Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

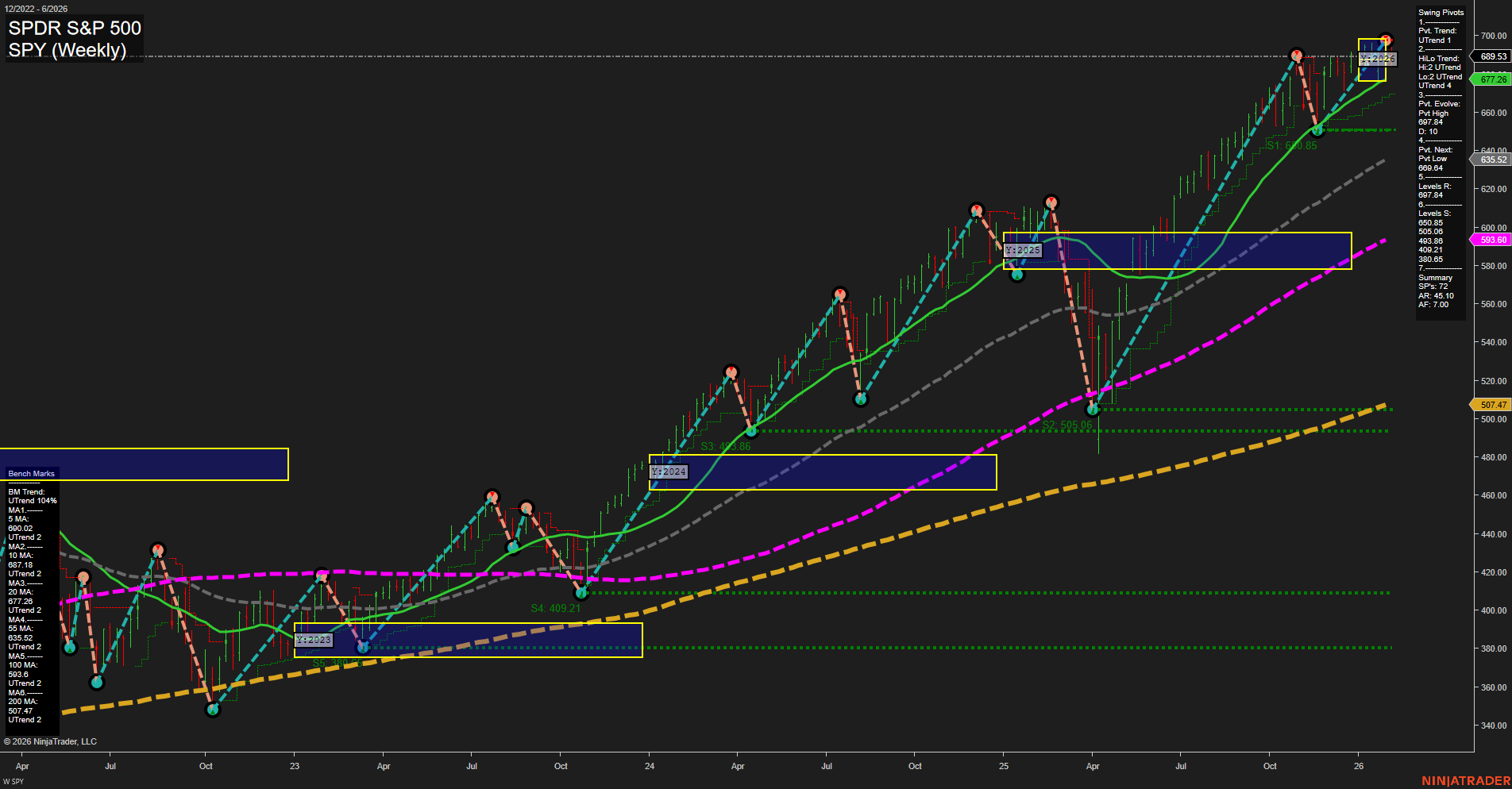

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- MCHP Release: 2026-02-05 T:AMC

- AMZN Release: 2026-02-05 T:AMC

- GOOGL Release: 2026-02-04 T:AMC

Earnings Summary and Market Conclusion (looking ahead):

As we look forward to this earnings cycle, attention is focused on major tech and semiconductor leaders with GOOGL reporting after market close on February 4, followed by MCHP and AMZN after the bell on February 5. These releases are particularly significant as they set the tone for the broader tech sector and can strongly influence sentiment in the Nasdaq and S&P 500 index futures. With market participants awaiting updates from other key players such as NVDA and the MAG7 group—especially regarding AI and tech growth—the lead-up to these reports is often characterized by reduced momentum and lighter trading volume, as traders exercise caution ahead of potentially market-moving information. The clustered timing of these heavyweight earnings tends to amplify volatility in index futures both immediately following results and in sessions thereafter, with sector rotation and risk appetite likely hinging on reported metrics and guidance. Overall, the upcoming days are broadly expected to reflect a “wait-and-see” approach, emphasizing the role of big tech earnings as catalysts for the next significant move in index futures.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Wednesday 10:00 – ISM Services PMI (High Impact):

The ISM Services PMI is a key gauge for the US service sector, heavily watched for signs of economic strength or slowdown. Large surprises frequently provoke sharp moves in index futures as traders reassess growth and monetary policy expectations. - Wednesday 10:30 – Crude Oil Inventories (Medium Impact):

Weekly inventory data can move oil prices, especially if prints deviate notably from estimates. Elevated oil prices can fuel inflation concerns and weigh on indices. - Thursday 08:30 – Unemployment Claims (High Impact):

Jobless claims serve as an up-to-date indicator of labor market health. Spikes or drops can quickly influence market sentiment around economic resilience or deterioration. - Friday 10:00 – Prelim UoM Consumer Sentiment & Inflation Expectations (High Impact):

The University of Michigan’s preliminary readings on consumer sentiment and inflation expectations provide an early look at consumer mood and perceived price pressures, critical for anticipating demand and Fed policy paths. Markets can react dynamically if data surprises.

EcoNews Conclusion

- Multiple high-impact US data releases are scheduled throughout the week, each with significant potential to drive volatility in index futures, particularly around the 10:00 AM time slot, which is often a catalyst for intraday reversals or continuations.

- Pay close attention to oil inventory figures, as unexpected changes can impact oil prices and, by extension, market inflation and sentiment.

For full details visit: Forex Factory EcoNews

Market News Summary

- Energy and Hard Assets Outperform: Energy led S&P sectors in January, with smaller sectors outperforming tech and other large constituents. There is a marked shift of market leadership toward real assets, including energy, infrastructure, and industrials, as investors seek exposure to sectors benefiting from strong fundamentals and evolving power demand.

- Tech and Software Faces AI-Driven Pressure: A new AI automation tool from Anthropic triggered a sharp global selloff in software, financial services, and asset management stocks. This led to a broad risk-off move, heavy volatility, and notable declines in indices like the Nasdaq and India’s tech space. Traders are reassessing tech sector valuations and the longer-term impact of AI disruption.

- Regional Banks and Real Estate Stand Out: Regional financials and real estate in the mid-cap space are attracting interest due to their improved outlook amid a steepening yield curve and potential rate cuts.

- Gold Surges on Uncertainty: Gold reached above $5,000 with silver also moving higher, fueled by safe-haven flows tied to geopolitical tensions and central bank accumulation. Analysts raised their gold price forecasts, while volatility continues near critical technical levels.

- Macro Backdrop Remains Volatile: Global markets are navigating delayed jobs data, heightened Mideast geopolitical tensions, and shifts in oil prices. The mood has swung quickly between risk appetite and risk aversion, as reflected in sentiment indices moving to “Fear” zones and large intraday index moves.

- Selective IPO and Listings Activity: Certain niche tech players, such as Delta Gold Technologies, are expanding cross-border market listings, even amid broad sector turbulence.

News Conclusion

- Market sentiment is split, with energy, hard assets, and safe haven metals seeing strong capital flows, while software, tech, and AI-related names experience significant risk repricing on disruption concerns.

- Volatility remains high as market participants digest evolving risks from AI automation, central bank activity, and geopolitical factors. Sector leadership is rotating, and correlations are shifting, resulting in divergent performance across indices and asset classes.

Market News Sentiment:

Market News Articles: 15

- Negative: 46.67%

- Neutral: 33.33%

- Positive: 20.00%

Sentiment Summary: Out of 15 market news articles reviewed, 46.67% presented negative sentiment, 33.33% were neutral, and 20.00% reflected positive sentiment.

Conclusion: The overall news flow currently shows a tilt toward negative sentiment, with nearly half of the articles expressing concerns or unfavorable developments, while positive outlooks remain limited.

GLD,Gold Articles: 6

- Positive: 66.67%

- Neutral: 16.67%

- Negative: 16.67%

Sentiment Summary: Out of six recent articles on GLD/Gold, 66.67% carry a positive sentiment, while 16.67% are neutral and 16.67% are negative.

This indicates that current market news coverage on gold is predominantly positive, with only a small portion reflecting neutral or negative views.

USO,Oil Articles: 4

- Positive: 50.00%

- Neutral: 50.00%

Sentiment Summary:

Out of four recent articles on USO and oil, sentiment was evenly split, with 50% of the articles reflecting a positive tone and 50% maintaining a neutral stance.

This distribution suggests mixed viewpoints in current reporting on USO and oil, indicating a balanced market sentiment in recent coverage.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: February 4, 2026 07:16

- GLD 454.29 Bullish 6.36%

- USO 77.47 Bullish 2.84%

- TLT 86.76 Bullish 0.24%

- IWM 262.78 Bullish 0.23%

- IJH 69.38 Bullish 0.19%

- TSLA 421.96 Bullish 0.04%

- AAPL 269.48 Bearish -0.20%

- DIA 492.31 Bearish -0.35%

- SPY 689.53 Bearish -0.85%

- GOOG 340.70 Bearish -1.22%

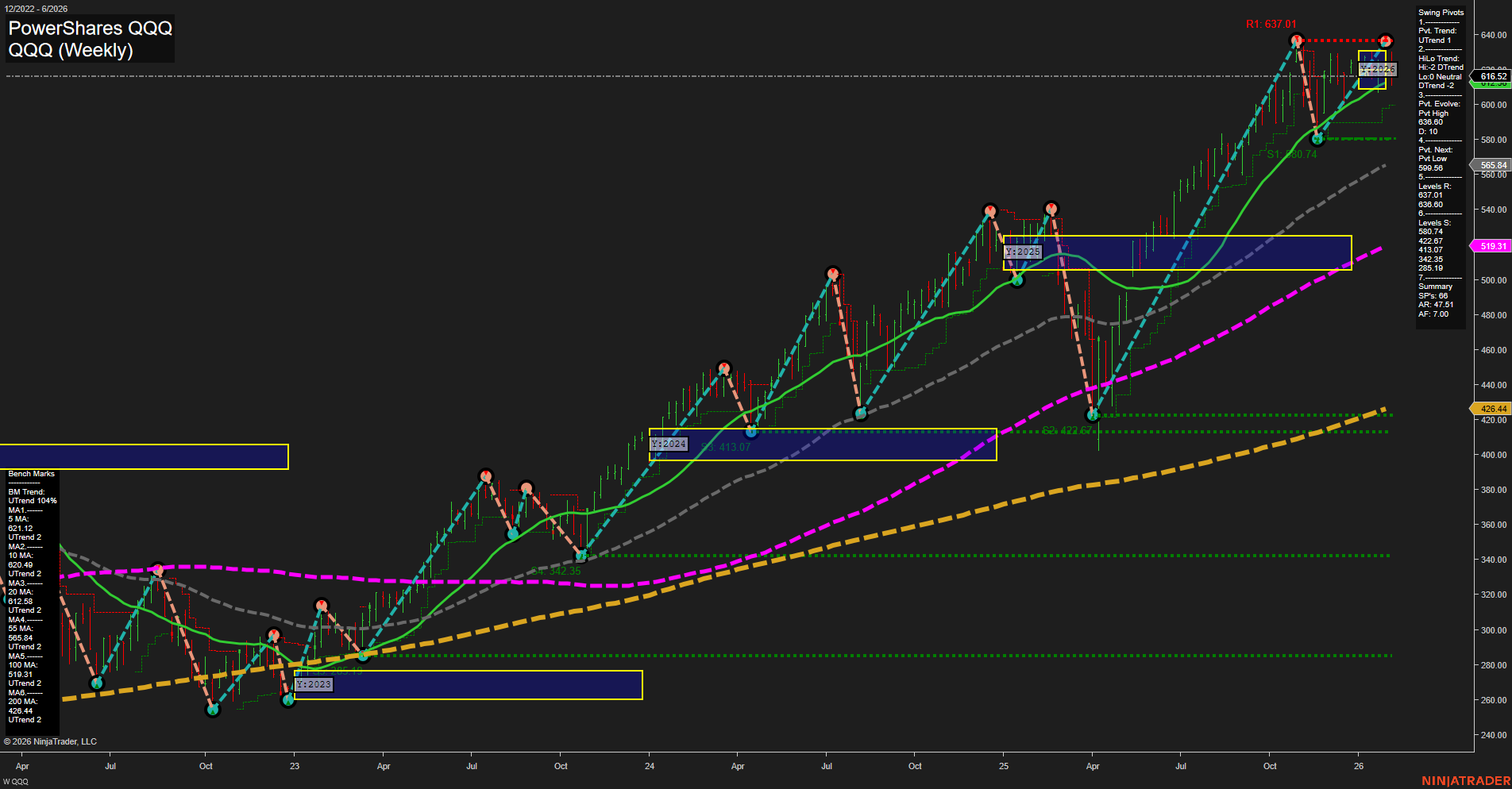

- QQQ 616.52 Bearish -1.54%

- AMZN 238.62 Bearish -1.79%

- IBIT 43.30 Bearish -2.08%

- META 691.70 Bearish -2.08%

- NVDA 180.34 Bearish -2.84%

- MSFT 411.21 Bearish -2.87%

ETF Stocks Summary

- SPY: Bearing -0.85%

S&P 500 ETF is under pressure, reflecting a negative sentiment across large-cap equities. - QQQ: Bearing -1.54%

Nasdaq-100 ETF is also negative, indicating tech-heavy weakness. - IWM: Bullish 0.23%

Russell 2000 ETF shows slight strength, highlighting resilience among small caps. - IJH: Bullish 0.19%

Mid-cap ETF is marginally higher, pointing to mixed trends in mid-sized companies. - DIA: Bearing -0.35%

Dow Jones ETF is modestly weaker, indicating broad-market softness.

Magnificent 7 (MAG7) Performance

- TSLA: Bullish 0.04%

Tesla ekes out a slight gain, contrasting with pressure on other tech mega-caps. - AAPL: Bearing -0.20%

Apple edges lower, following the broader large-cap trend. - GOOG: Bearing -1.22%

Alphabet trades lower, contributing to tech sector headwinds. - AMZN: Bearing -1.79%

Amazon sees notable weakness, mirroring negative momentum among peers. - META: Bearing -2.08%

Meta Platforms experiences declines in line with the sector slide. - NVDA: Bearing -2.84%

Nvidia underperforms, leading losses among MAG7 stocks. - MSFT: Bearing -2.87%

Microsoft exhibits significant downside, reinforcing negative tech sentiment.

Other ETFs: Macro Themes

- GLD: Bullish 6.36%

Gold ETF surges sharply, signaling a strong move toward safe-haven assets. - USO: Bullish 2.84%

Oil ETF climbs, reflecting energy strength amidst broader market volatility. - TLT: Bullish 0.24%

Long-term Treasury ETF is positive, indicating bond market stability. - IBIT: Bearing -2.08%

Spot Bitcoin ETF declines, mirroring risk-off sentiment in crypto-linked instruments.

Market Summary

Latest market snapshot (02/04/2026) highlights a notable divergence: macro and commodity ETFs (GLD, USO, TLT) are seeing bullish momentum, especially gold. In contrast, major equity benchmarks (SPY, QQQ, DIA) and most of the Magnificent 7 tech stocks are under marked pressure, led by Microsoft and Nvidia. Small and mid-caps (IWM, IJH) are showing rare relative strength. Risk-off tones are emphasized further by declines in Bitcoin-related IBIT.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2026-02-04: 07:16 CT.

US Indices Futures

- ES Consolidating below swing high (7043), YSFG near resistance, MSFG/WSFG above NTZ, most moving averages up, swing pivots bullish HTF, key support below, short-term neutral signals.

- NQ Below NTZ on YSFG/MSFG/WSFG, short/intermediate pivots down, swing high resistance, major supports below, all weekly MAs up (long-term bullish), all daily signals and structure bearish.

- YM Above YSFG/MSFG/WSFG NTZ, all weekly MAs up, price at new high (49410), short/intermediate/long-term up, support at 47507, resistance 49691+, daily showing resilience above benchmarks.

- EMD Above NTZ in YSFG/MSFG/WSFG, all MAs rising, short/intermediate swings up, resistance at 3517/3571, support 3379/3408, HTF trend and structure bullish, daily intermediate consolidation.

- RTY Price well above NTZ/benchmarks, all pivots and MAs up on weekly, resistance 2749/2720, support 2554/2401, short-term/daily trend up, intermediate-term consolidating, key levels well defined.

- FDAX Weekly and daily above NTZs, all MAs up, short-term weekly swing downtrend, intermediate/long-term structure bullish, support 24356–24584, resistance 24903–25641, consolidation near highs.

Overall State

- Short-Term: Neutral to Bullish (ES, EMD, RTY, FDAX neutral); Bearish (NQ)

- Intermediate-Term: Bullish (ES, YM, EMD, RTY, FDAX); Bearish (NQ)

- Long-Term: Bullish (ES, NQ, YM, EMD, RTY, FDAX); NQ daily remains bearish

Conclusion

Across US Indices Futures, higher time-frame technicals exhibit persistent long-term uptrends, with most session fib grids (YSFG, MSFG, WSFG) and moving average benchmarks confirming underlying strength for YM, EMD, RTY, and FDAX. ES consolidates near yearly grid resistance, showing mixed short-term momentum. NQ stands out with persistent bearish structure on daily/intermediate terms, though long-term bullish structure persists on the weekly. YM, EMD, and RTY remain well-supported above key pivot and support levels, with swing highs under retest or consolidation phases evident. FDAX shows bull trends intact with near-term consolidation. Overall, HTF market structure supports continuation of underlying long-term trends, but short-term signals and pivots indicate distinguishing consolidation or corrective phases, notably in ES, NQ, and FDAX, with daily and weekly fib grid and moving average alignment serving as pivotal reference points.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts