Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

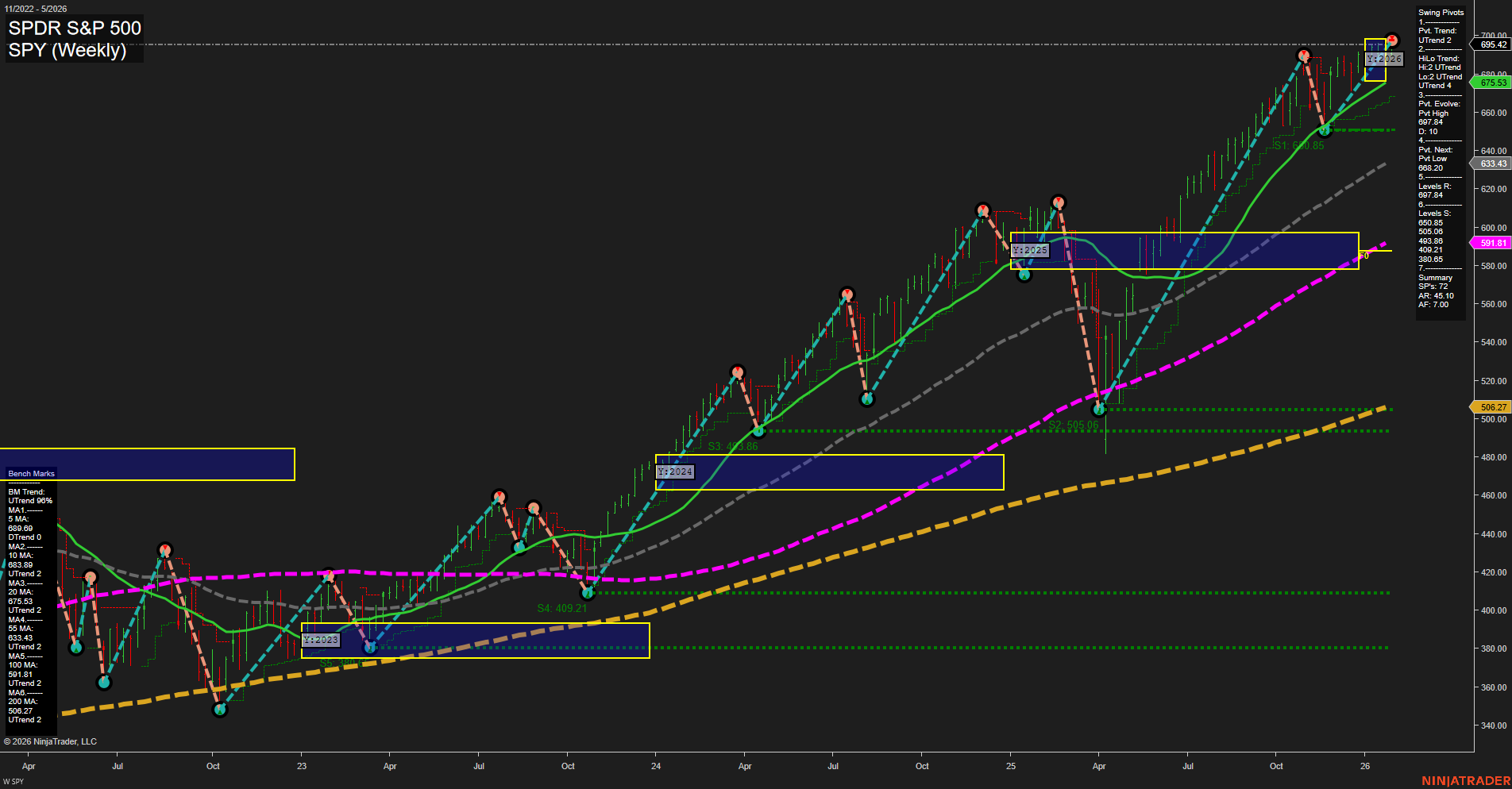

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- AAPL Release: 2026-01-29 T:AMC

As we approach Apple’s (AAPL) earnings release scheduled for after the market close on January 29, 2026, broad index futures have shown signs of subdued momentum and lighter volumes. This slowdown is typical as traders position cautiously ahead of heavyweight tech earnings, especially with heightened anticipation for AAPL and the forthcoming updates from NVDA and other prominent MAG7 and AI-related stocks. Given Apple’s significant index weighting and its influence over sentiment in both technology and broader markets, participants are likely to remain in a holding pattern until results are announced. The post-earnings reaction from AAPL, along with signals from related tech names, will be key in determining direction and volatility for index futures in subsequent sessions.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Thursday 08:30 – USD Unemployment Claims (High Impact): Initial jobless claims will provide a fresh snapshot of US labor market health. Significant deviations from forecasts may trigger sharp index futures reactions, impacting expectations for Fed policy direction.

- Friday 08:30 – USD Core PPI m/m (High Impact): Core Producer Price Index offers insights into upstream inflation pressures. Surprises—either higher or lower—can swiftly move index futures, as traders reassess inflation risk and rate outlook.

- Friday 08:30 – USD PPI m/m (High Impact): The headline Producer Price Index reading, arriving alongside the Core PPI, compounds market sensitivity. Simultaneous releases increase the potential for volatility in futures if inflation trends diverge from forecasts.

EcoNews Conclusion

- This cluster of high impact data in the 08:30 window (Thursday and Friday) is likely to drive early-session volatility in index futures, as traders quickly reassess macro outlooks based on labor market and inflation data.

- There are no medium impact oil-specific releases in this period, so energy price shifts are less likely to be data-driven during these sessions.

For full details visit: Forex Factory EcoNews

Market News Summary

- Federal Reserve Policy: The Fed held interest rates steady as expected, with Fed Chair Powell’s remarks sparking market attention. While policy is on hold, rate-cut expectations hinge on labor market weakness and upcoming economic data. This decision led to immediate dips in some U.S. futures, but the broader outlook was supported by strong corporate earnings.

- Earnings Highlights: Major tech names including Meta, Microsoft, and Tesla delivered better-than-expected results, bolstering sentiment in U.S. futures and keeping the Dow Jones and Nasdaq 100 on a bullish footing.

- Commodity Moves – Oil: Oil prices surged past key technical levels, with Brent crude exceeding $70 amid geopolitical tensions involving Iran and supply concerns. Additional drivers included a Fed policy pause, a weaker dollar, and supply adjustments from Venezuela. Conversely, expectations emerged that Saudi Arabia could offer discounts on its flagship crude due to ample supplies.

- Commodity Moves – Gold & Silver: Gold and silver hit new all-time highs, as investors sought safe-haven assets in response to global tensions and a softer dollar. Gold ETFs gained significant momentum, with strong demand supported by an improved macro backdrop and risk reassessment.

- Global Equity Moves: Major U.S. stock futures rebounded after mixed closes, with S&P 500 and Dow Jones futures rising following the Fed’s rate decision. Indonesian stocks suffered their steepest two-day drop since 1998 on the risk of a market downgrade. European oil sector faced pressure from weaker prices, impacting company earnings.

- Macro Backdrop & Market Drivers: Broader themes included ongoing trust deficits in bond and currency markets, evolving geopolitics, and continued AI-driven infrastructure growth. Attention also centered on shifting supply chains, labor force changes, and technological transitions (e.g., EV battery advances).

- Corporate Moves: Dow announced significant job cuts and cost-saving measures, highlighting economic efficiencies driven by AI adoption amid challenging business conditions.

News Conclusion

- Market sentiment was generally positive, underpinned by the Fed’s rate pause, solid earnings from major tech firms, and record-breaking rallies in gold and silver.

- Heightened geopolitical tensions and potential supply disruptions drove oil higher, while risk aversion supported gains in safe-haven commodities.

- Despite favorable trends in U.S. equities and commodities, select pockets of global markets remained volatile with downside risk, as seen in Indonesian equities and certain oil sector earnings.

- Macro and structural shifts, including monetary policy changes, evolving technology adoption, and labor market dynamics, continued to shape trading conditions and set up potential opportunities and risks for active market participants.

Market News Sentiment:

Market News Articles: 52

- Neutral: 50.00%

- Positive: 32.69%

- Negative: 17.31%

Sentiment Summary: The market news flow is predominantly neutral, accounting for 50% of the articles. Positive sentiment is reflected in approximately 33% of the coverage, while negative sentiment is present in about 17% of the articles.

These figures suggest a generally balanced tone in recent market news, with a moderate tilt toward optimism and a smaller share of negative sentiment.

GLD,Gold Articles: 18

- Positive: 61.11%

- Neutral: 27.78%

- Negative: 11.11%

Sentiment Summary:

The majority of recent articles covering GLD and gold are positive (61.11%), with a significant portion neutral (27.78%) and a smaller share negative (11.11%).

This suggests that overall market news sentiment toward GLD and gold is currently skewed positive, with some neutral coverage and limited negative sentiment present.

USO,Oil Articles: 13

- Positive: 53.85%

- Neutral: 30.77%

- Negative: 15.38%

Sentiment Summary: Out of 13 oil-related articles, approximately 54% have a positive sentiment, 31% are neutral, and 15% are negative.

Conclusion: Overall news sentiment in the oil market currently skews positive, with a significant portion of coverage also maintaining a neutral perspective. Negative articles remain in the minority.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: January 29, 2026 07:16

- GLD 494.56 Bullish 3.88%

- NVDA 191.52 Bullish 1.59%

- USO 76.62 Bullish 1.27%

- GOOG 336.28 Bullish 0.38%

- QQQ 633.22 Bullish 0.33%

- MSFT 481.63 Bullish 0.22%

- TSLA 431.46 Bullish 0.13%

- DIA 490.13 Bullish 0.01%

- SPY 695.42 Bearish -0.01%

- TLT 87.60 Bearish -0.23%

- IJH 69.45 Bearish -0.23%

- IBIT 50.51 Bearish -0.24%

- IWM 263.30 Bearish -0.54%

- META 668.73 Bearish -0.63%

- AMZN 243.01 Bearish -0.68%

- AAPL 256.44 Bearish -0.71%

Market Summary – State of Play as of 2026-01-29

Major Index ETFs

- SPY (S&P 500): 695.42 — Bearish (-0.01%)

The broad market, as measured by SPY, shows a slight downturn, mirroring a cautious sentiment among large-cap stocks. - QQQ (Nasdaq 100): 633.22 — Bullish (+0.33%)

Tech-heavy QQQ continues to outperform, supported by resilience in growth names. - DIA (Dow 30): 490.13 — Bullish (+0.01%)

The Dow ETF is effectively flat, signaling stability in blue-chip constituents. - IWM (Russell 2000): 263.30 — Bearish (-0.54%)

Small caps under pressure, showing underperformance versus large caps. - IJH (S&P MidCap 400): 69.45 — Bearish (-0.23%)

Mid-caps also trending down, aligning with broader risk-off sentiment in lower-cap segments.

MAG7 Snapshot

- NVDA (NVIDIA): 191.52 — Bullish (+1.59%)

Semiconductor leader driving growth optimism among megacap techs. - GOOG (Alphabet): 336.28 — Bullish (+0.38%)

Search/AI strength keeps Google in positive territory. - MSFT (Microsoft): 481.63 — Bullish (+0.22%)

Cloud and AI momentum supports sustained bullish bias. - TSLA (Tesla): 431.46 — Bullish (+0.13%)

Modest gains as EV demand remains in focus. - META (Meta): 668.73 — Bearish (-0.63%)

Social media giant leading the MAG7 decliners on the day. - AMZN (Amazon): 243.01 — Bearish (-0.68%)

- AAPL (Apple): 256.44 — Bearish (-0.71%)

Summary: The MAG7 shows a mixed picture, with tech leaders like NVDA, MSFT, and GOOG driving gains while META, AMZN, and AAPL lag.

Commodity & Fixed Income ETFs

- GLD (Gold): 494.56 — Bullish (+3.88%)

Gold ETF surges, signaling strong risk hedging or inflation concern. - USO (Crude Oil): 76.62 — Bullish (+1.27%)

Oil ETF points to rising energy prices, potential supply/demand inflection. - TLT (Long Treasury): 87.60 — Bearish (-0.23%)

Long bonds under pressure, possibly reflecting a higher rate environment or shifts in macro sentiment. - IBIT (Bitcoin ETF): 50.51 — Bearish (-0.24%)

Bitcoin-linked ETF seeing modest pullback, highlighting mixed appetite for risk assets beyond equities.

Overall Market Tone

- Bullish: QQQ, DIA, NVDA, GOOG, MSFT, TSLA, GLD, USO

- Bearish: SPY, IJH, IWM, META, AMZN, AAPL, TLT, IBIT

Market breadth reflects mixed action, with strength concentrated in tech, select commodities, and large-caps, while weakness appears in small/mid-caps, key names in MAG7, and risk-off vehicles.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2026-01-29: 07:17 CT.

US Indices Futures

- ES Strong uptrend, price above YSFG, MSFG, WSFG NTZ, all MAs up, new swing high at 7043, support 6715, no nearby resistance, trend-following context.

- NQ Weekly bullish with short-term strength, intermediate consolidation, price above all SFGs and MA benchmarks, recent high 26655.5, support below, uptrend persists amid pause.

- YM Broad uptrend, short-term neutral/consolidating, above all major SFG levels and MAs, recent high 49226, support 47519, resistance overhead, long-term structure remains up.

- EMD Weekly and daily bullish, price above all SFGs and MAs, most recent high 3496.7, support 3371.3, swing pivots up, large bars, trend continuation context.

- RTY Intermediate/long-term bullish, short-term neutral to bearish (daily pullback), price above MSFG/YSFG NTZs, swing high 2749.4, support 2631/2520, consolidating within uptrend.

- FDAX Long-term and intermediate bullish, short-term bearish/corrective, price below WSFG NTZ, swing high 24673, support 24133/24017, resistance 25641, underlying trend up despite pullback.

Overall State

- Short-Term: Mixed (Bullish ES/NQ/EMD, Neutral YM, Bearish RTY/FDAX)

- Intermediate-Term: Bullish (All except FDAX Neutral; FDAX Neutral)

- Long-Term: Bullish (All indices trending up on long-term benchmarks)

Conclusion

US Indices Futures remain structurally bullish on higher timeframes, with ES, NQ, YM, EMD, and RTY all above their yearly and monthly session fib grid benchmarks and trending MAs. ES and NQ lead with persistent uptrends and higher swing pivots. YM and EMD also sustain robust long-term trends, consolidating below recent highs. RTY and FDAX display short-term corrections or pullbacks but retain their bullish structure on broader timeframes—both trading above intermediate/long-term SFG NTZs with support levels holding. Recent signals and momentum confirm the dominance of the primary upward trends, though mixed short-term signals point to ongoing rotation and interim consolidation or retracement phases. Directional correlation persists across US indices futures, with leading (ES/NQ) and lagging (YM/RTY/EMD/FDAX) behavior aligned within a constructive HTF environment.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

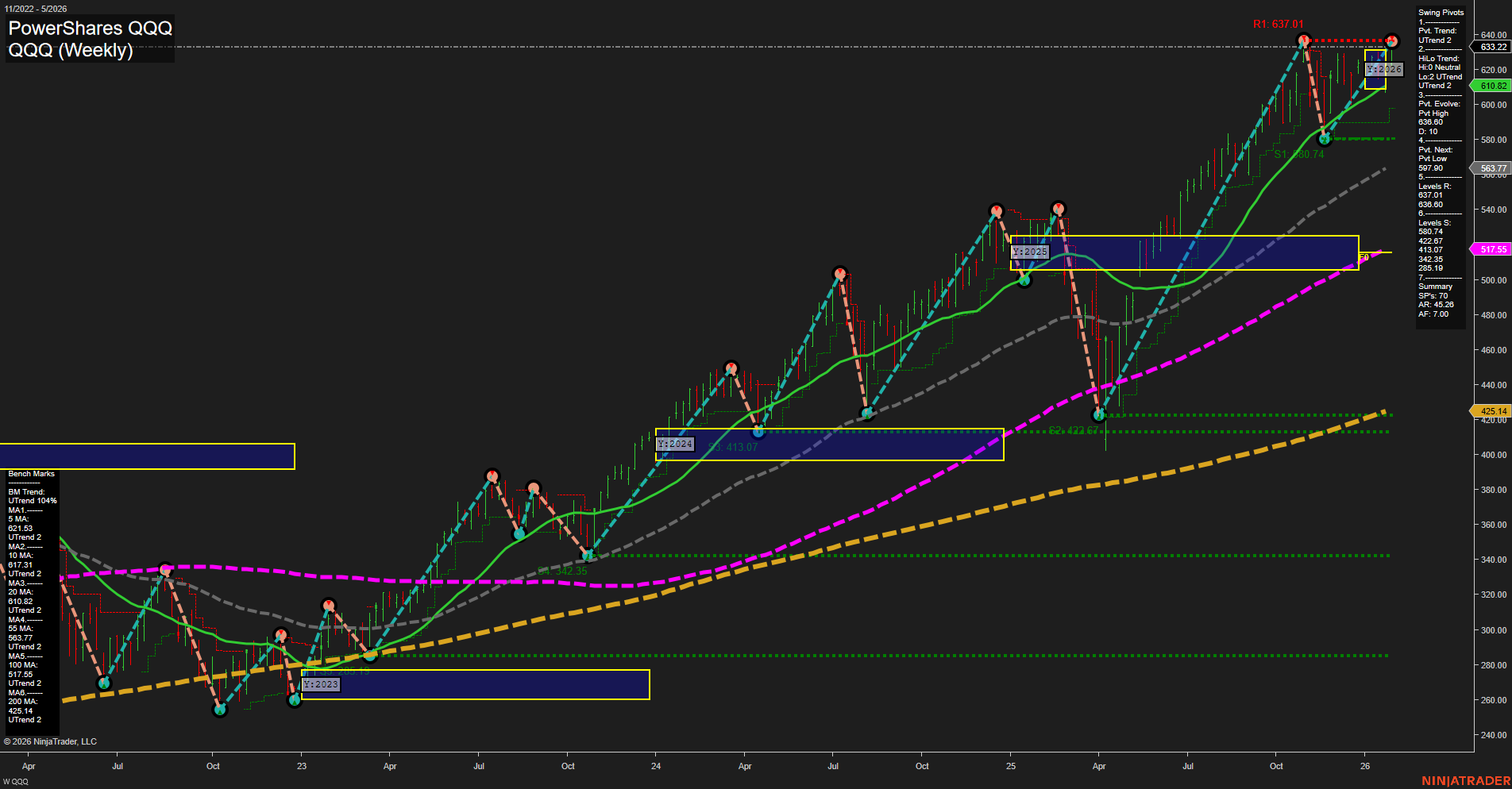

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts