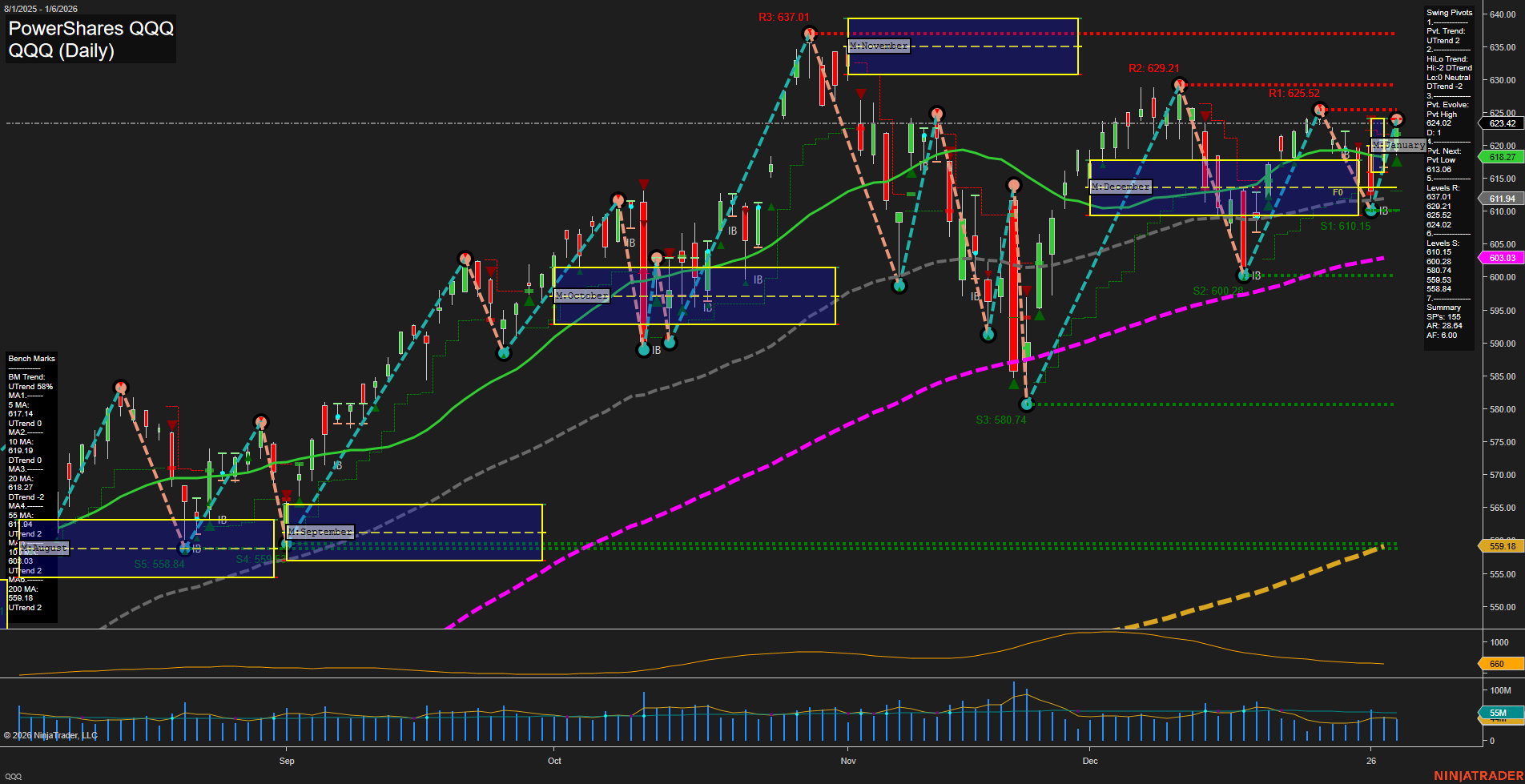

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts