Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

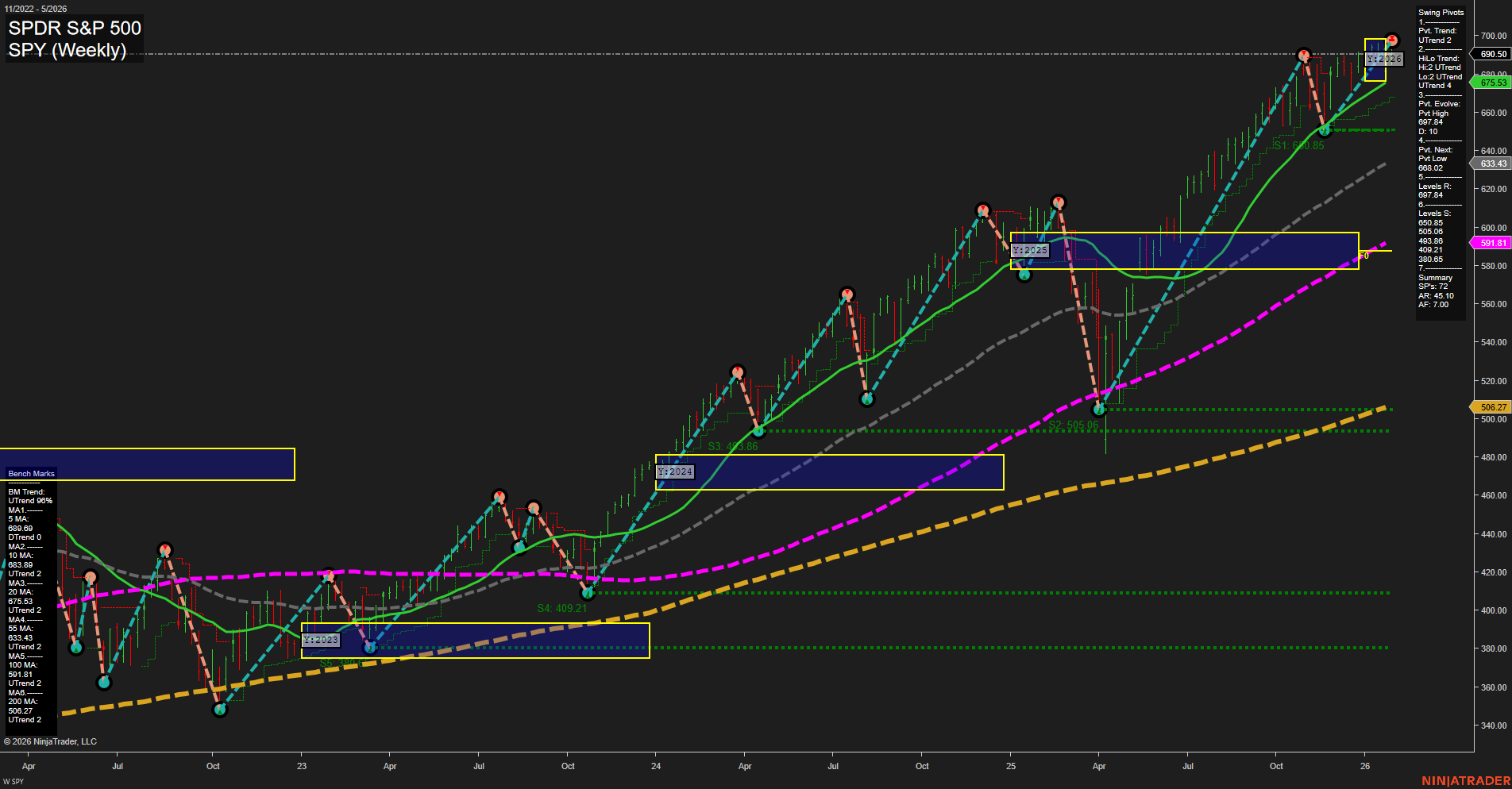

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- MCHP Release: 2026-02-05 T:AMC

- AMZN Release: 2026-02-05 T:AMC

- GOOGL Release: 2026-02-04 T:AMC

- AMD Release: 2026-02-03 T:AMC

- SMCI Release: 2026-02-03 T:AMC

Earnings Summary and Market Conclusion:

Looking ahead to the upcoming earnings releases, indices futures traders should note a concentrated wave of major tech announcements, with AMD and Super Micro Computer (SMCI) kicking off after the close on February 3rd, followed by Alphabet (GOOGL) on February 4th, and culminating with both Microchip Technology (MCHP) and Amazon (AMZN) after the market close on February 5th. These releases from key players in semiconductors, cloud, e-commerce, and AI infrastructure are likely to set the tone for broader market sentiment, especially considering their heavy weightings in major indices. In the days leading up to this earnings cluster, expect the potential for muted momentum and lighter trading volumes as the market anticipates pivotal updates from these companies, particularly with pending news from NVDA and the rest of the mega-cap tech (MAG7) and AI-linked stocks still influencing risk appetite. Post-earnings, sharp moves are possible as traders react to guidance and performance, which could drive renewed volatility and directional trends in equity futures.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

Monday

- 10:00 – ISM Manufacturing PMI (High Impact): Key gauge of US manufacturing sector health. Sharp deviations influence S&P 500, Nasdaq, Dow futures as traders react to signs of economic expansion or contraction.

- 10:00 – ISM Manufacturing Prices (Medium Impact): Relevant only if sudden oil price moves, as input costs and inflation expectations could affect indices.

Tuesday

- 10:00 – JOLTS Job Openings (High Impact): Indicator of labor market demand. Results well above/below consensus may impact market sentiment regarding employment robustness and Fed policy direction.

Wednesday

- 08:15 – ADP Non-Farm Employment Change (High Impact): Early signal on private sector jobs trend. Sharp surprises steer futures action ahead of Friday’s official jobs report.

- 10:00 – ISM Services PMI (High Impact): Influences broader market due to services sector dominance; strong/weak prints can shift futures direction and bias.

- 10:30 – Crude Oil Inventories (Low Impact): Generally low impact on indices unless sharp inventory drawdowns spike prices, stoking inflation and weighing on sentiment.

Thursday

- 08:30 – Unemployment Claims (High Impact): Weekly labor data that may trigger volatility if numbers deviate significantly from forecasts, hinting at an improving or weakening job market.

Friday

- 08:30 – Average Hourly Earnings m/m (High Impact): Closely watched wage inflation metric; stronger-than-expected prints could prompt hawkish policy fears, pressuring indices.

- 08:30 – Non-Farm Employment Change (High Impact): Most influential labor data, drives major futures moves—large surprises set tone for risk appetite or risk aversion.

- 08:30 – Unemployment Rate (High Impact): Contextualizes jobs report; unexpected upticks or drops add to NFP volatility, affecting futures direction.

- 10:00 – Prelim UoM Consumer Sentiment (High Impact): Timely sentiment pulse—significant misses or beats frequently sway indices near session end.

- 10:00 – Prelim UoM Inflation Expectations (High Impact): Influences perceptions of inflation trajectory, potentially impacting Fed outlook and index moves.

EcoNews Conclusion

- This week’s calendar is stacked with high-impact US data—especially focused on labor and growth, with major market-moving potential Tuesday through Friday.

- Jobs data (Wednesday and Friday) and ISM releases are likely to drive momentum and volatility in index futures, particularly around the 10 AM ET time cycle, which often catalyzes reversals or continuations.

- Volume and momentum may slow ahead of Friday’s Non-Farm Payrolls (NFP) report.

- Traders should remain vigilant at key release times as sharp directional moves are possible, especially if data diverges from expectations.

For full details visit: Forex Factory EcoNews

Market News Summary

- S&P 500 briefly tops 7,000: The index hit a new record, edging above 7,000 for the first time before retreating slightly, leaving it 0.56% below its all-time high.

- OPEC+ holds output steady: OPEC+ reached an agreement to maintain its pause on oil output increases for March despite oil prices nearing six-month highs driven by heightened Iran-related geopolitical tensions.

- Gold and silver prices slump: Gold dropped sharply after the Fed Chair nomination of Kevin Warsh, sparking risk-off sentiment. Silver logged its largest one-day percentage decline on record, though analysts see this as a correction rather than a full reversal.

- Liquidity pressure mounts: Treasury market settlements and a higher Treasury General Account (TGA) are tightening liquidity, draining $64.3 billion from markets with potential for ongoing stress amid upcoming refunding and elevated TGA targets.

- Small caps underperform: Small cap equities continue to lag, failing to generate alpha, with larger-cap stocks remaining favored against a challenging backdrop for smaller companies.

- Covered call ETFs gain spotlight: Elevated volatility and challenging valuations are creating an environment conducive to covered call ETF strategies, though caution is warranted regarding downside risks.

- Energy sector outperformance: The energy sector led all major indices last quarter, gaining 16% and maintaining a strong correlation with broader S&P 500 growth.

- Tech and AI margin tailwinds: Big Tech, exemplified by recent Amazon layoffs and AI-driven cost management, is benefitting from improved margins and signals potential for a softer labor market, which may favor policy easing.

- S&P 500 technical caution: Despite January’s gain, there are signs of momentum loss and a risk of February weakness, with technical exhaustion signals highlighting risk of a deeper pullback.

- Geopolitical risks rise for equities: January served as a reminder that strong fundamentals can be overshadowed by geopolitical shocks impacting market sentiment.

News Conclusion

- Major equity indices have shown resilience, but rising volatility, technical warning signals, and persistent liquidity concerns add risk going into February.

- Commodity markets are reactive to geopolitical developments, with oil supported by OPEC+ policy and Middle East tensions, while gold and silver face short-term corrections post-Fed Chair announcement.

- Structural outperformance by large caps and the energy sector continues, while small caps search for traction amid an uneven market landscape.

- Sector rotation, AI-driven cost dynamics, and policy expectations remain key macro factors shaping sentiment as traders monitor shifting risks and opportunities.

Market News Sentiment:

Market News Articles: 7

- Neutral: 42.86%

- Positive: 28.57%

- Negative: 28.57%

GLD,Gold Articles: 2

- Negative: 100.00%

USO,Oil Articles: 3

- Neutral: 66.67%

- Positive: 33.33%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 1, 2026 06:15

- TSLA 430.41 Bullish 3.32%

- USO 79.52 Bullish 0.48%

- AAPL 259.48 Bullish 0.46%

- GOOG 338.53 Bearish -0.04%

- IBIT 47.49 Bearish -0.23%

- DIA 489.03 Bearish -0.24%

- SPY 691.97 Bearish -0.30%

- TLT 87.13 Bearish -0.56%

- NVDA 191.13 Bearish -0.72%

- MSFT 430.29 Bearish -0.74%

- IJH 68.67 Bearish -0.91%

- AMZN 239.30 Bearish -1.01%

- QQQ 621.87 Bearish -1.20%

- IWM 259.65 Bearish -1.41%

- META 716.50 Bearish -2.95%

- GLD 444.95 Bearish -10.27%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2026-02-01: 18:15 CT.

US Indices Futures

- ES Bullish across YSFG, MSFG, WSFG; price above all benchmark MAs, swing high 7043.00, key support 6735.00, higher highs/lows, overall trend continuation, no major reversal signals.

- NQ Weekly Bullish ST/IT, Neutral LT; price above WSFG/MSFG NTZs, all MAs up, swing high 26655.50 resistance, supports 24722.00/23866.91, price below YSFG NTZ, structure consolidating gains.

- YM No data available for summary.

- EMD Weekly and Daily Bearish ST, Bullish IT/LT; recent swing high 3446.2, short-term downside correction, price above major MAs/YSFG, key supports 3420.8/3329.5, corrective phase within uptrend.

- RTY No data available for summary.

- FDAX Weekly Bearish ST, Neutral IT, Bullish LT; below WSFG/MSFG NTZ centers, MA support, price above YSFG, resistance 25641, support 24136; Daily Bearish ST/IT, Bullish LT, below key grid levels, elevated volatility, major support 24380.

Overall State

- Short-Term: Mixed (Bullish ES/NQ Weekly, Bearish NQ/EMD/FDAX Daily)

- Intermediate-Term: Predominantly Bullish (ES, NQ, EMD), Neutral to Bearish bias in FDAX

- Long-Term: Mostly Bullish (ES, EMD, FDAX); Neutral or Bearish for NQ

Conclusion

The prevailing higher timeframe structure for US Indices Futures indicates ongoing trend continuation phases in ES and EMD, with price consistently maintaining levels above MSFG and WSFG and major MAs, underlying support at successive swing pivot lows, and resilient bullish long-term structure. NQ reflects a transitional phase—short-term momentum is bearish on the daily, but the intermediate trend is upheld as price sustains above the weekly/monthly NTZs, with the long-term outlook consolidative below the yearly benchmark. FDAX is in a corrective phase across short and intermediate timeframes, with price below key session fib grid centers and short-term MAs, while the long-term framework remains upward. EMD mirrors FDAX’s configuration but retains strong intermediate and long-term bullish structure. SR levels and pivots continue to delineate critical levels across contracts; overall, the US indices display strong intermediate- and long-term bullish architecture with periodic short-term corrective phases as identified by WSFG and lower MA trends.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

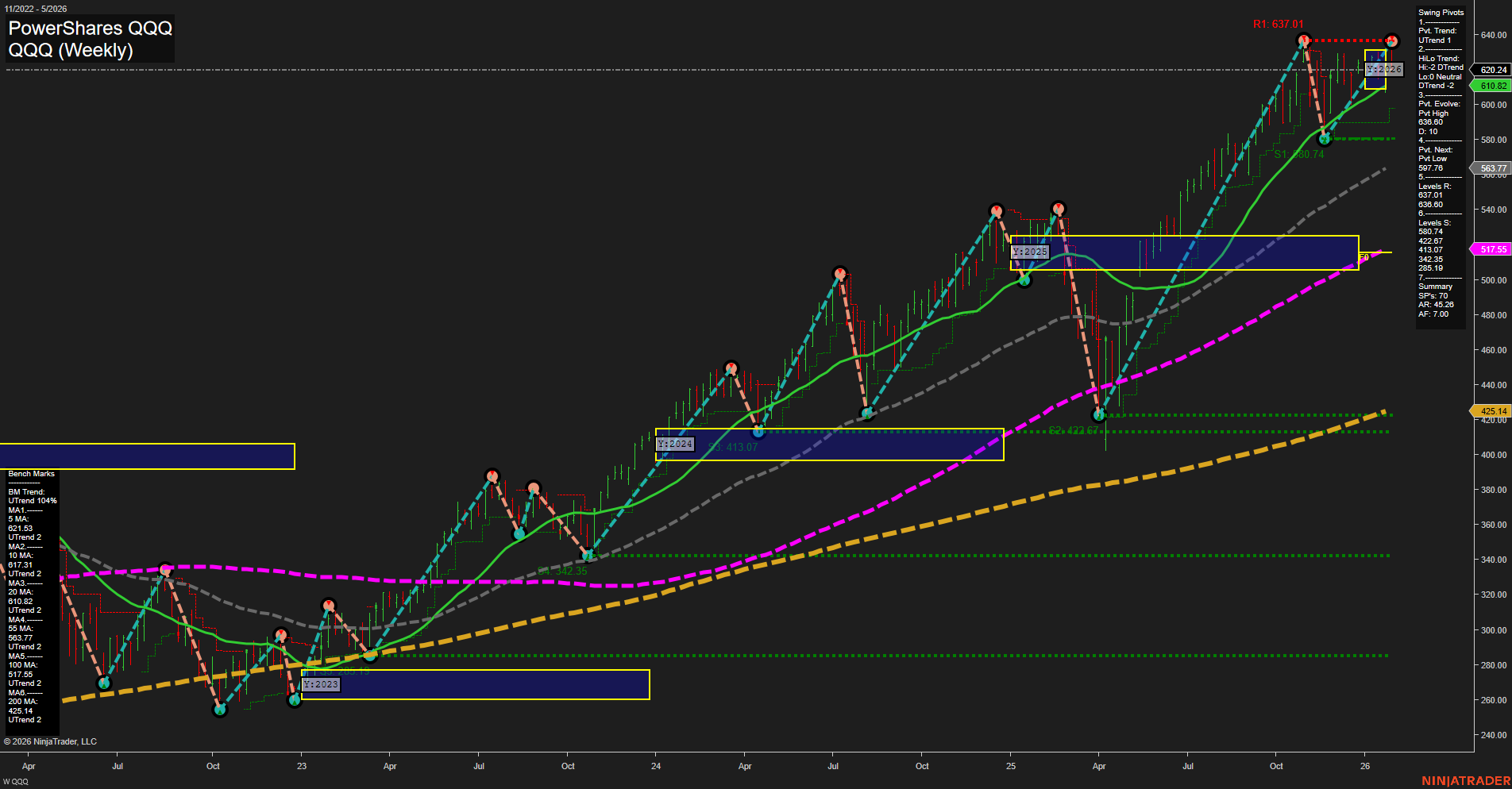

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts