Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

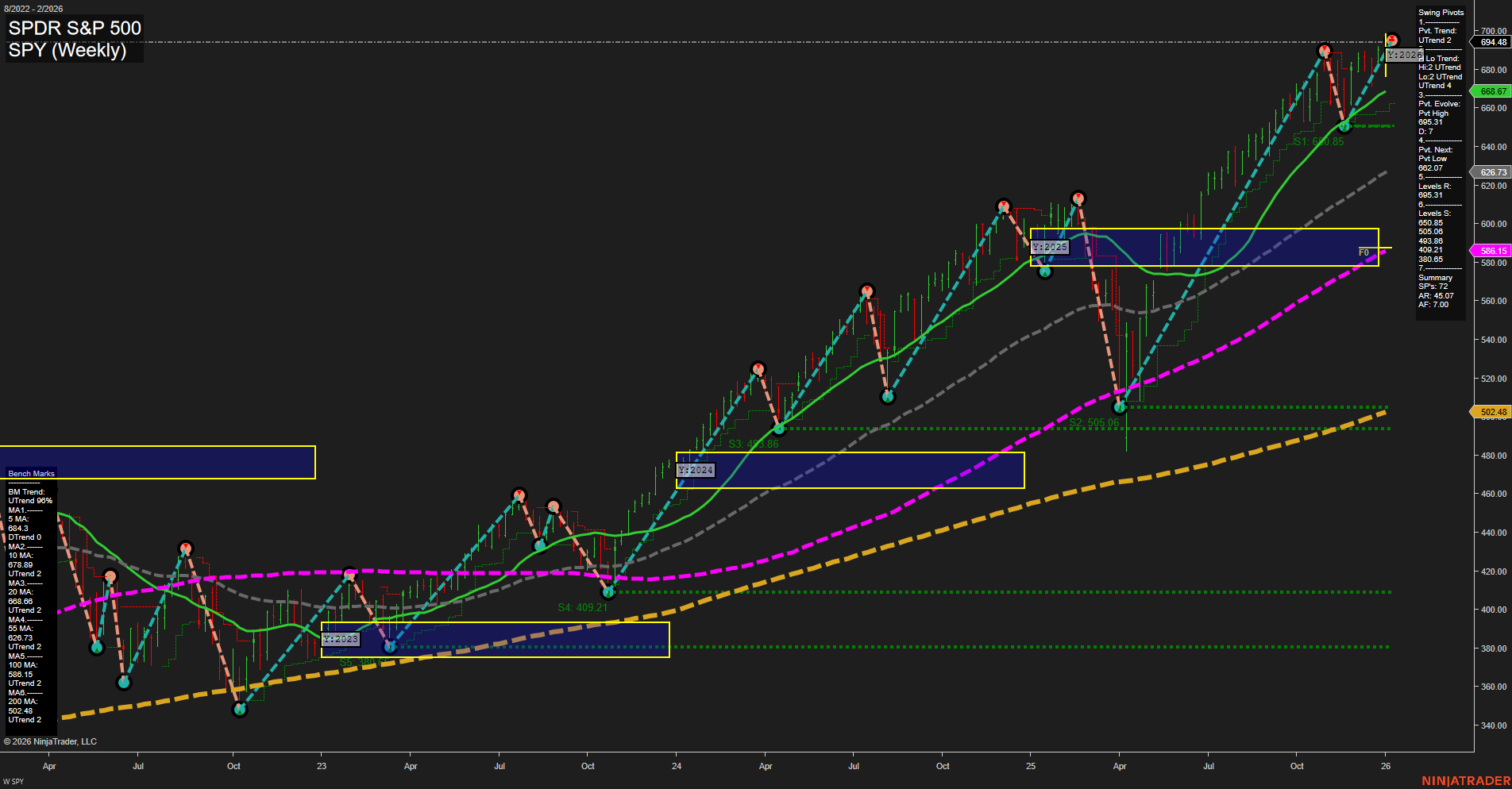

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

- 2026-01-19 Birthday of Martin Luther King, Jr

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- GS Release: 2026-01-15 T:BMO

- MS Release: 2026-01-15 T:BMO

- BAC Release: 2026-01-14 T:BMO

- C Release: 2026-01-14 T:BMO

- WFC Release: 2026-01-14 T:BMO

- JPM Release: 2026-01-13 T:BMO

Earnings Summary and Market Conclusion:

Heading into the week of January 13-15, 2026, indices futures traders should note a heavy concentration of major U.S. bank earnings. JPMorgan Chase (JPM) leads off with its release before the market opens on January 13, followed by Bank of America (BAC), Citigroup (C), and Wells Fargo (WFC) on January 14, and wrapping up with Goldman Sachs (GS) and Morgan Stanley (MS) before the open on January 15. This sequence of reports from key financial institutions will offer early cues on lending, credit quality, and broader economic sentiment, setting a directional tone for equity indices—especially the Dow and S&P 500. However, trading momentum and volumes may remain subdued in the days prior as market participants await these results and, crucially, remain on hold for forthcoming updates from NVDA and the MAG7/AI tech complex. The anticipation around these tech heavyweights may lead to tighter index futures ranges and choppy price action, amplifying the post-earnings reaction once these dual catalysts—the banks and the big tech/AI stocks—hit the tape.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Tuesday 08:30 – High Impact USD CPI & Core CPI (m/m & y/y): Major inflation gauges, heavily watched by market participants for clues regarding future Fed rate policy. Higher than expected readings may trigger selling in equity indices due to fears of higher-for-longer rates, while lower print may lift sentiment.

- Wednesday 08:30 – High Impact USD PPI & Core PPI (m/m) and Retail Sales (m/m & Core): PPI and Core PPI serve as upstream inflation signals, followed closely with retail sales reports which gauge consumer spending strength. Surprising strength in either may reinforce inflationary concerns, heightening volatility across S&P/NDX futures.

- Thursday 08:30 – High Impact USD Unemployment Claims: Weekly snapshot of labor market health; sharp moves away from consensus can spur short-term moves in stock index futures, especially when labor data could influence Fed policy path.

- Wednesday 10:30 – Crude Oil Inventories (Oil Relevant): Changes in inventory levels can affect oil prices, which in turn may have inflationary effects and impact index futures via energy and input cost channels.

EcoNews Conclusion

- This week’s high-impact inflation and employment reports are likely to drive outsized volatility in index futures, as traders recalibrate expectations for Fed rate moves.

- Market momentum and volume may slow ahead of Tuesday’s CPI release, reflecting caution in the lead-up to one of the month’s top tier data events.

- Any pronounced moves in oil, driven by inventory data, could feed back into headline inflation concerns and influence broader equity market direction.

- Traders should remain alert for potential volatility spikes at the 10 AM news release cycle, which often coincides with short-term reversals or trend continuations.

For full details visit: Forex Factory EcoNews

Market News Summary

- Geopolitical & Energy Markets: U.S. moves to control Venezuelan oil production could shift global market power dynamics, impacting OPEC’s influence. Political instability in Venezuela, following the U.S. military’s rendition of Nicolás Maduro and ongoing negotiations, adds further uncertainty to oil supply.

- Economic Data & FOMC Outlook: A mixed U.S. jobs report has increased speculation over potential Fed rate cuts. Market focus intensifies on the upcoming CPI release, as swaps markets anticipate year-over-year inflation near 3%, higher than consensus forecasts. This could create volatility, especially with core and headline inflation both expected to tick up.

- Corporate Earnings: Q4 earnings season kicks off with key reports from banks such as JPMorgan and Goldman Sachs and from Delta, which may drive moves in financial and airline sectors and influence broader sector rotation.

- Market Trends & Sentiment: Stocks are reflecting expectations of a commodities ‘supercycle’ in 2026, with increased interest in sectors tied to hard assets. Positive consumer sentiment has slightly beaten forecasts, though it remains below last year’s levels. Equities are coming off a strong year, with select ETFs viewed as positioned to potentially outperform the S&P 500.

- Policy Developments: The White House is close to naming the next Federal Reserve chair, a decision likely to influence U.S. monetary policy in the coming months.

News Conclusion

- Uncertainty from U.S.-Venezuelan oil policy developments is adding to geopolitical risk and could influence energy and commodity pricing.

- Anticipated hot CPI data and upcoming earnings reports may be significant near-term catalysts for index volatility and sector rotations.

- The narrative of higher-for-longer inflation is underpinning strength across commodities and precious metals.

- Positive consumer sentiment and sectoral momentum have supported recent equity strength, with some indicators pointing toward ongoing opportunities in both hard assets and select equity ETFs.

- Near-term market direction may hinge on inflation data, Fed chair nomination, and key earnings announcements.

Market News Sentiment:

Market News Articles: 6

- Positive: 50.00%

- Neutral: 33.33%

- Negative: 16.67%

GLD,Gold Articles: 2

- Positive: 100.00%

USO,Oil Articles: 4

- Neutral: 50.00%

- Negative: 25.00%

- Positive: 25.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: January 11, 2026 06:15

- TSLA 445.01 Bullish 2.11%

- META 653.06 Bullish 1.08%

- QQQ 626.65 Bullish 1.00%

- GOOG 329.14 Bullish 0.96%

- IJH 69.11 Bullish 0.88%

- IWM 260.23 Bullish 0.76%

- GLD 414.47 Bullish 0.72%

- TLT 87.93 Bullish 0.66%

- SPY 694.07 Bullish 0.66%

- DIA 495.02 Bullish 0.51%

- AMZN 247.38 Bullish 0.44%

- USO 70.78 Bullish 0.34%

- MSFT 479.28 Bullish 0.24%

- AAPL 259.37 Bullish 0.13%

- NVDA 184.86 Bearish -0.10%

- IBIT 51.16 Bearish -0.70%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2026-01-11: 18:15 CT.

US Indices Futures

- ES Strong bullish structure, price above YSFG/MSFG/WSFG NTZ, all MA benchmarks up, last swing high 7013.50, support at 6816.38, higher highs/lows, no reversal signals.

- NQ Price above YSFG/MSFG NTZ, weekly WSFG trend down (consolidation), swing high 26655.50, support 23464.35, all MAs rising, intermediate/long-term bullish, short-term neutral.

- YM [No current technicals data available.]

- EMD Robust uptrend all timeframes, price above all NTZs, all benchmarks/MAs trending up, last swing high 3424.5, resistances 3472.2/3549.3, wide support buffer, higher highs/lows, no reversal signals.

- RTY All session fib grids up, price above NTZs, swing high 2636.9, support at 2300.0, all benchmarks in uptrend, no resistance above, clear rally phase, no reversal/exhaustion seen.

- FDAX Persistent uptrend, price above all NTZ/F0%, MAs up across timeframes, last swing high 25,387, support at 23,133, breakout and trend continuation, higher highs/lows, strong trend phase.

Overall State

- Short-Term: Bullish (ES, EMD, RTY, FDAX), Neutral (NQ)

- Intermediate-Term: Bullish (All with data)

- Long-Term: Bullish (All with data)

Conclusion

US Indices Futures demonstrate continued uptrends across higher time frames, supported by price firmly above key YSFG, MSFG, and WSFG levels and all major moving averages trending up. ES, EMD, RTY, and FDAX are in sustained bullish structures with higher swing highs and wide supports below. NQ shows a neutral short-term consolidation below the WSFG NTZ but remains aligned with intermediate and long-term bullish direction. No immediate reversal or exhaustion signals are present, and trend continuation is supported by recent swing pivots, benchmarks, and session fib grid alignment. Intra-day pullbacks or retracements fit within the prevailing HTF structure.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts