After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

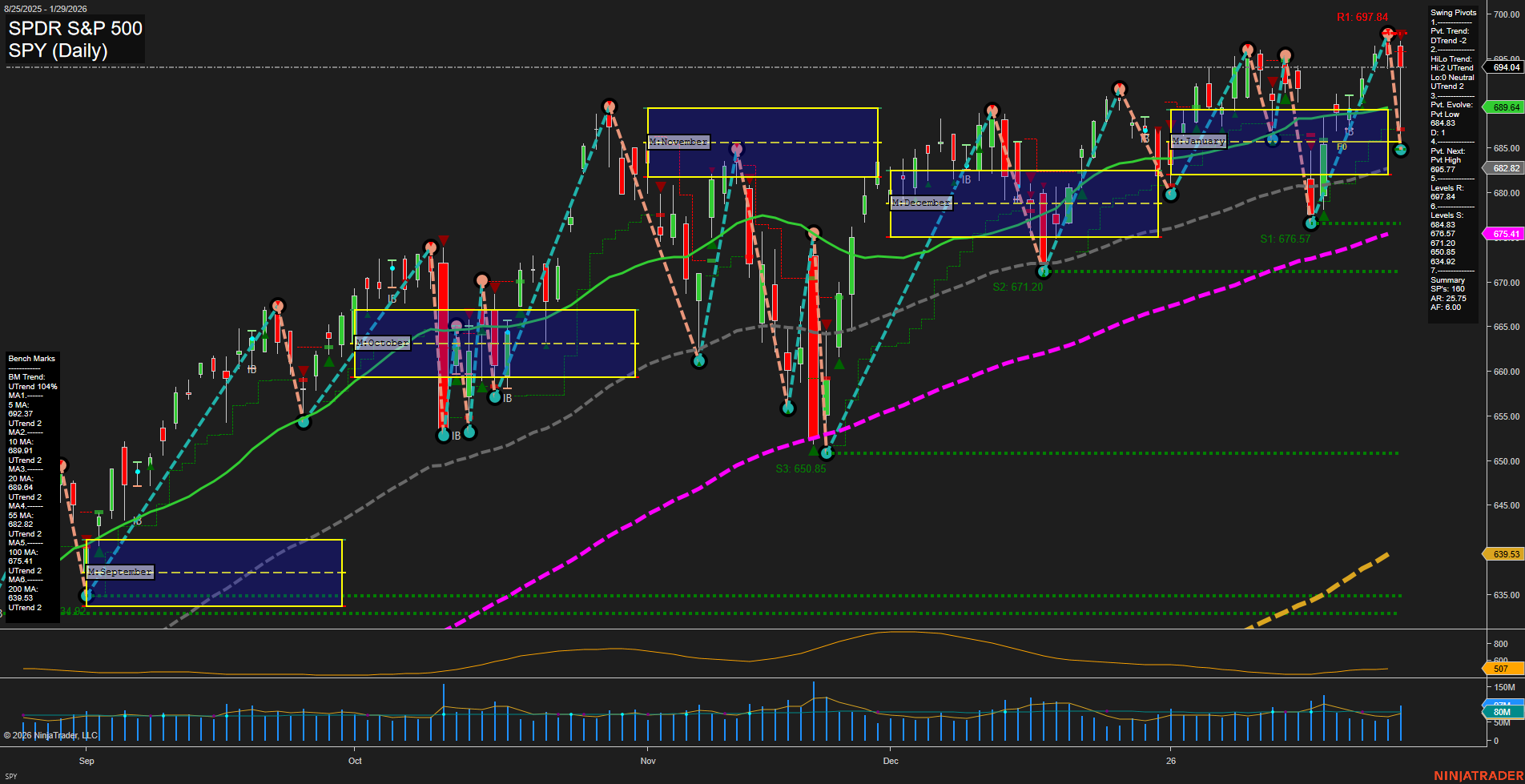

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Fed Chair Announcement & Market Impact: President Trump nominated Kevin Warsh as the next Federal Reserve Chair, prompting sharp, historic selloffs in gold and silver, with metals posting their worst single-day drop since the 1980s and volatility intensifying across precious metals. Wall Street interprets Warsh as relatively hawkish on inflation and the dollar. Business leaders and Fed officials publicly praised the pick, though others voiced concerns over Fed independence and the high bar for validating policy credibility. Confirmation is considered time-sensitive by lawmakers.

- Broader Market & Tech: A double selloff affected both tech stocks and metals, underscoring ongoing market unease driven by concentration in Big Tech, AI concerns, and circular spending. Indexes reacted negatively, with volatility levels elevated. Monthly moving averages for major indices were reviewed after a volatile session.

- Precious Metals: The dramatic selloff in gold and silver erased an estimated $7 trillion in market value after a strong January rally. Analyst commentary framed the correction as a healthy one within the context of a longer-term uptrend. Still, the scale of the drop delivered a risk-management warning for portfolio hedges. Silver forecasts anticipate further short-term weakness but suggest possible upside later in the year.

- Oil Markets & Geopolitics: Oil scored its first monthly gain in six months, with OPEC+ set to review production targets amid persistent uncertainty around global supply and geopolitical risks, notably relating to Iran. U.S. efforts to facilitate Indian imports of Venezuelan crude point to shifting supply chains as Russian flows slow. Analysts highlighted the potential for wider Middle East conflict to drive volatility in energy markets and beyond.

- Upcoming Catalysts: The week ahead features key U.S. jobs data and central bank decisions, which may further clarify the timing of the next Fed rate move.

- M&A Activity: Thoma Bravo is considering a sale of its healthcare-focused identity software asset, Imprivata.

- Portfolio Approaches: Several articles revisited asset allocation strategies and the difficulty of market timing, referencing moving averages and endowment-style portfolio models.

News Conclusion

- Kevin Warsh’s Fed nomination triggered significant shifts across asset classes, especially in precious metals, while also being met with both institutional praise and scrutiny for policy independence.

- The simultaneous weakness in tech and commodities suggests fragile sentiment and heightened uncertainty in broader markets.

- Precious metals experienced a sharp correction following a large advance, with analysts divided on whether the move signifies a short-term top or healthy consolidation within a bull trend.

- Energy markets remain sensitive to geopolitics and OPEC+ policy, as well as evolving U.S.–India oil trade dynamics.

- Focus shifts to upcoming macroeconomic data and central bank actions for further direction, with risk events likely to drive volatility.

Market News Sentiment:

Market News Articles: 45

- Neutral: 53.33%

- Negative: 28.89%

- Positive: 17.78%

GLD,Gold Articles: 19

- Negative: 42.11%

- Neutral: 36.84%

- Positive: 21.05%

USO,Oil Articles: 13

- Positive: 38.46%

- Neutral: 38.46%

- Negative: 23.08%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: January 30, 2026 05:00

- TSLA 430.41 Bullish 3.32%

- USO 79.52 Bullish 0.48%

- AAPL 259.48 Bullish 0.46%

- GOOG 338.53 Bearish -0.04%

- IBIT 47.49 Bearish -0.23%

- DIA 489.03 Bearish -0.24%

- SPY 691.97 Bearish -0.30%

- TLT 87.13 Bearish -0.56%

- NVDA 191.13 Bearish -0.72%

- MSFT 430.29 Bearish -0.74%

- IJH 68.67 Bearish -0.91%

- AMZN 239.30 Bearish -1.01%

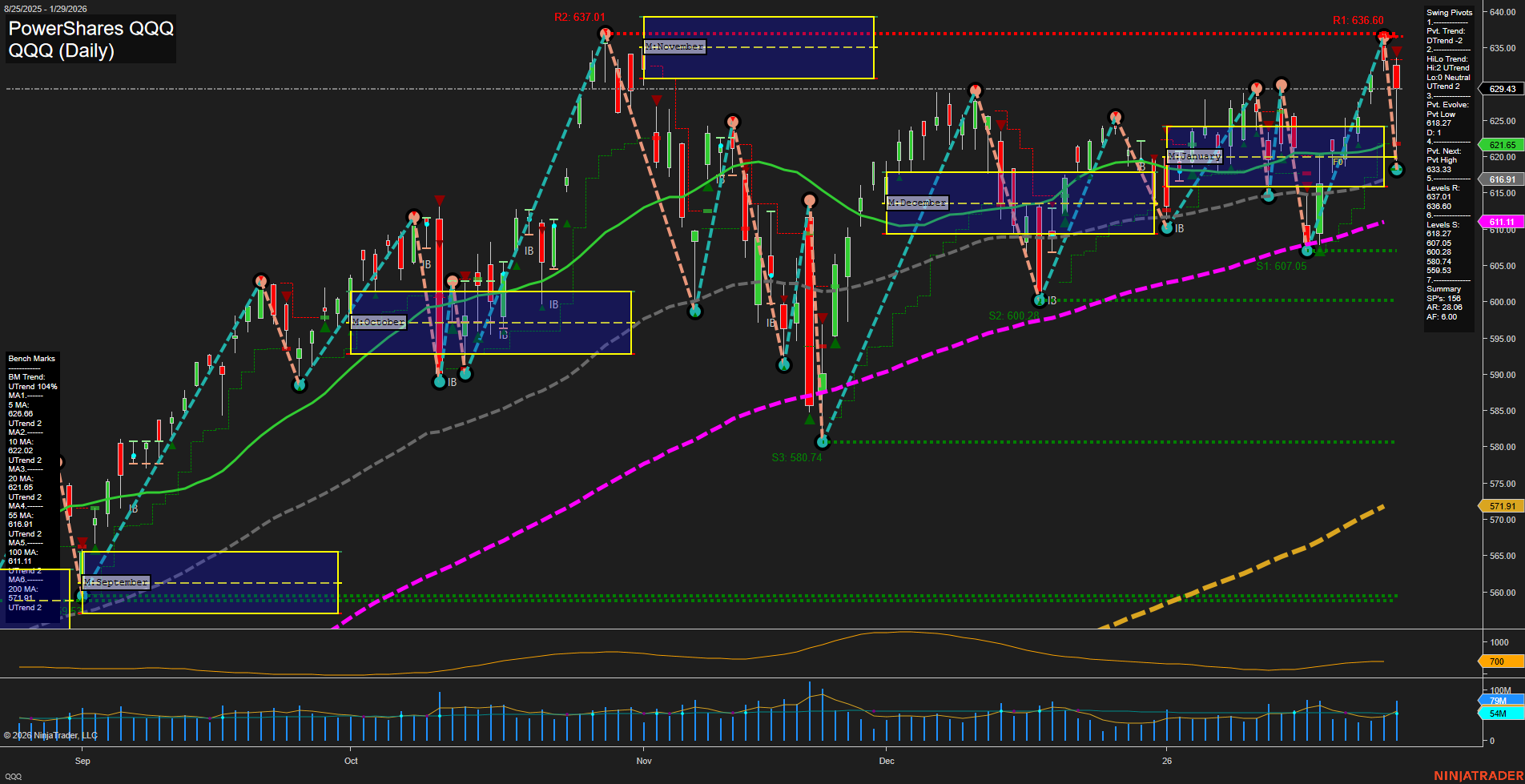

- QQQ 621.87 Bearish -1.20%

- IWM 259.65 Bearish -1.41%

- META 716.50 Bearish -2.95%

- GLD 444.95 Bearish -10.27%

ETF Stocks: Market Summary

- SPY: 691.97 (Bearish -0.30%) – Major S&P 500 ETF under pressure, reflecting recent market pullback.

- QQQ: 621.87 (Bearish -1.20%) – Nasdaq-100 ETF is notably weaker, underlining technology sector softness.

- DIA: 489.03 (Bearish -0.24%) – Dow Jones ETF slightly negative, mirroring broad blue chip caution.

- IWM: 259.65 (Bearish -1.41%) – Small-cap ETF leading declines, a sign of risk-off sentiment in smaller companies.

- IJH: 68.67 (Bearish -0.91%) – Mid-cap ETF also negative, showing mid-sized shares aligning with broader weakness.

Magnificent 7: Market Pulse

- AAPL: 259.48 (Bullish 0.46%) – Standing out with gains in a mixed tech basket.

- TSLA: 430.41 (Bullish 3.32%) – Outperforming sharply, bucking overall negative tech trends.

- GOOG: 338.53 (Bearish -0.04%) – Flat to slightly lower, suggesting indecision.

- MSFT: 430.29 (Bearish -0.74%) – Subdued movement in this tech heavyweight.

- NVDA: 191.13 (Bearish -0.72%) – Pulling back, reflecting possible sector rotation or risk-off mood.

- AMZN: 239.30 (Bearish -1.01%) – Leaning negative, consistent with broader selling.

- META: 716.50 (Bearish -2.95%) – Leading declines among the largest techs.

Other Key ETFs: Cross-Asset Check

- USO: 79.52 (Bullish 0.48%) – Oil ETF in positive territory, diverging from the risk-off tone elsewhere.

- GLD: 444.95 (Bearish -10.27%) – Gold ETF sharply lower, marking an unusually strong move versus conventional safe-haven expectations.

- TLT: 87.13 (Bearish -0.56%) – Long-term Treasury ETF on the defensive, suggesting pressure on bonds.

- IBIT: 47.49 (Bearish -0.23%) – Bitcoin ETF modestly lower, mirroring the risk-averse mood across several asset classes.

Market Overview

The snapshot shows predominately bearish action across major equity ETFs, most of the Magnificent 7, and several alternative assets such as gold and bonds, with few standouts (TSLA, AAPL, USO) showing relative strength. Pressure is broad-based, led by small- and mid-caps, while tech leaders see differentiated performance. Gold’s outsized drop is noteworthy, diverging from usual safety flows.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts