After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Precious Metals: Gold, silver, and platinum rebounded sharply after a recent heavy sell-off, with silver surging 9% due to dip buying. However, the sector remains volatile, as recent crowded positions by large funds preceded previous losses. Geopolitical tensions and changing Federal Reserve expectations are fueling continued moves, with gold staging its best one-day rally since 2008.

- Oil & Energy: US Gulf Coast refiners are struggling to handle a rapid increase in Venezuelan crude imports, putting downward pressure on prices. Meanwhile, the US is preparing to expand licensing for oil and gas production in Venezuela, which could impact global supply and market dynamics. The energy sector led S&P gains in January. Oil rebounded following a US Navy incident in the Middle East, and technical levels for crude suggest short-term support is being tested.

- Federal Reserve & Rates: The January jobs report is delayed due to a government shutdown, adding uncertainty to rate outlooks. Investors anticipate a steeper yield curve under incoming Fed Chair Kevin Warsh as the market expects rate cuts alongside a reduction in the Fed’s balance sheet, but some skepticism remains about Warsh’s ability to deliver aggressive balance sheet shrinkage.

- Stocks & Broader Markets: Wall Street saw broad losses, with tech and software stocks leading the declines amid renewed uncertainty over AI-driven competition and sector earnings. Obesity drug makers fell sharply on underwhelming forecasts. Market leadership rotated to smaller S&P sectors and value-oriented segments, while the largest sectors weighed on the benchmark.

- AI & Technology: Tech giants’ investments in AI infrastructure are significantly increasing capital expenditures and debt, impacting balance sheets and heightening equity risks if AI monetization disappoints. Major software and legal services stocks experienced sell-offs tied to AI competition anxieties, though some profitable software stocks attracted buyer interest.

- Cryptocurrency & Alternative Assets: Bitcoin slid to post-election lows, moving alongside broader risk-off sentiment. Interest in tokenized gold products is rising among investors as digital asset platforms seek to capitalize on precious metals’ volatility.

- Mergers & Special Corporate Actions: SpaceX’s planned merger with xAI, valued as high as $1.25 trillion, added renewed attention to tech mega-deals, although analysts warn of enormous capital needs for long-term projects like space data centers.

News Conclusion

- Markets are experiencing heightened volatility across commodities, equities, and alternative assets. Strong rebounds in precious metals, active shifts in oil policy, and rotations within S&P sectors are being punctuated by evolving geopolitical tensions and changes at the Federal Reserve.

- Technology and AI-related capital expenditure cycles are placing new pressures on tech company balance sheets, while concerns about AI competition are straining certain software and legal service stocks.

- Shifts in Fed policy expectations and unresolved government shutdown issues are contributing to risk-off moves and increased sensitivity to macroeconomic data.

- Activity is notable in merger and acquisition discussions and new regulatory moves, particularly in energy and technology sectors, reflecting broader strategic positioning in turbulent markets.

Market News Sentiment:

Market News Articles: 41

- Positive: 48.78%

- Negative: 29.27%

- Neutral: 21.95%

GLD,Gold Articles: 21

- Neutral: 47.62%

- Negative: 28.57%

- Positive: 23.81%

USO,Oil Articles: 12

- Positive: 50.00%

- Neutral: 25.00%

- Negative: 25.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 3, 2026 05:00

- GLD 454.29 Bullish 6.36%

- USO 77.47 Bullish 2.84%

- TLT 86.76 Bullish 0.24%

- IWM 262.78 Bullish 0.23%

- IJH 69.38 Bullish 0.19%

- TSLA 421.96 Bullish 0.04%

- AAPL 269.48 Bearish -0.20%

- DIA 492.31 Bearish -0.35%

- SPY 689.53 Bearish -0.85%

- GOOG 340.70 Bearish -1.22%

- QQQ 616.52 Bearish -1.54%

- AMZN 238.62 Bearish -1.79%

- IBIT 43.30 Bearish -2.08%

- META 691.70 Bearish -2.08%

- NVDA 180.34 Bearish -2.84%

- MSFT 411.21 Bearish -2.87%

Market Summary: ETF Stocks, Mag7, and Key ETFs (As of 02/03/2026 17:00:00)

ETF Stocks: Mixed Sentiment

- SPY: 689.53 Bearish (-0.85%)

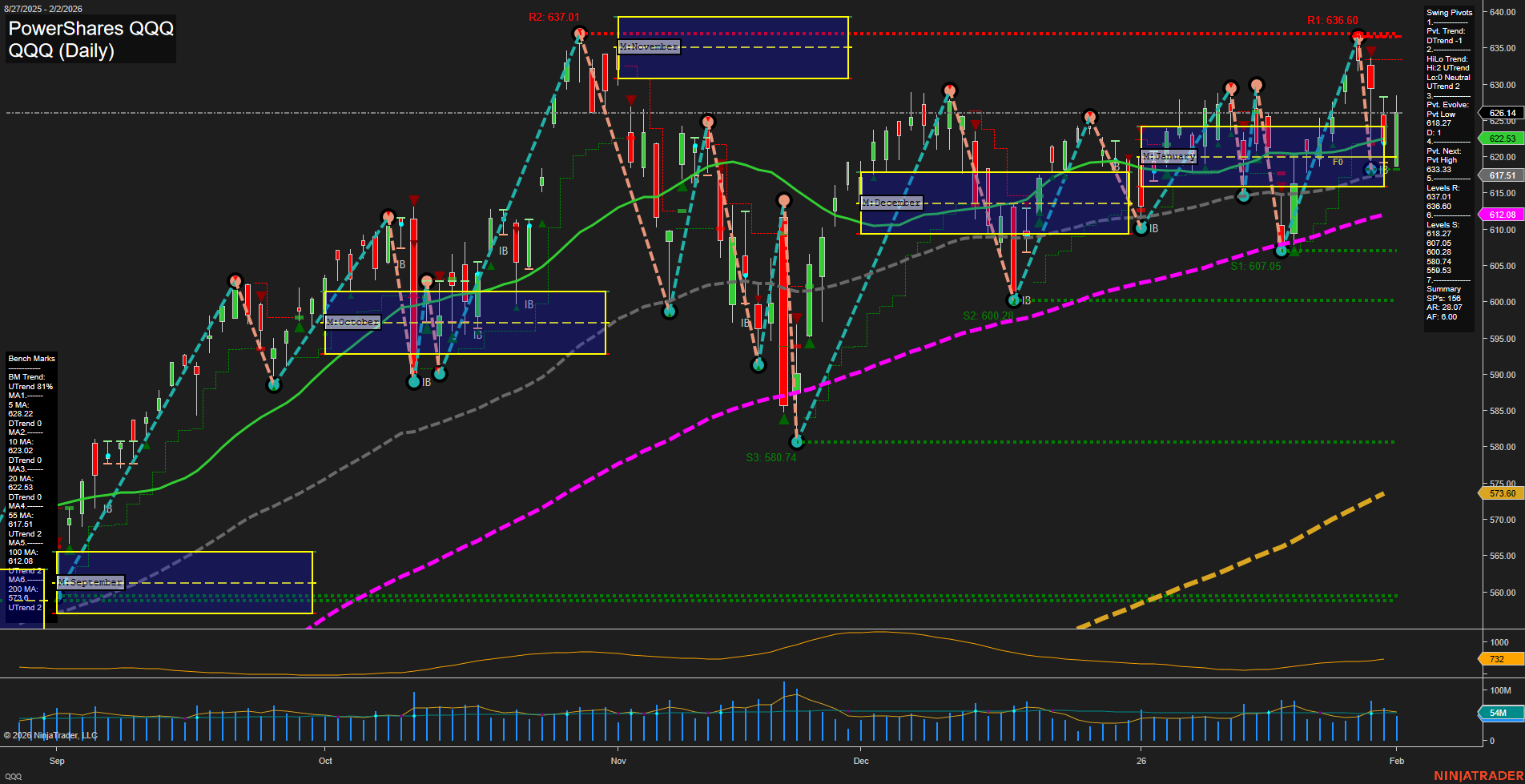

- QQQ: 616.52 Bearish (-1.54%)

- IWM: 262.78 Bullish (+0.23%)

- IJH: 69.38 Bullish (+0.19%)

- DIA: 492.31 Bearish (-0.35%)

Broad market ETFs showed a mixed performance. SPY and QQQ closed down, reflecting weakness among large-cap and tech-oriented stocks. Small- and mid-cap ETFs (IWM, IJH) posted minor gains, indicating relatively stronger sentiment in these segments.

Mag7 (Mega Cap Tech): Broadly Weak

- AAPL: 269.48 Bearish (-0.20%)

- MSFT: 411.21 Bearish (-2.87%)

- GOOG: 340.70 Bearish (-1.22%)

- AMZN: 238.62 Bearish (-1.79%)

- META: 691.70 Bearish (-2.08%)

- NVDA: 180.34 Bearish (-2.84%)

- TSLA: 421.96 Bullish (+0.04%)

The so-called “Mag7” technology and growth stocks saw widespread declines, with most constituents trading lower. TSLA was the exception, closing marginally higher while the rest registered losses ranging from mild (AAPL) to pronounced (MSFT, NVDA, META).

Other Notable ETFs: Clear Bullish Tone

- GLD (Gold): 454.29 Bullish (+6.36%)

- USO (Oil): 77.47 Bullish (+2.84%)

- TLT (Long Bonds): 86.76 Bullish (+0.24%)

- IBIT (Bitcoin): 43.30 Bearish (-2.08%)

Commodities: Both GLD and USO logged solid gains, indicating strong bullish momentum in gold and oil markets.

Bonds: TLT edged up, reflecting a slight bullish trend in long bond ETFs.

Crypto-related ETF: IBIT was notably weak, closing lower by over 2%.

Overall State of Play

The snapshot shows sector rotation and defensive positioning: Risk-off sentiment prevailed among tech and large-cap equities, while commodities—especially gold—and selected small/mid-cap equities manifested resilience or gains. Bond proxies were modestly positive, contrasting with the notable weakness in crypto-exposed ETFs.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts