After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

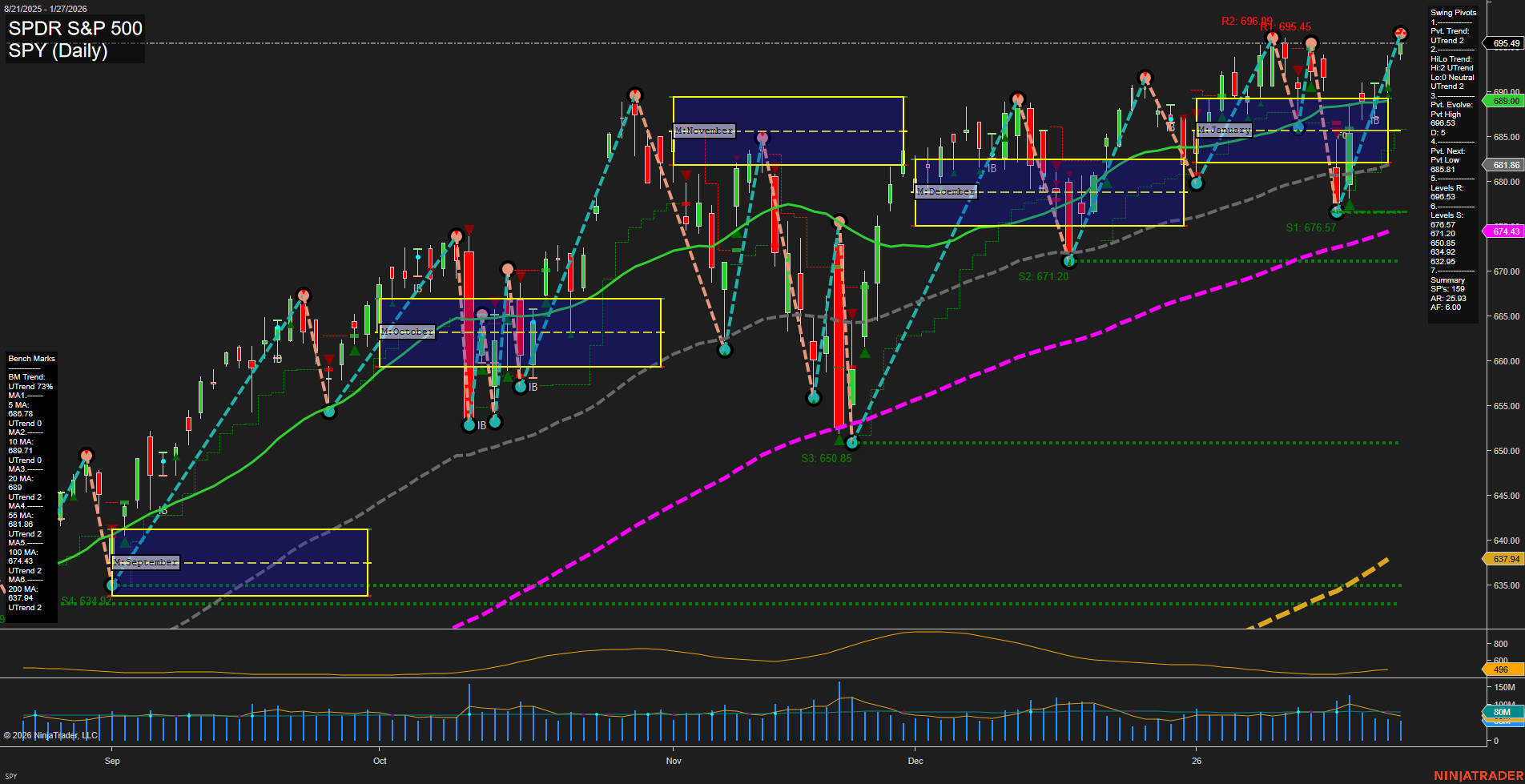

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Youth participation in stock investing continues to rise as new account offerings make access easier, reflecting ongoing generational shifts in market engagement.

- Debate continues around U.S. yield curves, with skepticism on whether a steepening curve is consistently a bullish economic signal.

- Venezuela’s return to previous crude oil production highs appears unlikely soon due to investment and infrastructure hurdles.

- Oil markets remain supported; WTI and Brent are pushing new highs as inventory data and geopolitical tensions generate bullish sentiment.

- S&P 500 broke through 7,000 for the first time. Moves driven by tech sector strength and optimism around artificial intelligence, yet pre-Fed decision profit-taking is evident.

- Brazil’s Petrobras expands oil sales to Indian refiners, pointing to continued robust international energy trade flows.

- Federal Reserve faces ongoing investigations, adding a layer of uncertainty regarding central bank leadership.

- Tariff reversal expectations are building confidence among investors, shifting focus to underlying economic activity.

- China’s gold imports fell sharply in December, but January retail demand jumped, supporting higher gold prices despite global shifts.

- Gold surged past $5,300, underscoring its increased appeal as an alternative to the dollar.

- S&P’s milestone is under discussion among investment committees as broader market implications are considered.

- Fed Chair Powell expresses confidence on inflation trends, signals rates on hold amidst stable labor markets and easing tariff pressures.

- Record-breaking rallies in gold and silver coincide with rising concerns regarding fiat currencies globally.

- Fed Chair Powell downplays the gold rally, asserting no loss of central bank credibility.

- SpaceX signals intent to enter public markets with a high-profile IPO, drawing attention from major banks and capital allocators.

- Small-cap stocks continue a strong upward momentum, with certain names flagged for strong earnings and upside potential.

- The Fed’s January meeting outcome aligns with expectations: policy rates held steady, as markets eye the AI-driven wealth story as a key driver.

- Powell notes the economy’s continued strength, with AI and consumer spending highlighted as primary supports.

- Gold’s technical momentum confirms the extension of its bull run, though watchfulness for pullbacks grows as momentum accelerates.

- The dollar strengthened and markets fluctuated after the Fed held rates, with inflation risks flagged.

- Gold’s ongoing rally appears fueled by a fundamental shift in structural demand, rather than speculative excess from Western investors.

- Powell addresses the future of Fed leadership, emphasizing the importance of remaining apolitical.

- End-of-day wraps highlight strong gold performance, persistent memory chip momentum, and broad market resilience.

- Oil prices maintain elevated levels due to geopolitical risks and robust Asian demand, despite initial oversupply expectations.

- Brazil’s central bank held rates steady at 15% but hints at potential rate cuts in March.

News Conclusion

- Markets are digesting a historic S&P 500 milestone above 7,000, propelled primarily by technology and AI optimism, while gold rallies to new records amid dollar competition and shifting global demand.

- The Federal Reserve maintained interest rates as anticipated; commentary centers on inflation moderation, stable labor, and the broader economy’s resilience.

- Energy markets remain in focus with high oil prices supported by supply-side uncertainties, geopolitical tensions, and solid emerging markets demand.

- Uncertainties around the Fed chair and ongoing investigations, as well as developments in U.S. tariffs, add complexity to market outlooks.

- Small-cap stocks, anticipated IPO stories, and sector momentum (notably in AI and semiconductors) continue to shape trading opportunities and sentiment at the start of the year.

Market News Sentiment:

Market News Articles: 49

- Neutral: 53.06%

- Positive: 32.65%

- Negative: 14.29%

GLD,Gold Articles: 21

- Positive: 57.14%

- Neutral: 33.33%

- Negative: 9.52%

USO,Oil Articles: 11

- Neutral: 45.45%

- Positive: 36.36%

- Negative: 18.18%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: January 28, 2026 05:00

- GLD 494.56 Bullish 3.88%

- NVDA 191.52 Bullish 1.59%

- USO 76.62 Bullish 1.27%

- GOOG 336.28 Bullish 0.38%

- QQQ 633.22 Bullish 0.33%

- MSFT 481.63 Bullish 0.22%

- TSLA 431.46 Bullish 0.13%

- DIA 490.13 Bullish 0.01%

- SPY 695.42 Bearish -0.01%

- TLT 87.60 Bearish -0.23%

- IJH 69.45 Bearish -0.23%

- IBIT 50.51 Bearish -0.24%

- IWM 263.30 Bearish -0.54%

- META 668.73 Bearish -0.63%

- AMZN 243.01 Bearish -0.68%

- AAPL 256.44 Bearish -0.71%

Market State of Play: ETF Stocks

- SPY: 695.42 Bearish (-0.01%) — The S&P 500 ETF is marginally lower, signaling caution among large-cap U.S. equities.

- QQQ: 633.22 Bullish (+0.33%) — The Nasdaq 100 ETF is holding gains, showing continued appetite for tech-heavy exposure.

- IWM: 263.30 Bearish (-0.54%) — Small-cap ETF faces renewed selling pressure, underperforming the broader market.

- IJH: 69.45 Bearish (-0.23%) — Mid-caps are weak, in line with the soft small-cap theme.

- DIA: 490.13 Bullish (+0.01%) — The Dow ETF trades virtually flat with a slight tilt to the upside, reflecting old-economy resilience.

State of Play: Magnificent 7 (Mag7)

- AAPL: 256.44 Bearish (-0.71%) — Apple reverses, pacing weakness among the major techs.

- MSFT: 481.63 Bullish (+0.22%) — Microsoft extends gains as large-cap software retains momentum.

- GOOG: 336.28 Bullish (+0.38%) — Alphabet moves up, keeping the Mag7 theme mixed.

- AMZN: 243.01 Bearish (-0.68%) — Amazon slides, adding to the defensive posture among consumer tech leaders.

- META: 668.73 Bearish (-0.63%) — Meta joins the laggards within the group, underlining sector divergence.

- NVDA: 191.52 Bullish (+1.59%) — NVIDIA stands out with robust gains, boosting the semiconductor space.

- TSLA: 431.46 Bullish (+0.13%) — Tesla edges up, but the move remains subdued compared to peers.

Other Key ETFs

- GLD: 494.56 Bullish (+3.88%) — Gold ETF surges, signaling strong demand for safe-haven assets.

- USO: 76.62 Bullish (+1.27%) — Oil ETF pushes higher, suggesting constructive dynamics in energy markets.

- TLT: 87.60 Bearish (-0.23%) — Long-duration Treasury ETF slides, indicating ongoing rate concerns.

- IBIT: 50.51 Bearish (-0.24%) — Bitcoin ETF retreats, reflecting softer risk sentiment in digital assets.

Summary

The session reflects a diverging backdrop: Mag7 and large-cap tech share split leadership with pockets of strength (NVDA, MSFT, GOOG, TSLA) and notable laggards (AAPL, META, AMZN). Major ETFs are broadly mixed, with small- and mid-caps under pressure, while GLD and USO stand out with robust gains, hinting at risk-off rotation into commodities. Treasuries and crypto ETFs remain weak.

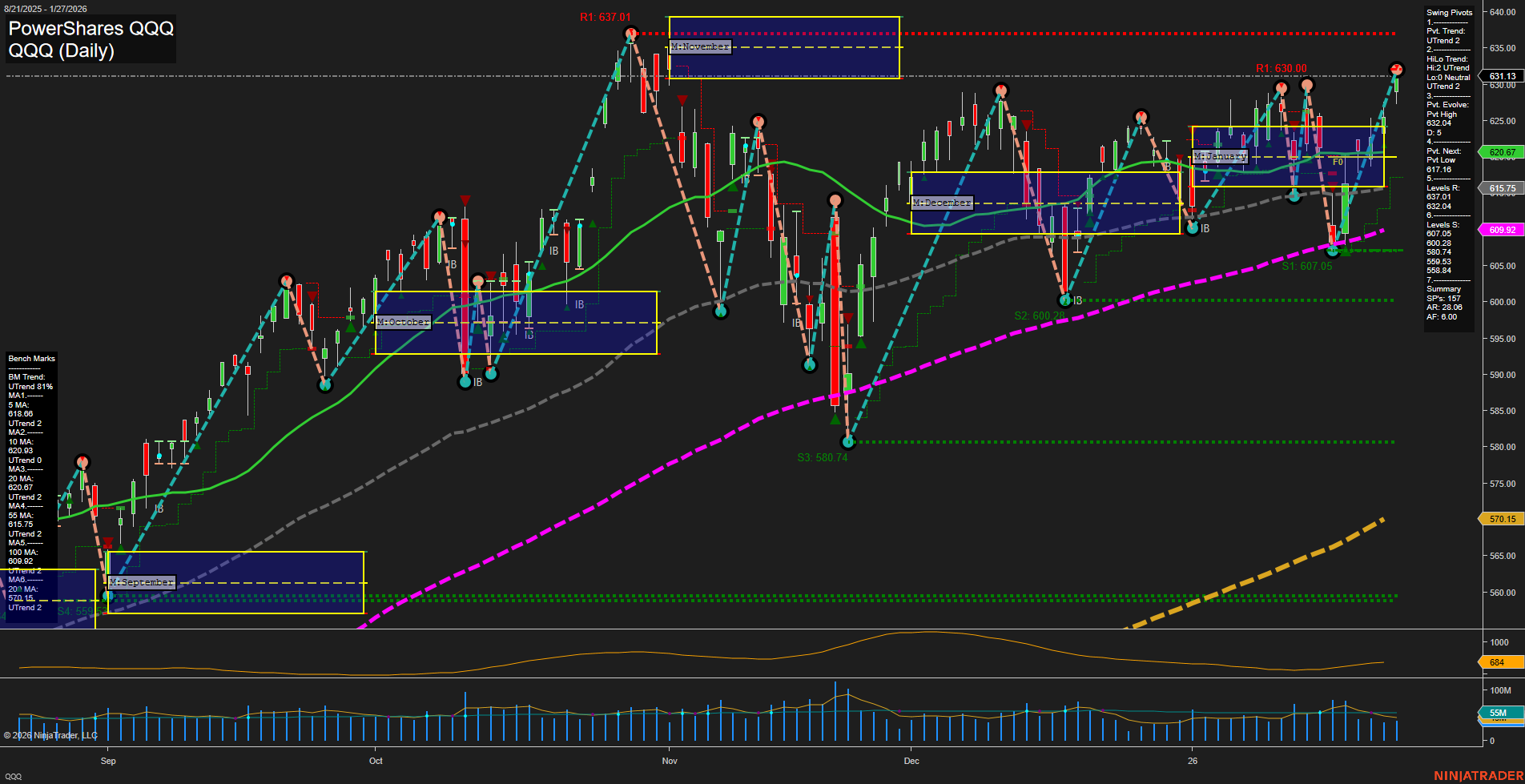

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts