After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Record-Setting Indices: The Dow, S&P 500, and Russell 2000 all closed at record highs following a week marked by strong economic data and positive sentiment. The S&P 500 continued its bullish run, supported by jobs data and technical patterns signaling further upside, while the Nasdaq and Dow also logged noticeable gains.

- Jobs Data Impact: December’s jobs report provided a mixed outlook but was sufficient to reduce recession fears and underpinned the recent rally. Although job creation was not exceptionally strong, the data reassured markets regarding the U.S. labor market’s stability.

- Federal Reserve Watch: The Federal Reserve is not expected to announce rate cuts in January. Regional bank leadership changes were announced, but the jobs report did not motivate immediate monetary policy adjustments.

- Venezuela and Oil Markets: Geopolitical events dominated headlines with the U.S. capture of Venezuela’s president and moves to revive Venezuelan oil exports. Announcements of significant investments and incoming shipments of Venezuelan oil to the U.S. influenced the energy and defense sectors.

- Sector Rotation: Beyond tech, sectors such as materials and industrials outperformed early in the year even as enthusiasm around AI investment cooled somewhat. Analysts noted that strong performance could continue even if big tech’s AI-driven spending slows in 2026.

- Company Leadership & M&A: There has been a shift among the world’s largest companies by market capitalization, with Nvidia, Apple, and Microsoft trading places. The M&A outlook for 2026 is improving according to industry experts.

- Gold and Commodities: Gold prices extended their uptrend, approaching new highs. Commodities trading activity also intensified around Venezuelan oil exports.

- Valuations and Market Risks: While markets appear strong and outlook is positive, some analysts warn that current valuations are historically high, pointing to risks of potential bubbles, particularly in technology and AI.

- Legal and Political Risks: Oil-related legal disputes and policy uncertainty continue, including unresolved issues involving Citgo and Supreme Court battles affecting major oil companies.

News Conclusion

- The first full week of 2026 has closed with record highs in the major U.S. indices, driven by encouraging jobs data, strong investor sentiment, and ongoing sector rotation out of mega-cap tech.

- Geopolitics and energy headlines—specifically those concerning Venezuela—are influencing oil and related sectors, spurring large capital commitments and exports.

- The Federal Reserve remains on hold, with no immediate changes to interest rates expected, as recent economic data provides neither urgency nor cause for concern.

- Despite broad strength, caution is noted regarding elevated valuations, ongoing legal disputes within the oil sector, and longer-term risks associated with rapid run-ups like those seen in AI stocks.

- Overall, markets remain bullish with breadth across sectors, but underlying risks and volatility potential have not dissipated.

Market News Sentiment:

Market News Articles: 53

- Neutral: 56.60%

- Positive: 35.85%

- Negative: 7.55%

GLD,Gold Articles: 11

- Positive: 63.64%

- Neutral: 36.36%

USO,Oil Articles: 19

- Neutral: 52.63%

- Positive: 31.58%

- Negative: 15.79%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: January 9, 2026 05:00

- TSLA 445.01 Bullish 2.11%

- META 653.06 Bullish 1.08%

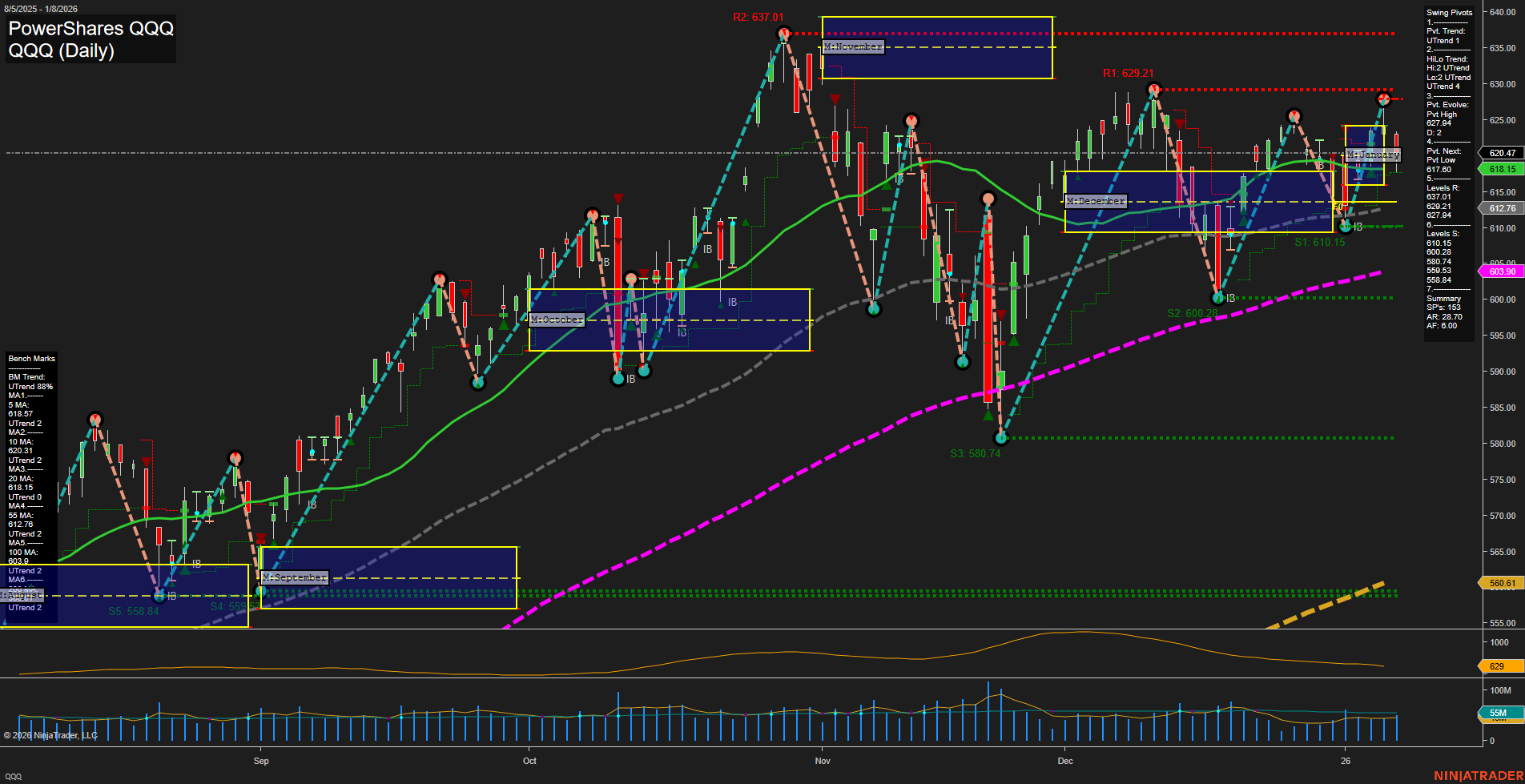

- QQQ 626.65 Bullish 1.00%

- GOOG 329.14 Bullish 0.96%

- IJH 69.11 Bullish 0.88%

- IWM 260.23 Bullish 0.76%

- GLD 414.47 Bullish 0.72%

- TLT 87.93 Bullish 0.66%

- SPY 694.07 Bullish 0.66%

- DIA 495.02 Bullish 0.51%

- AMZN 247.38 Bullish 0.44%

- USO 70.78 Bullish 0.34%

- MSFT 479.28 Bullish 0.24%

- AAPL 259.37 Bullish 0.13%

- NVDA 184.86 Bearish -0.10%

- IBIT 51.16 Bearish -0.70%

Market Summary for Traders — 2026-01-09 Close

ETF Stocks: Major Benchmarks

- SPY (S&P 500): Bullish +0.66% – Large-cap stocks remain in positive momentum.

- QQQ (Nasdaq 100): Bullish +1.00% – Continued tech sector strength driving gains.

- IWM (Russell 2000): Bullish +0.76% – Small-caps advancing, tracking broader risk-on sentiment.

- IJH (S&P MidCap 400): Bullish +0.88% – Mid-caps leading the pack with robust performance.

- DIA (Dow Jones Industrial Average): Bullish +0.51% – Blue chips up, but less aggressively than growth sectors.

Magnificent 7: State of Play

- TSLA: Bullish +2.11% – Strongest showing among top tech, big momentum.

- META: Bullish +1.08% – Solid upward move continues.

- GOOG: Bullish +0.96% – Gains on the back of steady growth.

- AMZN: Bullish +0.44% – Performance lags sector leaders, but in the green.

- MSFT: Bullish +0.24% – Modest upside, showing resilience.

- AAPL: Bullish +0.13% – Quiet session; maintains stability.

- NVDA: Bearish -0.10% – Only big-tech component in decline for the day.

Other ETFs: Fixed Income, Commodities & Digital Assets

- GLD (Gold): Bullish +0.72% – Gold continues steady gains, indicating persistent demand.

- TLT (20+ Yr Treasuries): Bullish +0.66% – Long bonds rally as rates stabilize.

- USO (Crude Oil): Bullish +0.34% – Oil prices edge higher, staying positive.

- IBIT (Bitcoin ETF): Bearish -0.70% – Digital assets ETF under pressure after recent highs.

Summary of State of Play

The session featured broad-based bullishness across equities, with ETFs in the large-cap, mid-cap, and small-cap space all posting gains. The tech sector remains a notable driver, led by strength in TSLA, META, and QQQ. Commodities and bond proxies also saw positive moves, while digital assets and NVDA were notable exceptions with mild pullbacks. Overall, the market snapshot indicates a risk-on environment with only selective areas showing weakness.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts